Technical Analysis

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Market context

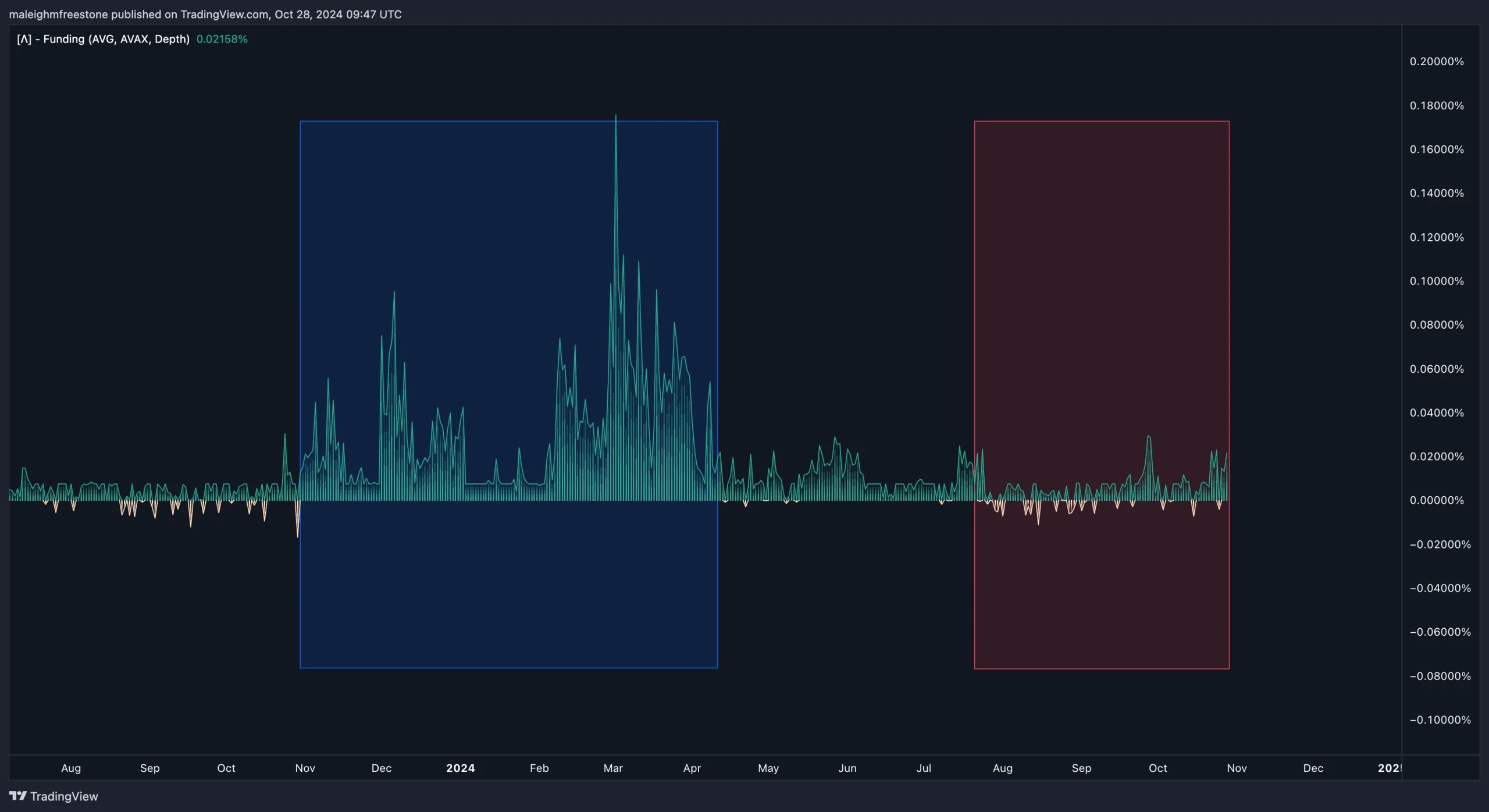

AVAX is showing strong signs of a potential bottoming formation with a clear inverted head and shoulders pattern forming. This aligns with areas where we've seen significant negative funding, particularly from July 22 onwards, suggesting a shift in sentiment as the price reached lows around $21.750 and $19.820.Historically, AVAX's price action has reacted to periods of negative funding by rallying higher, making this alignment a key indicator of a possible reversal. A rounded bottom structure is also observed, adding further conviction for a bullish move, especially as we consider Total3's similar pattern, indicating broader altcoin strength.

Market mechanics

Funding Rate: From November last year, funding has generally remained positive or near equilibrium, indicating sustained interest in longs. However, from April 2024, a bearish trend emerged in funding, intensifying into significant negative levels by July 22. This shift in funding sentiment corresponds with the recent lows and strengthens the argument for a potential bottom in AVAX.

Playbook

- Build Zone: Continue building within the weekly buying pressure box, using levels from the inverted head and shoulders pattern to accumulate.

- Upside Potential: Watching for confirmation of a rounded bottom, with a break above the key neckline to target a sustained uptrend.

- Strategy: Maintain focus on spot accumulation and gradually increase position as the structure forms. Avoid leverage for now, as volatility may pick up if the inverted head and shoulders pattern confirms a move higher.

Cryptonary's take

AVAX's pattern aligns well with broader market indicators, and funding trends show that this could be the foundation of a larger move. Holding within this structure allows for building a position with a strong risk-reward ratio, and the signs are aligning for a potential bullish reversal.AVAX isn't an asset we currently hold or are included in our CPRO picks, but it remains a strong performer, has community interest, and is a promising technical formation.