Best Altcoins to Buy in 2025

The altcoin market presents significant opportunities and risks in 2025. This comprehensive guide analyzes the top altcoins to buy, their technological foundations, market projections, and essential risk management strategies to navigate this dynamic landscape.

Here are the topics we'll cover today,

- Understanding altcoins in 2025

- Top altcoins to buy in 2025

- Navigating altcoin investment risks

- Strategic approach to altcoin investing

Understanding Altcoins in 2025

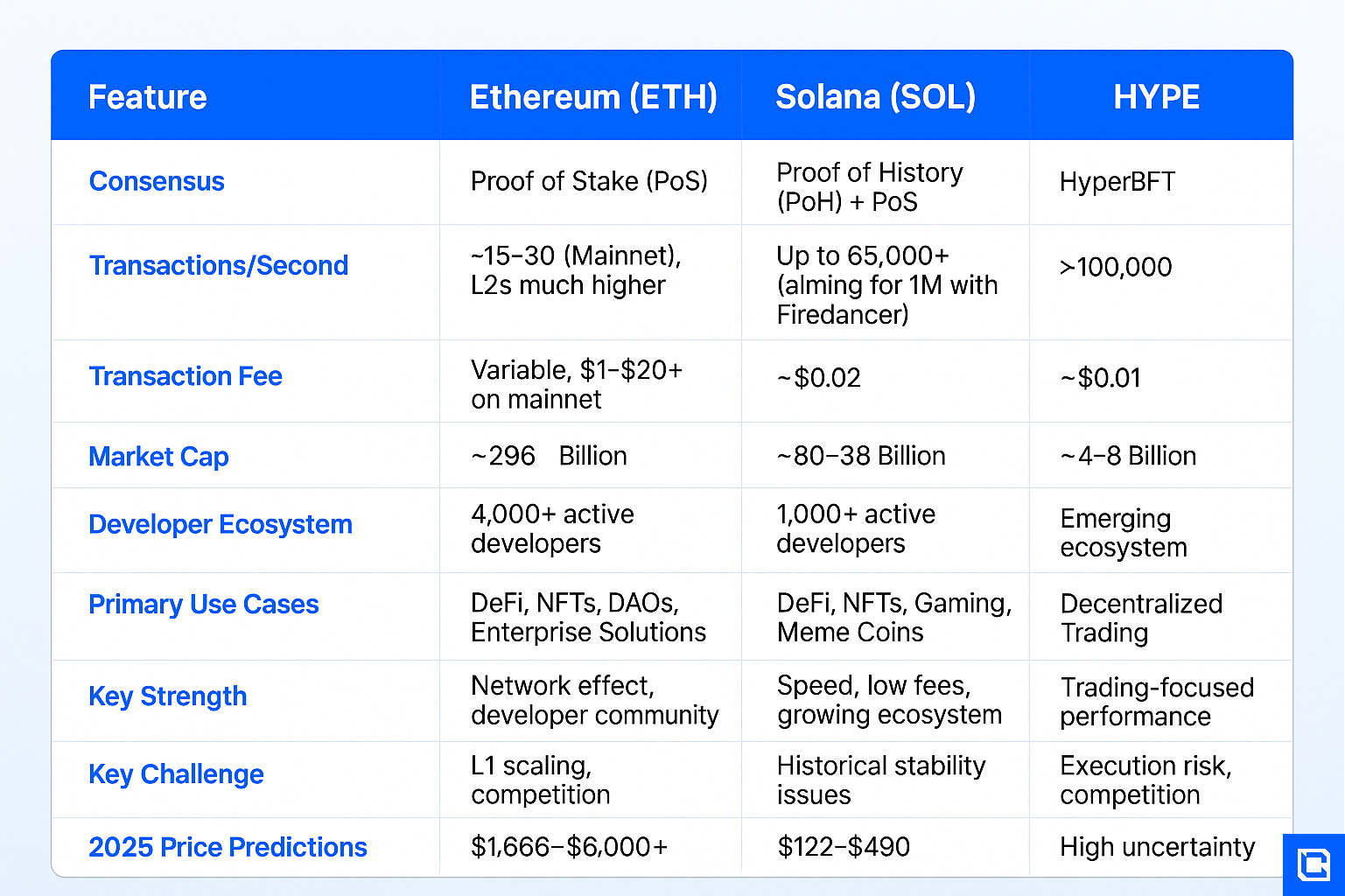

Altcoins, or alternative cryptocurrencies to Bitcoin, represent a diverse and rapidly evolving segment of the digital asset market. The term "altcoin," a portmanteau of "alternative coin," encompasses all cryptocurrencies launched after Bitcoin, dating back to 2011. Today, thousands of distinct digital assets exist, each with varying objectives and functionalities.The current altcoin landscape features three standout projects that exemplify the evolution and potential of this market:

- Ethereum (ETH): The pioneer of smart contract functionality, enabling programmable blockchain applications and serving as the foundation for the DeFi revolution

- Solana (SOL): A high-performance blockchain focused on throughput and low transaction costs, designed for scalable decentralized applications

- HYPE (Hyperliquid): A newer entrant specializing in high-performance decentralized exchange infrastructure with proprietary consensus mechanisms

Top Altcoins to Buy in 2025

Now that you understand the basics of what altcoins are, let's go over each of them that you should consider investing in.1. Ethereum (ETH): The Smart Contract Foundation

Ethereum stands as the undisputed leader in the smart contract platform space, pioneering the technology that powers the entire decentralized application ecosystem. As the second-largest cryptocurrency by market capitalization (~$296 billion), it continues to dominate despite increasing competition.

Core Technology & Innovations:

- Ethereum Virtual Machine (EVM): The computational engine that executes smart contracts, effectively functioning as a decentralized "world computer"

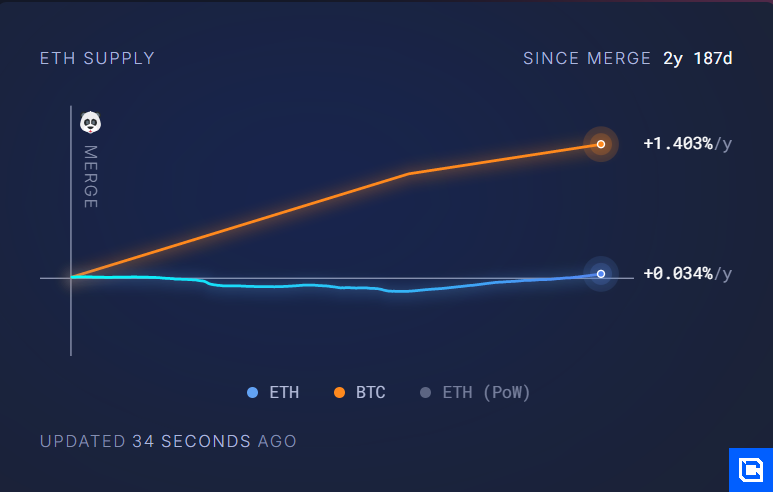

- The Merge (September 2022): Successful transition from energy-intensive Proof of Work to eco-friendly Proof of Stake, reducing energy consumption by ~99.95%

- Dencun Upgrade (March 2024): Implemented proto-dank sharding to dramatically reduce data fees for Layer-2 solutions, making transactions up to 10x cheaper

- Pectra Upgrade (Anticipated 2025): Expected to deliver further scalability improvements and enhancements to the PoS protocol

- EIP-1559: Token burn mechanism that has removed over 3.8 million ETH from circulation, creating potential deflationary pressure when network activity is high

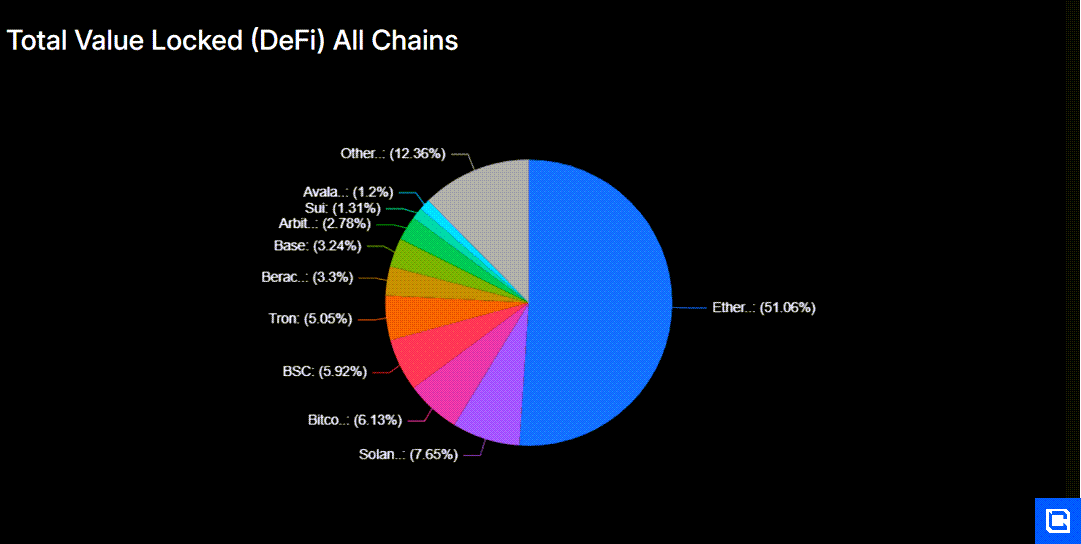

Ethereum's primary strength lies in its vast ecosystem, with over 4,000 active developers and 250+ significant DeFi protocols building on its infrastructure. Despite a 45% price drop in Q1 2025, Ethereum maintained its stablecoin dominance with a 55.8% market share and continues to lead in Total Value Locked metrics.

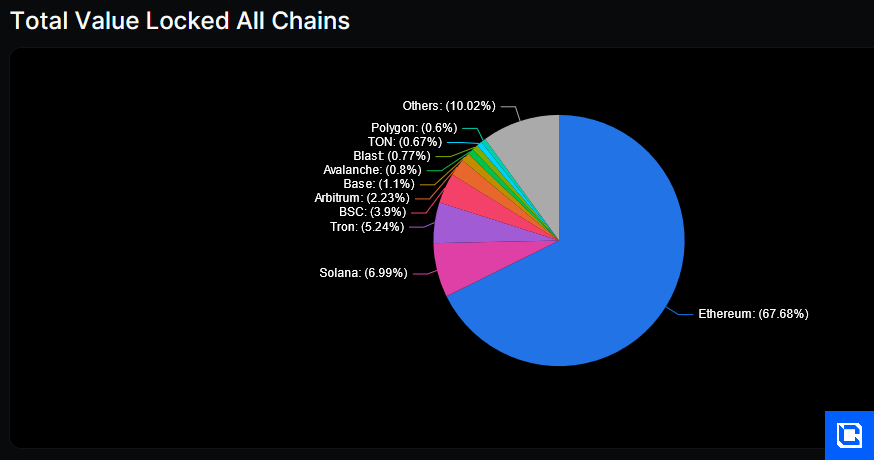

Layer-2 scaling solutions like Arbitrum, Optimism, and Polygon have extended their capabilities, addressing previous scalability and fee concerns. Of the $96 billion locked in DeFi, Ethereum holds around $46 billion.

- Users can swap with less slippage in a DEX (decentralised exchange). Slippage is a term used to describe the assets lost in a swap due to low liquidity.

- Ethereum, with the deepest liquidity pools (and the largest DEXs), is attractive for moving wealth around with minimal losses.

- In a lending protocol, the more assets available to borrow, the more interest is paid, and the more attractive it becomes for those with liquidity to add more, fueling an increase in the depth of the liquidity within the system.

- NFTs on Ethereum have become a bit of a status symbol within the crypto community. Examples include Bored Ape Yacht Club, a collection of NFTs that are highly sought after - primarily for clout. But they're valuable nonetheless, with a floor price (the cheapest token in the collection you can buy) costing tens of thousands of dollars.

Valuation Exercise + Price Targets

Ethereum provides the foundation for building a viable decentralised financial system, and that's why we believe it can eventually overtake Bitcoin. Bitcoin, as of today, is a non-productive asset; it is a store of value comparable to gold in its function. Ethereum, however, provides the means to rebuild the financial infrastructure and almost every other part of the global on-chain via smart contracts.Ethereum might not stay as dominant as it is, which is highly unlikely. But given the numbers we're talking about in the sections above, it is still the top dog, second only to Bitcoin.

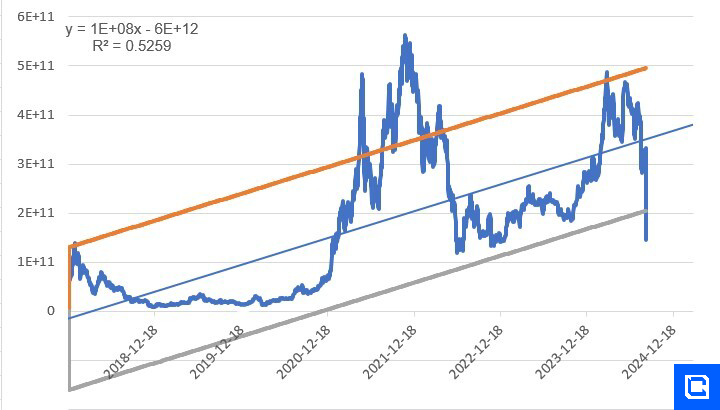

For Ethereum's valuation, we employed a mix of quantitative and qualitative methods. First, we analysed Ethereum's historical fully diluted market by regressing it with time as an independent variable.

As a result, we developed a model (blue linear line) that explains 52% of Ethereum's market cap variance. We extended the model to estimate Ethereum's future market cap.

The blue line is the best-fit model, resulting in a linear line with minimum error (residuals). Even though the blue model has relatively high accuracy, crypto has seasonality and experiences bull and bear markets where prices are far from linear. As a result, there are some residuals from the model.

To further minimise them, we calculated the standard deviation of errors. That results in a range where the most errors occur. We added and subtracted one standard deviation of residuals from our blue model, resulting in the upper and lower bounds of the model. Further, to determine the price of Ether, we assumed a static supply of ETH. Ethereum's tokenomics are interesting because it can be both inflationary and deflationary. Historically, it has approximately the same supply with negligible differences below 0.01%.

Therefore, it makes sense to consider it somewhat static. As a result of our analysis, we came up with the following scenarios for short-term and long-term:

For the 24/25 Cycle

Base Case Scenario: This is our model's lower bound (grey line). Based on this bearish scenario, our model estimates Ethereum's fully diluted market cap to be $280b in the 24/25 cycle.

Bull Case Scenario: This is our model's main trend (blue line). Based on this scenario, our model estimates Ethereum's fully diluted market cap to be $424b in the 24/25 cycle.

Best-Case Scenario: This is our model's upper bound (orange line). Based on this scenario, our model estimates Ethereum's fully diluted market cap to be $570b in the 24/25 cycle.

For the Longer Term (2032)

We have stopped using an arbitrary 2030 for our longer-term targets and adopted two Bitcoin cycles from the current cycle. This places our long-term timeframe in 2032. Therefore, we employed the same methodology as in our short-term estimations and extended the model until 2032 to estimate the future value of Ethereum's market cap.As a result, the model came up with the following scenarios for 2032.

Base Case Scenario: This is our model's lower bound (grey line). Based on this scenario, we can expect the market cap of Ethereum to be roughly $907b by 2032

Bull Case Scenario: This is our model's middle line (blue line). Based on this scenario, Ethereum's market cap will be roughly $1.1t by 2032.

Best-Case Scenario: This is our model's upper bound (orange line). Based on this scenario, Ethereum's market cap will be roughly $1.34t by 2032.

Here is the summary table of our estimates plus the potential price of Ethereum.

Model Estimates for 2032

Cryptonary's Definitive ETH Price Targets

24/25 Price Targets- Base case: ~$4,240 | 1.93x upside

- Bullish case: ~$5,700 |2.59x upside

- Best case: ~$11,400 |5.18x upside

- ~$22,273 |10.13x upside

Price predictions for ETH in 2025 range between $1,666 and $6,000, with VanEck analysts projecting a potential stretch target of $6,000+ in Q1 2025. The potential approval of an Ethereum spot ETF represents a significant catalyst that could drive institutional adoption.

Ethereum's position as the backbone of DeFi, NFTs, and emerging RWA tokenization makes it the blue-chip investment in the altcoin space despite increased competition.

2. Solana (SOL): The High-Performance Blockchain

Solana has emerged as Ethereum's most formidable technological challenger, offering exceptional performance characteristics that enable applications not feasible on other networks. With market capitalization between $80-88 billion, it has firmly established itself as a top-tier alternative.

Technical Architecture:

Solana's breakthrough performance stems from its unique combination of innovations:

- Proof of History (PoH): A verifiable cryptographic clock that timestamps and sequences transactions before they enter consensus, enabling parallel processing

- Gulf Stream: A mempool-less transaction forwarding protocol that pushes transactions to validators before block completion

- Turbine: A block propagation protocol that breaks data into smaller packets for efficient network distribution

- Sealevel: A parallel smart contract runtime allowing thousands of transactions to process simultaneously rather than sequentially

- Pipeline: A transaction processing unit that optimizes validation for concurrent operations

These innovations enable Solana to achieve industry-leading performance:

- Transaction throughput up to 65,000 TPS (compared to Ethereum mainnet's 15-30 TPS)

- Average transaction fees of approximately $0.02

- Block time of 400 milliseconds

- Validator count of approximately 1,414 (versus 1 million+ for Ethereum)

Despite a 34% price decline in Q1 2025, Solana demonstrated remarkable ecosystem resilience:

- Attracted over $450 million in net inflows during market turbulence

- Stablecoin supply grew by 140% year-to-date, increasing market share from 2.7% to 5.5%

- Hosts over 400 active projects across DeFi, NFTs, and gaming sectors

- Maintains particular strength in retail user engagement through vibrant meme coin activity

Solana's future looks even more promising with upcoming upgrades:

- Firedancer: A new validator client being developed by Jump Crypto that aims to dramatically increase transaction capacity to potentially 1 million TPS

- Solana Seeker: A crypto-focused mobile phone planned for 2025 launch to drive mainstream adoption

- Enhanced MEV Protection: Improved mechanisms to protect users from maximal extractable value exploitation

Solana's target market primarily involves high-frequency operations like payments, trading, gaming, AI, and DePIN.

In terms of TVL, Solana holds a ~7% market share within the scope of DeFi. With a TVL of $11 billion to Ethereum's $108 billion, Solana is roughly 10% the size of Ethereum.

Solana's relative size in DeFi does not negate the use of liquid staking for capital efficiency, allowing staked interest-bearing tokens to be used within DeFi protocols. This is why we think the start of LSD-Fi protocols, which are DeFi primitives built on top of liquid staking protocols, will be a massive step for Solana to attract new liquidity.

One example is stablecoins over-collateralised by SOL, leveraging liquid staking tokens to generate yield. This concept already exists on Ethereum with protocols like Lybra Finance. Recently, the largest DEX aggregator on Solana Jupiter has been the first to propose a design to launch a similar stablecoin on Solana.

Solana's advantage over Ethereum is that its staking yield is higher, averaging 7-8% on the highest-yielding liquid staking protocols. This means that if a stablecoin backed by staked SOL were to launch, its yield would average around 7-8%, based on staking reward, and outperform the yield users can earn on ETH-backed stablecoins.

We are looking forward to more designs like this that leverage LSTs to create products for users to generate higher returns on their assets on Solana.

Solana's Valuation Exercise + Price Targets:

As the leading smart contract platform, Ethereum represents the most appropriate benchmark for valuing Solana based on the logic of market share capture and growth potential.While crypto markets are speculative, using Ethereum provides a rational framework.

In November, we released a report on why Solana is a compelling long-term opportunity. In the report, we stated that we believed Solana was in the trenches but likely to pull through.

Our 0.05 ETH/SOL target implied Solana capturing 5% of Ethereum's value by 2025. This projection aligned with our belief in Solana's ability to carve out a significant market share-which it did.

Moreover, historical data further supports this valuation target. During the last bull market on October 1, 2021, SOL reached a ratio of 0.047 against ETH. Considering this historical precedent, our target of 0.05 ETH/SOL by 2025 appears reasonable and aligns with the potential dynamics of a bullish market.

Now, the question is whether Solana is able to push through this range with conviction. We're unsure, as Ethereum has also been growing at a significant rate over the last six months.

So, conservatively, we will assume that SOL keeps pace with ETH and remains around this ratio.

However, we anticipate ETH will continue to appreciate as we enter the bull market for the rest of the year and beyond.

With a 0.05 ETH/SOL target, price projections are:

- ETH at $6,000 → SOL Price = 0.05 ETH/SOL * $6,000/ETH = $300

- ETH at $8,000 → SOL Price = 0.05 ETH/SOL * $8,000/ETH = $400

- ETH at $10,000 → SOL Price = 0.05 ETH/SOL * $10,000/ETH = $500

- ETH at $15,000 → SOL Price = 0.05 ETH/SOL * $12,000/ETH = $750

Solana's unwavering focus on performance creates a compelling investment case. Price predictions for 2025 suggest a potential range between $122 and $490.

Its unique technical architecture positions it ideally for applications requiring high throughput and low latency, particularly in gaming, real-time finance, and consumer applications.

While historical network instability remains a concern, the platform has demonstrated significant improvement and continued adoption despite market headwinds.

3. HYPE (Hyperliquid Token): Specialized Trading Infrastructure

HYPE represents the emerging trend of specialized blockchain infrastructure focused on specific high-value use cases. As the native token of Hyperliquid, a Layer-1 blockchain designed exclusively for high-performance decentralized exchange functionality, it targets the intersection of DeFi trading and institutional-grade performance.

According to the Cryptonary's thesis on Hyperliquid, The HLP Vault has about $300M in TVL and achieved $50M in profit, consistently delivering positive APRs. Unlike passive competitors like GMX's GLP, HLP employs an active, non-transparent strategy, allowing flexibility in volatile markets.

Auction-based token listings: Probably one of the coolest features Hyperliquid has introduced. Whenever a team or community wants to get their token listed on HyperLiquid, they need to win an auction.

It has been so successful that this auction mechanism has set new benchmarks for token listings, with recent auctions fetching up to $975,000 per token. Proceeds from these auctions contribute directly to $HYPE buybacks, creating deflationary pressures.

Technical Foundation:

HYPE's architecture is purpose-built for trading excellence:

- HyperBFT Consensus: Proprietary consensus mechanism optimized specifically for trading operations, achieving 100,000+ TPS with sub-second latency

- On-Chain Execution: All transactions processed directly on-chain, eliminating counterparty risks associated with centralized exchanges

- CEX-Like Experience: Interface and functionality deliberately mirroring major centralized exchanges like Binance and OKX to lower the adoption barrier

- Cross-Chain Integration: Planned interoperability with other major blockchains to facilitate seamless asset movements

- Maximum supply capped at 1 billion HYPE tokens

- Circulating supply of approximately 333.92 million as of early 2025

- Market capitalization between $4.2-8.02 billion

- Trading price between $17-$24 based on early 2025 data

- Implementation of token burn mechanism to control supply inflation

- Structured vesting schedule for team and investor allocations

HYPE serves multiple functions within its ecosystem:

- Trading fee discounts for token holders (up to 40% reduction)

- Staking rewards for liquidity provision

- Governance rights over protocol development and parameters

- Access to premium features and trading tools

- Q1-Q2 2025: Addition of new trading pairs and community incentive programs

- Q3 2025: Cross-chain integration to enhance interoperability

- Q4 2025: Advanced derivatives trading functionality

- 2026+: Institutional partnerships and mass adoption initiatives

Valuation Analysis: Why are we bullish?

By comparing $HYPE to Binance's $BNB, we can better understand its valuation and potential:- Market Metrics: $HYPE's market cap is approximately 8.5% of BNB's, with its fully diluted valuation (FDV) at 26%.

- Trading Activity: Hyperliquid's trading volume and open interest in derivatives reach about 7.3% and 12.5% of Binance's levels, respectively, showcasing significant traction in a competitive market.

- Economic model: $HYPE allocates 54% of revenue to buybacks, significantly outpacing Binance's historic 20% allocation for token burns. Hyperliquid generates over half a billion in revenue annually.

Additionally, Hyperliquid's automated listing and auction mechanisms drastically reduce operational costs compared to Binance's manual processes.

- Community-centric model: $HYPE holders benefit directly from Hyperliquid's growth, unlike many tokens with less direct revenue sharing, including Binance's BNB

Long-Term Growth Drivers:

- EVM launch: The introduction of HyperEVM is expected to unlock new use cases, including gas fee revenue, further driving $HYPE's utility.

- Higher auction Prices: As demand for HIP-1 token listings grows, auction revenues are projected to increase substantially.

- Platform fees: Scaling trading volumes, particularly during a bull market, will amplify fee-based revenues, bolstering Hyperliquid's growth trajectory.

- EVM gas fees: If HyperEVM activity aligns with platforms like Base, it could generate $15M or more in monthly fees.

- Ecosystem growth: High-quality dApps on HyperEVM will amplify trading activity and increase $HYPE utility.

Price Targets:

Here are some basics related to the $HYPE:- Current circulating market cap: $4b

- Fully diluted market cap: $12b

For the base case, we believe Hyperliquid can be worth at least 50% of Solana's current FDV. Hyperliquid is also fast, extra cheap and doesn't have any history of congestion. However, hyperliquid still has a nascent ecosystem, and the bridging process can be very difficult. This can limit the adoption of the chain, whereas Solana has a very easy onboarding process.

All things considered, we believe our first target should be half of Solana's FDV, which is roughly $70b-80$b mcap. This will result in $70-$80 per HYPE or around 5.8x-6.6x from current prices.

Bull case: For the bull case, we think Hyperliquid can reach the current FDV of BNB (Binance). BNB is currently worth around $100b, and Hyperliquid is a superior product, in our opinion. However, Binance has a stronger ecosystem and backers. We believe as Hyperliquid matures, HYPE will close the gap and reach $100b mcap.

We believe these targets are more than attainable, and to be frank, we are being slightly conservative, considering how deep we are into the bull market. The downside here is relatively minor; anything below $20 is very cheap and will likely be bought very quickly.

However, the upside is still massive relative to risk. Therefore, we believe it is a very attractive asset in the market, and we are confidently adding it to our list.

Investment Considerations:

HYPE represents a higher-risk, higher-reward opportunity compared to established platforms like Ethereum and Solana. Its success depends on delivering its ambitious performance claims and attracting trading volume from both centralized exchanges and incumbent DEXs.

The project must overcome the challenge of its name, which invites scrutiny regarding substance versus marketing. However, its focused approach and specialized technology position it uniquely in the competitive DEX landscape if execution meets expectations.

Navigating Altcoin Investment Risks

While Ethereum, Solana, and HYPE offer compelling investment opportunities, they each present distinct risk profiles when deciding on the best altcoins to buy. That's why you must carefully evaluate each of the risks:

Ethereum-Specific Risks

Despite its market leadership, Ethereum faces several challenges:- Layer-1 Scaling Limitations: Even with upgrades, Ethereum's mainnet remains constrained by throughput limitations, pushing activity to Layer-2 solutions

- Increasing Competition: Projects like Solana, Avalanche, and BNB Chain continue to challenge Ethereum's dominance with superior performance characteristics

- Execution Risk of Future Upgrades: The complex Pectra upgrade introduces technical risks if implementation encounters difficulties

- Regulatory Uncertainty: As the largest smart contract platform, Ethereum faces heightened regulatory scrutiny, particularly regarding DeFi applications built on its network

Solana-Specific Risks

Solana's high-performance blockchain faces its own challenges:- Historical Network Instability: Past outages have raised concerns about reliability; though significantly improved, this history remains a consideration

- Validator Centralization: With approximately 1,414 validators compared to Ethereum's 1 million+, Solana's network is relatively more centralized

- Retail-Heavy User Base: Solana's significant meme coin activity suggests more speculative usage compared to Ethereum's institutional adoption

- Technical Complexity: The sophisticated architecture enabling Solana's performance introduces additional points of potential failure

HYPE-Specific Risks

As a newer entrant, HYPE presents elevated risk factors:- Execution Risk: Delivering on ambitious technical promises remains the primary challenge for this emerging project

- Smart Contract Vulnerabilities: New protocols face heightened risk of undiscovered security flaws

- DEX Competition: Established decentralized exchanges on Ethereum, Solana, and other chains present formidable competition

- Liquidity Challenges: Attracting sufficient trading volume to compete with major exchanges represents a significant hurdle

- Name-Related Perception: The "HYPE" name itself invites scrutiny regarding substance versus marketing

| Risk Factor | Ethereum (ETH) | Solana (SOL) | HYPE |

| Market Volatility | Moderate | High | Very High |

| Technical Risk | Low-Moderate | Moderate | High |

| Competitive Threat | Moderate | Moderate-High | Very High |

| Regulatory Exposure | High | Moderate | Moderate |

| Project Maturity | High | Moderate | Low |

Risk Mitigation Strategies by Project

- Ethereum: Consider diversifying across both ETH and leading Layer-2 tokens; implement dollar-cost averaging; monitor regulatory developments

- Solana: Set clear thresholds for network performance metrics; diversify across multiple Solana ecosystem projects; maintain stop-loss orders

- HYPE: Limit allocation to a smaller percentage of the portfolio; research team credentials extensively; establish clear performance milestones for continued investment

Strategic Approach to Altcoin Investing

The 2025 altcoin landscape offers distinct investment opportunities through Ethereum, Solana, and HYPE, each representing different risk-reward profiles and technological approaches. That's why when picking the best altcoins to buy, we need to properly evaluate our strategic approach.Investment Strategy by Project

- Ethereum (ETH): Position as a core holding for exposure to the smart contract and DeFi ecosystem. Consider 50-60% of altcoin allocation for conservative investors seeking established infrastructure exposure. Complement with strategic positions in promising Layer-2 tokens (Arbitrum, Optimism) to capture scaling benefits. Monitor potential ETF developments as a significant catalyst.

- Solana (SOL): Allocate 20-40% of altcoin portfolio for exposure to high-performance blockchain infrastructure. Consider timing entries during market weakness, as Solana typically experiences higher volatility than Ethereum. Focus on the Firedancer upgrade timeline as a potential value inflection point. Diversify across the Solana ecosystem with selective exposure to leading Solana-native DeFi protocols.

- HYPE: Limit exposure to 5-15% of altcoin allocation, reflecting higher risk profile. Consider a tranched investment approach, increasing positions as development milestones are successfully delivered. Implement strict stop-loss parameters given elevated volatility expectations. Monitor key adoption metrics like daily active users and trading volume growth rather than focusing solely on price action.

Technical Analysis Parameters for Each Project

Tailored technical analysis approaches for these three distinct assets:- Ethereum: Focus on ETH/BTC ratio to identify relative strength; monitor ETH gas prices for network activity; track institutional fund flows through on-chain metrics

- Solana: Analyze daily active addresses growth; monitor validator distribution metrics for decentralization progress; track stablecoin issuance on Solana as adoption indicator

- HYPE: Compare trading volume growth against competing DEX tokens; monitor liquidity depth across trading pairs; analyze token distribution metrics for early concentration risk

- Core Foundation: Ethereum provides established infrastructure exposure with institutional adoption

- Performance Layer: Solana delivers next-generation blockchain capabilities for applications requiring high throughput

- Specialized Innovation: HYPE represents targeted solutions for specific high-value use cases

While the altcoin market will undoubtedly continue to evolve through 2025 and beyond, these three projects represent different facets of blockchain innovation worth considering for a balanced cryptocurrency investment strategy. With proper risk management, thorough research, and strategic position sizing, investors can navigate this dynamic landscape to potentially capture significant growth while managing the inherent volatility and technological risks.

Wrapping Up

As we've explored, the altcoin landscape in 2025 is full of opportunity, if approached with strategy and awareness. Ethereum, Solana, and HYPE each bring something unique to the table: Ethereum offers deep liquidity and developer strength, Solana delivers unmatched speed and low fees, and HYPE pushes the boundaries of decentralized trading infrastructure. Together, they represent a well-rounded exposure to the best altcoins to buy in 2025, across both established and emerging sectors.However, successful altcoin investing isn't just about chasing hype or high returns, it requires a thoughtful approach to risk. Ethereum is your foundation, Solana is your performance play, and HYPE is your high-upside bet with strict guardrails. Diversifying between these assets and applying tailored strategies to each can help you stay ahead in a volatile market without taking on unnecessary risk. For deeper insights and real-time analysis, make sure to check out Cryptonary. Our monthly subscription gives you access to institutional-grade research and expert-driven strategies, an excellent way to stay ahead in the hunt for the best altcoins to buy this year.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms