Tutorial: Premia

Premia is a DeFi option protocol operating on Ethereum and Arbitrum. Users can buy options, or deposit into a pool, which sells them.

We cover Premia in detail in our Pro article, but before we get started with this tutorial, here’s a quick overview …

How Premia works

Premia runs a peer-to-pool market-making model. This means that when you purchase an option on Premia, it is sold to you by the pool. This pool is a DeFi Option Vault (DOV), which other users deposit into.DOVs essentially democratise the process of selling options. Selling options is a complex process requiring specialist knowledge to decide on different metrics. You need to take into account ‘the Greeks’, including delta and gamma, but that is out of the scope of this report. Such strategies are used by market makers and sophisticated traders in TradFi but are reserved almost exclusively for the ultra-rich.

With Premia, users simply provide liquidity to a pool, which removes the requirement to match options sellers and buyers. This allows buyers to have more flexibility on option parameters such as strike price and expiration date. It also enables liquidity providers to earn passive yield without actively writing or managing options on a monthly basis.

There are lots of new updates coming to Premia in the next few months, but you’ll have to read our Pro Article for all the deets – it contains some serious alpha leaks!

This tutorial will go through how to provide liquidity, buy options and stake on Premia.

Tutorial

Connecting your Wallet

Head to https://premia.finance/ and click ‘open app’.

First, you’ll need to connect your wallet.

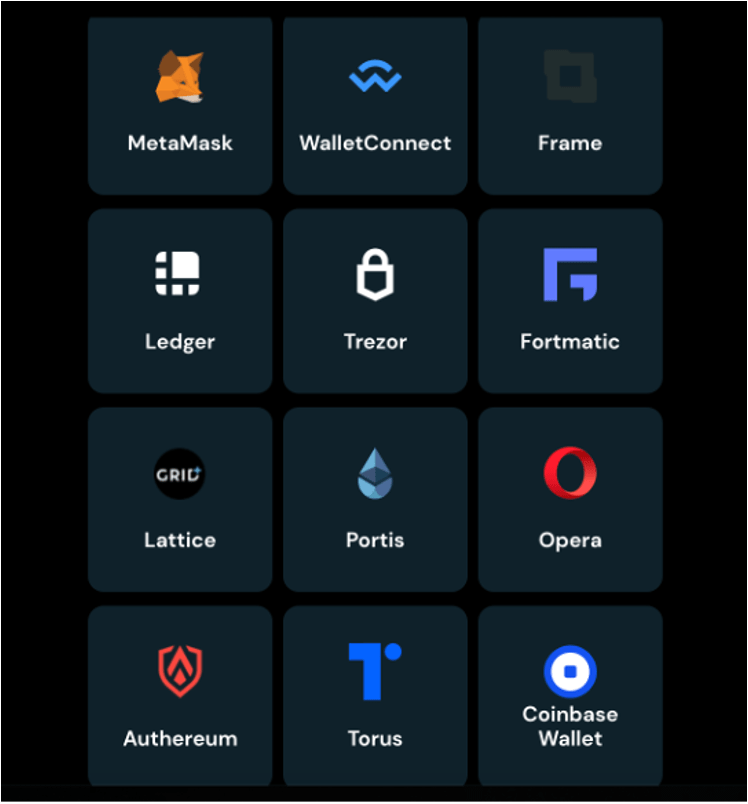

Premia currently supports the following wallets:

You’ll need to agree to Premia’s disclaimer, unlock your wallet and approve the connection.

We’ll be using MetaMask for this tutorial. You can check out our beginner and advanced tutorials for a full guide on how to set up and use MetaMask.

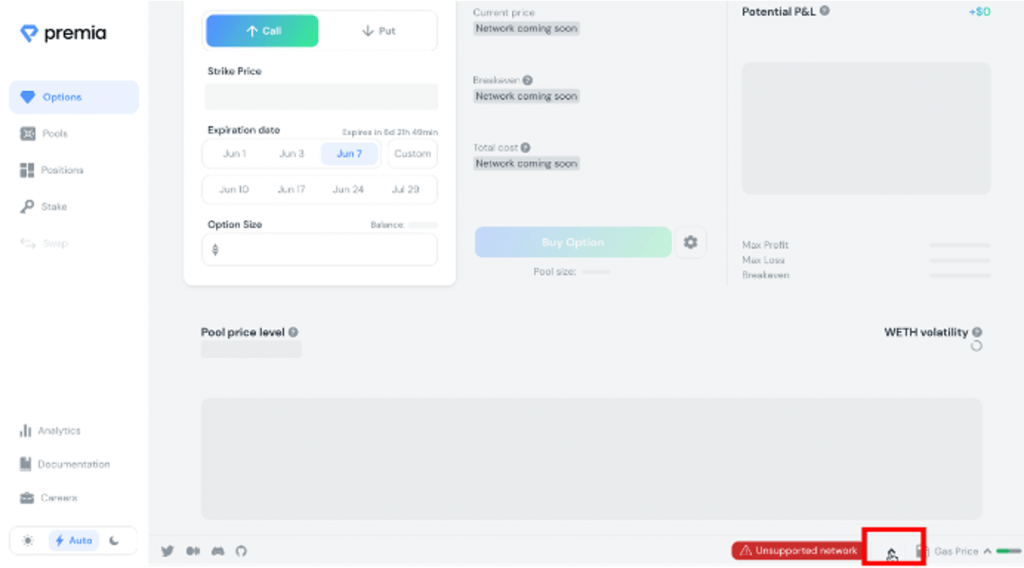

Premia currently supports three different networks – Ethereum, Fantom and Arbitrum. You can switch between these networks by clicking on the arrow in the bottom right of your screen.

Swapping and Bridging Tokens

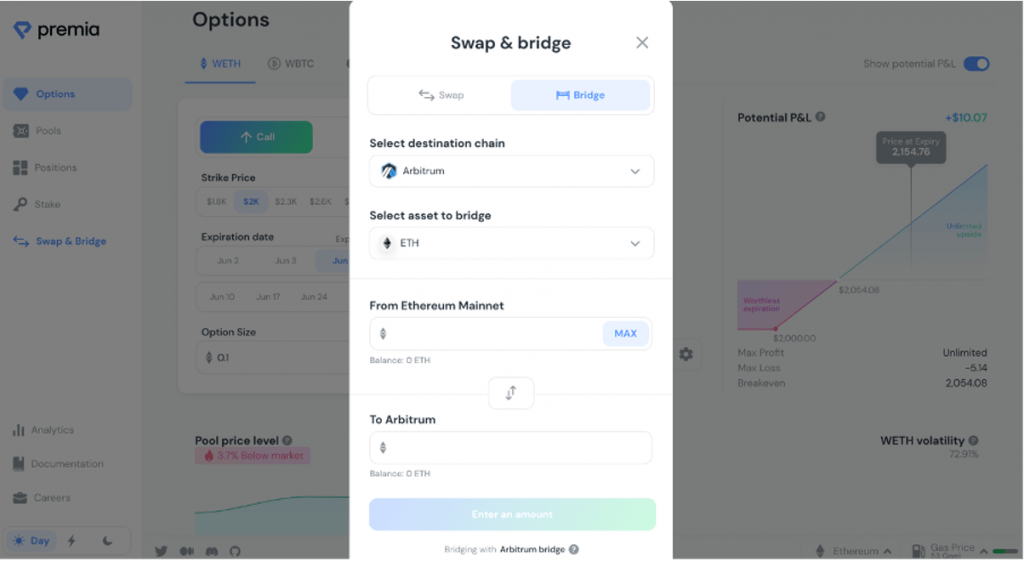

To make things even more user-friendly, Premia has made it possible to bridge from other networks and exchange tokens directly on the platform.Bridge Tab

You can easily transfer tokens between the networks that Premia currently supports.

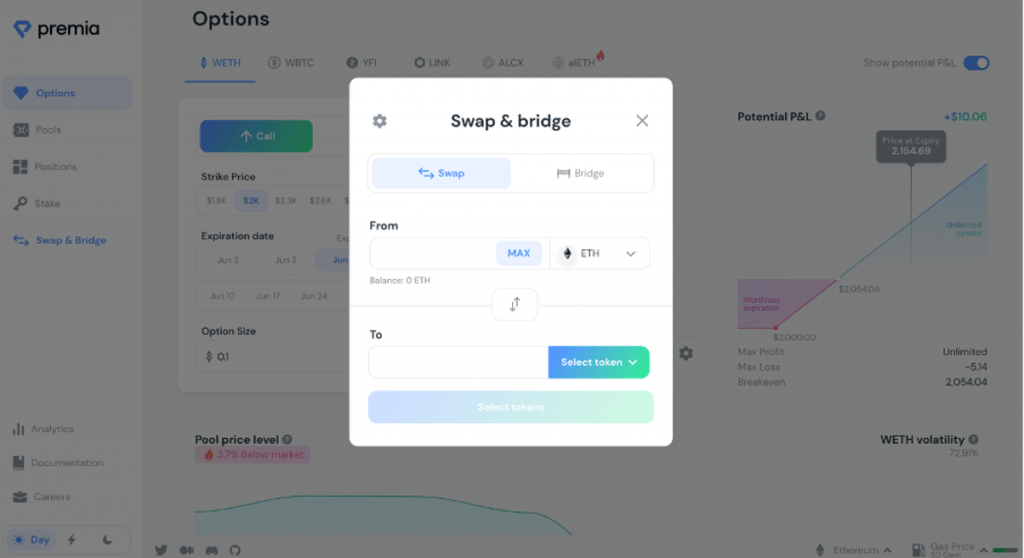

Exchange Tab

Swapping tokens is also very straightforward.

You can swap between any tokens that Premia has liquidity for.

Providing Liquidity

First, make sure you’re on the right network.

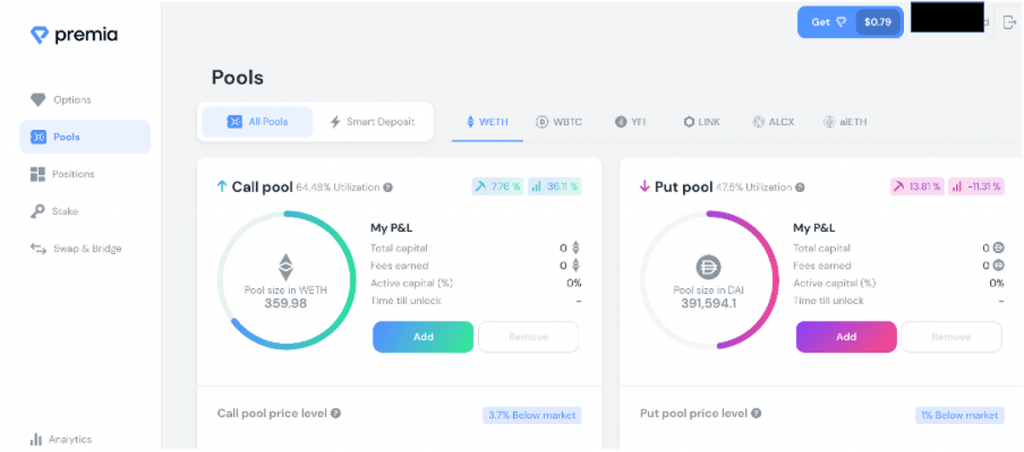

In the pool tab, you’ll first need to choose the asset pair you would like to provide liquidity for and then decide whether you want to supply to the call or the put pool.

Covered Calls: sells call options, which give the buyer the right to buy the underlying asset at a set point in the future for a set price (the strike price). The buyer will pay a premium in exchange for this right, this is the profit you receive as a liquidity provider (if all goes well). The assets deposited into the pool are the collateral which covers the risk of selling the option.

Cash-Secured Puts: sells put options, which give the buyer the right to sell the underlying asset at a set point in the future at a set price. Cash is deposited into the pool, ready to buy the asset at the strike price.Selling options is much more complex than buying them and it’s important to note that if the options the pool is selling (i.e. the options you are selling) expire ‘in-the-money’, it means that the buyer profits, and you (the pool depositor) will lose out.

For more information about options, and to understand how exactly they work, check out our What are Options guide. For more information on the covered call strategy and to see the payoff profile, check out our crypto school guide on covered calls.

You can also check out Premia’s analytics page to see the full list of token pairs and search for the top-performing pools/options.

The percentage utilisation (the percentage of the pool capital that is locked in options contracts) and the estimated annual rate of return for selling options (in this case 36.11%) will be displayed. Liquidity providers also earn PREMIA - the protocol’s native token, which is reflected by the ‘liquidity mining rate’ (in this case 7.76%).

Towards the bottom of the screen, you’ll see a graphic depicting the pool price level.

Without getting too technical, the higher the price level is above market, the greater the utilisation in relation to the supply. This means buyers will pay higher premiums for options contracts, and you, the liquidity provider, will earn more.

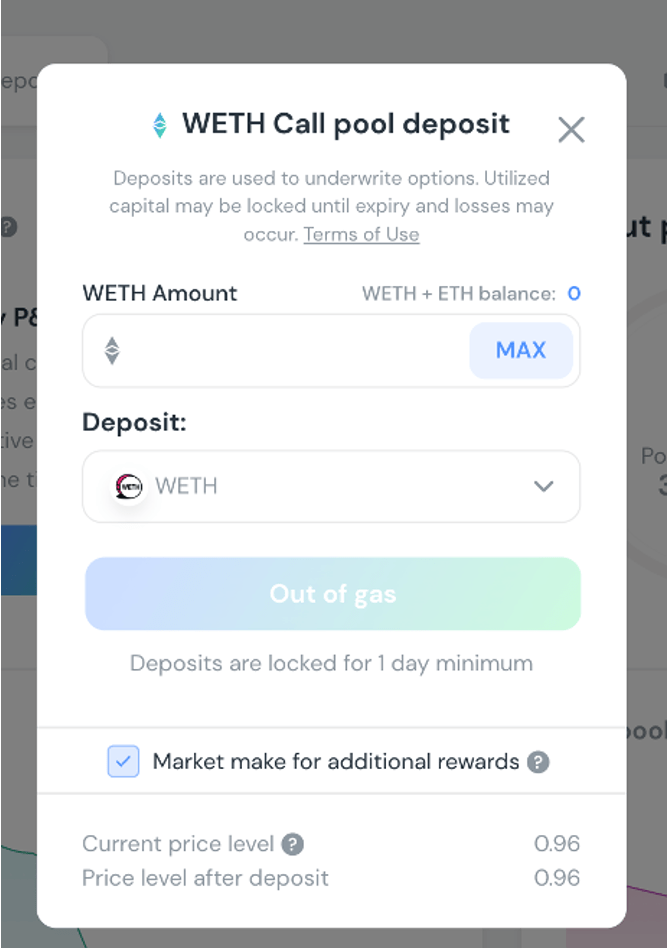

Click ‘add’ to proceed.

Enter in the amount you want to add or click ‘max’ to deposit the total amount in your wallet. Premia allows you to deposit with any asset that the protocol has liquidity for. The protocol will swap these assets for you when you deposit to the pool.

Premia charges liquidity providers a 2.5% annualised utilisation fee, which means when your funds are locked and you are earning yield, you get charged 2.5% APR (so just over 0.2% per month).

The ‘Market make for additional rewards’ feature is enabled by default. This essentially means that the buyer can sell the option back to the pool before expiration. For the seller, it means that capital can be released sooner but also adds an unknown as only the option buyer can choose to sell it back.

If this is your first time using Premia, you will need to approve spending first and then confirm the purchasing transaction.

Once the transaction is finalised, your liquidity position should be visible in the ‘positions’ tab.

Note that your liquidity will be locked for a minimum of 24 hours.

Buying Options

First, make sure you are set to the network that you want to use.

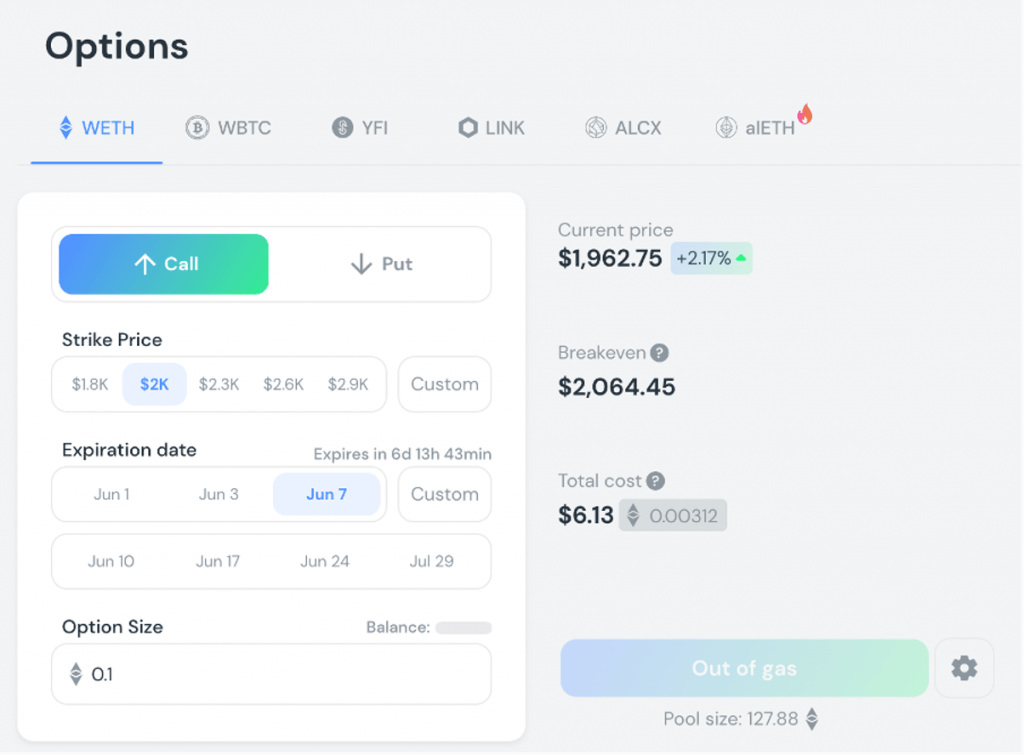

In the options tab, select the token you want to buy options for and whether you want to buy a call or a put option.Again, you can check out Premia’s analytics page to see the full list of token pairs and search for the top-performing pools/options.

Everything else, such as the expiration date and strike price, can be set manually (by clicking ‘custom’) or by selecting one of the already available options.

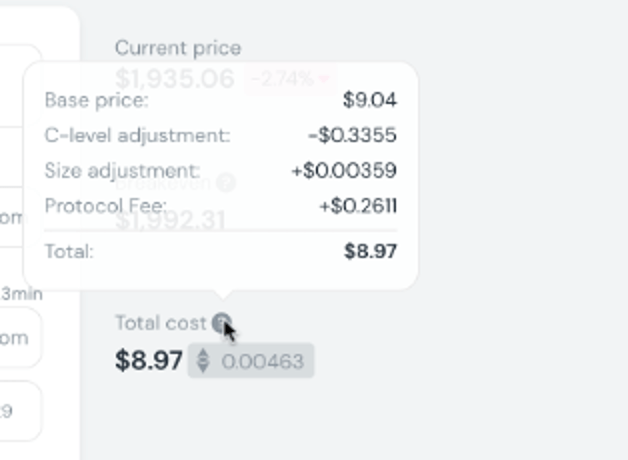

Once you enter this information, as well as the option size (i.e. amount), the total cost (i.e. premium) of the contract will be automatically calculated. Premia charges a 3% fee on all options.

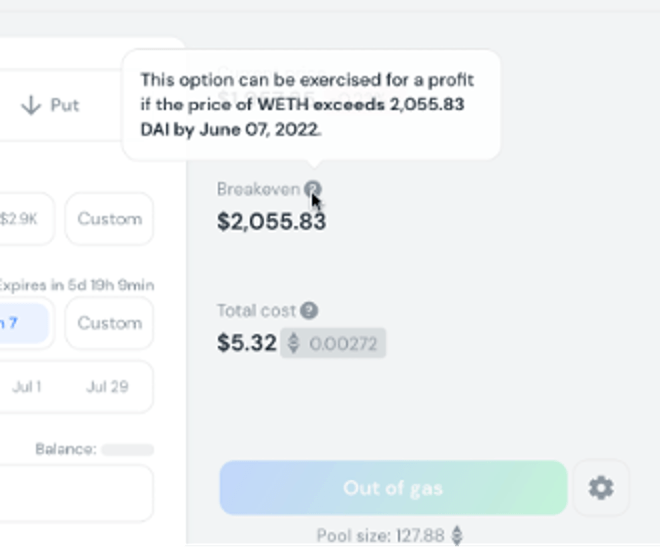

Note that the ‘breakeven price’ is quantified in terms of the underlying asset (in this case DAI, which is a stablecoin) that Premia uses to trade the option.

Similar to the pool tab, you have the pool price level charts.

When the price is ‘below market’, it means that there is high supply in the pool and less utilisation, so the price of the options contract will be cheaper compared to competitors.

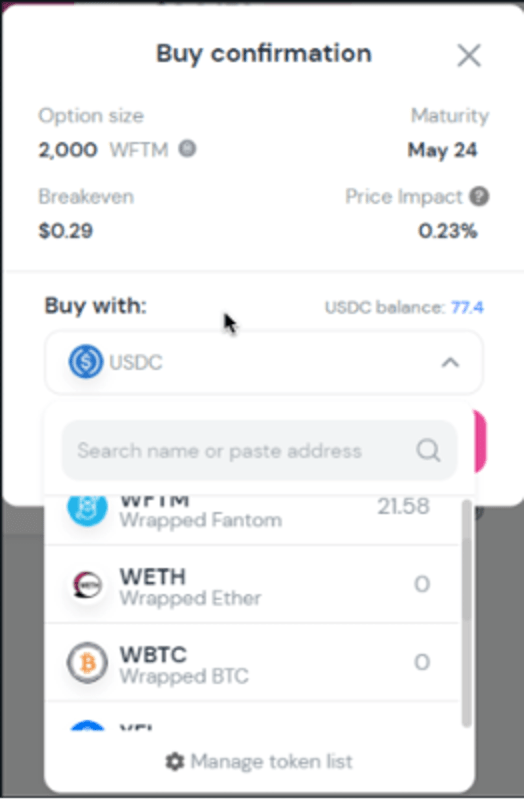

Once you’re happy, click ‘buy option’. Premia allows you to purchase options with any asset that the protocol has liquidity for. These assets will be swapped for you when you purchase the option.

If this is your first time using Premia, you’ll need to approve spending first and then confirm the transaction in your wallet.

Once the transaction is finalised, the contract should be visible in the ‘positions’ tab.

All options on Premia are fully collateralized, meaning the underwriter’s (liquidity provider’s) tokens are locked in the option from the time of purchase until settlement. All options are settled 24 hours after expiry.

Note: option buyers will lose out when the option expires out of the money. This essentially means that the option won’t be worth exercising, so the loss will be in the form of the premium paid to purchase the option. In this case, the depositor into the pool earns the premium.

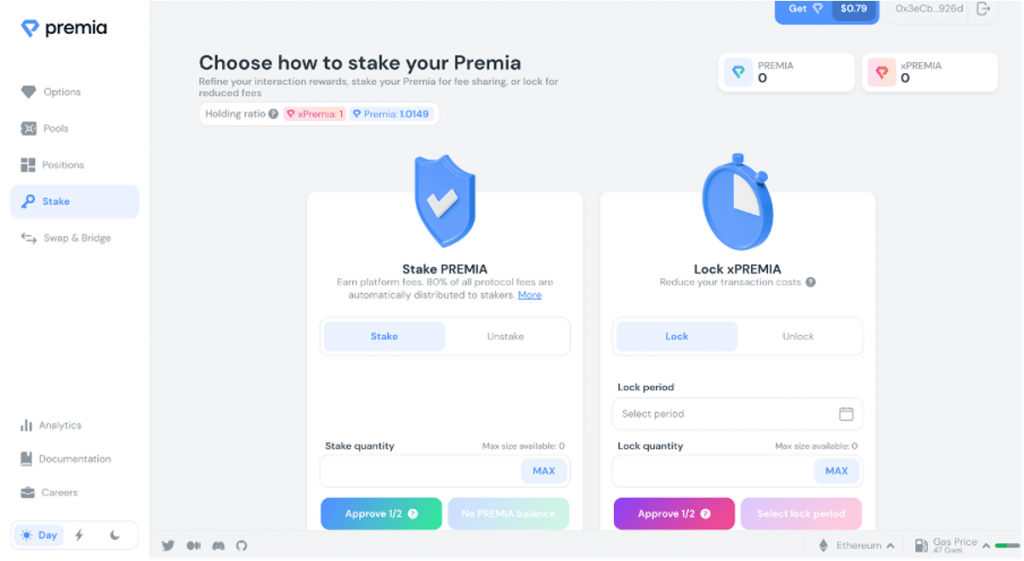

Staking PREMIA

At the moment, staking is only available on Ethereum. If you don’t own any PREMIA, you can use the swap tab to exchange, or you can buy it on exchanges such as Uniswap and Sushiswap.In the staking tab, enter the amount of PREMIA you would like to stake or click ‘max’ to stake your total balance.

You will first need to approve spending and then approve the staking transaction in your wallet.

80% of all protocol fees are converted to PREMIA, which are then distributed to PREMIA stakers.

Positions Tab

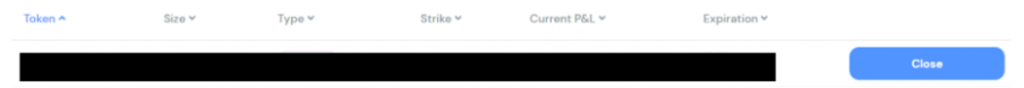

All of your active positions will be displayed here.Selling options back to the pool

As already mentioned, options buyers can sell their options back to the pool before expiration.This essentially means that where before options could only be sold for the value of the option at that time, now buyers can get some of the time value (value of time left until expiry) as well. In simpler terms, it gives buyers the possibility to take advantage of better prices by exercising early.

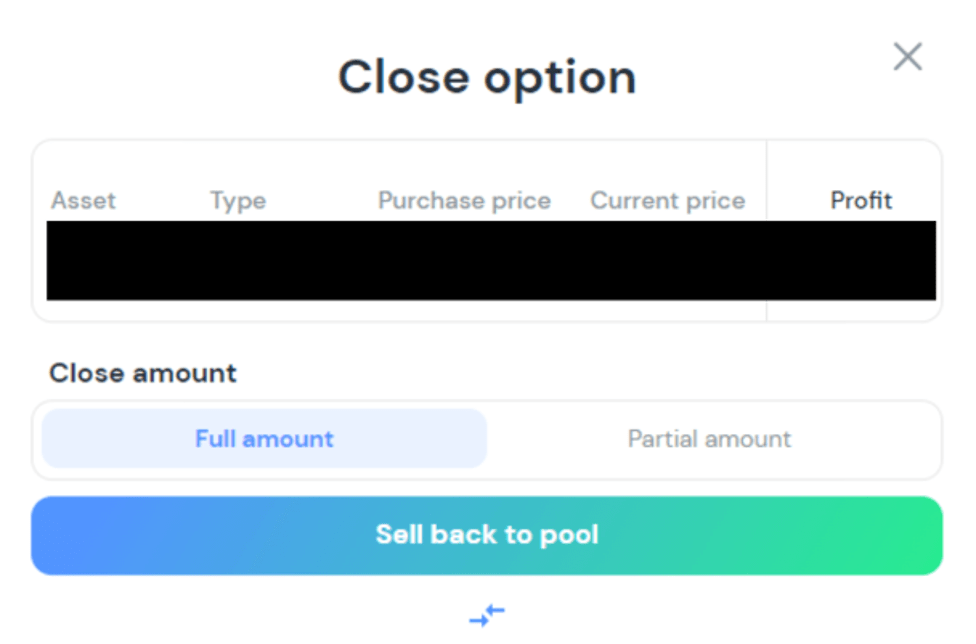

To do this, click on ‘options’ followed by ‘close’ beside the option you want to sell.

Selling the total amount is a default option, but if you want to sell a fraction of your position, select ‘partial amount’ and enter the amount you want to sell.

Withdrawing liquidity

Withdrawing liquidity

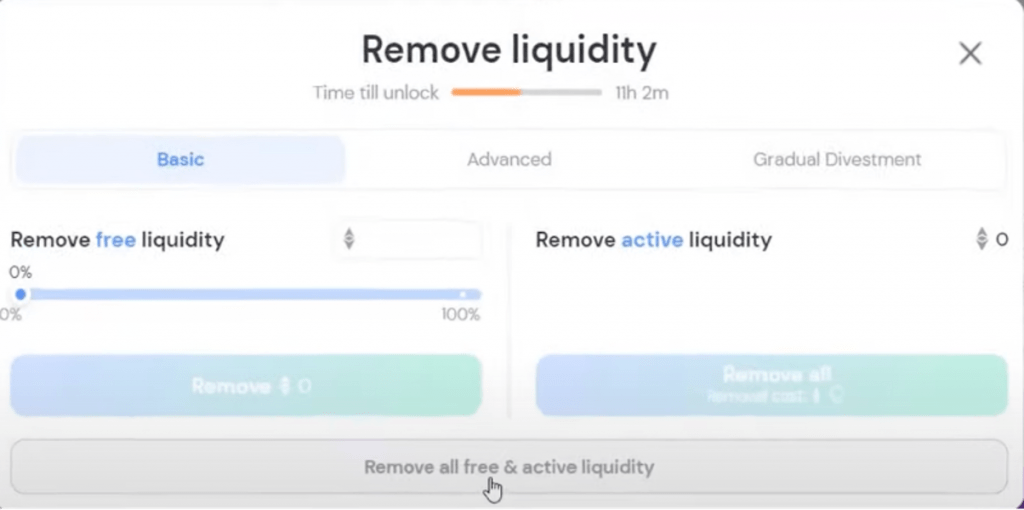

Click ‘yield’ followed by ‘remove’ next to the position you want to withdraw. On the following pop-up screen, you’ll have a couple of options.

Basic: here you can specify the amount of free liquidity ( i.e. not locked in an options contract) that you want to remove. You can also remove any liquidity that is actively locked in a contract, but you will have to pay a removal cost.

Advanced: positions will show here if they're locked in an options contract.

Gradual divestment: if your liquidity is locked in a contract, you can use this tab to specify a date to remove your assets. This will ensure that your assets will not be given out to any new options buyers.

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

Comment and share if you found this tutorial useful! Check out our ‘80% APY!? Is it Sustainable?’ and ‘Don’t Lose the Option’ Pro Articles for more on DeFi Options.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms