As we approach the final months of 2024, the crypto market finds itself on the edge of a crucial turning point. The Federal Reserve is on the cusp of initiating its much-anticipated easing cycle, but the question remains: Can they deliver the elusive 'soft landing,' or are we heading into a storm of volatility?

With inflation cooling but cracks forming in the labour market, the macro landscape is changing rapidly—and with it, the future of crypto.

In this report, we dive deep into the shifting dynamics of the global economy, unravel the Fed's next moves, and examine how these developments could shape the performance of Bitcoin and the broader crypto market in Q4 and beyond.

TLDR

- Fed's Soft landing gamble: With inflation cooling, the Fed is focused on managing a weakening labour market. A smooth easing cycle is crucial to avoiding market turbulence and ensuring risk assets like crypto perform well into 2025.

- Rate cuts looming: This week's Fed meeting could deliver a 25bps rate cut with dovish messaging. A more aggressive cut might signal deeper economic concerns but could ignite risk-on sentiment for crypto markets.

- Labour market in focus: Jobless Claims are holding steady, but any significant spike could be a red flag for the economy and prompt faster rate cuts, which would impact crypto liquidity and market sentiment.

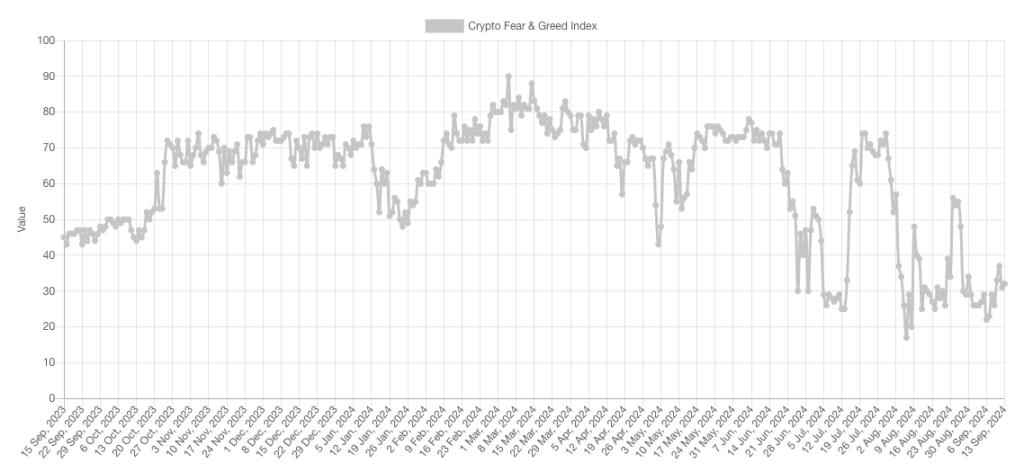

- Crypto sentiment at lows: Bitcoin’s Fear & Greed Index and Google search trends reflect bearish sentiment, but the cleansing of excess leverage from early 2024 may set the stage for a healthier market rebound.

- On-chain data signals a rebound: Metrics like MVRV and the Bitcoin Risk Index show that Bitcoin could be nearing a local bottom, setting up for a more bullish cycle as we move into Q4 and 2025.

- Volatility ahead before the elections: Seasonality and the upcoming US Presidential Election are keeping risk appetite low, but a Trump win could unleash a significant crypto bull run heading into 2025.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Macro outlook

Markets and the Fed have now fully pivoted to focusing on the weakening labour market and less so on inflation, as headline inflation has decelerated markedly over the past 6 months, now down to 2.5%.Headline Inflation:

Alongside this, breakeven inflation rates have moved drastically lower over the same timeframe, indicating that the market believes that the inflation battle is close to being won. Since April, the 5-year Inflation breakeven rate has fallen from 2.5% to 1.9%, below the Fed’s 2.0% mandated target.

US 5-Year Inflation Breakeven Rate:

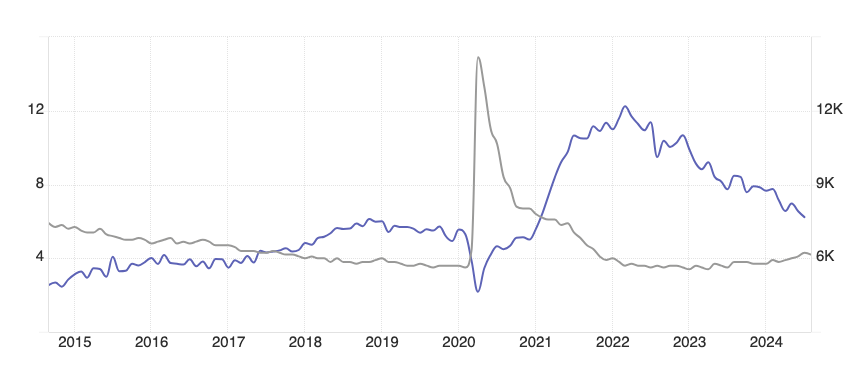

The Fed is now trying to deliver a ‘soft landing’, and whilst GDP remains positive (aided substantially by the large fiscal spending), some cracks are beginning to appear in the labour market. This has the Fed more concerned, as Powell told us at Jackson Hole, who said that he ‘would not welcome further cooling in the labour market’. Since early 2022, the labour market has been very strong by historical standards. However, from January to August of this year, the Unemployment Rate has increased from 3.7% to 4.3%. Alongside this, the number of Job Openings has been in a relatively steep downtrend since early 2022.

The chart below shows that Job Openings and the Unemployment Rate have an inverse relationship. If the number of Job Openings continues to decline, we might expect the Unemployment Rate to continue to increase, which the Fed wouldn’t welcome and would likely result in their easing cycle (lowering of Interest Rates) becoming more aggressive as they scramble to avoid a ‘hard’ landing.

The Fed’s ideal is to enter a new easing cycle (the lowering of Interest Rates), in which they lower the Interest Rate gradually and methodically. In order to do this, they need the labour market not to materially weaken.

If the labour market does materially weaken, the Fed will have to lower Interest Rates more abruptly. This would likely not be taken well initially by markets.

Job Openings (blue) against the Unemployment Rate (grey):

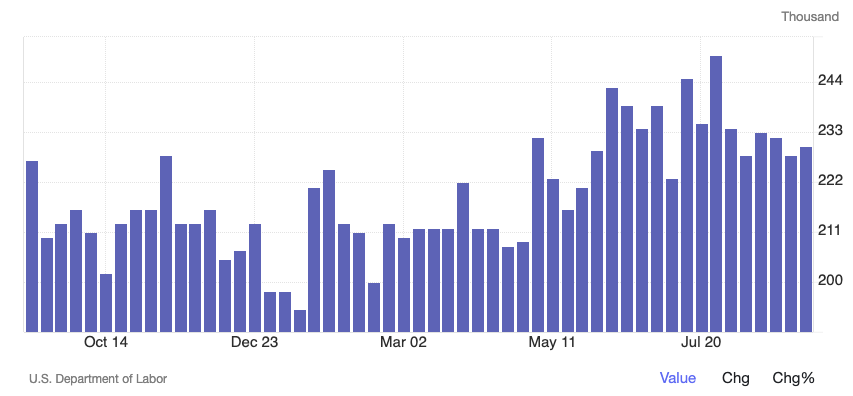

Despite the Unemployment Rate creeping higher and now above the Fed’s end-of-year expectations, Jobless Claims are yet to meaningfully trend higher, although the average numbers are higher than they were a year ago when the US had a historically tight/strong labour market.

For us, Jobless Claims are the key figure to watch over the coming month. We receive this data point on a weekly basis. If Jobless Claims remain between 200k and 250k a week, that’ll indicate that the labour market is holding up.

A large spike in Jobless Claims (from multiple weeks of data) would likely be the first major signal that the labour market is more materially weakening. Risk assets (crypto) will hold up/perform better if Jobless Claims stays around its current figures.

Jobless Claims:

All the above shows us that employers are not looking to take on a plethora of new workers or lay off workers. The question for the Fed and markets now is whether the labour market is outright weakening or returning to normalisation. This is likely to be the difference between a ‘soft’ and a ‘hard’ landing.

For risk assets to perform, they will want to see a soft landing and, therefore, the labour market data to continue holding up. For now, the labour market data is holding up, which allows the Fed to begin cutting Interest Rates gradually at this week’s (Sept 18th) Fed Meeting.

This week’s Fed meeting

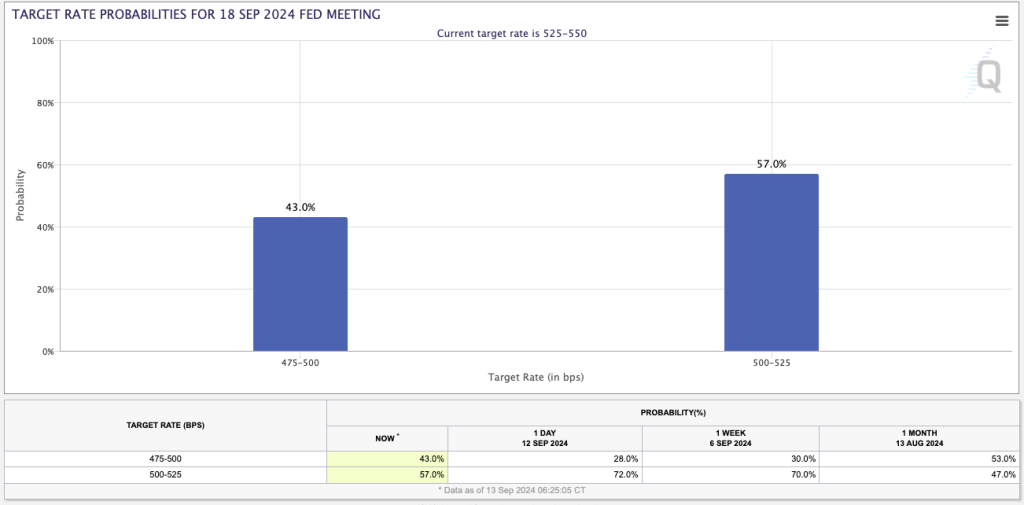

Recently, we have seen the Unemployment Rate rise, whilst the number of jobs added has decreased. This has thrown more in to question whether the Fed should start with a 50bps cut or just 25bps.This week’s Fed Meeting is now even more in the balance between a 25bps and a 50bps rate cut, following Nick Timiraos's article, which strongly hinted that 50bps is still on the table, with markets having priced it out prior to the article. Timiroas is seen as a Fed mouthpiece and has been nicknamed ‘Nikileaks’, so the market has reacted in response to his article, as the Fed has used him previously to hint at possible outcomes that they then do.

Following this, the market is now pricing a 43% chance (as of Friday 13th) of a 50bps cut at this week’s meeting, up from a 28% chance just yesterday. Target Rate Probabilities for Sept 18th Fed Meeting:

If the Fed does make a 50bps cut this week, how it messages it will be super important. This is difficult to do, as starting with a 50bps cut suggests a policy mistake back in July when the Fed chose not to cut by 25bps and leave rates unchanged.

However, it may also suggest that the data has weakened more materially than the Fed had expected and that they’re now behind the curve. i.e., they should have foreseen the data weakening and cut by 25bps in July to get in front of this.

Nonetheless, they won’t want to send a message to the markets about either of these scenarios. Hence, messaging 50bps is very tricky and likely pushes the Fed into a corner by only being able to do 25bps, or they potentially risk a market sell-off.

We believe the Fed will cut by 25bps this week and give a lot of forward guidance and dovish messaging. This is despite the fact we see Powell as being one of the more dovish members and he may internally be pushing for 50bps, but we’re not sure he’ll get the rest of the committee on board with this, and therefore the safer option might be 25bps with a lot of dovish messaging.

Another thing to pay close attention to next Wednesday (18th) is that we get the release of updated Economic Projections 30 minutes before the Powell Press Conference. In the Fed’s last SEP (Summary of Economic Projections), they had the 2024 year-end Unemployment Rate at 4.0%. It’s currently at 4.3%, with three months of the year left, and the Unemployment Rate is on a gradual uptrend.

If the Fed raise its Unemployment Rate year-end forecast, which we assume it will, they’ll have to be careful in how it explains this and how worried they are that the Unemployment Rate is much higher now than they had forecasted it to be.

Alongside this, another point we think will be notable is the tapering of the Balance Sheet (QT – quantitative tightening). It’s possible the Fed suggest they’re looking to slow down the pace of the taper or even put a stop to QT altogether. If they signal this, risk assets will likely respond well to this, as this would be a net positive for liquidity.

Ultimately, we see the Fed reducing Interest Rates by 25bps this week, but we believe their messaging will be dovish. If we’re right, risk assets will likely respond positively to this.

Bitcoin market sentiment

Many of you will know this and have felt this yourselves: crypto sentiment has been very low and fearful recently. We can see this in a few simple charts. The Fear & Greed Index has been at yearly lows over the past month, while Google search terms for ‘Bitcoin’ are also at lows—this correlates with a lack of on-chain activity.Crypto Fear & Greed Index:

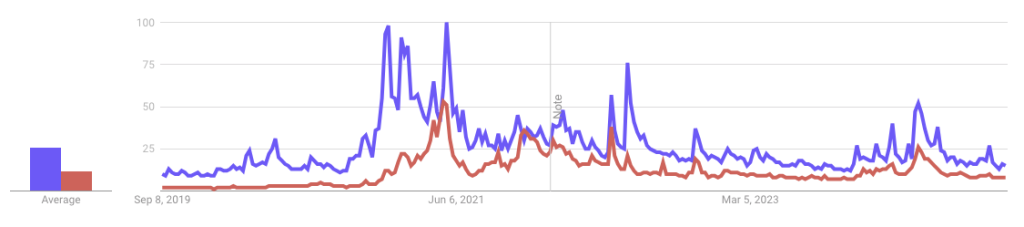

Google Search Trends for the words ‘Bitcoin’ (blue) and ‘Crypto’ (red):

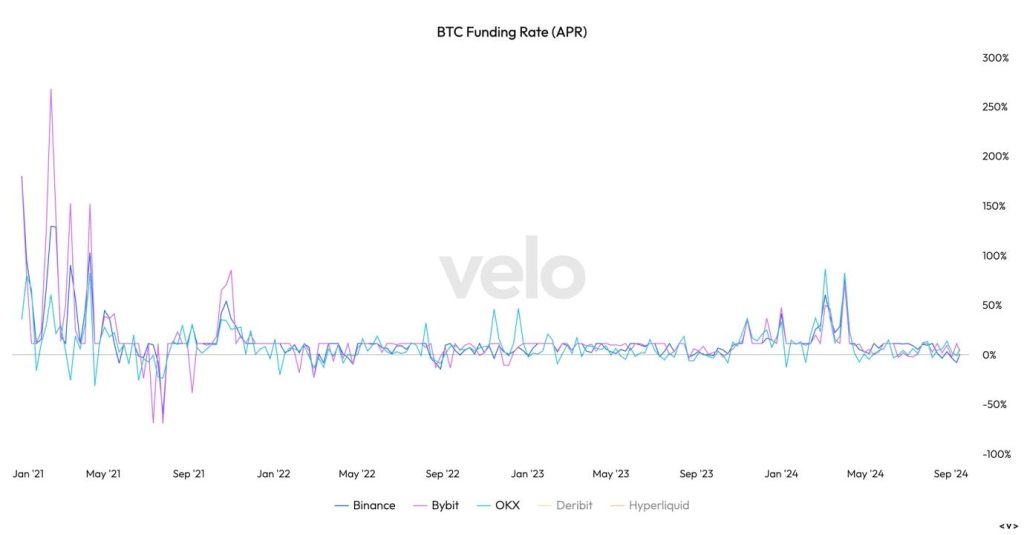

If we look at the funding rates (APR) for Bitcoin, we can see that they were extremely heightened back in early 2021, and they increased more substantially again in Q1 2024 but did not reach even close to the heights of 2021. Heightened Funding Rates mean that traders are paying substantial premiums to Long Bitcoin, usually in periods of heightened activity.

These periods are not sustainable and usually result in flushouts. The below suggests that we haven’t yet seen the retail mania that we saw back in 2021, but we did have excesses in Q1 2024, which have now been flushed out, returning us to a healthier leverage market and an all-around healthier set-up to move into.

BTC Funding Rates:

The above suggests that we did have more substantial on-chain activity in Q1 2024 than usual but without a major retail influx.

On-chain data

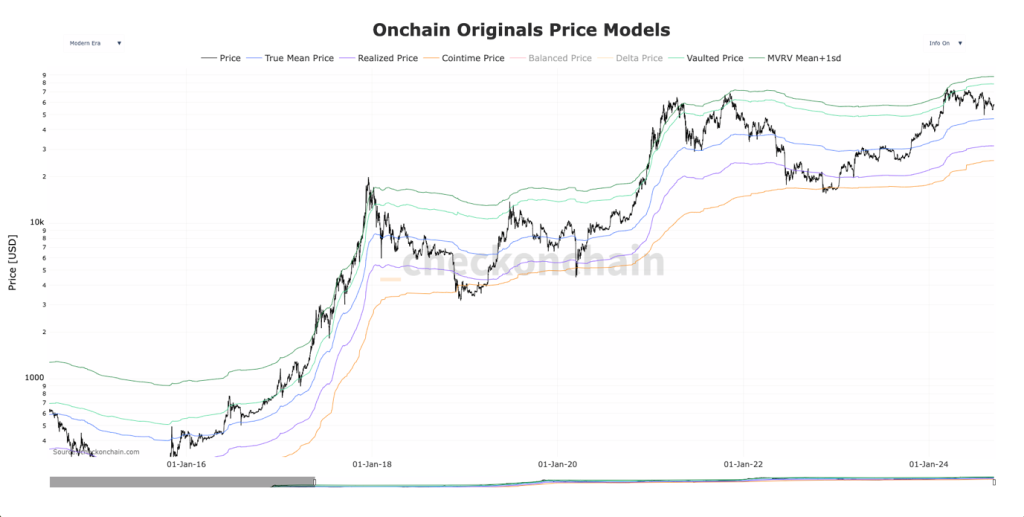

The first set of metrics we’ll look at is the Original Pricing Models. We can see that earlier on in the year, BTC was trading close to, and even touching, the MRVR Mean + 1 standard deviation – overvalued at that point in time.Since, price has pulled back. MVRV is one of the best metrics for valuing Bitcoin and showing when its price is trading at overvalued or undervalued levels. Price is now bearish in the immediate term, having lost two key levels and now trading below these levels: the 200-day moving average (at $63,700) and the short-term holder cost basis (at $63,300).

If BTC continues its short-term bearish trend, it could visit its True Mean Price (at $47,00) in the immediate term, although this isn’t our base case. Overall, if we look at the structure, it's typical for Bitcoin to reach the MVRV Mean + 1 standard deviation and pull back from there as it did back in 2019. The fireworks come when price can close above the MVRV Mean + 1 standard deviation (dark green line), as it did in 2017 and late 2020.

Onchain Originals Price Models:

If we zoom in, let’s see if BTC represents good value for a buy, even in the short term. We’ll look at two metrics: the Bitcoin Risk Index and the Bitcoin Futures Short/Long Liquidations Dominance.

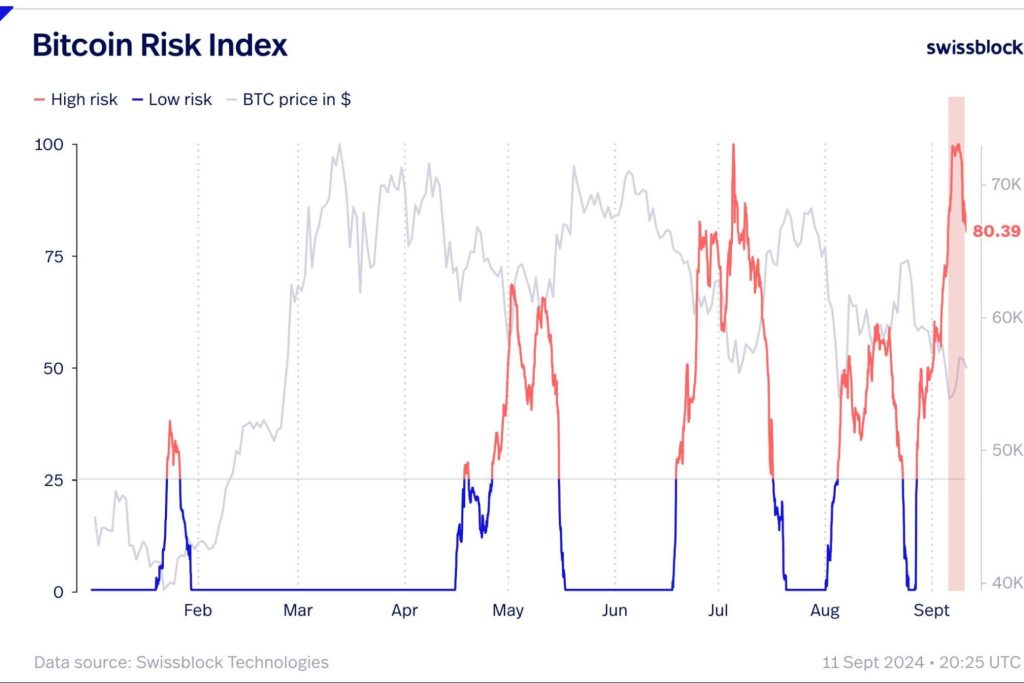

Bitcoin Risk Index:

When the Bitcoin Risk Index peaks and then turns lower, this historically offers a good opportunity to buy Bitcoin, particularly in the short term. When it peaks and turns lower, this tends to correlate with price hitting a local bottom and turning higher.

The second metric is the Bitcoin Futures Short/Long Liquidations Dominance. When Shorts make up a low percentage of liquidations, this correlates with local market bottoms.

Bitcoin Futures Short/Long Liquidations Dominance:

In the short-term, BTC may have put in a local bottom in the $52,000’s, however price has already bounced 10% higher from there, signalling that at least some of the move has played out.

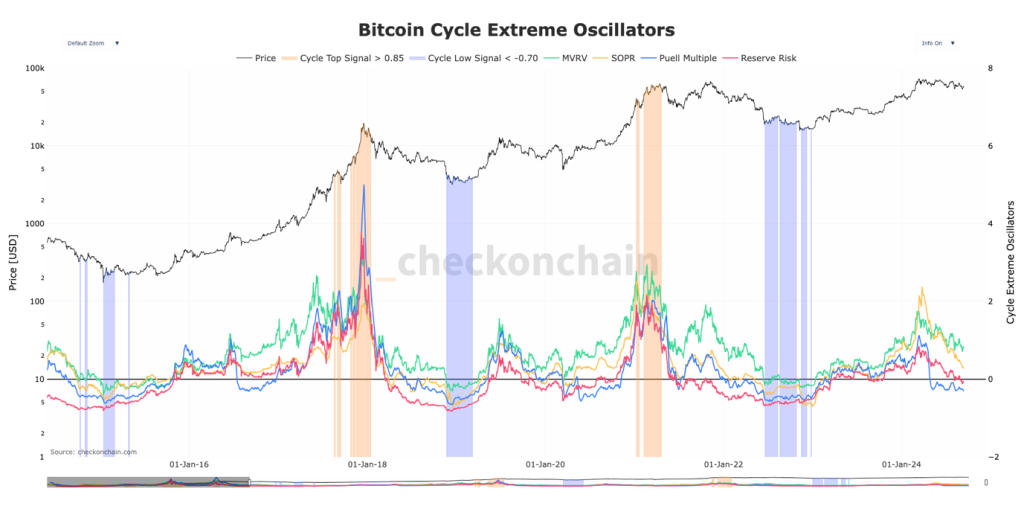

In the longer term, we still believe that Bitcoin is mid-cycle, with a more significant bull period ahead of us. To assess this, we can look at the Bitcoin Cycle Extreme Oscillators. This metric is a mix of several Bitcoin pricing models. It suggests that when values greater than 0.85 (on this metric) are reached, Bitcoin has or is close to peaking, price-wise, and vice versa (bottoming) when this metric puts in values sub -0.70.

The chart below shows that in this current cycle, we saw an uptick in this collection of metrics back in Q1, but this has not signalled a cycle top.

Bitcoin Cycle Extreme Oscillators:

We can summarise the on-chain data as follows: Early in 2024, Bitcoin reached overvalued levels for its current cycle. Since then, we have seen a healthy resetting as the leverage market has gone through a substantial cleansing, and the longer-term valuation models have also pulled back. These models now suggest that Bitcoin is close to value territory (for where we are in the cycle), whereas in Q1 2024, Bitcoin was overvalued.

The shorter-term metrics suggest that a bottom has either been put in or is very close (we think it’s probably in). To support this, the leverage market has reset, whilst sentiment has also been at lows. When excesses in the leverage market are flushed out and sentiment hits lows, this has historically been a good time to turn more bullish, particularly when the longer-term on-chain models look as favourable as they do.

Poor risk appetite in Q3: Presidential race & seasonality

Even though we remain very positive on the crypto market here, there are some other factors to consider, such as seasonality and the US presidential elections.In Q3, we have seen and potentially expect to see the level of risk appetite remain low until these events are concluded. The elections for the next US President take place on November 5th. Markets don’t like uncertainty, so they usually trade in a volatile and somewhat defensive manner until after the event is decided. However, we would expect markets to move into a more risk-on environment once the election is settled, particularly if there isn’t a sweep and if Trump wins.

On the flip side, a Harris win will likely see crypto trade poorly the following week, but we still believe the long-term trends are intact, regardless of who wins. In addition, Q3 is usually a quarter when risk assets underperform, as we can see from the chart below. We would expect this to improve again following the election's conclusion.

Seasonality of the S&P:

Cryptonary’s take

In the short term, the market is on tenterhooks. We’re in a period of weak seasonality for risk assets where the Fed is trying to thread the needle of beginning an easing cycle to get in front of a moderating but potentially weakening labour market, but not ease too quickly; otherwise, they risk alarming markets (that the economy isn’t holding up as well as the data suggests) or they risk inflation rearing back up again. This may mean we’re still in for a bumpy and volatile few months until the election is decided.A Trump win will likely be a catalyst for a significant crypto bull run.

Beyond the next few months, the setup is there for crypto and risk assets to perform going into the end of 2024 and 2025. The Fed is moving into an easing cycle that may take time to get going, but it is going to get going, and the Fed have a lot of room to lower rates. This will be stimulative for liquidity and, therefore, risk assets.

In the last few months, liquidity has increased, mostly due to collateral values rising. As the Fed begins cutting Interest Rates, this should have a stimulative effect on risk assets, as we can see it has done previously for Bitcoin.

Bitcoin & Global Liquidity:

From an on-chain perspective, the longer-term pricing models show that Bitcoin is currently in a phase similar to mid to late 2019, which would suggest a more bullish period, particularly as we get into the latter part of Q4 and then 2025. In the short term, on-chain metrics suggest that the market got too bearish, with Short interest building up alongside sentiment being at yearly lows. This is usually a recipe for a turnaround.

Action points

We’ve identified above that we expect further choppiness and volatility in the coming months and until the election. During this period, we chose to remain in the concentrated barbell portfolio and are not looking to take too many risks beyond this.As we progress past the election (and especially if we get a Trump win) and begin to see more of these rate cuts come into fruition, we will look to become more risk-on and diversify into plays that can potentially outperform the majors (BTC, ETH, and SOL) in 2025.

From a macro perspective, the key issue we’re focusing on in the short and medium term is whether the labour market can hold up. This is perhaps the biggest risk to the above views.

Cryptonary, Out!