Market Direction

Bitcoin (BTC) price prediction Eyeing $73,600 if $68,900 breaks!

Bitcoin (BTC) is eyeing a potential breakout after bouncing off the $66,000 support level, retesting its $68,900 resistance. With funding rates stable, could BTC head toward its all-time high of $73,600? Here’s today’s analysis and forecast.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

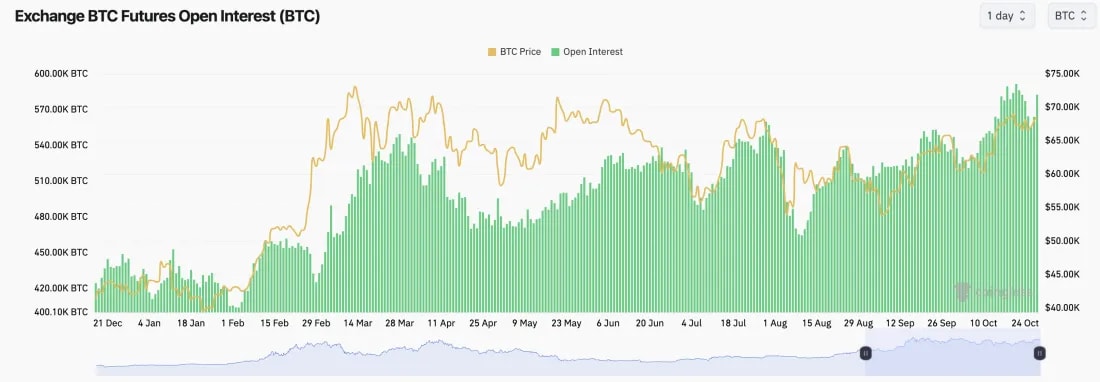

- On the move down to $66k last Friday, nearly 10% of Open Interest by coins was wiped out. This is a small, but a nice flush out on that move. However, we have seen OI move back up to it's highs over the last 24 hours.

- However, Funding Rates remain contained in positive territory, hanging around the 0.01% level, which is a very normal level and doesn't indicate over heating.

Technical analysis

- BTC initially rejected the overhead horizontal resistance at $68,900 and pulled back to our first marked area between $65,000 and $66,000.

- Price has since bounced really convincingly and is now retesting the underside of the horizontal resistance at $68,900 again, but this second time, the RSI isn't in overbought territory.

- To the downside, we'd expect the $65,000 to $66,000 area to continue to act as major support.

- To the upside, $68,900 is the main level for the price to break out above. Beyond that, it's the all-time high at $73,600.

- Next Support: $66,000

- Next Resistance: $68,900

- Direction: Bullish

- Upside Target: $73,600

- Downside Target: $66,000

Cryptonary's take

BTC looks really positive here. You'd want to see price pullbacks bounce off the main areas of support, which is what we've got, and now the price is butting into the main horizontal resistance. It seems that risk appetite is becoming more comfortable for some people as it looks more likely that Trump might win the US presidential election.We wouldn't be surprised if BTC doesn't break above-price all-time highs pre-election. But we do think BTC can break above $68,900 between now and the election and be butting into all-time highs at and around election day.