The 2024 cycle has shown a significant shift in investor behaviour, where memecoins have gained unexpected traction, challenging the more traditional utility tokens. This shift has sparked a debate about where your capital might be safer and more productive in the long run.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Utility coins vs memecoins

Utility tokens typically enter the market with grand ideas, promising to revolutionise the crypto market. These tokens often gain early market validation due to their exciting prospects and robust teams. However, the real challenge for utility tokens arises later, as they face competition, technological hurdles, and the risk of unfulfilled promises.Memecoins, often seen as a joke in previous cycles, have become a focal point for many investors.

In the last cycle, Dogecoin and Shiba Inu demonstrated the exponential potential of memecoins, changing lives and reshaping the cryptocurrency landscape. This cycle, investors are looking for the next big memecoin, spurred by the ease of access provided by platforms like Solana, Phantom, and Jupiter.

Utility tokens are akin to businesses. Like businesses, they face competition and must continuously innovate to stay relevant. In the fast-paced world of technology, where AI and other advancements rapidly evolve, utility tokens can struggle to keep up. A utility token's initial success often hinges on its ability to deliver on its promises. Still, over time, the same factors that brought in capital can jeopardise its position in the market.

The trajectory of utility tokens vs memecoins

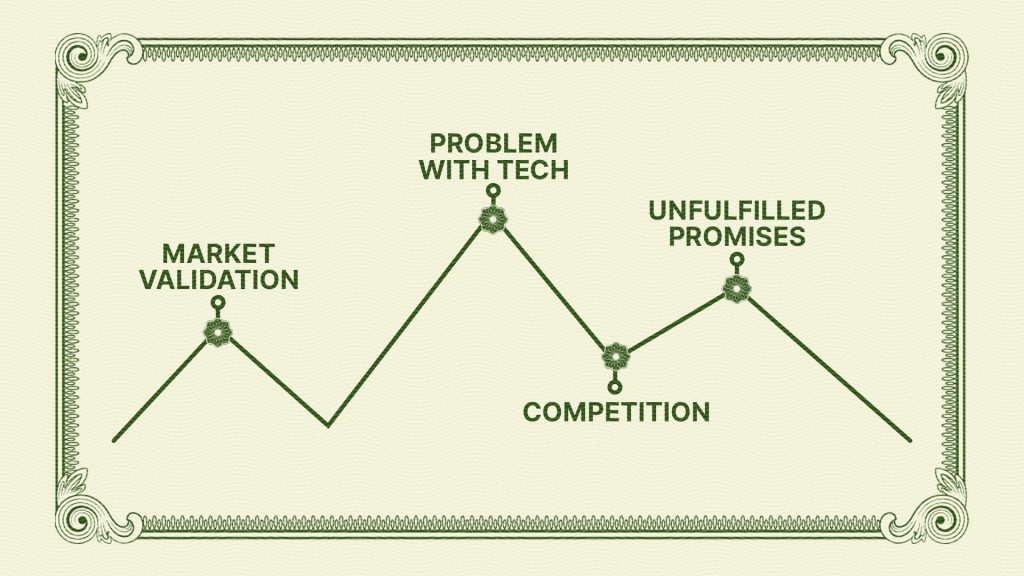

Utility tokens typically experience a surge of interest at their inception, driven by their new and exciting technology.However, as time goes on, these tokens often face challenges. Technological issues, unmet promises, and new competition can cause these tokens to lose momentum. This is similar to how businesses in the Fortune 500 experience turnover, with only the most innovative and adaptable companies remaining on top.

In contrast, memecoins follow a different trajectory. They often start with low expectations but can rapidly gain market validation if they capture the collective imagination of a community. Once a memecoin reaches a certain market cap, it can maintain its position with fewer risks compared to utility tokens. This is because memecoins are not tied to the success of a particular technology or roadmap but are driven by community sentiment and cultural relevance.

Market performance: Utility coins vs memecoins

Memecoins operate in a unique space where their success is not necessarily tied to technology or utility but to their cultural and community-driven appeal. Meme coins like Dogecoin, Shiba Inu, and Pepe have shown bullish structures, often outperforming many utility tokens in the market. This performance is driven by the collective belief of the community, which creates a robust and resilient force behind the token's value.Unlike utility tokens, meme coins are not burdened by roadmaps, promises, or the need to continuously innovate. Their value is purely speculative and driven by market sentiment. This makes them less susceptible to the same pitfalls that utility tokens face, such as technological obsolescence or competition.

Above is Arbitrum's chart, an asset that performed well in October as investors priced in the ETH ETF in anticipation of capturing a cycle-long bullish surge. That's not to say Arbitrum can't perform—it still might—but compared to Pepe's chart below, it's a fascinating comparison of the visual structural strength of the two assets.

Cryptonary's take

In today's fast-paced technological landscape, where innovation happens rapidly, memecoins offer a simpler and potentially lucrative investment opportunity. While they are undeniably risky, their volatility is part of what makes them attractive to investors seeking high returns.Memecoins don't have to worry about staying technologically relevant or delivering on complex promises, making them more straightforward in some respects. In contrast, utility tokens must continuously innovate and adapt to new technological advancements. This constant need to evolve can be both a strength and a weakness, depending on how well the token's team can keep up with the pace of change.

While utility tokens have the potential to revolutionise industries, they also face significant challenges that can jeopardise their long-term success. Memecoins, on the other hand, are driven by community sentiment and cultural relevance, which can sometimes allow them to weather market storms better than utility tokens.