On-chain indicators provide clues into how Bitcoin may fare in the short term.

That said, we don’t expect any major moves today; markets are closed in the U.S. today, so expect the action to begin more from tomorrow.

In this update, we will cover:

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

This week's macro data

Data-wise, this week, we don't really have anything of significant importance.The next major data is next week, where we have US GDP on Wednesday and then PCE, Personal Spending, and Personal Income on Thursday.

However, this week, we do have a plethora of Fed-speak. The markets will move on the Fed speak if Fed members say something not currently expected, which we don’t see being the case.

What they're all likely to do is keep their cards relatively tight to their chest and potentially push back on rate cuts following the recently hotter inflation data we've seen. They’ll suggest that they will continue to watch how this data comes in over the upcoming months.

If Fed members allude to the real rate becoming less restrictive if inflation does rear up again, then markets may see some tightening as rate cuts are pushed further out again.

Remember, the odds of a March rate cut in November were 100%; now, in February, the odds of a March rate cut are 12%.

This is the theme we've predicted - the market will price out these rate cuts if inflation comes in hotter in the coming months.

ETF flows

Over the last week, ETF flows have been very net positive, which has probably helped push BTC's price close to $53k.Currently, there are approximately 900 newly-issued Bitcoins a day, yet there is buying pressure of about 6k (give or take, of course) from the ETFs each day.

This, of course, varies on the day with regard to what the inflows are. This is a phenomenal amount of buying pressure into just 900 newly issued Bitcoin each day. Now, when we reach the halving, that supply will fall to 450 Bitcoins per day.

This sounds great, but if you look at this numbers-wise, this already looks to us like a supply squeeze - the halving will help with this, but it almost doesn't matter if newly issued Bitcoin is 900 or 450; there’s a demand for 6,000 BTC to bought by the ETFs every day.

Numbers-wise, this could be argued to be a supply squeeze already, so does a reduction in newly issued coins matter a huge amount if we continue to see this kind of ETF buying pressure?

Our point is here that this is very bullish, whatever way you look at it.

But, immediately after the halving, the effect may not be hugely significant straight away.

Current inflation is 900 BTC per day, but to satisfy ETF demand, the market has to find another 5,100 Bitcoin. If the inflation rate cuts down to 450 issued BTC a day, then the market has to find another 450 each day, from 5,100 currently.

Hopefully, you see our point.

The above holds, assuming Bitcoin ETF inflows remain extremely positive.

If this changes, then we will reassess.

On-chain data

Now, despite our long-term bullishness, and we think the setup for Bitcoin to do well over the coming 9-15 months is phenomenal, we are just slightly sceptical short-term.The reason is that with the move from $43k to almost $53k, BTC is now a little overheated on a number of these key on-chain 'Market Indicator' metrics.

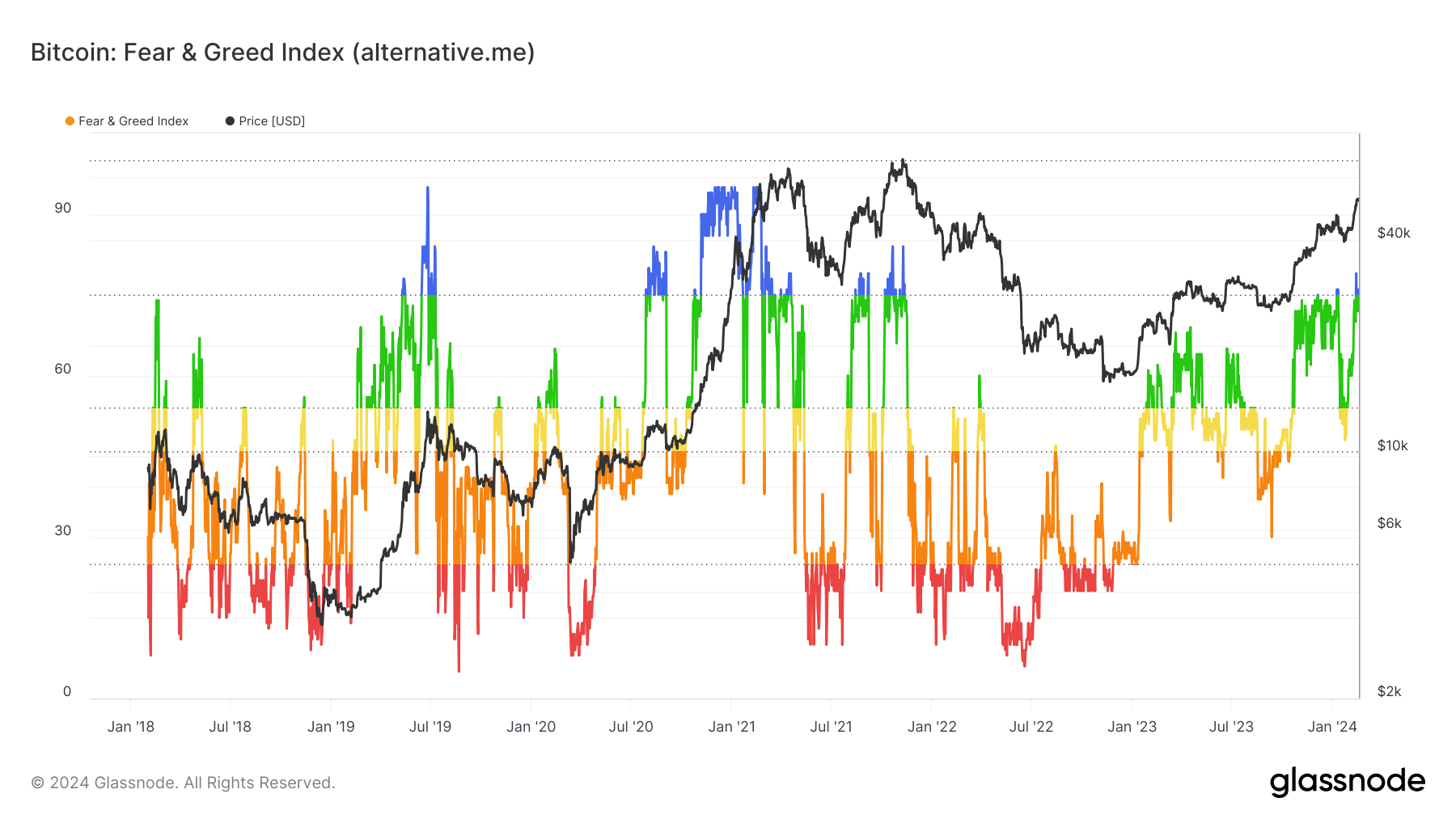

Alongside this, the Fear & Greed Index is currently well into Greed territory. The bullishness may continue, but we are just exercising some caution here partly due to these metrics.

We are still not selling Spot bags, but we'd wait for pullbacks to put fresh dollars to work in BTC.

Let's attach a number of these on-chain indicators below.

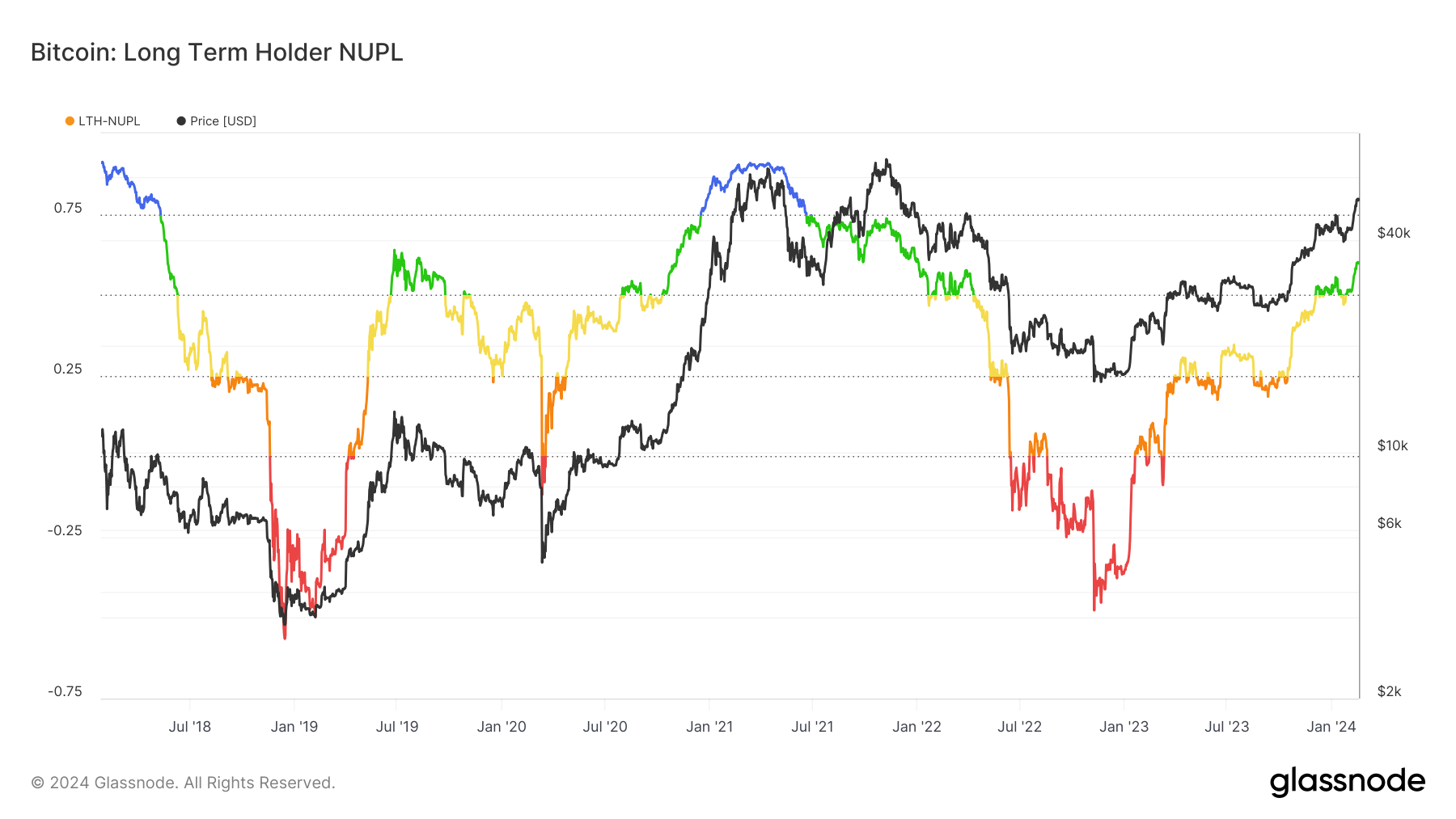

LTH-NUPL

Long-term holders’ net unrealised profit/loss is now well into a high-profit level currently. It is unusual for this metric to be this high this early in the cycle.

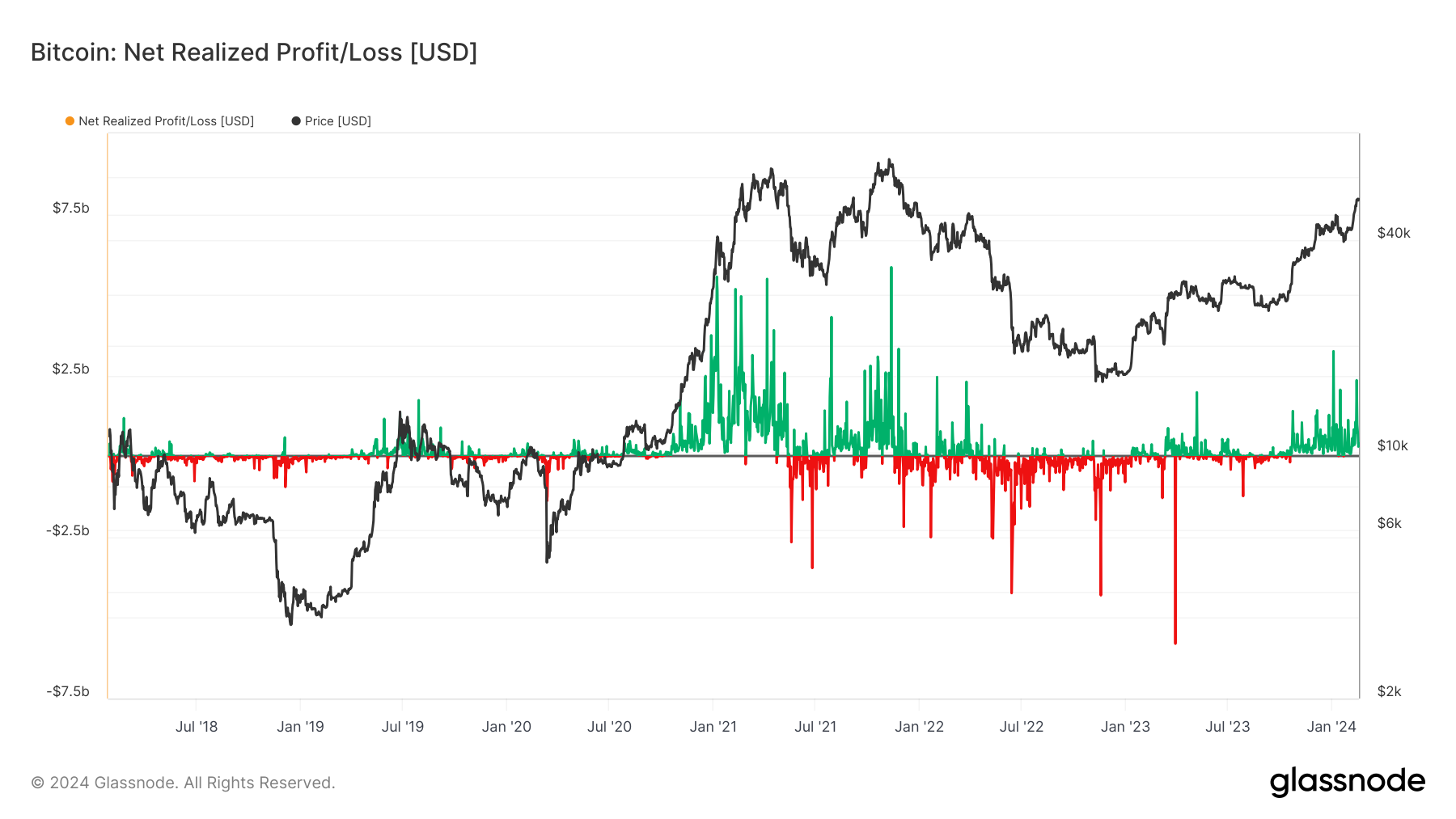

Net realised profit/loss

We’ve seen some decent profit-taking into the move up to $52k. It's not a massive amount of profit-taking, but it is worth noting for sure - indicated by the most recent green spike.

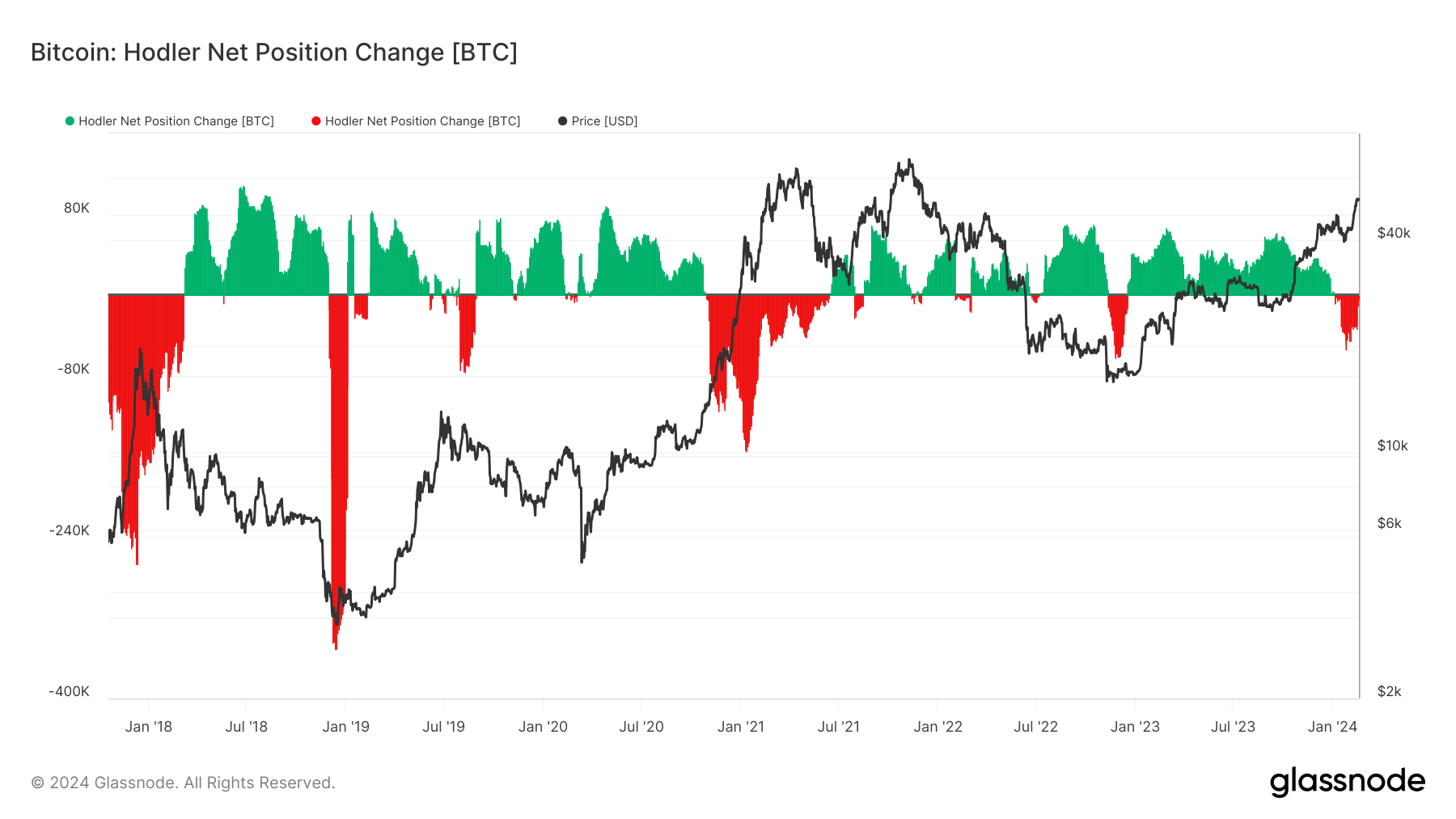

Hodler net position change

Long-term holders net sold down positions recently into the higher prices. This is early in the cycle for them to be doing this. It is hard to know if this means we're full bull now (but very unlikely, this early into the cycle) or if this is just some profit-taking that these investors are just reducing their size or even planning to load up more in the coming months if they see a price dip.It's important to note that a large percent of Bitcoin (approximately 70%) hasn't moved in over a year.

So, the general trend here is still to hodl, of course.

Fear & greed index

No long stories – this is in the extreme greed area.

Cryptonary's take

Essentially, the message here is the same as we've put out recently.Not looking to sell spot bags, but we will be cautious about new buys for BTC at current prices.

A number of the metrics suggest it wouldn't be surprising to see a 10-15% pullback. If we get a pull-back pre-halving, that'll likely be a great long-term buying opportunity. It is possible that the halving itself won't make much of an immediate difference to BTC prices.

That said, the ETF does change things. We're still early in this cycle, being ten weeks or so out from the halving. We maintain that this year will likely be a great year for BTC and crypto in general.

If the buying pressure from the ETFs is sustained, the super rally coming to BTC will blow our minds – this will be the mother of all rallies.

Don’t fumble the bag!

Cryptonary, OUT!