Now that we’ve looked at what Tokenomics is, supply, distribution/allocation, and the differences between inflationary and deflationary tokens, it’s time to consider utility.

Utility is often also referred to as the use-case of the token. When looking at utility, consider the question: Why would you hold this token? The answer may be revenue sharing, staking, governance etc.

For something to have value, people need to believe it to be valuable and that it will continue to be valuable in the future.

We may ask ourselves:

- What is the token’s utility? What does it do?

- Is it governance? (Is it used to decide what happens to the protocol?)

- Is it revenue sharing?

- How will this token make me money?

- Why do people want to own the token?

Token utility vs utility tokens

Note that the term ‘utility token’ is not the same as the term ‘token utility’.Simply put, token utility is the umbrella term for what a token does. A utility token is one of those use-cases, which refers to a token that doesn’t fit into the other categories (such as governance, revenue sharing etc.).

Often, utility tokens are in fact tokens without much utility!

What are utility tokens?

While many tokens claim to be utility tokens, this can actually means they have little to no value and are not inherently good investments.Some crypto exchanges use a utility token for their internal payment system. These tokens are sold before the protocol launches, raising funds to build the platform. It’s expected that those token holders will then use the tokens to pay for fees on that exchange.

This utility token model works for exchanges. However, the only thing that gives the token value is the users’ willingness to pay fees on the exchange. The main argument against this model is that users could just use a different exchange on which they could use Ether or another asset they already hold to pay fees. So, why would they bother buying the exchange token? Well, they probably wouldn’t, so they wouldn’t use the exchange. This bad token use-case actually drives people away from such protocols.

Revenue and Rewards

In this context, we’re talking about revenue and rewards in terms of how much income the asset can generate for you by holding it. Rewards may be earned through staking, mining, revenue-sharing, and yield farming. Such rewards can help further the demand for the token.- How much income can the asset generate for you by holding it?

- Are rewards earned through staking, mining, revenue-sharing, or yield-farming?

If a token has built-in rewards and revenue sharing through staking or other forms, it’s easier to justify investing in it.

Note that staking may have restrictive effects on supply. When you stake a crypto, those tokens are often locked up for a period of time. Staking acts as a way to reduce the supply of tokens on exchanges. It restricts the number of tokens in circulation, which could encourage positive price action.

Not all proof of stake tokens have a lock-up period, so in these cases, tokens could be moved to an exchange at a moment's notice and push a downward move as people take profits. Also, sometimes, lock-up periods don’t align incentives but are designed simply to get people to lock up for long periods of time, meaning they can’t sell, which may be negative if a large number of tokens eventually unlock and hit the market.

Also note if a token offers staking without using the proof of stake consensus mechanism to secure the network (or another use case meaning the tokens are actually productive whilst they are staked), the project is essentially just incentivising you for locking up your token. The project isn’t getting anything out of it and your tokens aren’t doing anything productive. This can be an issue and feeds into ponzinomics (and while it is seen a lot, it’s a bad thing).

Governance

Owning governance tokens gives holders a say in decisions- choosing the direction the protocol takes, as well as controlling things like token emissions (and much more!).What are governance tokens?

Governance tokens represent ownership in a decentralised project. They give holders the right to influence the project’s direction. This may include deciding which new features or products to develop, which partnerships to pursue, or how to spend funds (including deciding whether to share the revenues with the community).For example, derivatives protocol dYdX, is decentralising governance and has outlined plans to achieve full decentralisation and community governance by the end of 2022: "There will no longer be central points of control or failure of the protocol," they stated, before continuing to say that "all aspects of the protocol that can be controlled will be fully controlled by the community.” Right now, the platform runs on a hybrid model where some operations are decentralised, and some are centralised.

While the exact process differs depending on the protocol, governance token holders can typically propose changes through a set proposal submission process. Then, if specified criteria are met, the proposal will go to a vote. Holders can then use their tokens to vote on the proposal.

In decentralised protocols where there is no centralised governing body, governance tokens are essential for decision-making (taking the role of the centralised body, and putting it on all token holders). They enable the distribution of power across an entire community. Token holders are not just users, but owners of the protocol.

Note that governance tokens don’t make sense for every protocol.

What is veTokenomics?

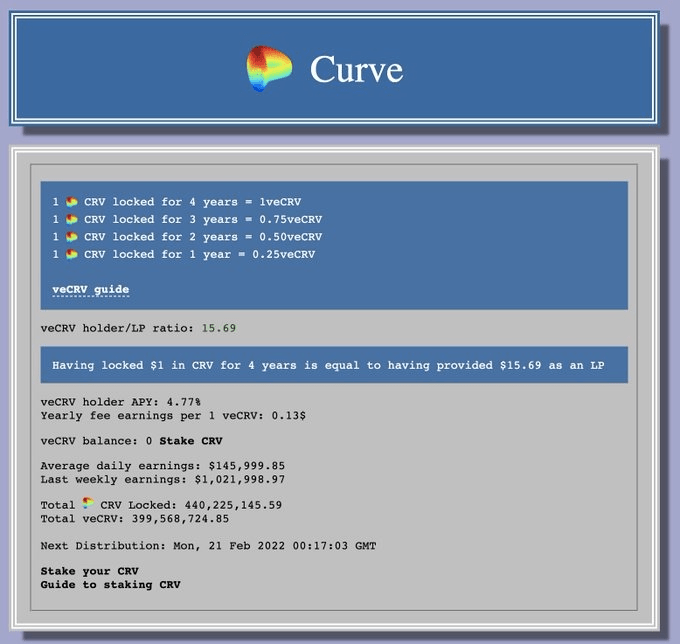

‘ve’ stands for ‘vote escrowed’ and is becoming a popular tokenomics model among newer DeFi protocols. It is a method of locking up tokens, removing them from circulating supply and making sure holders can’t sell them. It can be a ponzinomic method of locking supply, but there are real use cases in which it can be productive and positive. It is specifically used amongst governance tokens, and the longer you lock your tokens for, the more weight your tokens have when it comes to voting on governance.Curve introduced the ve (vote-escrowed) staking model, requiring holders to lock their CRV tokens which are then converted into veCRV, allowing holders to take part in voting. The lock period isn’t fixed, but holders can lock up their CRV for a maximum of 4 years, with more voting power awarded to people who lock their token for longer periods.

Also, once the holder has decided to lock their CRV for a certain period of time, there’s no option to unstake them early. The aim behind token-locking is to build a longer-term value proposition for the token holders. Locking tokens also creates an incentive for all holders to act in the protocol’s best interest.

veTokenomics solves a potential problem with whale manipulation. In non-ve models, large whales can purchase lots of tokens for short-term governance and rewards. Potentially, a whale could purchase millions of tokens to manipulate governance proposals of a competing protocol, and then simply dump the coins.

In the ve model, this kind of manipulation isn’t as effective, if possible at all, as they have to lock tokens, and if they do it for a short period planning to dump after, they will carry much less weight.

Examples of utility

Bitcoin is a store of value like gold (accessible to anyone) and there’s a lot of demand for an easily accessible store of value.Ethereum users can pay fees on applications built on it (Dapps) with ETH. There’s a lot of demand for ETH to pay gas fees. And, with the Ethereum Merge, people staking ETH get a share of revenue from gas fees.

For DeFi tokens, utility may come in the form of votes in the governance system for their protocol, revenue sharing with token holders, or many other use-cases.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms