TLDR

- Weak US30Y Bond auction has caused bonds sell off.

- The risk-off sentiment in traditional markets may impact crypto temporarily.

- Bitcoin tests key resistance at $38,000, but the RSI signals caution.

- The overheated derivatives market suggests a potential for a significant pullback.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

Following yesterday’s very weak US30Y bond auction, the US30Y bond sold off, seeing yields increase by 17 basis points. This shows that investors still see long-term U.S. debt as unattractive. Primary dealers bought just north of 24% of the total debt offered/sold, which is far more than the 12% average of last year - this indicates that the marginal buyer is no longer there.Other bonds (different durations) also sold off yesterday following the result of the auction and the weakness that was shown. Alongside this, risk assets (the Nasdaq and the S&P) sold off and are trading lower pre-market today. A risk-off environment should provide some headwinds for crypto in the near term. However, with such bullish momentum on the back of ETF news for Bitcoin and now also ETH, it’s possible macro headwinds may not be enough to quell positive price action in the very short term.

Let’s now dive into the technicals for BTC.

Technical analysis

Having broken to the upside of the ascending wedge, we saw BTC push into the horizontal resistance of $37,700 to $38,000, which initially saw price reject from this level.Today, BTC looks to be trying to retest that failed wick and refill it - potentially seeing BTC test $38,000 again. However, this is a key horizontal resistance; if broken, BTC likely heads into the $40,000 to $42,000 area.

The RSI on the daily, 3D, and weekly timeframes are all overbought, particularly the daily and the 3D, which suggests some caution should be had here - or to at least not ape into fresh positions without seeing a slight pullback first.

If there is a more major rejection, we would expect $35,600 to be local support, and if broken, the downside target may be $34,000 - where we would expect buyers to step back in more meaningfully.

BTC 1D

Market mechanics

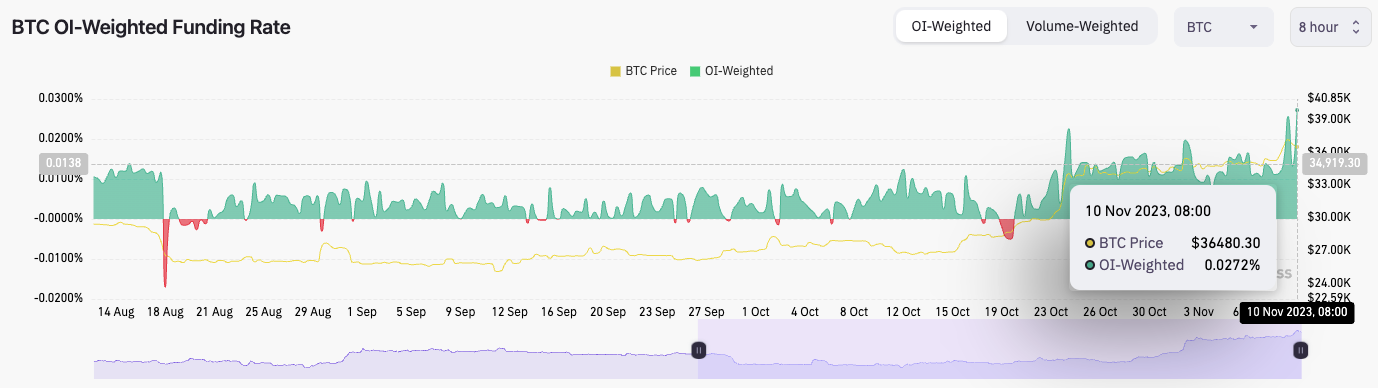

The mechanics suggest an overheated derivatives market here. The BTC funding rate is very positive, meaning longs are paying shorts a massive premium to be long.

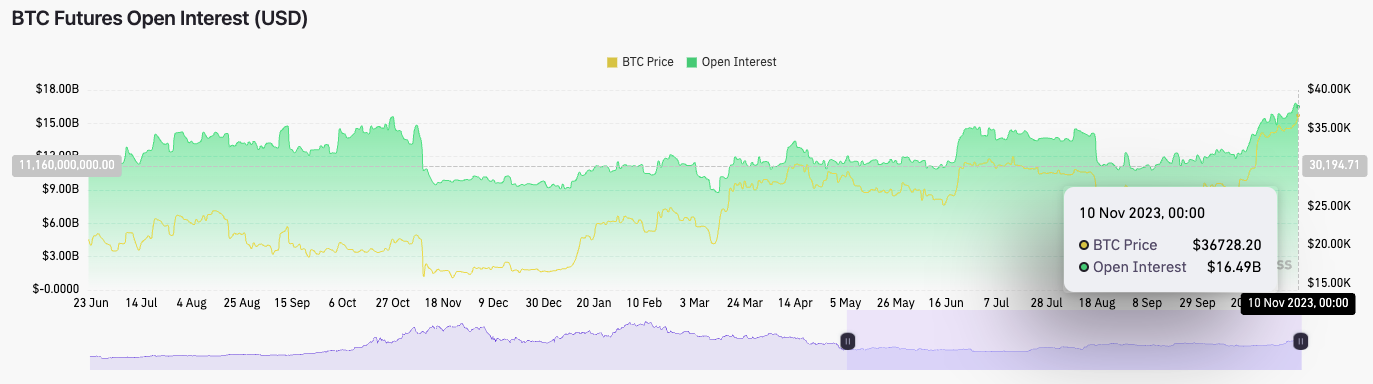

The open interest (the amount of leverage being taken out) is also massive but not historically high.

The above suggests that a lot of leverage is being taken out, with most positioning being long. When the mechanics are this one-sided, the offside positions (in this case, longs) are usually flushed out, which means the price will go down.

Cryptonary’s take

Despite the macro being able to potentially provide some short-term headwinds for risk assets, momentum in crypto currently is very positive, which is showing in the mechanics. We’re getting much leverage with a huge bias to be long. In prior situations, these longs are usually shaken out.It is very possible that price will continue to go higher, potentially surpassing $38,000, which, if achieved, will open the door to a move to $40,000. However, with the market mechanics being overheated, this suggests that a more meaningful pullback is needed to flush out these late longs before the market can continue more sustainably.

If price does pull back and can reach $34,000, we would be strong DCA buyers for the long term at this price point for Bitcoin.