Tokenomics 2: Supply & Market Cap

As we mentioned in the first Guide in this series, Tokenomics, or ‘token economics’, is the basics of evaluating a crypto. It covers everything about how tokens work, including their mechanics, distribution, the factors that influence long-term value (such as supply and demand), and much more.

If you haven’t yet read the first article in this series: What is Tokenomics? we suggest you go back and do so first.

Now that you know what Tokenomics is, we’re going to start by looking deeper at supply- a hugely important factor to consider when evaluating the desirability of a token.

The questions we may ask ourselves when looking at a crypto’s supply include:

- How many tokens exist right now?

- What is the market cap?

- What is the circulating supply?

- How many new tokens will be released, and how regularly?

- Are some tokens set aside to be released to team members, investors and advisors in the future?

- Is there a maximum possible supply? And when will this be reached?

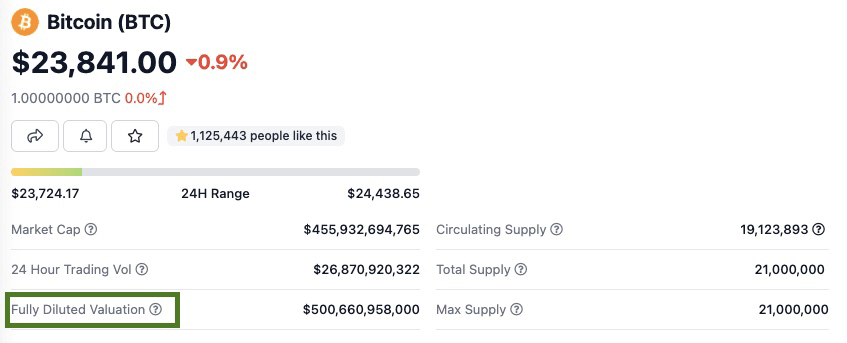

- What is the fully-diluted valuation?

- Is the supply inflationary, stable, or deflationary?

Supply & value

When looking at a crypto’s supply, it is vital we consider how the supply will change over time, as this is a determining factor as to whether the token will hold, increase or decrease in value over time.Also, when the token’s price is affected by supply change, the perceived value of the project can also be affected. This is because when the price falls due to an increase in supply, investors can get spooked and sell out, perceiving the fall to be a risk. This can be very negative for a protocol, especially one that relies on public attention and hype, as it can cause a domino effect, with more investors getting spooked and selling out, driving the price further down, in a self-reinforcing loop.

In terms of supply, with all else being equal, a token’s value will increase if, in the future, fewer tokens exist compared to now – this is known as deflation. On the other hand, if more exist, a token’s value will decrease – this is known as inflation. We’ll look at inflation and deflation in more detail below.

Coingecko is a useful resource for researching a crypto’s supply, both circulating and maximum. However, it’s important to note that identifying a crypto’s supply is not always straightforward. Even apparently simple metrics like market cap can be misleading or even manipulated (through misinformed circulating supply metrics).

Let’s take a closer look at circulating supply, maximum supply, total supply, market capitalisation and fully diluted value.

Circulating supply

The circulating supply is the number of tokens that have been issued so far (the number of tokens currently in the market).Consider:

- How many tokens have been issued so far?

- How many tokens exist right now?

Calculating Bitcoin’s circulating supply, for example, is simple. However, other tokens like Ethereum and Solana self-report their circulating supply, or have software that monitors it, which CoinGecko and CoinMarketCap use to update their listings. Checking these services is the easiest way to find a crypto’s circulating supply.

The circulating supply is important because it determines the supply currently available to be sold on the market. When we compare the circulating supply with the maximum supply, it tells us how many more are going to be released, which is vital when considering the potential value of a protocol in the future.

Next, we’ll look at the maximum supply.

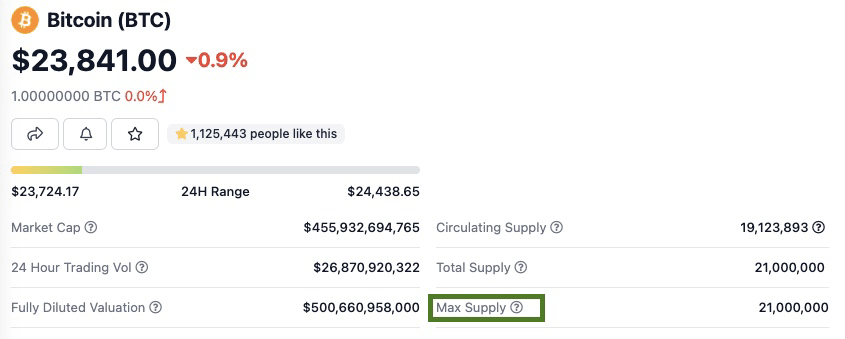

Maximum supply

The maximum supply is the maximum number of tokens that will ever be created. However, note that for some tokens, there is no set maximum supply.- How many tokens will exist in the future?

- Is there a set maximum supply?

- When will the maximum supply be reached?

When considering the potential future value of a crypto, it’s important to look at the maximum supply, rather than the current circulating supply. As if you are considering holding a token for the long term, the maximum supply will likely be reached whilst you hold it.

If the circulating supply is low, but the maximum supply is high, that’s a potential red flag, as it could cause the value of your tokens to be diluted. Short-term holders don’t need to worry as much regarding the maximum supply, as it’s likely they won’t be around for all token unlocks. However, they do need to know about it, as if there are large unlocks soon, they could get badly stung.

Vesting (team and investor token unlocks) and distribution (token unlocks or release outside of team and investors) schedules (how and when tokens are released over time) are also important to consider - we’ll cover those later in the series.

Bitcoin

Bitcoin has a maximum supply of 21,000,000. This scarcity is central to its value proposition. It explains why many see it as a store of value and refer to it as ‘digital gold.’There are also some cases where the number of tokens will reduce. Some projects, either at random or following some pre-set rules, burn a certain percentage of tokens (meaning that they can’t be recovered and are gone from the supply forever). Burning can relate to fees, so the more a particular asset is used, the faster its tokens are burned.

Ethereum

Ethereum, for example, doesn’t have a maximum supply. However, Ethereum’s EIP1559 update introduced a burn of a portion of the gas fees. This means that if the Ethereum network is used heavily, it becomes deflationary.We’ll take a closer look at this later, but this simply serves to highlight why it's important to look at a range of tokenomic factors when determining whether or not a particular crypto is valuable.

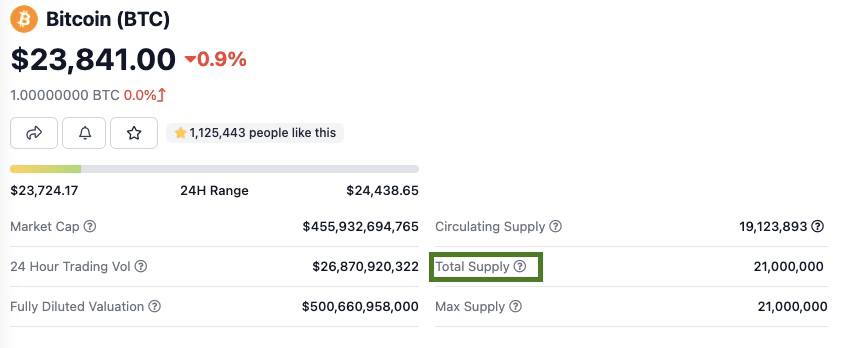

Total supply

A crypto’s total supply is the number of tokens that have already been created or mined. In other words, the number of tokens that currently exist rather than the maximum number of tokens that will ever exist.- What is the crypto’s total supply?

- How does the total supply compare to the maximum supply?

The total supply = the on-chain supply - burned tokens (if there is a burn mechanism).

Now we know the circulating supply, maximum supply and total supply, let’s look at what market cap and fully diluted value are.

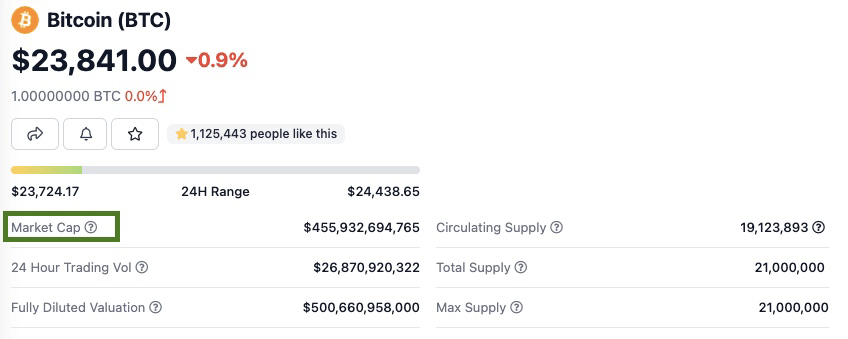

Market capitalisation (market cap)

Market cap is the total dollar value of all coins in circulation.A crypto’s market cap is calculated by multiplying the circulating supply by the token’s price.

- What is the crypto’s market cap?

- Is there good growth potential, or is it already at a high valuation?

The market cap of a crypto is far more important than the token’s $ price, as the price doesn’t actually tell you what a project is valued at.

A crypto’s price is decided by the number of tokens in supply, which is often a completely random and arbitrary number. Therefore, price is entirely useless when valuing a project unless you are multiplying it by the circulating supply (which gives you the market cap) or maximum supply (which gives you the fully diluted value - more on this later).

Market cap offers an indication of how valuable a crypto is, as well as its growth potential (as if you know it is valuable, but it has a small market cap, there could be high growth potential). It’s much easier to get massive returns from small market cap coins, as there is significantly more room to grow. However, a crypto with a smaller market cap is a riskier investment, as it’s much more likely to go to 0 than one with a larger market cap.

Some cryptos have a huge supply, like Dogecoin, for example, which is why it’s one of the biggest by market cap even though the $ value of each coin is very low. Hence why it’s important to look at a crypto’s market cap and not just $ price.

If crypto X has a circulating supply of 600,000 tokens and each token is valued at $1, its market cap is $600,000. If crypto Y has 100,000 tokens in circulation and each is valued at $3, its market cap is $300,000. So, while the individual $ price of crypto Y is higher, crypto X has a market cap that is twice as valuable.

Fully Diluted Value (FDV)

The fully diluted value (FDV) is the theoretical market cap of the crypto if all tokens were in circulation.This is calculated by multiplying the crypto’s current price by the maximum supply of tokens.

- What would the theoretical market cap be if all tokens were in circulation?

- How many tokens are waiting to be released into circulation?

If there is a significant difference between a token’s market cap and fully diluted value, it means there is still a large number of tokens waiting to be released into the market, which could be a red flag. So, it’s important to also check how and when these tokens will enter the market - something we’ll look at later in the series.

There’s a big difference between a token whose supply is growing by 5X in 5 months, rather than 5X in 5 years. So, it’s also necessary to look at the time period over which these tokens will be released.

Again, note that finding these numbers is not always simple. The circulating supply, maximum supply, and FDV figures on crypto tracking websites are sometimes not available or inaccurate (as the projects can self-report these figures).

Checking block explorers or the project's documents/websites is the most accurate way to find the information. However, tracking websites are much easier, and usually are accurate.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms