Market Direction

Let's dive in and see which way the charts point.

TLDR

- BTC remains heavily overbought historically, suggesting potential for a pullback.

- Bullish pennant forming on the 4-hour, but several rejections at $34.5k resistance.

- Funding rates are very positive, indicating bias for longs rather than shorts.

- The uptrend line remains support, but expect consolidation/retracement soon.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

So far, the move has been really positive and remains relatively healthy. As price has had a larger move higher, we can see that the horizontal resistance of $34,500 has acted as the main resistance for now, with BTC testing this level several times.BTC is now well back inside its main uptrend line (thick yellow line), which should be positive for price.

On the 4-hour timeframe, BTC is forming a bullish pennant, which usually has a bias to break to the upside. However, we have to note how overbought BTC is here, along with the fact it’s below the horizontal resistance of $34,500, having rejected there several times.

BTC 4hr

RSI and funding rates

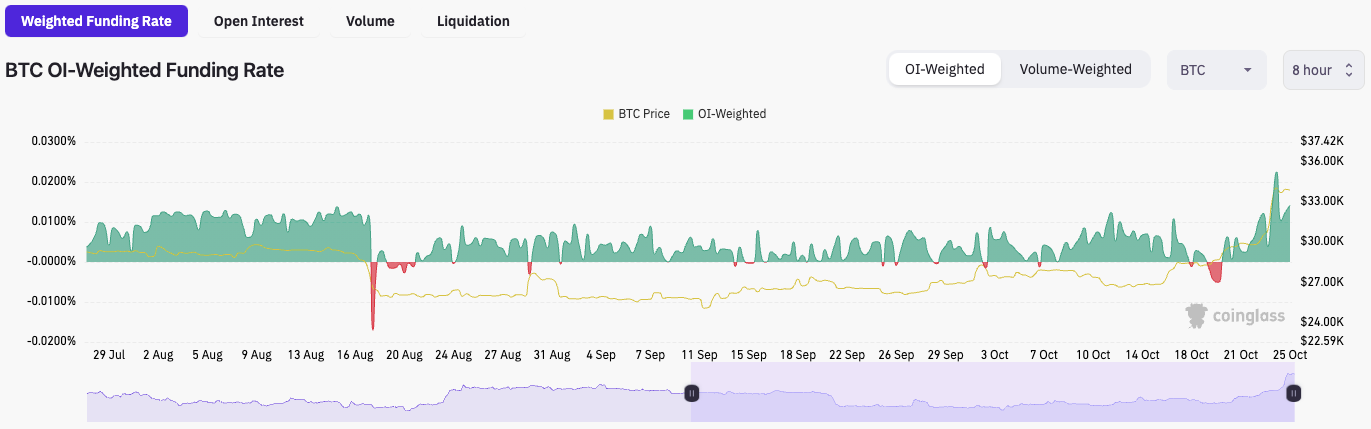

On most timeframes, but particularly the daily timeframe, Bitcoin is very overbought, currently at 87 on the RSI – this is massive. The last time Bitcoin was this overbought on the RSI was January 2023, but before that, it was January 2021. So, this should contextualise just how overbought Bitcoin is here.The funding rates are very positive and are positive across the board. This indicates that shorts have steered clear of this move higher, which somewhat aids the case for a price pullback for Bitcoin.

Bitcoin Weighted Funding Rate

Cryptonary’s take

Bitcoin remains very overbought and overbought at historical levels. This should suggest some caution here, and unless further positive ETF news comes, we feel it’s likely that BTC should have a price pullback in the short term.The level of interest for a price pullback could be the $31,300 horizontal level that may now act as new support.

Action

- If price does pullback to $31,300, this may be a good area to begin buying BTC if you’re currently under-allocated.

- We would remain cautious about opening fresh longs at the current price of $34,200, as we do expect a pullback in price in the short term.