Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

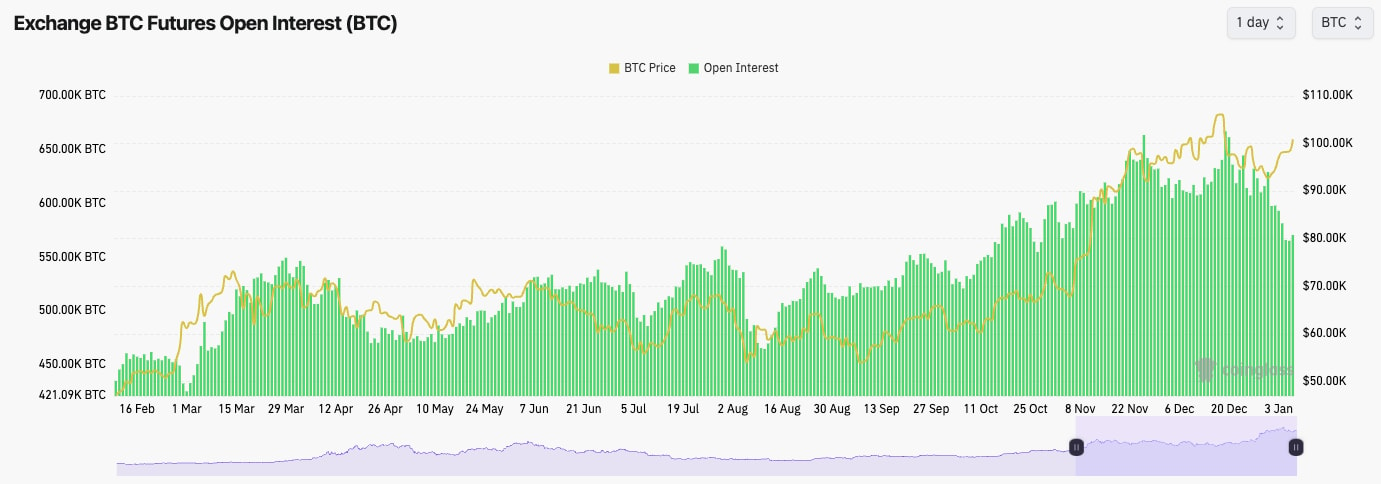

- BTC's Open Interest is down to 570k BTC from the local high of 667k BTC. This approximate 15% drawdown in OI is good and healthy to see. It means that excess leverage has been flushed, and BTC sits at $101k... super strong.

- Funding Rates are also at normal levels of 0.01%; again, excess leverage has been flushed, which is good to see.

- Overall, this is a healthy setup from a leverage perspective.

Technical analysis

- BTC found support at $91,500, and it has broken out of the local downtrend line, sending prices higher.

- We've had a move higher into the local horizontal resistance at $98,900, and on the US open today, we've had a convincing break above. We'll now be looking for today's candle closure to be in this kind of area ($101k; anything north of $100k is good).

- Beyond $98,900, the main horizontal resistance is between $101,700 and $102,500. A break above this level, and you'd expect a swift retest of $108k.

- If we get a strong close today, we'll be looking at $98,900 to become new horizontal support.

- The RSI is above its moving average, and now it's retesting its downtrend line. A breakout from here is what likely pushes us to $108k again.

- The RSI is also not too close to being overbought yet. Room to go higher here.

Get the latest Bitcoin price prediction—dive into our detailed analysis to stay one step ahead!

- Next Support: $98,900

- Next Resistance: $102,500

- Direction: Bullish

- Upside Target: $108,000

- Downside Target: $95,500