Tokenomics 3: Token Distribution

Now you know what Tokenomics is and how to evaluate a crypto’s supply, another thing to consider is allocation or token distribution - what tokens will go where?

This is an essential factor to consider when investigating a project’s tokenomics.

Some of the questions we'll consider include:

- How did the project launch its token?

- Who gets the tokens at the launch, and how many each?

- How were tokens distributed (fair launch, pre-mine, ICO, IEO etc)?

- How many tokens are allocated to team members?

- How many can the community get hold of?

- How and when will new tokens be released?

If a few investors, or team members, hold a large amount of the tokens, it adds a high potential risk. They could have excessive swing over governance, or control the price by pumping and dumping to suit them. Even without anything dodgy, they could simply have made a lot of money already, and dump their tokens to cash out, resulting in the price falling.

A good distribution design is when no individual or group holds a significant amount of the token. Instead, it should be distributed among many, with a heavy focus on community allocation.

Fair launch

A fair launch is when the community collectively mines the coin or token e.g. Bitcoin, or Litecoin. There’s no token allocation for fair launch cryptos.Note that a fair launch is the best, but it’s very rare, as it requires the creators of the crypto to get no allocation (which most aren’t happy to do).

Fun fact, Vitalik wanted Ethereum to be a fair launch, but pressures from other team members prevented this.

Pre-mine

Most altcoins have a pre-mine, which is the process of allocating a fixed amount of tokens prior to public launch (to insiders and early investors). In the case of a pre-mine, some or all tokens are minted before opening up the network to the public.Consider:

- If there was a pre-mine, how many tokens were allocated to insiders/early investors?

When looking at the documents, there should be a tokenomics section, where you can see how the tokens are distributed and who they’re going to. If this doesn’t exist, that is a potential red flag, and something that should be looked into further.

Note, that it is a risk if an excessive amount of tokens have been allocated to the project’s team and investors.

Private sale

A private sale is an early-stage fundraising round, where investors can buy into the project at a cheaper rate.- How many tokens were available to private investors?

- When will tokens be available to private investors?

- What price did early investors pay? How much money have those investors made?

If you can find it, it’s worth noting the prices that early investors paid, as it gives you a guide on what the protocol was considered to be worth at the time, and tells you how much money those investors have made. If this is a very large amount, they are more likely to sell.

Tokens allocated to angel investors/venture capitalists (from private sales) will often be the first to be sold, as they will have bought in at very low prices, and are likely to want to cash in profits.

As an example, the first investors in DYDX got in at a $10m valuation. The project is now worth $1.8bn (fully diluted value at the time of writing), meaning a very healthy 180x for the investors!

Public sale

A public sale is when a project makes its token available to the public, this is done in a variety of ways (which we will look to cover in detail in future, more detailed guides).- How many tokens are available to the public?

- What % of the total supply is available to the public?

- When will those tokens unlock for people who took part in the public sale?

ICO (Initial Coin Offering)

In recent years, ICOs (Initial Coin Offerings) have become less popular due to scams. Since then, alternative token offering methods have emerged (they function broadly in the same way, but without the negative connotations of ICOs). These are IEOs and IDOs.IEO (Initial Exchange Offering)

An IEO or Initial Exchange Offering is a type of funding method in which a centralised crypto exchange oversees the sale of the tokens.This means that the project and its whitepaper go through a vetting process, reducing the risk of scams and increasing investor confidence.

IEOs can also help generate publicity for projects and help them make money quickly.

IDO (Initial DEX Offering)

An IDO or Initial DEX Offering is the same as an IEO. However, it is run on a Decentralised Exchange (DEX).As they are decentralised, IDOs remove the need for third-party influence, protecting against biases and human errors. They are generally considered a fair way to launch a new crypto project.

Often, IDOs have anti-whale and anti-bot measures, to ensure no single investor can purchase a massive amount of tokens, and to prevent other bad actors (although these don’t always work).

Note that while projects are vetted by the DEX, there is less regulation than an IEO on a large, regulated exchange, so be wary and ensure to DYOR before taking part in an IDO!

Vesting Schedule

Tokens may be locked up for a specific period of time, during which they cannot be transacted or traded. The vesting schedule (also referred to as the token lockup period) is the timeline of how the team and investor tokens will be released.- Is there a token lockup period?

- How long is the lockup period?

- How and when will team and investor tokens be released?

Usually, vesting schedules take place over many years, often with a ‘cliff’, which refers to a period before they start unlocking, often 1 year (but decided by the team and can be any period). This prevents unlocking too many tokens at once or in a short period of time, which can sink the price of a token and have potentially fatal consequences, as well as giving the protocol time to develop and preventing rug-pulls (as team and investors can’t just sell out instantly).

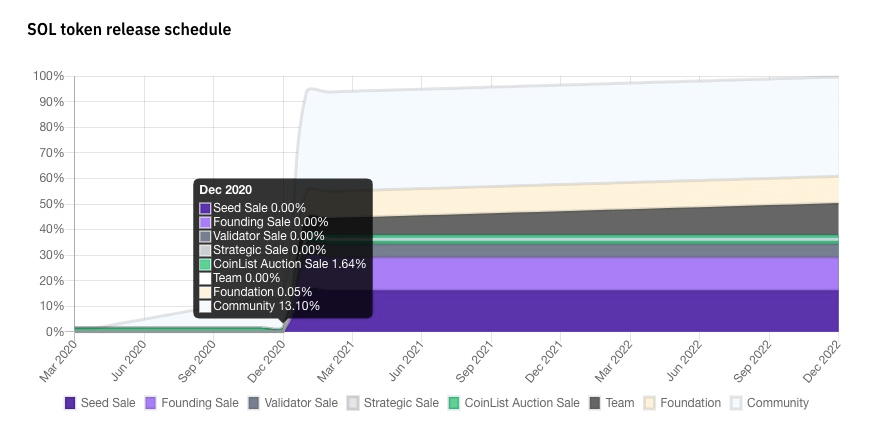

Solana is an example of a bad vesting schedule. Note the huge release of tokens in early 2021:

Emissions Schedules

Emissions refer to how quickly new crypto tokens are created and released by the protocol. For example, a new Bitcoin block is added to its blockchain every 10 minutes. Miners are rewarded with BTC for every block that is validated. Right now, the reward is 6.25 BTC, at the next Bitcoin halving event in 2024, this will be reduced to 3.125 BTC.- How quickly are new tokens created and released?

A token’s emissions schedule usually won’t be available on a platform like Coingecko. So to find it, it’s necessary to dive deeper into the project’s documents or Google.

Sometimes projects will allocate a significant amount of token emissions to early Liquidity Provider rewards. This can be a subtle way for early team/insiders to significantly increase their share of tokens, because they own tokens already, so they can provide liquidity and earn rewards.

The LooksRare (NFT marketplace) team faced community backlash when they cashed out 10,500 WETH (est. $30 million) from unattributed LOOKS tokens. (LOOKS is the native token used for paying platform fees and is awarded to users when they sell NFTs on the platform, alongside WETH rewards for staking and trading). After the news became public, the price of LOOKS dropped by nearly 15%.

Wallet holders

Another aspect of tokenomics is the wallet holders.- What wallets hold the token?

- Does one wallet hold a large amount of the supply?

This means you can find out which wallets are holding large amounts of the token. This is useful as it allows you to see if one wallet holds a large amount of the supply, and can therefore dictate the price, or dump the token.

Note, often the largest wallets are the protocols treasury, mining wallet, vesting contract or similar. So be sure to check out the wallets before jumping to conclusions.

Also, note that if it is a governance token, these holders, if their positions are large enough, can have considerable sway over the protocol's governance.

In the next Guide in this series, we'll look at the difference between inflationary and deflationary tokens.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms