We have been torn with this recently and are more open to accepting it as a new paradigm shift.

Hopefully, today’s update helps you recognise how we may be in a new form of cycle so you can better understand how price action may play out going forward.

We are up for an exciting 12 months ahead.

Let's go!!!

TLDR

- Bitcoin has hit $57k as metrics like wallet balances suggest institutions are front-running the next halving cycle, pointing to an early start of the bull run.

- On-chain data shows low retail interest, indicating we're early in the bull run, but derivatives markets are getting overheated.

- Key economic data (PCE inflation) is due this week, and it could impact markets if it comes in hot or cold.

- Bitcoin futures funding rates and open interest signal caution are warranted in the short term, though the rally may continue.

- SOL remains range-bound, and a breakout above $120 represents an opportunity for traders looking to add risk after recent BTC and ETH surges,

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Data this week

Firstly, let's look at the economic data this week to ensure we're on top of this from a top-down approach. Yesterday, there were several Bond auctions with a large amount of issuance. These auctions tailed, meaning there wasn't enough demand for the amount of issuance issued. This is something to watch going forward, particularly if demand for US debt slows.

However, the data the markets will watch more closely this week is the PCE data, due on Thursday. This is PCE (Personal Consumption Expenditure) data, Personal Income and Personal Spending. For now, the data is expected to come out and be consistent with prior data readings. Markets will likely only react if the numbers are very hot or cold, but the reaction would likely be negative. If the numbers come in and around consensus, markets can continue higher.

To track this data yourselves, find the economic calendar here.

On-chain data

Many of the 'Market Indicator' metrics continue to show that BTC is overheated here, but this is common in early bull markets just before the major bull gets going. But, it is rare to happen a few months before the BTC halving.

However, some metrics suggest that we’re in a new form of cycle, where the major bull gets going much earlier. Previously, the major bull part of the cycle began 4-6 months post-halving. But are investors/traders/institutions now just front-running that six months earlier (we're currently two months out from the next halving)?

This is very possible. Let's look into these metrics.

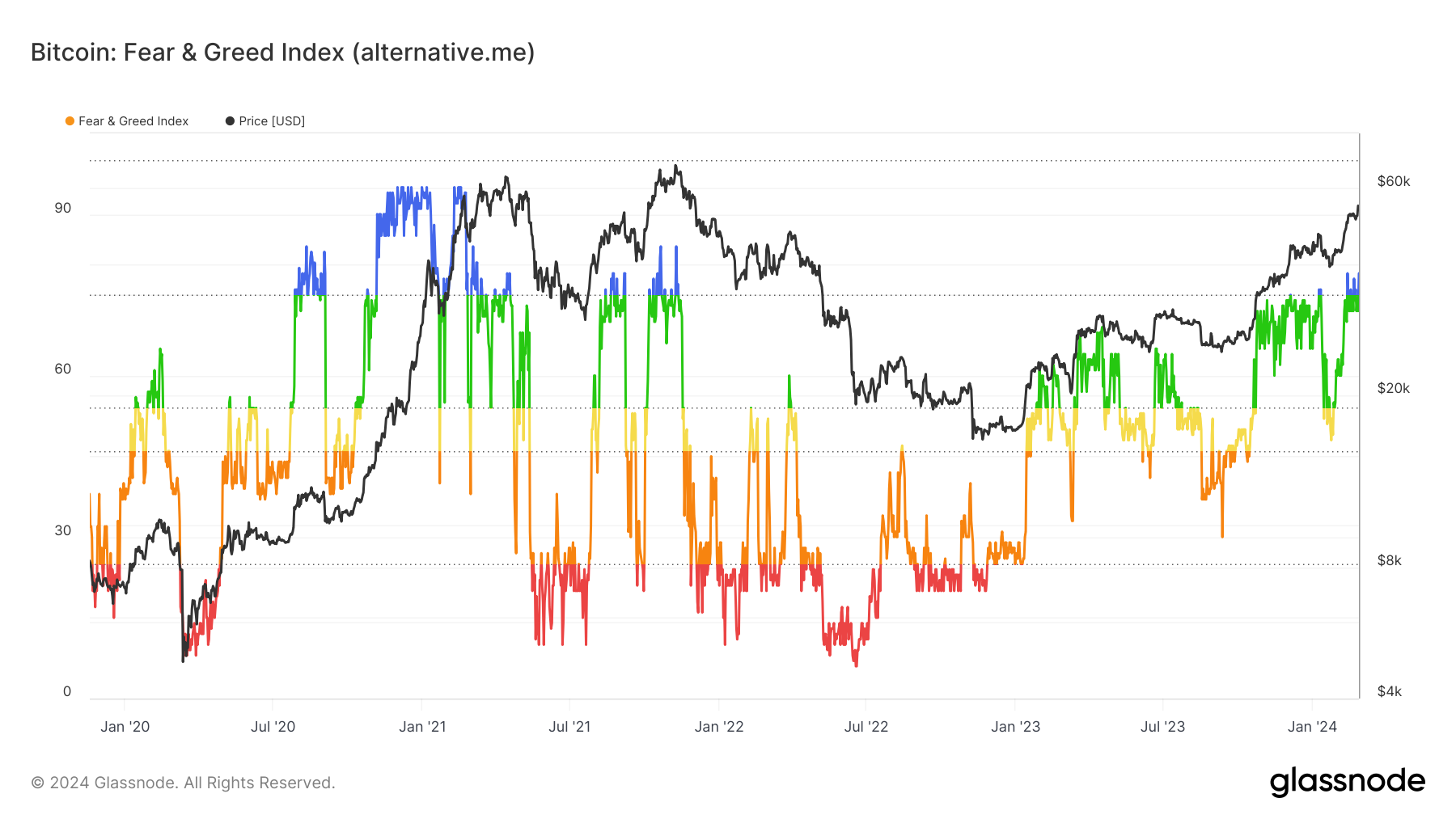

On first viewing, the Fear & Greed Index looks concerning with it currently in 'Greed'.

However, we also saw this formation in August 2020 (a few months post-halving) and one month before full bull mode began. If the full bull part of this cycle is much earlier, i.e., being front-run by six months, then this would suggest that this is where we're at currently.

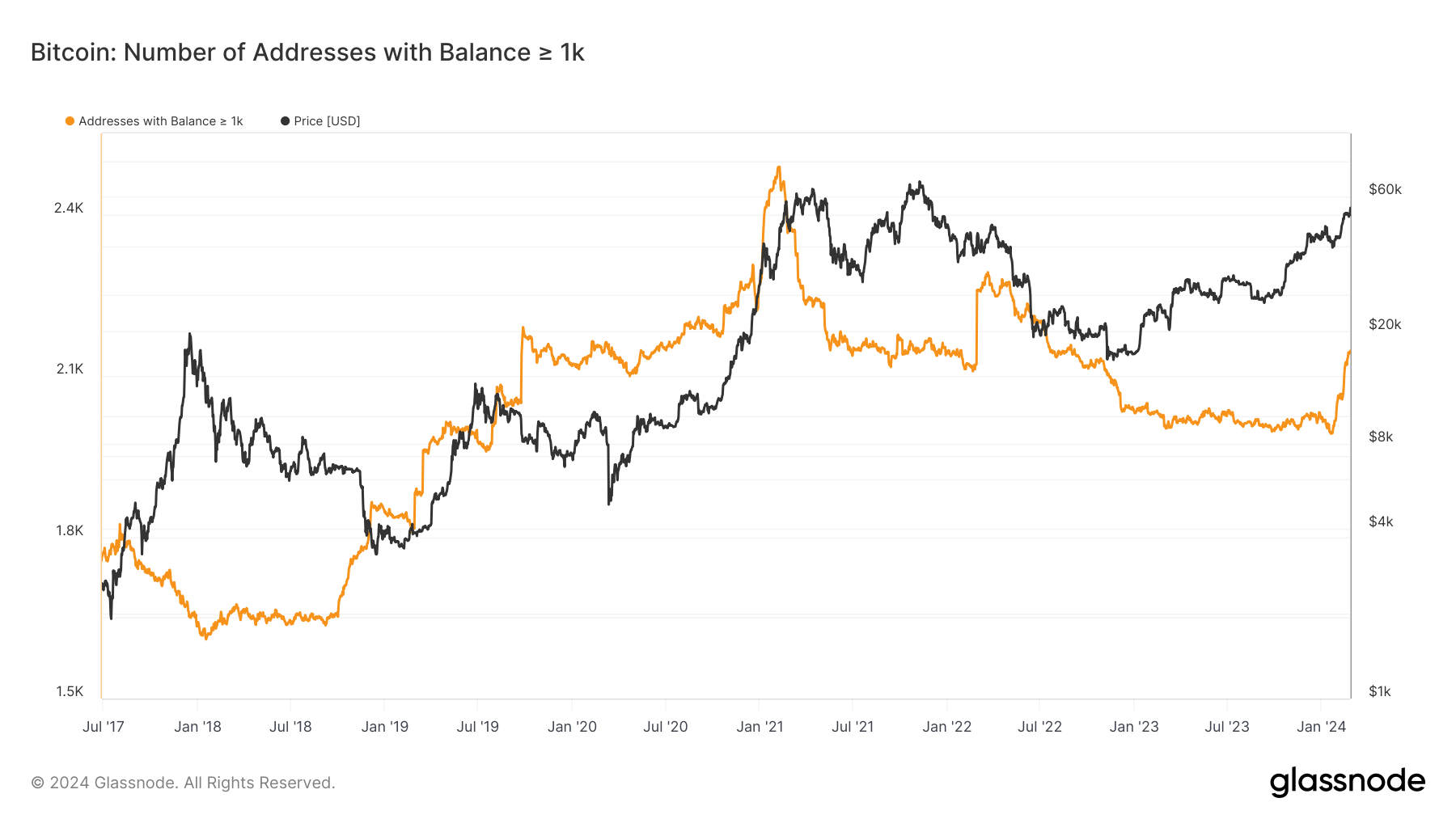

One of the metrics we paid close attention to in the bear market was the Wallets with Balance > 1k BTC.

In 2018, these addresses remained flat (no accumulation or distribution). However, towards the end of 2018, going into 2019, these wallet addresses increased significantly. We're seeing the same thing currently from this cohort.

Check this tweet we put out recently about it, also.

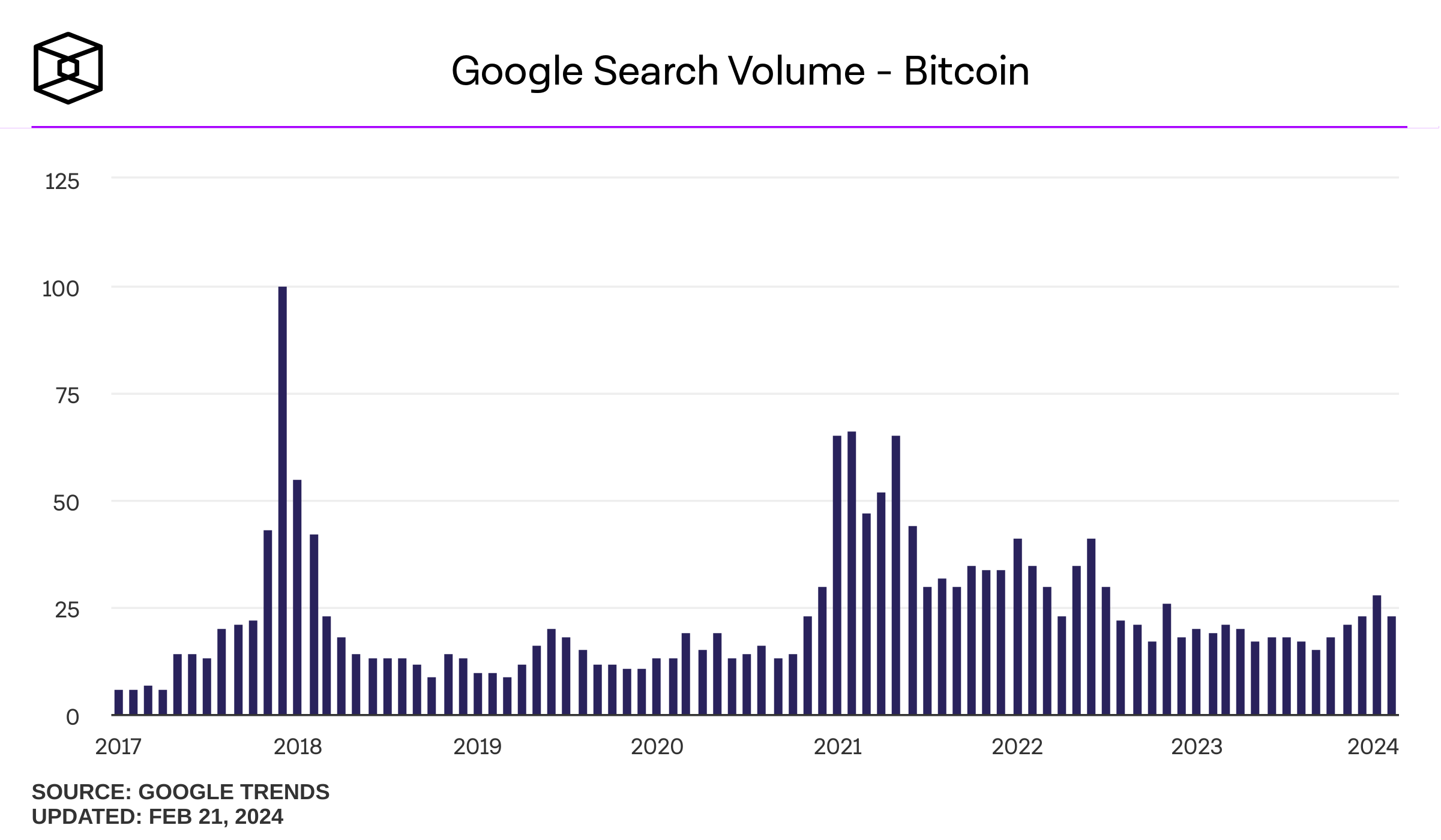

Things may seem to look somewhat euphoric here; after all, there are retail investors here, or at least, they are beginning to move back into the space. However, some core key metrics suggest they're still nowhere to be seen. If we look at the number of Google searches for the term Bitcoin, we can see that they’ve only picked up slightly recently.

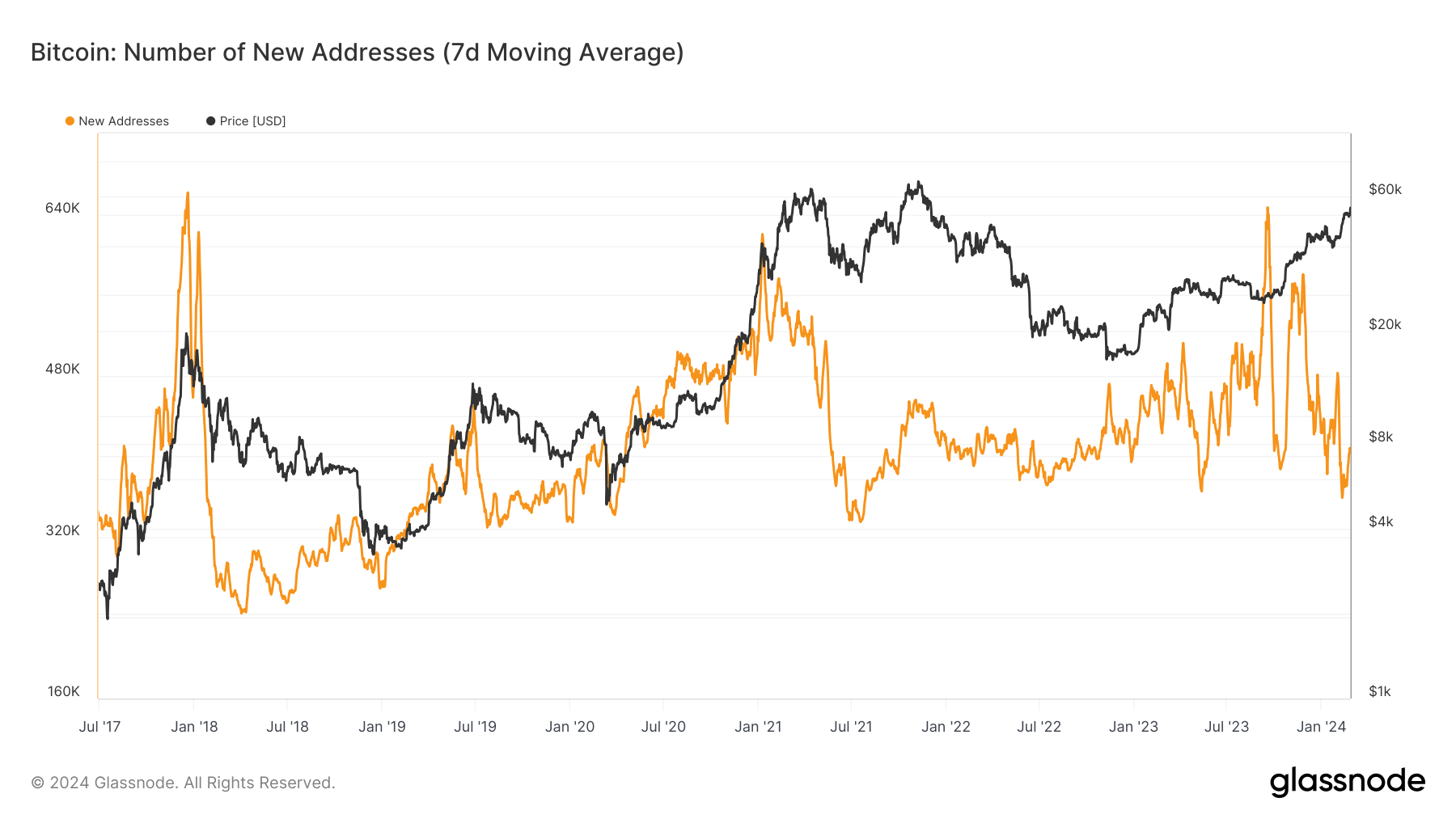

However, they remain very low. When we look at the Number of New Addresses metric, we can see this is still very low. Historically, going into full bull mode where retail is piling in as prices soar higher, we would see this metric uptrend.

Currently, it's at lows = bullish.

Has the new environment triggered a new cycle?

As I have briefly covered above, we may be in a new form of cycle.

Usually, full bull comes in 4-6 months post halving. However, some of the metrics suggest we're at that point now, with retail yet to come in. Front running is usually 3-6 months, so it would make sense, particularly with the ETF here, that traders/investors/institutions are trying to front-run the inevitable halving effect that's coming in April, and they're willing to pay higher prices (maybe a slight premium now) because they believe prices will be meaningfully higher in 6-12 months.

The metrics above do suggest we're in the August 2020 style of market, which was about 2-3 months before the full bull market began, and prices took off in late 2020 and the first half of 2021.

The futures market suggests caution

With this move up to $57k, the futures market looks quite overcooked.

Now, in bull markets, it's normal that this environment can continue, but Funding has gone extremely positive (Longs are now overcrowded), and Open Interest is still high. Because of the above, we would be careful of a flush-out in the short-term if one were to come - but the more this rally continues, the more increasingly likely the flush-out becomes. And we would be buyers of that price flush-out.

The below shows the Funding Rates for many top coins, which are majorly positive - Longs are currently overcrowded.

Cryptonary's take

There’s an opportunity in SOL.

When looking at the above, we do have to consider that with BTC being more widely accepted amongst institutions (the big boys) and this showing in the ETF flows, perhaps we're in a new environment where everyone who is here knows the halving is coming in April and they are front-running that now.

As we've said, full bull usually starts 4-6 months post-halving, so it makes sense that if the halving effect is being front-run, we're seeing that happen now, at this point in this cycle.

Opportunity-wise, our advice is always to be positioned but to add to position when the "hype" on that play is down somewhat.

Hence, a month ago, we said that ETH was likely the play simply because it had underperformed. In the last month, ETH is up approximately 49%.

In this past month, ETH and BTC have both run extremely well, yet SOL has remained range-bound in a larger range. Yes, it did move the most (the most obvious out-performer) earlier on, in, say, late 2023. But, over the past six weeks or so, SOL has been range-bound between $80 and $120 ($117). The breakout for SOL is likely a move above $120.

If you're feeling under-exposed to the market and are generally looking to add more risk, BTC and ETH have had major moves recently (the word 'recently' is the key), whereas SOL has been more stagnant. Therefore, from a risk viewpoint of looking to add more risk today, SOL is the most attractive play from where we stand.