Tutorial: How to Stake on Lido Finance

Briefly, staking involves locking up a portion of your assets to help validate transactions and support a blockchain network’s security in exchange for rewards. For more on staking, click here.

Overview

What is Lido Finance?

Lido Finance is a decentralised application that allows users to stake and earn yield while also staying liquid.One of the downsides to staking is that for a certain period of time, stakers assets are ‘locked up’. This means that users have to decide between wanting to use their assets to help support a network, or using their assets to earn yield through other DeFi protocols (e.g. providing liquidity or lending).

Lido tries to give users the best of both worlds through liquid staking. Basically, when you deposit assets into Lido, the protocol will stake these assets on your behalf. As a staker, you are distributed staking tokens in a 1:1 ratio to your staked assets (e.g. staked ETH or stETH in the case of ETH).

These staked tokens can then be used to earn yield on other DeFi protocols such as Curve, Sushi and Yearn (links).

Risks involved

It’s important to be aware of the risks involved when staking with Lido. It’s also a good idea to do your own research around the project as well.- As is the case with any protocol on the Ethereum blockchain, Lido faces potential smart contract vulnerabilities (e.g. bugs and hacks). To minimise this risk, Lido’s smart contracts undergo several security audits and are also covered by a bug bounty program.

- There is the risk that Ethereum 2.0 (the next phase of the Ethereum blockchain) will fail to properly launch or reach the expected levels of adoption.

- Slashing risk: briefly, staker’s assets are sent to validators which are responsible for verifying transactions. If the validator your assets are staked with acts up in some way (e.g. goes offline for a prolonged time), you can end up losing these funds. Lido stakes across several reputable validators and also provides cover for up to 5% of slashing penalties.

Tutorial

How to Stake on Lido: ETH

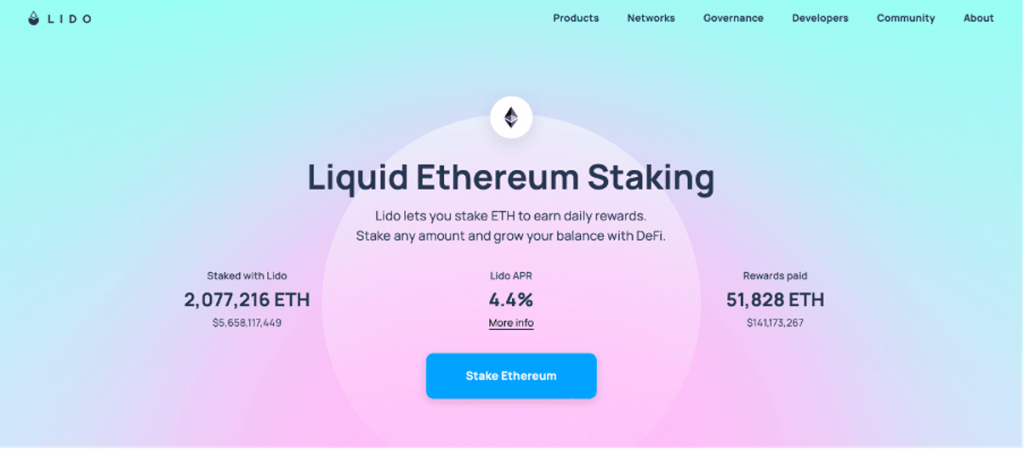

Lido facilitates staking on: Ethereum, Solana and Kusama. This example will go through how to stake ETH on Ethereum, but the process is straightforward for all networks.First, head to Lido.fi. Click the ‘networks’ tab and select the network you want to stake with.

On the following page, select the network you want to stake with. Here you’ll be able to see the Annual Percentage Rate (APR) or yearly rate of returns for each staking pool. Click ‘stake Ethereum’ to proceed.

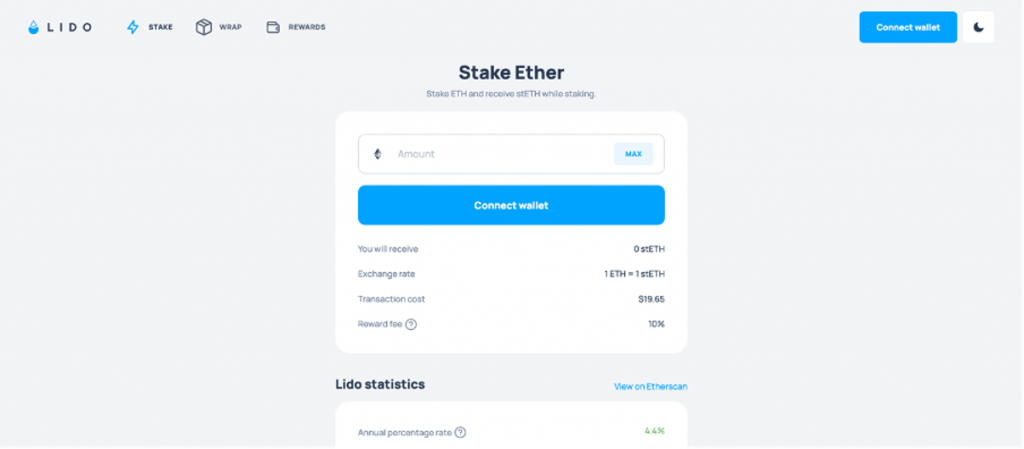

Next, you will need to connect your crypto wallet. Lido supports several different wallets; for this tutorial, we will go with MetaMask. Click here for a full beginner’s tutorial on how to set up and use a MetaMask wallet.

Simply follow the prompts to unlock and connect your wallet. Make sure that your wallet is set to the correct network (i.e. in this case, the Ethereum Mainnet).

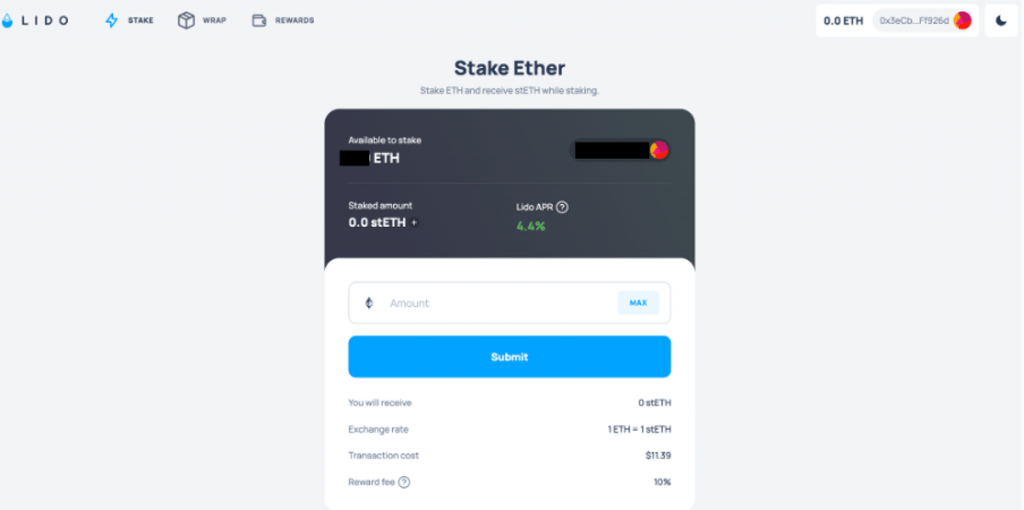

Next, enter the amount of ETH you want to stake. You can stake as little as 0.01 ETH on Lido. Your wallet’s ETH balance will be displayed. To stake all of your ETH, click ‘max’.

The transaction cost represents the network gas or transaction fee you’ll have to pay. The Lido DAO also takes a 10% rewards fee from the interest you earn while staking. These fees are used to fund improvements to the Lido protocol and to provide stakers with insurance against potential slashing risks

Once you click ‘submit’ and confirm the transaction with your wallet, your ETH will be staked! Your stETH balance will now be visible in your wallet. This balance will be updated daily based on rewards earned and represents the value of your deposited ETH plus any staking rewards earned minus any slashing penalties.

Note that it will not be possible to withdraw your ETH on Lido until transactions are enabled on Ethereum 2.0, which is expected to happen sometime in the second quarter of this year. At the time this tutorial was written, 1 ETH = 1 stETH but it may not always remain this way as the yield could get priced in. Therefore, it's possible that stETH > ETH for some time before withdrawals become available.

As mentioned, it’s possible to earn yield with stETH on various DeFi protocols (e.g. providing liquidity to the stETH-ETH pool on Curve). As well as this, stETH can be traded on the secondary market, meaning that you can sell stETH for ETH (e.g. on decentralised exchanges or centralised exchanges).

As always, it’s important to do your own research into these protocols and the risks involved before making any investments.

Comment and share if you found this tutorial helpful! Want to learn more about Liquid Staking? Check out our pro article here.

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms