Guide: The State of Play-to-Earn Projects

Play-to-earn projects have been making a lot of noise in the crypto space over the past year, both good and bad. Top games like Alienworlds and Splinterlands are seeing high numbers of weekly average users. Funding has increased for play-to-earn games year-over-year, signalling growth in the industry.

However, the larger these projects grow, the more they become targets for malicious hackers. Axie Infinity and its Ronin Network were the victims of the largest DeFi exploit in history just back in March. The developer has since gathered funds to compensate users affected by the hack.

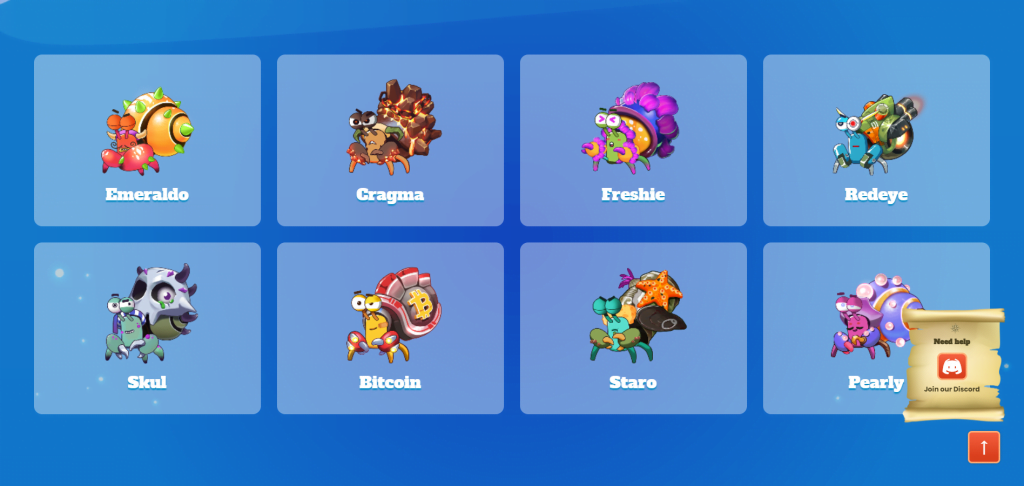

Other games have risen to challenge Axie Infinity’s first-mover advantage, like Aurory on Solana and Crabada on Avalanche. Meanwhile, signs of growth in the space continue, as the United States’s National Football League (NFL) and Major League Baseball (MLB) have both announced upcoming play-to-earn NFT games.

Developments like these point to a situation in which play-to-earn games act as the gateway for the onboarding of millions of new crypto and NFT users. However, questions remain about the overall sustainability of play-to-earn projects and their management.

How do play-to-earn economies work?

It’s important to understand how play-to-earn economies function before diving into the long-term viability of projects like these. Value in any in-game economy is in the form of tokens that are native to that game, though this could change in the future to Layer 1 coins (i.e. ETH or AVAX).These native tokens are used for in-game purchases and for facilitating trades between players. As long as those tokens are seen as valuable by both players and investors alike, they have value.

If we use Axie Infinity as an example, players use ETH to purchase Axies, which are Pokemon-like NFT creatures. Players earn Smooth Love Potion (SLP) tokens. SLP functions as a kind of experience point that is spent when breeding new Axies. Axies can be used for breeding a total of seven times, with each time costing more SLP.

Players are rewarded SLP by winning battles with their Axies and by completing quests. This mechanic worked pretty well for a while but has run into some issues recently.

Players can also trade Axies as well as purchase in-game real estate. Each transaction requires a fee that consists of SLP and Axie Infinity’s governance token, Axie Infinity Shards (AXS).

For another reference, the metaverse project Decentraland uses its native token, MANA, to facilitate the purchase of in-game plots of land, goods, and services. MANA’s value is ultimately derived from the demand to participate in Decentraland’s virtual world.

Are play-to-earn economies sustainable in the long run?

Currently, play-to-earn games like Axie Infinity face a problem: their long-term viability, and by extension their economies and cryptocurrencies, rely heavily on adding new users.As Axie Infinity grew in popularity early on, it attracted new players from developing countries. Players in those countries earned SLP through the game and its “scholarship” program. This led to more and more players joining Axity Infinity, earning SLP, and selling it for profit.

Eventually, the amount of SLP being created through battles and quests became greater than the amount of SLP being destroyed by breeding Axies.

The continued selling of SLP for real-world money has contributed to an oversupply of the cryptocurrency and a lack of demand. In addition, the amount of SLP that can be created is uncapped, creating a perfect storm for an inflation problem.

New users are needed and with them the hopes that their participation in the game by breeding new Axies will level out this imbalance - a supply and demand imbalance that is by no means unique to Axie Infinity.

Sky Mavis, the developers of Axie Infinity, are aware of the issues surrounding the sustainability of their game’s economy and working to address the issues caused by their current system. They are currently planning a transition to an economy driven by existing players rather than by bringing in new players. They’ve outlined the details in their whitepaper.

Play-to-earn projects = mass adoption?

Despite the questions surrounding play-to-earn economies and their long-term prospects, these games represent an opportunity to introduce cryptocurrency to a broader audience. Axie Infinity, as the largest player in the crypto gaming space with nearly 3 million users globally, has introduced half of its users to cryptocurrency and three-quarters of its users to NFTs.

More generally speaking, an October 2021 report from DappRadar and the Blockchain Game Alliance showed that 55% of blockchain activity for that month was related to game dApps. That bodes well for gaming’s influence in the crypto market, as does large studios like Square Enix announcing support for NFTs and gaming’s ability to onboard new users into crypto.

Newer play-to-earn games, like the horse racing game Pegaxy, are embracing the model introduced by Axie Infinity to try to continue the generation of income for people living in developing countries. A good portion of players in these countries don’t have bank accounts, a problem that crypto as a whole is trying to solve.

Time will tell if the play-to-earn industry can weather its current difficulties and continue to drive the adoption of blockchain technology among the average population.

Want to learn more about crypto x gaming? Click here to read our exclusive Pro series on the topic.

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

Please remember to comment and share if you found this guide useful! Also, let us know what guides you’d like to see next!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms