Explore the latest Bitcoin crypto analysis and predictions

- Bitcoin price prediction today: $58k Support—Is 60k the Next Move? (August 13, 2024)

- Bitcoin bull run: 4 key signs pointing to a massive upsurge soon (August 13, 2024)

- Bitcoin (BTC) price prediction today: Will it break $60,000? (August 12, 2024)

- Bitcoin (BTC) price prediction: Will it break out of the $58k-$62k range? (August 12, 2024)

- Bitcoin (BTC) price prediction today: Is $56,500 the buy zone? (August 9, 2024)

- Bitcoin (BTC) price prediction today: Next move after $59k surge? (August 9, 2024)

- Bitcoin (BTC) price prediction today: Is 15% bounce to $58k real? (August 8, 2024)

- Price Prediction Bitcoin, Ethereum, Solana & Meme Coins (July 24, 2024)

- Bitcoin Correction: Decoding Fed Policy, Bond Yields, and BTC's Next Move (July 23, 2024)

- Bitcoin Crash: Overnight Analysis and Inflation Data (July 23, 2024)

- Crypto Bull Market: Dollar Down, Bitcoin Up? The Rally Is Just Beginning (July 23, 2024)

Bitcoin (BTC) price predictions

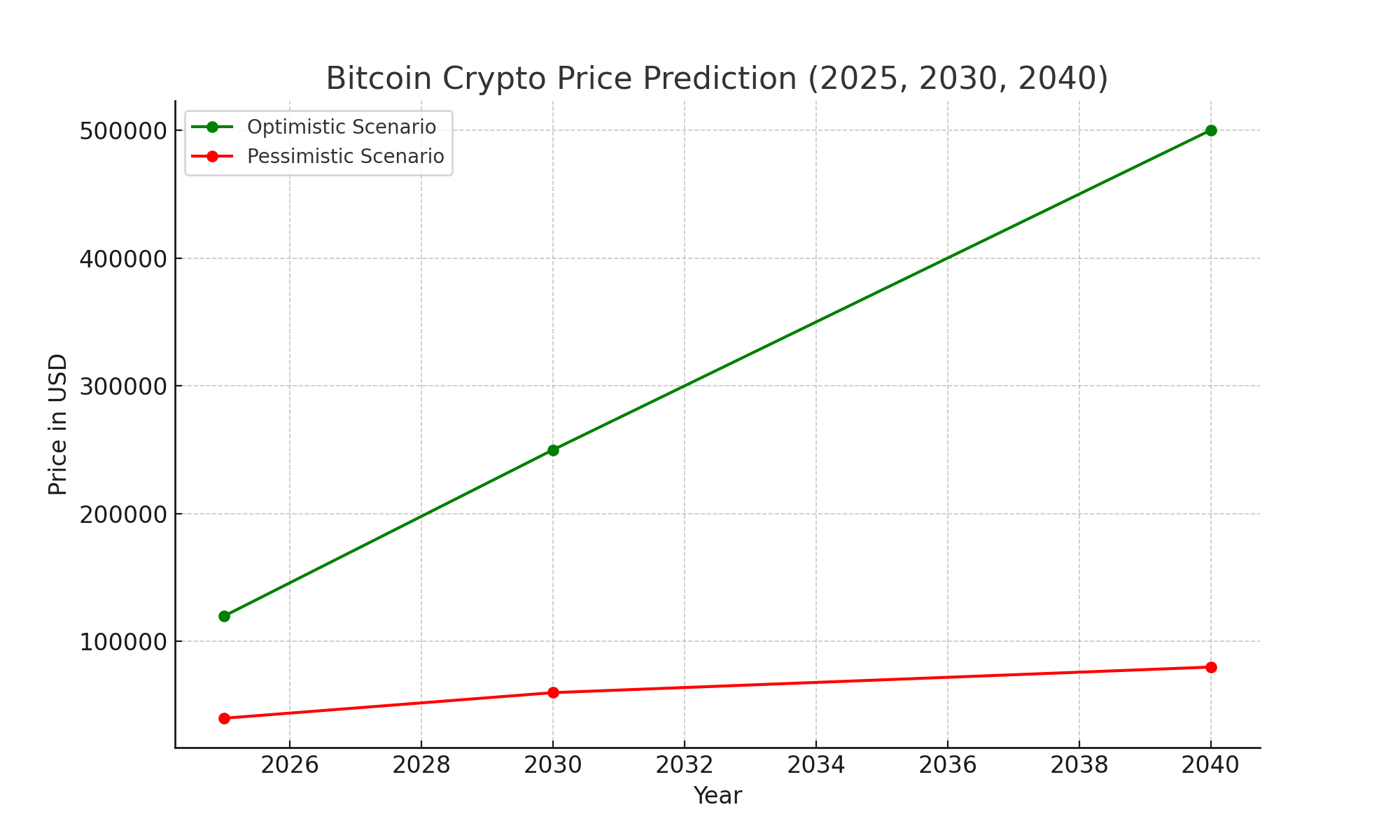

2025 Price Prediction

Optimistic Scenario ($100,000 - $150,000):

Why?: If Bitcoin continues to strengthen its position as a digital store of value and sees increased adoption by institutional investors, the price could experience substantial growth. Additionally, favourable macroeconomic conditions, such as low-interest rates and inflation concerns, could drive more capital into Bitcoin as a hedge.Key Drivers: Increased institutional adoption, integration into traditional financial systems, favourable macroeconomic trends, and continued innovation in blockchain technology.

Pessimistic Scenario ($30,000 - $50,000):

Why?: If regulatory challenges arise, such as stringent restrictions on cryptocurrency trading or a crackdown on mining activities, Bitcoin's price could face significant downward pressure. Additionally, a broader market downturn or a shift in investor sentiment towards other assets could also negatively impact the price.Key Drivers: Regulatory hurdles, decreased market interest, technological setbacks, and a potential global economic downturn.

2030 Price Prediction

Optimistic Scenario ($250,000 - $500,000):

Why?: By 2030, if Bitcoin has solidified its role as a global financial asset, perhaps even serving as a reserve currency for certain regions, its price could see exponential growth. Continuous innovation, integration into everyday financial systems, and widespread adoption could all contribute to this scenario.Key Drivers: Widespread adoption by institutions and governments, technological advancements, strong community support, and a thriving global economy.

Pessimistic Scenario ($50,000 - $100,000):

Why?: If Bitcoin faces increasing competition from other cryptocurrencies or fails to scale effectively, its price might stagnate or only see minimal growth. Additionally, if global regulatory bodies take a unified stance against cryptocurrencies, Bitcoin could struggle to maintain its value.Key Drivers: Increased competition from other digital assets, failure to adapt or scale, and a restrictive regulatory environment.

2040 Price Prediction

Optimistic Scenario ($1,000,000 - $2,000,000):

Why?: If Bitcoin remains relevant and continues to evolve with technological advancements, it could become a cornerstone of the global financial system. This would likely be driven by its integration into mainstream finance, widespread use as a digital asset, and ongoing innovation in blockchain technology.Key Drivers: Global financial integration, continuous technological innovation, strong market presence, and a stable or growing global economy.

Pessimistic Scenario ($100,000 - $300,000):

Why?: By 2040, if newer, more advanced technologies surpass Bitcoin or if it fails to keep up with evolving market demands, the price could either decline or stabilize at lower levels. The emergence of more efficient or versatile digital currencies could also contribute to this scenario.Key Drivers: Technological obsolescence, market irrelevance, regulatory challenges, and potential shifts towards more advanced or alternative digital assets.

Factors Affecting Bitcoin Price

Let's break down the Bitcoin price prediction process into detailed steps, covering every aspect to help you understand how such predictions can be made and the potential factors that could influence the price in 2025, 2030, and 2040.- Historical data analysis

- Objective: To understand the past behavior of Bitcoin's price, including trends, cycles, and patterns.

- Steps:

- Collect Data: Gather historical price data from the inception of Bitcoin to the present. This includes daily, weekly, and monthly prices.

- Identify Trends: Look for long-term trends, such as consistent growth, decline, or periods of stability. Pay attention to significant price movements and correlate them with events (e.g., major news, technological updates).

- Pattern Recognition: Identify recurring patterns like bull and bear cycles, which can help predict future movements. For example, if Bitcoin has shown a pattern of rallying after halvings, this could be factored into the predictions.

- Market sentiment analysis

- Objective: To gauge how the market feels about Bitcoin, which can influence its price.

- Steps:

- Social Media Monitoring: Track discussions about Bitcoin on platforms like Twitter, Reddit, and specialized crypto forums. Positive or negative sentiment can often lead to price spikes or drops.

- News Analysis: Monitor news sources for articles about Bitcoin. Announcements about institutional adoption, regulatory changes, or technological breakthroughs can significantly impact sentiment.

- Community Engagement: Assess the level of community engagement and developer activity. A vibrant and active community usually correlates with a stronger price outlook.

- Technical analysis

- Objective: To use historical price data to predict future price movements based on patterns and technical indicators.

- Steps:

- Chart Analysis: Plot the price on different time frames (daily, weekly, monthly) and use chart patterns like head and shoulders, flags, or triangles to predict future movements.

- Indicators: Apply technical indicators such as Moving Averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). For instance, a bullish crossover in MACD might suggest an upward price movement.

- Support and Resistance Levels: Identify key price levels where Bitcoin has historically found support (low points) and resistance (high points). These levels can help predict where the price might head in the future.

- Fundamental analysis

- Objective: To assess the intrinsic value of Bitcoin based on its utility, adoption, and broader market conditions.

- Steps:

- Use Case Evaluation: Analyze what Bitcoin is used for. A strong, unique use case (e.g., being integral to a successful financial platform) can increase demand and price.

- Adoption Rate: Look at how widely Bitcoin is being adopted. Are more people and businesses using it? Increasing adoption typically leads to price appreciation.

- Partnerships and Integrations: Investigate any partnerships or integrations with other platforms. Strategic partnerships can significantly boost Bitcoin's value by increasing its utility.

- Regulatory Environment: Consider the impact of government regulations. Favorable regulations can enhance Bitcoin's value, while restrictive laws can suppress it.

- Economic factors

- Objective: To understand how broader economic conditions might influence Bitcoin's price.

- Steps:

- Global Economic Conditions: Consider the impact of global economic trends, such as inflation, interest rates, and economic growth. For instance, in times of high inflation, cryptocurrencies are sometimes seen as a hedge, potentially increasing demand for Bitcoin.

- Monetary Policy: Central bank policies, especially in major economies, can affect cryptocurrency prices. For example, quantitative easing can lead to increased liquidity in the market, some of which may flow into cryptocurrencies.

- Market Correlation: Assess how Bitcoin correlates with other assets, like traditional currencies or the stock market. If Bitcoin tends to follow broader market trends, those trends will be a significant factor in Bitcoin's future price.

- AI-Based forecasting models

- Objective: To leverage machine learning models that can analyze large datasets and predict future prices based on identified patterns and correlations.

- Steps:

- Data Feeding: Feed historical price data, along with economic indicators and market sentiment data, into the AI model.

- Model Training: Train the model to recognize patterns that have historically led to price increases or decreases.

- Prediction Output: Use the trained model to predict future prices. The model might produce a range of possible prices with different probabilities.

FAQs

1. What is Bitcoin and how does it work?Bitcoin is a decentralized digital currency that operates on a peer-to-peer network. It leverages blockchain technology to enable secure and transparent transactions without the need for a central authority. Bitcoin's supply is capped at 21 million coins, which adds to its scarcity and value proposition.

2. What factors influence the price of Bitcoin?

Several factors can impact the price of Bitcoin:

- Market Sentiment: The overall sentiment towards Bitcoin among the crypto community can significantly influence its price. Positive news, social media trends, and institutional endorsements can drive up demand and price.

- Supply and Demand: The balance between the available supply of Bitcoin and the demand for it in the market determines its price. Increased demand with a limited supply can lead to price appreciation.

- Cryptocurrency Market Trends: The broader cryptocurrency market often influences the price of individual coins, including Bitcoin. A bullish or bearish market can impact Bitcoin's value.

- Speculation and FOMO (Fear of Missing Out): Speculative trading and the psychological factor of FOMO can cause rapid price fluctuations in Bitcoin.

- Regulatory Environment: Changes in cryptocurrency regulations can affect the overall market sentiment and, consequently, the price of Bitcoin.

Bitcoin is widely available on most cryptocurrency exchanges. To buy Bitcoin, you would generally need to:

- Create an account on a supported exchange.

- Verify your identity according to the exchange's requirements.

- Deposit funds into your exchange wallet (usually in fiat currency or another cryptocurrency).

- Use the exchange's trading platform to purchase Bitcoin.

4. Is Bitcoin a good investment?

Investing in cryptocurrencies, including Bitcoin, carries significant risks. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Bitcoin, being one of the most established cryptocurrencies, has shown strong historical performance but is still subject to market risks. Before investing in Bitcoin or any cryptocurrency, it's crucial to conduct thorough research, understand

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.