Bitcoin remains stuck in limbo but could break either way this weekend. Meanwhile, key altcoins like Ethereum, Solana, and THORChain face critical tests at support and resistance.

Join us as our Head of Analysis scans the landscape to highlight the must-watch technical levels for clues on where we could be headed next.

TLDR

- BTC is coiling up between strong support and falling wedge resistance - a breakout looms.

- ETH is losing a key level, but an oversold reading may spark a bounce.

- SOL is finding buyers after sharp slide - can it break free?

- RUNE surging but running into a wall of resistance.

- What’s happening with THOR? Details below!

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

BTC | Bitcoin

Following yesterday’s weak US 30Y Bond auction, Equities (SPX & NDX) pulled back slightly at the resistance area we highlighted last week. At the same time, Bitcoin found some support at its horizontal support of $26,500. The weakness in yesterday’s US 30Y Bond auction is likely to be negative for risk assets in the medium to long term.Still, we may see the relief rally in risk assets continue in the near term due to risk assets moving higher despite the negative geopolitical situation.

Over the past week, Bitcoin has had an inverse correlation to SPX and NDX, moving lower, while the SPX and NDX have moved higher.

Technical analysis

Bitcoin broke down from its wedge pattern and initially tested the horizontal support at $26,500, where some buyers stepped in.BTC’s price is now out of the local uptrend (bottom border of the wedge). This is the opening update we gave yesterday, and it remains the same today. We’re now looking at whether the $26,500 level can hold as support, and we begin to see buyers stepping in.

We still believe Bitcoin will go lower in the coming months. Still, in the very immediate term, Bitcoin can retest $27,300. This price point is the horizontal resistance and the underside of the bottom border of the wedge (which may also act as resistance).

We’re now in a slightly tighter range of $26,500 to $27,300, and we expect $27,300 to act as a resistance.

RSI & funding rates

Yesterday, we were looking to see if Bitcoin could form a hidden bullish divergence – we now have this today. This is a higher low in price but a lower low on the oscillator. This could help fuel Bitcoin for a retest of $27,300.The funding rate is only just positive and has whipped around over the past 24 hours, while the open interest is up 10% from last month but still not relatively high.

In terms of liquidation levels, there are a lot of short liquidations between $27,100 and $27,300. There are also a lot of long liquidations at $26,500. Again, this emphasises the tightness of this range.

Conclusion on trading BTC

If the SPX and NDX can hold up, BTC should move slightly higher in the short term, even though it has been inversely correlated in the last week. It’s key that the $26,500 level continues to hold as support, and we’re watching $27,300 for the next resistance.Action

- Just watching here but with a keen focus on the SPX and BTC, but for now, we are doing nothing.

- If BTC can move up to $27,300 and begins to find resistance there (watch the smaller timeframes for this), this may be an opportunity to short Bitcoin from $27,300 with a target of $26,200.

- If the opportunity doesn’t present itself – for instance, if Bitcoin just moves lower, we will look to begin DCA’ing sub $24,000. The game plan remains the same.

ETH | Ethereum

We called yesterday to say that ETH is looking super weak, and now ETH is below the horizontal support of $1,550.Technical analysis

This is a key area for ETH to get back and hold above the $1,550 horizontal level. ETH is also in a downward wedge, which may help give ETH a breakout and a break higher. Ultimately, the main battle is at the horizontal level of $1,550. We need to see buyers come in, and it doesn’t look hugely positive so far.

RSI and funding rates

The RSI is interesting, as it has now broken below its uptrend. However, we have a hidden bullish divergence – a lower low in price and a higher low on the oscillator. This could give us enough fuel to get back above $1,550 and try to retest $1,625.Regarding the funding rates, it’s the same as BTC. Positive, but mixed across exchanges. Nothing to really go off here.

Conclusion on trading ETH

Although ETH does look weak and hasn’t performed very well, we feel that ETH can move higher here to at least get back above the $1,550 level and then attempt a push to $1,610.Action

- We recommend doing nothing on ETH. BTC is the more exciting play for a trade if it can get back to $27,300. The game plan remains the same as yesterday.

- We remain excited to begin DCA’ing into ETH if it reaches lower price levels. Our first target of interest is the $1,400 level.

- We feel ETH could even head lower than $1,400 in the long term, potentially as low as $1,100. We will begin DCA’ing sub $1,400.

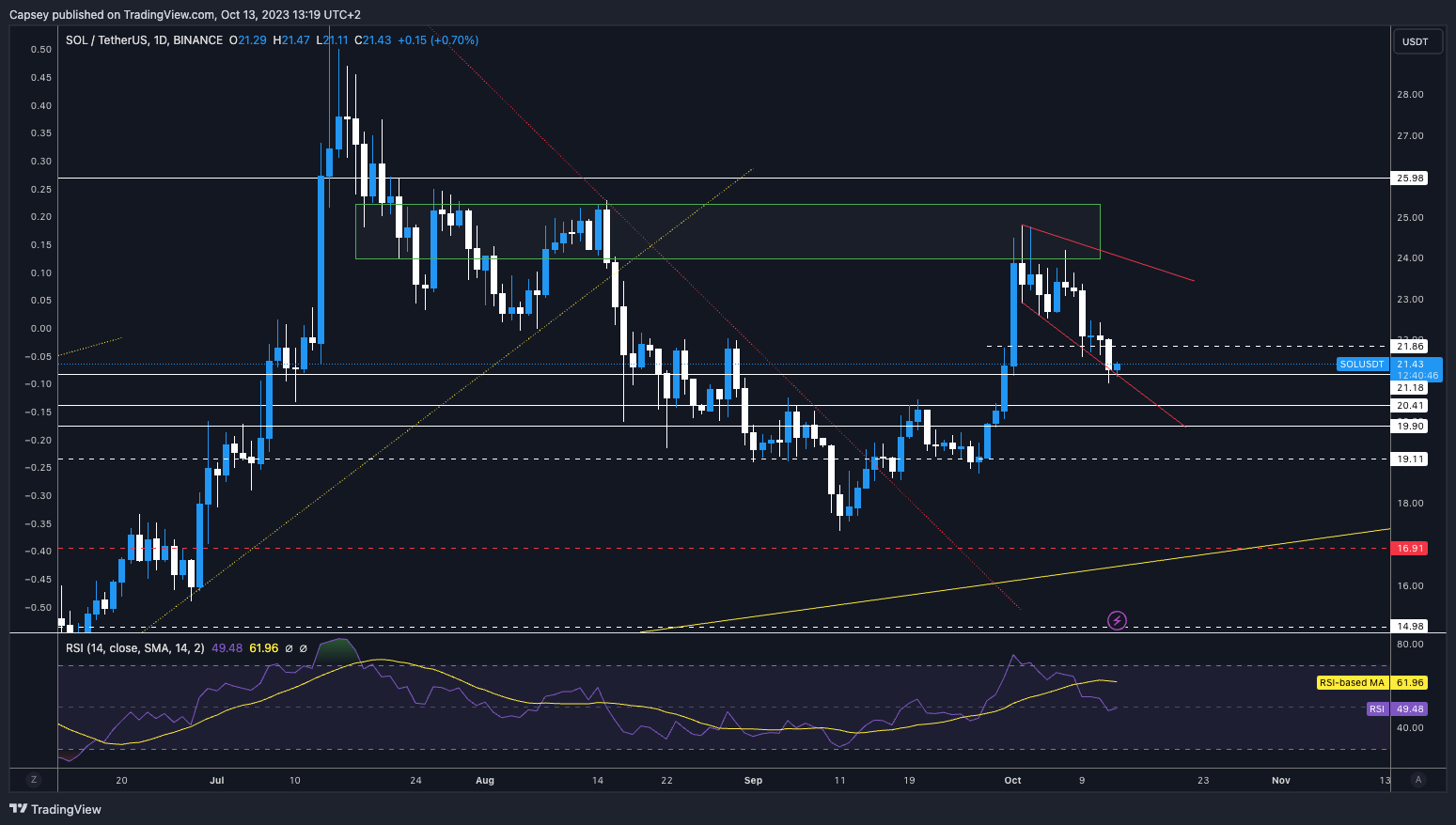

SOL | Solana

Since finding a top in the $24 area, we’re now seeing SOL at its first major horizontal support of $21.18.Technical analysis

SOL has so far held the $21.18 horizontal support, which also has the support convergence from the bottom border of the broadening wedge. We expect SOL to find some support at this level and at least try to attempt a bounce up to $21.86.

RSI and funding rates

The RSI has now reset to a more middle territory and is well below its MA. A move back to retest the RSI MA at 62 would likely mean SOL getting back up to $22. No divergences are at play here, and none seem to be forming at the moment.The funding rate for SOL is now relatively negative but potentially not negative enough that this could be open to a short squeeze. It is important to continue watching this to see how it develops.

Conclusion on trading SOL

Steering clear of SOL for now. The focus is on BTC and another altcoin play that we like.Action

- SOL is another asset on which we’re just watching from the sidelines. The opportunities are elsewhere.

- This update remains the same as yesterday’s, although there are now greater odds of a bounce here.

RUNE | THORChain

Whip-sawing price action, and one we certainly got wrong. However, this was due to THORSwap coming back online.Technical analysis

There was a phenomenal bounce from the $1.50 horizontal support, which has driven RUNE back above $1.61.However, the first retest of the $1.68 horizontal resistance has seen that area act as resistance for price. We believed RUNE would head down to $1.50, and we were right in this; we were just wrong on the initial move, but the final destination was reached.

Our next key test is whether RUNE can break above $1.68. If it can, we will target the $1.90’s.

RSI and funding rates

The RSI is at 45, so it’s in middle territory. There are no clear RSI trends or any divergences here.The funding rate is very negative on Binance and ByBit exchanges and could drive a short squeeze. This would immediately discourage us from shorting if we were interested in shorting RUNE.

Conclusion on trading RUNE

RUNE can get more upside here, but it needs to show initial strength and get above the horizontal resistance of $1.68 first. Then, a move higher could be driven by shorts covering from a short squeeze.Action

- We are doing nothing here, although if we held a large bag of RUNE, we’d look to sell some of the size at $1.90 (assuming we can get there). But that is the current plan for RUNE.

THOR | THORSwap

It’s a big move so far on THOR today, but now we’re moving into and testing some key levels.Technical analysis

After the huge move down, THOR began forming a bear flag, which usually has a bias for the price to break lower. Despite remaining in that bear flag, the price has moved higher to the upper end of the bear flag and tested the top border as resistance.This also converges with the underside of THOR’s main uptrend line (thicker yellow line). This will likely act as a resistance, at least in the short term. There is a key horizontal support at $0.135, which we expect to hold as support at least in the near term.

RSI and funding rates

With the RSI at 47, there is more room for this to go lower and to see that bear flag break down. There are no divergences at play that we need to be aware of here, so the price action and technical analysis govern our next moves.Conclusion on trading THOR

There is much more positive price action, but we remain in the bear flag. THOR is likely seeing a positive response to THORSWAP coming back online, but we feel that’ll be short-lived, and prices will be lower in the coming months.Action

- We would look to reduce positions into the $0.19 area.

- We would look to re-accumulate sub $0.135

Cryptonary’s take

The crypto market remains on shaky ground overall, with upside momentum lacking. Bitcoin and Ethereum are battling at critical inflexion points that will determine if this relief bounce has legs or if lower lows are still ahead.Among altcoins, those finding support like Solana could see short squeezes, but top performers like THORChain face heavy overhead resistance on any continued rally. We remain cautious here, avoiding major positions until key levels decisively break.

Cryptonary OUT!