In this report:

- Trade war and market mayhem

- How markets weathered the storm

- The rise of Hyperliquid and HyperEVM

- Memecoins are back- or are they

- Cryptonary's take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Trade war and market mayhem

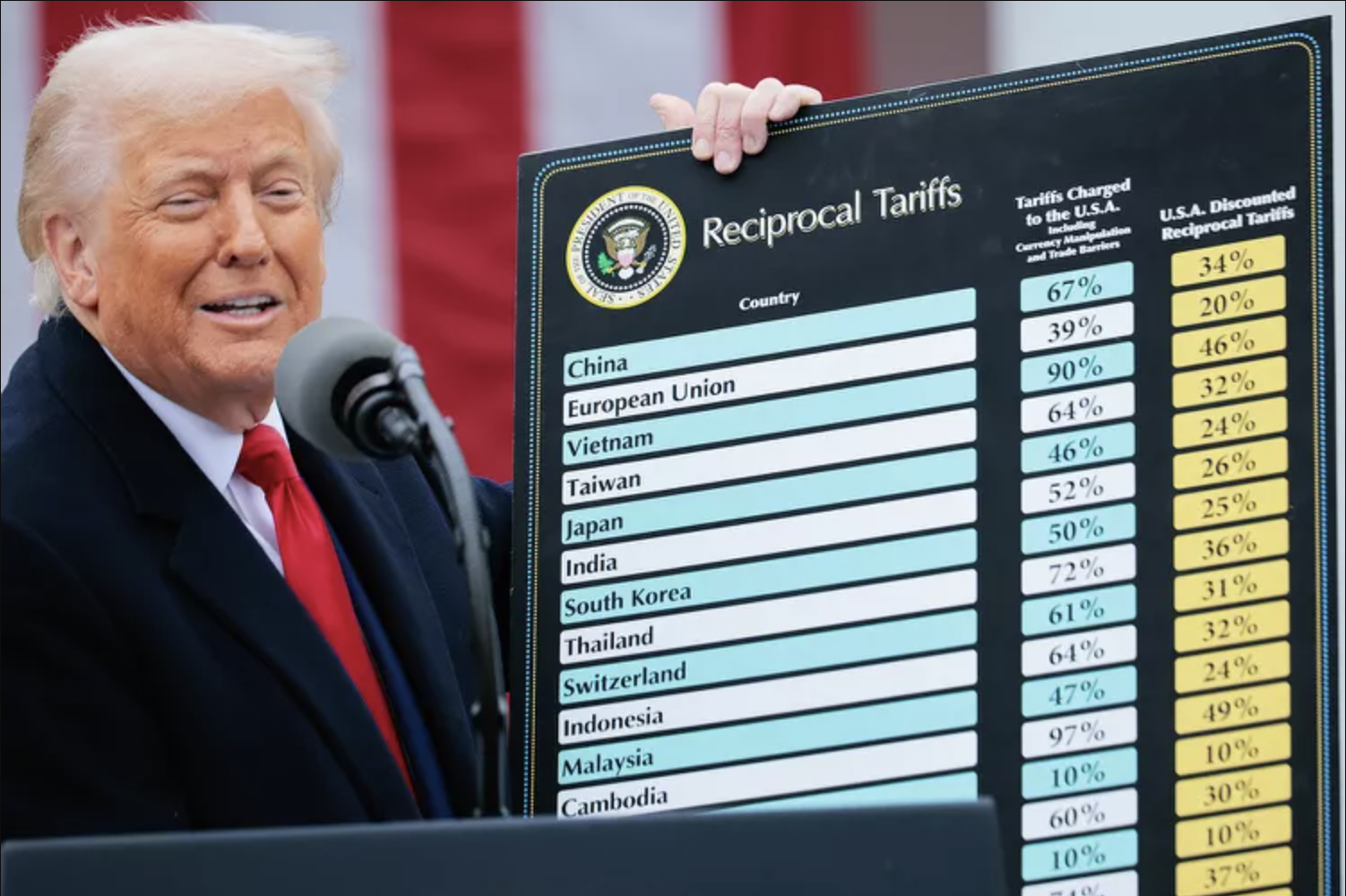

Picture this: April 2025 kicks off with global markets holding their breath-Trump drops the tariff bomb. On April 2, President Donald Trump unveiled sweeping "reciprocal" tariffs that stunned global markets. A 10% baseline tariff was levied on nearly all U.S. imports, but the headline shock came with the specifics: China would face a punitive 125% tariff, the EU 20%, and Japan 24%.These "Liberation Day" tariffs were pitched as a strategy to restore trade balance, but global markets interpreted them as a full-scale escalation. Within days, China retaliated with an 84% tariff on U.S. goods and announced export controls on critical rare earth minerals-integral to manufacturing and defence.

Panic to pivot: How markets weathered the storm

The initial market reaction was chaotic. On April 3, Bitcoin briefly surged to $88,500 as traders initially misread Trump's tariff announcement as a blanket 10% import duty-interpreted by some as less severe than expected. But once details of the reciprocal framework emerged, including steep tariffs targeting China and the EU, sentiment reversed sharply.By April 4, the Dow had shed over 2,200 points, the S&P 500 dropped 6% in a single session, and the Nasdaq officially entered correction territory - falling more than 20% from its recent highs. Risk assets across the board were hammered as markets priced in a protracted trade war and global slowdown.

What’s next?

From crash to comeback — but the data’s still lagging. If you're chasing now, you're late. Unless you're reading this.Amid the turmoil, gold reclaimed its status as the market's ultimate safety valve. By April 22, demand for safe-haven assets surged, with gold spiking to a new all-time high of $3,500 per ounce, reflecting the sheer scale of global investor unease. The VIX crossed 60, its highest reading since the banking crisis of 2022, confirming a full-blown volatility spike.

On the macro data front, the March non-farm payrolls report, released on April 4, added more complexity. 228,000 jobs were added-well above expectations. The unemployment rate rose to 4.2%, and average hourly earnings growth softened to 3.8% YoY. While the jobs number showed resilience, the labour market's underlying strength was called into question.

Then came inflation data. On April 10, the March CPI print surprised to the downside: headline CPI fell 0.1% MoM, while core CPI rose just 0.1%, both below expectations. Year-over-year core CPI came in at 2.8%, confirming a broader trend of disinflation despite the tariff narrative. Gasoline prices were a key driver, plunging over 6%, but the market's reaction was muted-tariffs, not inflation, had become the dominant fear.

Meanwhile, consumer confidence cratered. On April 12, the University of Michigan's Consumer Sentiment Index came in at 50.8, down from 57.0 in March and over 30% lower than December 2024 levels. Short-term inflation expectations jumped to 3.5%, reflecting fears that tariffs would reverse the Fed's hard-won disinflation trend.

The bond market was no less dramatic. Between April 13 and 15, 10-year Treasury yields spiked to 4.35%, partly on speculation that China was offloading U.S. Treasuries in retaliation. Treasury Secretary Scott Bessent floated the idea of buybacks to restore market stability. While this calmed some nerves, it underscored how delicate the global liquidity picture had become.

A turning point came on April 16, when the White House appeared to soften its tone. A 90-day tariff pause was announced for non-retaliatory countries like Mexico and Canada. Bessent was sent to Tokyo for negotiations, and European leaders signalled an openness to dialogue. Markets responded positively. From April 17 to 20, risk assets bounced sharply, and Bitcoin began leading the recovery, climbing back above $90,000 by month's end.

By April 29, with BTC near $94,000 and gold retracing slightly from its highs, there were growing signs that peak fear may be behind us. But while markets have stabilised for now, a sustained recovery will depend on continued macro improvement and greater policy clarity as we move into May and June.

From fear to FOMO

Throughout April, our stance was deliberately cautious. With escalating tariffs, rising inflation risks, and an absence of fresh stimulus, we anticipated an extended period of market weakness before any durable recovery could take hold. For a time, that thesis appeared to play volatility surged, sentiment collapsed, and Bitcoin sank to the low $76,000s.

But what happened next wasn't what many of us expected.

In the final stretch of the month, a sudden pivot in tone from President Trump-who softened his tariff stance and publicly floated 'being very nice to China'-helped restore investor confidence. Treasury Secretary Scott Bessent emerged as the calming hand behind the scenes, hinting at negotiation and downplaying further escalations. Combined with confirmed institutional accumulation-including ETF inflows and Strategy's $1.42 billion Bitcoin purchase-crypto markets responded sharply. By April 29, BTC was trading near $94,000, up nearly 25% from the lows.

The question now isn't just why markets rallied-but how to respond.

Many participants stayed sidelined for most of April, waiting for lower entries amid a deeply uncertain macro landscape. That wasn't an error. It was risk management in one of the most complex market environments in recent memory.

But as often happens, sentiment turned faster than fundamentals. The CoinMarketCap Fear & Greed Index hit a low of 15 (Extreme Fear) on April 5. By April 29, it had rebounded to 53 (Neutral)-a 250% shift in just three weeks. That wasn't just a bounce; it was a full sentiment reset. In hindsight, the low $76Ks on BTC proved to be an excellent entry-but rarely do bottoms feel that way in the moment.

Those who were dollar-cost averaging into that fear are likely well-positioned now. For others, the takeaway isn't about chasing missed moves-it's about preparing for the next opportunity. Markets reward planning, not perfection.

From our perspective, this remains a relief rally. The economic data currently supporting risk assets (cooling inflation, stable jobs, surprise GDP strength) is largely pre-tariff. As the cost impact of trade policies begins filtering into supply chains and balance sheets, we expect macro headwinds to re-emerge-likely by late May or June.

In the meantime, we anticipate range-bound conditions. For BTC, the key range is $91,700 to $98,900, with $95,700 as the mid-level. If $91,700 breaks to the downside, a retest of $86,000-or even the low $ 80Ks- is firmly back on the table.

This isn't about sounding the alarm-it's about staying prepared. April reminded us how quickly conditions can shift. Whether you're holding stables or mapping out your next move, this is the time to re-evaluate your levels, refine your playbook, and remain focused. Emotion may drive headlines, but execution still drives outcomes.

The rise of Hyperliquid and HyperEVM

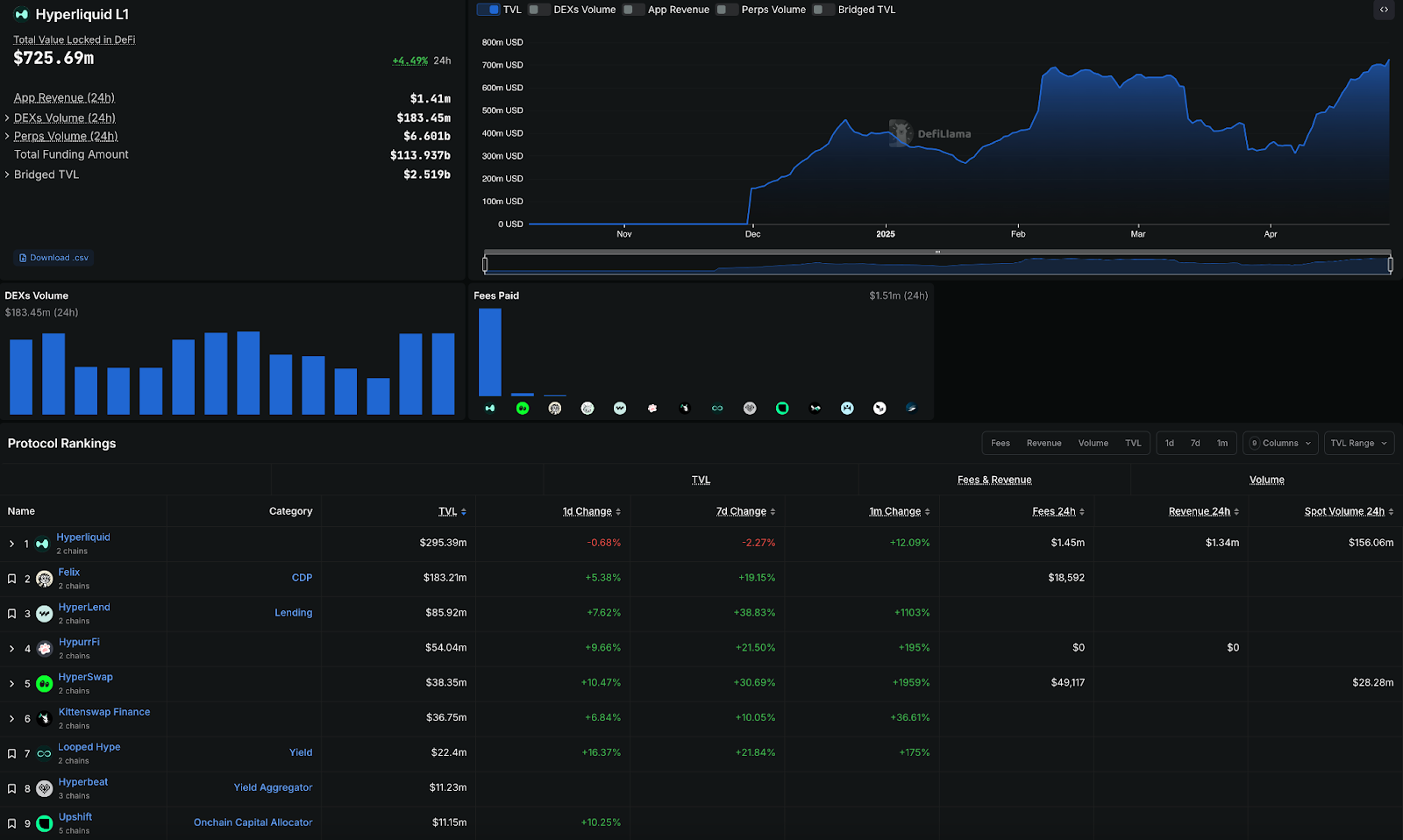

While the broader crypto market spent most of April grappling with macro uncertainty, one ecosystem quietly flipped the script: Hyperliquid. In just a few weeks, it didn't merely hold its ground - it accelerated. Protocol TVL soared, ecosystem usage deepened, and native DeFi activity on HyperEVM began gaining serious traction.By April 30, Hyperliquid's Layer 1 had amassed over $725 million in Total Value Locked, with DEX volume hitting $193 million over 24 hours and daily revenue reaching $1.6 million, according to DeFiLlama. More notably, this revenue was organic - fueled by real usage across perpetual trading, native staking, and smart contract interactions via HyperEVM.

That strength is even more impressive when you consider what the protocol endured over the past 60 days. On March 12, a trader exploited a vulnerability by opening a highly leveraged ETH position, triggering a $4 million loss for the HLP vault. Then, on March 26, a separate manipulation involving the JELLY token resulted in a $12 million unrealized loss - again tied to the HLP system. In total, tens of millions in value were put at risk. The team acted swiftly - patching vulnerabilities, communicating transparently, and taking decisive steps to safeguard user funds. Still, sentiment wavered. The $HYPE token briefly plunged to $9.30, marking a drawdown of over 60% from its local highs. And while price and protocol revenue have rebounded impressively, TVL in the HLP vault remains well below peak levels - suggesting that full trust recovery may still take time.

Despite those setbacks, by late April, $HYPE had rebounded sharply - nearly doubling back to $19.60 - as confidence returned, growth resumed, and attention rotated in. The recovery wasn't just price-based; it was structural. Usage wasn't isolated to a single product. Protocols like HyperLend, Felix, Hypurr, Keiko, and Kittenswap saw double-digit TVL growth throughout April, with several posting 100%+ increases. Notably, six of the top seven dApps by TVL are tokenless and actively rewarding points or emissions - ideal conditions for stablecoin farmers, DeFi power users, and airdrop hunters alike.

This momentum coincided with the release of our HyperEVM Airdrop Strategy Guide on April 12. The timing proved prescient. Just days later, both liquidity and speculation began concentrating on HyperEVM-native assets. The platform now ranks among the top 10 most profitable chains on any given day, with trading revenue rivalling established L1s - despite being less than a year old. That is no small feat, and the market is beginning to reflect it.

What began as a high-performance trading venue is now evolving into a full-fledged DeFi ecosystem - with the fundamentals to back it. With real revenue, expanding ecosystem depth, meme-driven retail engagement, and proven resilience through adversity, Hyperliquid is emerging as one of the most complete narratives in crypto today. True to its vision as "The Blockchain To House All Finance," the protocol is building toward something far more ambitious than just trading. Whether you're staking $HYPE, farming tokenless dApps, or rotating into HyperEVM memes - the risk/reward equation here is becoming hard to ignore.

Memecoins are back-or are they?

After months of cooling off, memecoins showed flickers of life in April. Sparked by Bitcoin's rebound from $76,000 to nearly $94,000, the risk-on impulse at the tail end of the month triggered sharp outperformance in select names. FARTCOIN rallied over 200%, while PEPE, POPCAT, and others posted 50-100% moves - signalling that when conditions improve, memes remain the market's highest beta trade.But these weren't broad-based rallies. The sector remains constrained by macro headwinds and fragmented liquidity. For now, the memecoin rotation has been fast, localized, and highly selective - a sign that traders are willing to speculate, but still hesitant to commit.

Memes as market barometers

Memecoins function as sentiment amplifiers. When Bitcoin rallies, they run harder. When volatility spikes, they vanish. They thrive in risk-on conditions, and April's late-month bounce offered a window - however brief - for that dynamic to re-emerge. Across social media, trading volumes, and on-chain activity, memes once again took centre stage during brief surges of optimism.Importantly, Bitcoin is still struggling to hold above key trend levels like its 50-day EMA, and broader liquidity remains thin. Until BTC convincingly breaks above $98,900 and macro conditions improve, these meme runs are likely to remain fleeting. Let's be real - most people aren't speculating on frog coins when their landlord wants USDC on the first of the month.

The retail edge

What continues to make memecoins unique is their accessibility. Unlike altcoins - often weighed down by insider allocations and unlock schedules - the best memes are community-owned from inception. They lean on branding, humour, and viral energy instead of promises of utility. And that retail-first structure offers outsized upside during bull runs.This cycle, exchange accessibility has only strengthened the thesis. Coinbase, Binance, Bybit, and even TradFi platforms like Robinhood now list top memes. That frictionless access allows capital to rotate into narratives quickly - and often explosively - when sentiment shifts.

Risks and red flags

Still, not all memes are equal. April also saw a string of influencer-pushed coins crash - including Mubarak on BSC, which pumped to a $140 million market cap before falling 50% in days. Forced narratives, VC-funded launches, and top-down marketing campaigns continue to flop without strong community backing.The lesson is simple: memes must be earned, not engineered. The ones that endure - DOGE, PEPE, WIF - all began as bottom-up movements. Coins with insiders, presales, or team-controlled liquidity rarely survive beyond the first hype cycle.

The road ahead

Are memes back? Sort of. The pulse is there - but the heart isn't racing just yet. Until BTC breaks higher and risk-on flows return with force, the memecoin sector will likely remain tactical. Expect rotation, but not yet sustained euphoria.In the meantime, stay sharp, stay nimble - and stay patient. The next wave of 50x-100x memes is coming, and we'll be the ones to find it. Our track record speaks for itself, and when the time is right, you'll hear it from us first.

Cryptonary's take

April delivered a strong recovery - no question. Bitcoin bounced nearly 25% off the lows, volatility settled, and select sectors like Hyperliquid and memecoins showed serious strength. But the move came fast, and in many ways, ahead of the data. Much of what we've seen priced in - softer inflation, job market resilience, earnings upside - still reflects a pre-tariff economy.That's an important context heading into May. Markets are forward-looking, but they're not immune to delayed impacts. If tariffs begin showing up in inflation prints, earnings margins, or consumer sentiment, the next few months could offer new entries across risk assets. For those with dry powder, it's worth keeping your frameworks sharp and your levels clear.

We're not rushing to reallocate, but we're not fading strength either. This is still a range-bound, headline-sensitive market, where true clarity may take time to emerge. In the meantime, we stay nimble, disciplined, and ready to deploy when the right setup comes into view.

Cryptonary, OUT!