All you need to know about potential Bitcoin ETF approval

Open interest in CME Bitcoin futures is at an all-time high as the U.S. Securities and Exchange Commission (SEC) could approve the creation of Bitcoin ETFs later this month. But what are the deadlines for the decisions about the Bitcoin ETF, and which ETFs are still in play?

Investors are more optimistic about the approval of an ETF

In 2013, the Winklevoss brothers were the first to start the conversation about a possible Bitcoin ETF. The brothers filed their first S-1 with SEC, officially announcing their intention to launch a Bitcoin ETF later that year. The product was touted as a way for more experienced investors to participate in Bitcoin without buying and holding the digital currency. As Bitcoin grew in popularity over the years, many other companies recognized the potential of a Bitcoin ETF, such as VanEck, which filed a registration statement for a Bitcoin exchange-traded fund (ETF) with SEC on August 15, 2017, using Form N-1A.

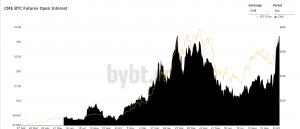

While the number of companies applying for a Bitcoin exchange-traded fund increased, the SEC kept rejecting or delaying their applications. Around 13 futures- and spot-backed Bitcoin ETFs are awaiting approval, and the investment product already exists in Canada. Previously, most of the investors were not very optimistic that an ETF would be approved after all these years of facing rejection. But more recently, the sentiment has changed as Gary Gensler himself stated that it is likely that the SEC will approve a futures-based ETF rather than a physical ETF this year. This suggests that the SEC is not rejecting the idea of an ETF and is taking the applications seriously.Optimism about the potential approval of an ETF can be seen in current market behavior. Open interest in CME Bitcoin futures hit an all-time high. You could think of open interest as the money investors are using to support bets on market activity. The all-time high could mean that institutions are betting on the approval of an ETF and believe it will have a positive impact on the Bitcoin price. Another hint that a futures-backed ETF is on the way is that SEC tweeted today that investors should educate themselves on the risks of a fund that holds Bitcoin futures contracts and weigh the potential risks and rewards while linking to an article that explains how a Bitcoin futures work.

Which Bitcoin ETFs are still in play?

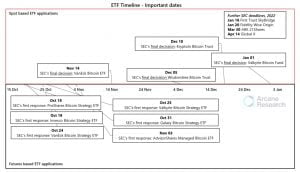

Recently, the SEC delayed its decision on four-spot-backed Bitcoin ETFs, but the futures-backed ones are still in play. The 75-day deadline for a regulator decision on ProShares' proposed Bitcoin strategy ETF ends this Monday. Similar funds from Valkyrie, Invesco, and VanEck were filed in the days following ProShares' application. These applications could also be approved or rejected at the same time or in the days after. To understand which ETF is most likely to be approved, let's take a look at the composition of ETFs that have been filed by these companies.

ProShares

ProShares

The ProShares Bitcoin Strategy ETF is the first ETF that SEC will decide on. The deadline for it is October 18. It is an ETF that is 30% based on CME futures, and the rest is backed by "money market instruments." This could be options/GBTC or a Canadian ETF. The decision on this ETF is crucial as it sets the tone for the rest of the ETFs awaiting approval. If the SEC approves this ETF, the regulator will likely quickly approve other ETFs to ensure sufficient competition. However, as noted above, only 30% of the ETF is backed by CME futures. Thus, there is a possibility that the SEC may feel that the ETF is not sufficiently backed by futures and decide to delay or reject it.

Invesco

The second candidate is Invesco, which is awaiting approval on October 19. The company filed its Bitcoin Strategy ETF in August and used a similar investment strategy to ProShares. It aims to gain indirect exposure to Bitcoin futures markets by investing in Bitcoin futures contracts. However, the filing also states that if the fund cannot fully participate in Bitcoin futures, it may occasionally invest in Bitcoin-related assets such as ETPs. The fund will invest about 25% of its assets in the subsidiary. Peter Hubbard is listed as the director of portfolio management and vice president of the trust.

Valkyrie

Another ETF awaiting approval in October is Valkyrie with its Valkyrie Bitcoin Strategy ETF. Investors are awaiting a decision from SEC on this exchange-traded fund on October 25. Valkyrie's ETF takes a different approach than Proshares and Invesco, as it is 100% backed by futures. In the filing, the company states that "the Fund will seek to purchase a number of Bitcoin futures contracts so that the total notional value of the Bitcoin underlying the futures contracts held by the Fund is as close to 100% of the Fund's net assets of the Fund as possible." This means that the SEC cannot reject this ETF giving the reason that it is not fully backed by futures contracts. On October 13, Valkyrie also updated the prospectus for the Bitcoin futures ETF, adding the ticker $BTF, which a Bloomberg journalist said is a good sign that the ETF will be approved.

VanEck

VanEck is waiting for approval with its Bitcoin Strategy ETF on the same day as Valkyrie. The company has a long history of ETFs being delayed by the SEC. VanEck's ETF is similar to ProShares and Invesco and will have exposure to Bitcoin futures and other investment vehicles and products that provide exposure to Bitcoin, such as crypto ETFs listed in other countries as for example Canada. Commenting on the ETF approval, VanEck said the SEC is already involved in cryptocurrency trading in a number of ways. Robinhood was used as an example because it offers cryptocurrency trading and falls under the jurisdiction of the SEC because it is registered as a broker-dealer. The SEC may also have gained "de facto regulatory control" over Coinbase, which stopped offering a lending product a few weeks ago at the commission's request.

What about a Spot backed ETF or an ETH ETF?

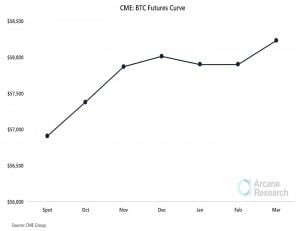

While all eyes are on the fillings for futures-backed ETFs, investors are also speculating that a physically-backed BTC ETF could be approved in 2022 if the SEC decides to approve the futures-backed ETFs. Some experts argue that retail investors looking to gain exposure may not be able to understand the nuances and complexities of futures-based ETFs and may prefer to stay away from bitcoin futures ETFs, as the futures market could risk contango if contracts expiring at a later date become more expensive than those approaching their end date. “I am expecting the average negative yield to be at around 5%-10% on the CME bitcoin futures curve,” said Patrick Heusser, head of trading at Swiss-based Crypto Finance AG. This means that if the price of Bitcoin doubles in the next 12 months, the ETF would underperform by at least 5%-10%.

While the approval of an ETF is not fully certain, yet the market seems to agree that the SEC will likely approve at least one of the futures-backed ETFs that is mentioned above. Bitcoin is currently sitting at the price of $57,379.08 and has risen 28% in the past 30 days. A lot of investors think that if an ETF is approved Bitcoin will manage to reach new all-time highs, but some are less optimistic and think that the approval could be a “buy the rumor sell the news” event.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms