Bitcoin remains rangebound, struggling below $53k resistance as overcrowded longs and high open interest signal flush-out risk. Yet, for long-term holders, anything below $50k presents a buying zone. Ethereum prints similar overheated signals as it taps $3k, unable to stretch its parabolic run much further without a cool-off.

Yet for projects like Solana, Links, and Optimism, their corrections may carve out higher support floors before their next legs up. THORChain and Render Network could offer value plays following pullbacks. Meanwhile, Mina Protocol must hold its ground at $1.28 to avoid further capitulation.

It's a mixed bag - with on-chain analytics painting a nuanced picture, the general direction is northbound, but you’ll need to determine how you play each coin on its merits.

Let's dive in.

You can jump to the analysis of assets you are most interested in by clicking the directional links below.

Market mechanics

Firstly, we'll start with the mechanics to build a picture of what's building up behind the scenes. We'll zoom right out and have a look across the board at the Funding Rates.

We can see in the above table that in the majority, many of the Funding Rates are well above 0.01%, which is the usual healthy level for them. With Rates this positive, it indicates a big bias among traders to be Long. If this continues or increases, Longs may become too overcrowded and vulnerable to a flush-out if price begins moving lower. This is a signal for us to be more cautious here, at least not to be ape'ing into new Longs at these higher prices, along with Funding being where it is.

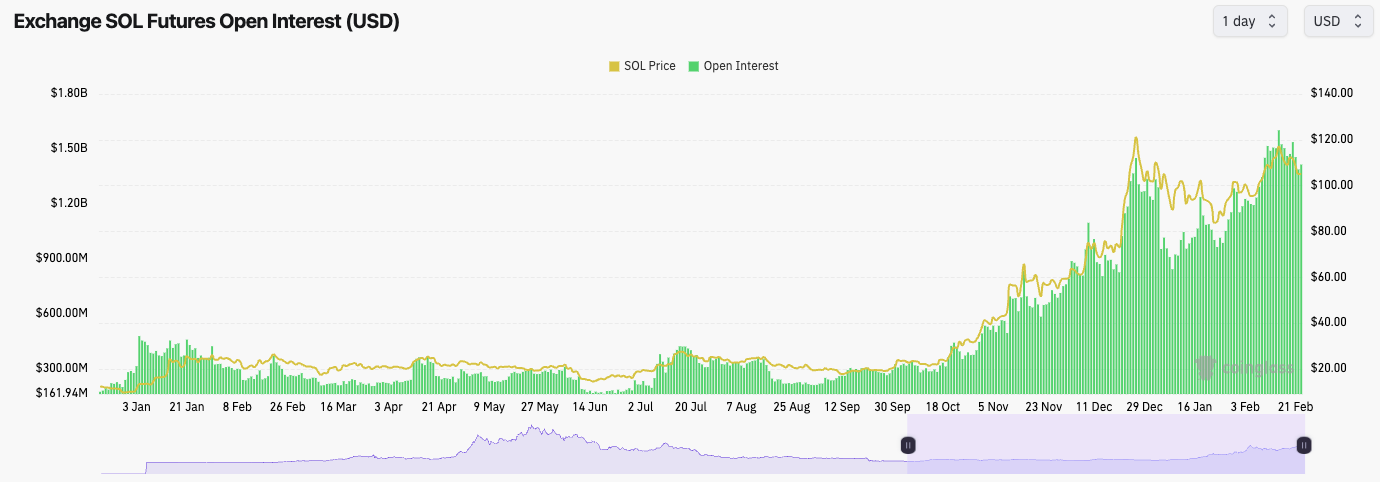

If we now look at the levels of Open Interest among the Majors (BTC, ETH, and SOL), we can see that all three have very high levels of Open Interest.

This indicates that there is a lot of leverage currently in the system. Again, this is usually a signal to be wary as higher levels of Open Interest usually mean flush outs are more likely, particularly if price moves against the overcrowded side - in this case, Longs.

BTC update

- Price remains beneath the horizontal resistance at $53k.

- Price has now moved back into the Kelten Channel and found support on the mid-level.

- There is a local support at $47,100, which also converges with the uptrend line.

- The RSI has reset on the smaller timeframes but remains slightly overcooked on the larger timeframes, particularly the Weekly, which has printed a bear div in overbought territory.

Cryptonary's take

We're not looking to add at these prices, particularly with where the mechanics are. Prices may continue to move higher, especially if ETF flows remain positive, although yesterday's weren't. We're not looking to sell Spot bags this early in the cycle, but to add exposure, we'd look at the upper Yellow box between $46,300 and $47,000, with DCA orders becoming increasingly aggressive sub $45k.ETH update

- ETH has begun to find some resistance at $3,000, even though the more major horizontal resistance is overhead at $3,140.

- ETH is at the top of its Kelten Channel, and on the Daily, it is above its channel. This would suggest that a small pullback is possible.

- The major support to the downside is $2,640.

- The RSI for ETH is now in overbought territory but not printing any bearish divergences like BTC, so this may have room to run slightly further, although odds do not really favour this upside.

Cryptonary's take

We continue to hold Spot ETH, although we wouldn't be surprised to see ETH pull back slightly. If ETH does pull back, we would be buyers, with the first major area being the Yellow box, which is between $2,480 and $2,540.We would see anything around $2,340 or below as a gift-buying opportunity for the long run.

SOL update

- SOL rejected into the $117 horizontal resistance we had marked for several weeks. This area also converged with the top of the channel.

- Price has then broken beneath the main uptrend line (thick Yellow line) and has now also breached below its local uptrend line (thin Yellow line).

- However, price has found support at the bottom of the channel.

- To the downside, there are key supports at $102, $95 and then $80.

- The RSI has now reset on all timeframes, with the Weekly also out of overbought territory.

Cryptonary's take

Following SOL's massive run-up in late 2023, it may be now establishing itself in a higher range between $80 and $120, and we may stay ranging for more months.Overall, it is bullish to hold at these higher price points, and it gives SOL the floor to really shoot higher when the true bull market kicks off, likely summer/September onwards.

If price reaches the upper Yellow box between $94 and $96, this will likely be a good long-term buying opportunity. Anything below this, particularly in the low $80s, we'll be increasingly more aggressive with buy orders.

LINK update

- Having broken up to the top of its channel twice, it has now rejected and pulled back slightly.

- However, the pullback has come back to the bottom of the channel, which also converges with the prior horizontal resistance, and there is now potentially new support at $17.75.

- The RSI has also now comfortably reset from overbought levels.

Cryptonary's take

LINK is one we like for the long term. If you're under-exposed, we will look to try to build a position if price can pull back to the Yellow box between $16.30 and $16.80RUNE update

- Once price bounced from the Yellow box and then broke out of the downtrend line (thicker Red line), we saw price move higher and break through what could have been the potential resistance at $5.31.

- Price then moved onto the next horizontal resistance at $5.80 and has seemingly rejected from there.

- Price is approaching the bottom of the channel and a key horizontal support level at $4.78. Price will need to hold here to put in a higher low.

- The RSI has now reset on all major timeframes.

Cryptonary's take

If RUNE moves lower to the Yellow box between $3.70 and $4.00, this could be a good long-term buying zone again. However, we’re looking for RUNE to find support in the mid-to-high $4s. Let's see what we get. We're currently relatively neutral in terms of RUNE's next move.RNDR update

- RNDR has more than doubled in the past 4-6 weeks, with its RSI in very overbought territory.

- Price is well above its Kelten Channel on all major timeframes.

- The clear support also aligns with the Yellow box between $5.06 and $5.32.

Cryptonary's take

If you're under-exposed to Render, we would wait for a more substantial pullback to begin adding exposure. The key level we are currently watching for is the converging area of the horizontal support and the Yellow box between $5.00 and $5.35.MINA update

- MINA is battling at a key level here at the horizontal level of $1.28. A close below may indicate more downside.

- The bottom of the channel could also provide some support for price, particularly as it also converges with the local Yellow box at between $1.18 and $1.21.

- The RSI is healthy on all major timeframes, which may help price find support at higher price points, potentially the local Yellow box.

Cryptonary's take

The Yellow box could provide a good first, smaller entry if you're under-allocated to MINA. If price falls to the low $1's, that's where we'd look to increase our exposure.OP update

- OP is in a nice uptrend, holding both the main and local uptrend.

- Price initially rejected from the top of the channel and is now at the middle level.

- The bottom of the channel converges with the local Yellow box and the local uptrend line, so this area between $3.22 and $3.31 should provide some support for price.