Market Direction

Bitcoin (BTC) price prediction today: Can Bitcoin hold support and reach $66k?

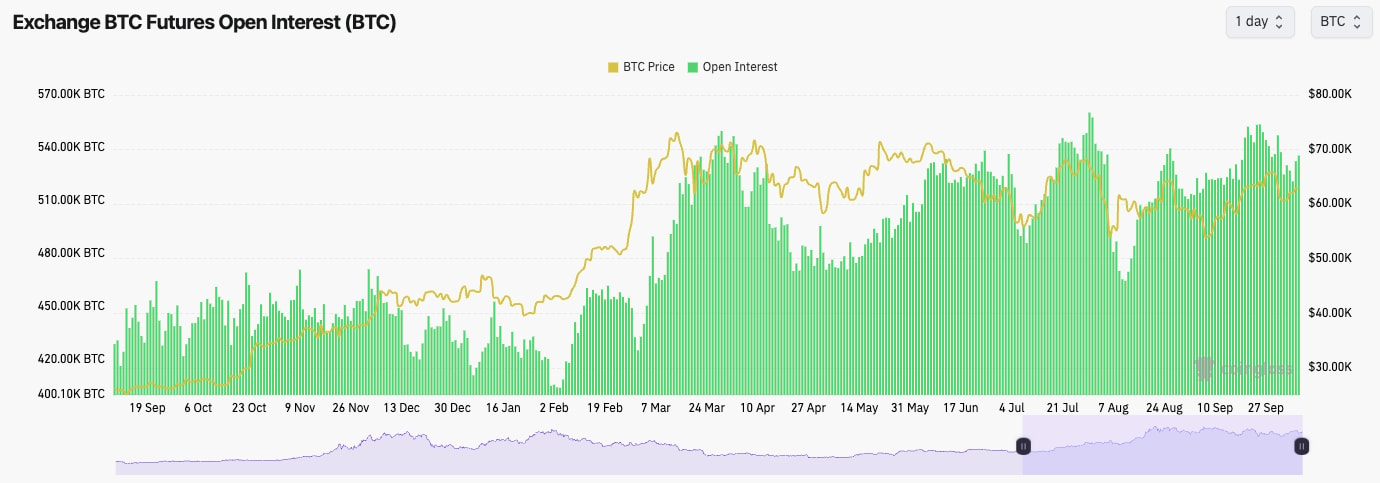

Bitcoin's price consolidates between $62k and $64k as it faces resistance at $63,400. Positive inflation data could push BTC toward $66k in the coming days, while open interest suggests further upside potential.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- Interestingly, Funding Rates have been positive, but they've fluctuated, as Traders have tried Shorting local tops, only to then be blown out of their Shorts just a few hours later, driven by a Spot bid.

- Open Interest is up over the last day but still not at levels that would suggest it's overheated to the upside.

- Overall, BTC isn't overheated here, and from a mechanic's perspective, it could continue to grind higher.

Technical analysis

- After BTC printed the higher high, it pulled back to close to our support area (the Yellow box).

- Price has since bounced from this support area and retested the horizontal resistance of $63,400, where price continues to struggle to climb back above.

- In terms of support, the area between $60k and $62k is likely strong support. We consider the bullish structure to be intact as long as the price remains above $57k.

- On the upside, $63,400 is the local horizontal resistance, with $68,900 being the major resistance beyond that.

- The RSI has reset but is beneath the Moving Average.

- Next few days prediction: Neutral ($62k to $64k range)

- Next 7 days prediction: Bullish

- Next 7 days price target: $66k