15 years ago to the date, @halfin famously tweeted "Running Bitcoin" before he received the first transaction from Satoshi Nakamoto.

So, it is quite significant that the SEC officially approved all Spot Bitcoin ETFs on the same date.

Today, we will dive into how the market reacted to the ETF approvals, what we expect going forward, and how you should participate in the market as the post-ETF world unfolds.

Expectations pre-ETF approval

There’s no doubt that yesterday was a huge day for the space, and in the long term, it will support higher prices.For one, ETFs should increase demand for BTC – at least by improving access to buying BTC/a BTC equivalent. We are also heading into a slight supply squeeze with the upcoming halving. All these can only be bullish for prices over the next 12 to 18 months.

However, yesterday perhaps didn't go as many people expected, price-wise. For instance, many were calling for at least $52k, if not higher. We saw some on Twitter calling for $60k by day's end.

Obviously, that didn't play out. When you see this level of euphoria, with a one-day timeline, that should be a caution warning rather than a full risk-on warning.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

How did it all go down?

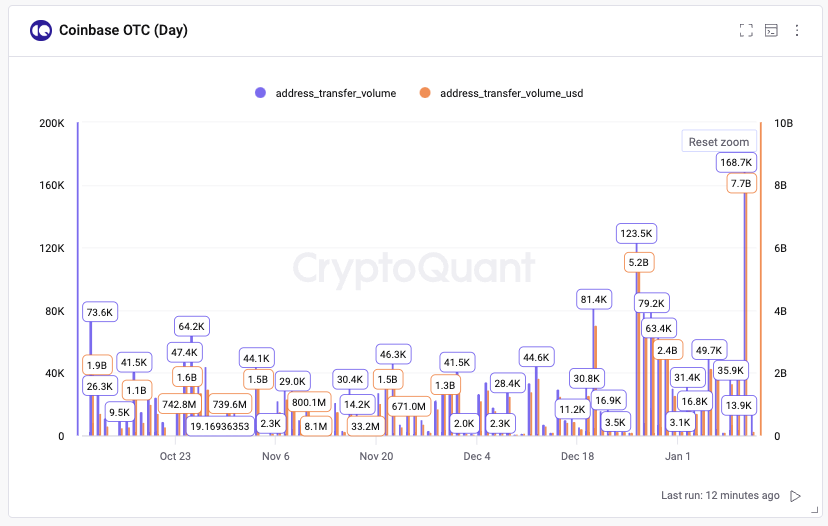

Essentially, we had a lot of chopping in and out of different ETF vehicles, with some of the volume organic and some not. Blackrock likely had a tonne of volume lined up, Greyscale clients may have sold some of their GBTC to move into cheaper ETFs (cheaper meaning the fee the ETF issuer charges the investor).But, what we think was heavily overlooked initially was that these issuers had bought a lot of BTC in the months before the ETF. They would have been able to pay $30k to $40k per BTC, and they could sell it to "their clients" yesterday for $47k and also charge a 0.2%/0.3% fee.

So, it's possible that the issuers already have a chunk of BTC that they bought over prior months and sold to their clients yesterday.

Perhaps the Coinbase flows diagram below shows this.

What happens from here on is now the tricky part, but we'll understand it better as time progresses.

Price action from now on

Today, and at least the first few days of next week, will be key to see what the actual volumes and inflows are.For BTC’s price to go higher in the coming weeks, we'll need to see a reclaim of $47k and then a grind higher from there.

If we get that over the next seven days, we think that'll be bullish and show that net inflows to the ETFs are good. However, we fear that the institutional investors aren't going to ape into a 2-year BTC price high.

Yes, the first $1b to $2b of inflows may come in quickly, but that may just be to take advantage of the fee structures - early inflows pay no fee or a reduced fee. If there is a more meaningful dip for BTC, then that's when you'd expect inflows to increase, so this is something we have to be assessing and watching out for.

Remember, institutions are smart money; they don't ape in on day 1 into a 2-year price high.

Market context for what may happen next

Now, if we put this out in context:BTC is at 2-year highs price-wise, and it has not had a meaningful pullback (-20% or greater) since mid-August 2023.

Market indicators with on-chain metrics look similar to the summer of 2019. Check out a Cryptonary tweet on this perspective. A decent pullback followed.

Big insider selling came in Coinbase shares over the last month.

Crypto mining stocks sold down yesterday. Is this profit-taking from TradFi? Does this explain why we didn't see an ape'ing in yesterday?

The price wise on market open was mostly due to retail ape'ing, and that’s why we urged for caution yesterday - it was not the time to take out fresh Longs.

Cryptonary's take

So, a big update above, let's break it down and see what we expect going forward.Today's trading and at least the first few days of next week will be important. If we see inflows and good inflows, then you want to see BTC's price grind higher. If we see inflows, and they don't grind higher, we will be confident that we will see a more meaningful pullback in the coming month or so.

For now, we'd steer clear of leverage trading. Let's see how today goes and how price reacts to any ETF flows. We need to see bullish momentum for price to grind higher. If not, we'll be even more confident in the thesis that we see a downside from here.

Looking at the charts, we see many altcoins have moved up but into local resistances, and they've struggled. We feel they will go lower in the next month – BTC and altcoins. But again, today's trading and inflows and at least the first few days of next week are super important.

We haven't made any changes to our portfolios. Our team members still hold Spot BTC, ETH, and other altcoin bags – check out Cryptonary’s Picks for our bags. One of our researchers did sell half their SOL at $99 two days ago. But the other half is staked, and they've borrowed mSOL and bSOL against it. So, in the majority, they are still well in the market.

Our game plan is to put more USDT to work on major dips in the coming weeks/months. Let's see what we get!

And remember, big pullbacks should be celebrated. Zoomed out, the next 12-18 months is a big bull market, so major pullbacks should be bought.