Bitcoin bulls face crucial test at resistance as leverage builds

The air grows thin for Bitcoin bulls as price stalls below heavy resistance at $38,000. With leverage stacking up and crucial inflation data ahead, Bitcoin’s recent rally may grind to a slow stop. However, if bulls can breathe just a little longer, escape velocity may yet be within reach. The stakes are high, and the margin for error is razor-thin. Bitcoin now faces its moment of truth.

TLDR

- Bitcoin rejected the initial test of the major $38K resistance level as leverage in the derivatives market builds

- Crucial U.S. inflation data out tomorrow could spark volatility if it comes in hotter than expected.

- Technicals show Bitcoin overbought on multiple timeframes with bearish divergences forming.

- We expect a flush-out of overleveraged longs for BTC to record continued upside in the short term.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

The focus this week is on the Fed-speak and the inflation data tomorrow. The expectation is for Fed-speak to be on the hawkish side, emphasising Fed Chair J Powell’s talks last week where he continued with the higher for longer narrative. Regarding the inflation data tomorrow, the consensus is for inflation to be weaker. If it is, markets can move higher. However, if it comes in hotter, the opposite will likely be true.Let’s now dive into the technicals for BTC.

Technical analysis

We outlined that the $37,700 to $38,000 area of resistance would act as a strong resistance, and Bitcoin has initially rejected from this level. The local support to the downside is $35,600, followed by $34,000 and then $33,300.Bitcoin may form a pennant or even a bull flag, which may help price to go higher and test back into the $38,000 area. However, there are some bearish technicals.

Looking at the RSI, we see we’re overbought on the daily, 3D and weekly timeframes. On the daily timeframe, we can see the build-up of 2 bearish divergences back-to-back, which could drag prices lower.

BTC 1D

Market mechanics

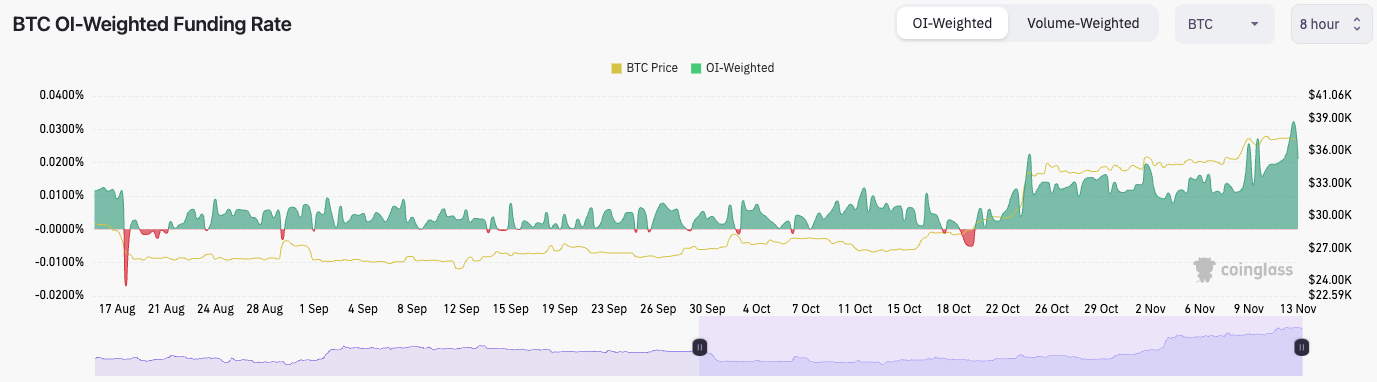

The mechanics suggest an overheated derivatives market. While the funding rate on BTC has come down slightly in the past hours, it remains very positive, indicating a strong bias amongst traders to be long.

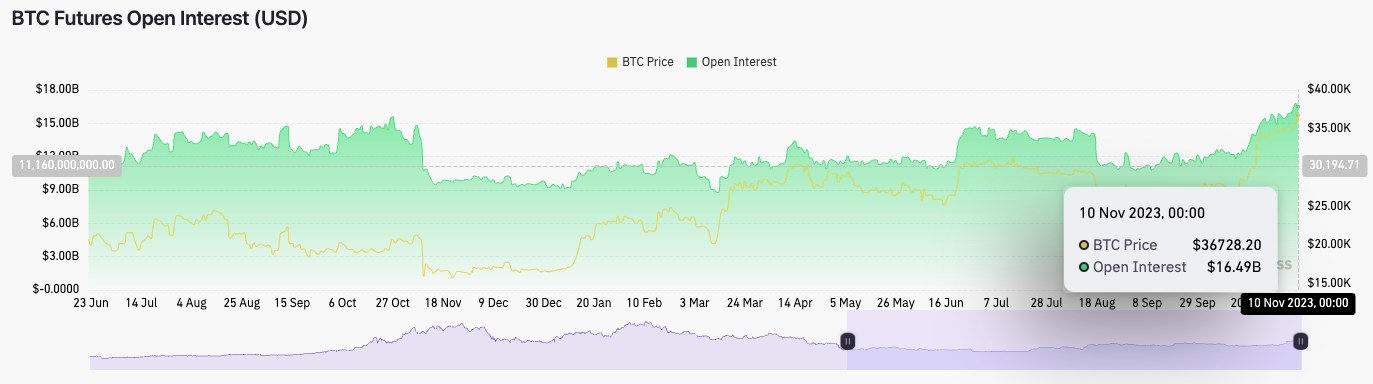

The open interest (so the amount of leverage being taken out) also remains very elevated and has been for several days now.

In assessing the mechanics, the market looks to be in somewhat of a frothy environment here, which is very long-biassed. To see meaningfully higher prices, we may need some of this leverage to be flushed out, which likely means price down, to liquidate some of the offside longs.

Cryptonary’s take

This week, there should be relatively few headwinds from a macro perspective. The most major one could be if inflation data comes in hotter than expected tomorrow. However, we don’t expect that it will.Bitcoin has initially rejected from a main horizontal resistance of $38,000 while there is a build-up of froth in the derivatives market. This suggests that the market needs a more meaningful pullback to, say, $35,600 to flush out the over-levered longs that remain.

If a Spot BTC ETF is approved this week, that’ll likely see Bitcoin get another leg higher, giving more room for altcoins to move higher. However, this would likely be the top of the move if this did happen. We think we could see a pullback from this (if it were to happen), particularly as late leverage is likely to pile in and become extremely vulnerable to being chopped out.