Bitcoin’s bull run: ETF hype vs. overheating derivatives market

The buzz around Bitcoin’s recent rally is exciting. Investors will be hanging onto Federal Reserve Chair J Powell's Fed-speak today. Will Bitcoin's exhilarating climb continue, or is it teetering on a precipice?

Let's see whether the hype around a Spot BTC ETF approval is enough to sustain this rollercoaster ride.

TLDR

- Powell's speech today could impact financial conditions and risk assets.

- Bitcoin broke out of its ascending channel but faced strong resistance at $37,700.

- A positive funding rate and high open interest suggest frothiness in the market.

- A Spot BTC ETF approval could drive prices higher, but a rejection may lead to a sell-off of around $34,000.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

With a firm focus on Powell speaking later today, the markets will be looking to see if there is any pushback from Powell regarding easing financial conditions. We’ve seen the US10Y drop by 40 basis points in the last 7 trading days. It’s possible Powell won’t give too much away and will keep his cards close to his chest.At this moment, there may not be enough reason to push back, particularly as yesterday’s US10Y bond auction went relatively well - and with more issuance to come. The Fed and the Treasury may want to keep the marginal buyer there.

This should allow for an accommodative environment for risk assets, at least in the near term, until we begin to see some pushback from Fed members.

The S&P is potentially set for its 9th day of gains, whilst the Nasdaq has broken out of a downtrend resistance active since mid-July.

Let’s now dive into the technicals for BTC.

Technical analysis

Bitcoin has now broken above its ascending wedge/channel, which it’s been in for the prior two weeks. However. price is now heading into a major horizontal resistance of $37,700.BTC ETF applications may be approved between today (09/11/23) and 17/11/23, which is hyping the market and helping it drive higher.

The major supports to the downside are $34,000 and $33,300, with macro support at $31,800.

The RSI is phenomenally overbought here on the daily, the 3D timeframe and now also the weekly. The most overbought on the weekly time frame since February 2021. The hype of a potential Spot ETF approval is most likely driving the market higher here.

Let’s look into the mechanics more.

BTC 1D

BTC weekly

Market mechanics

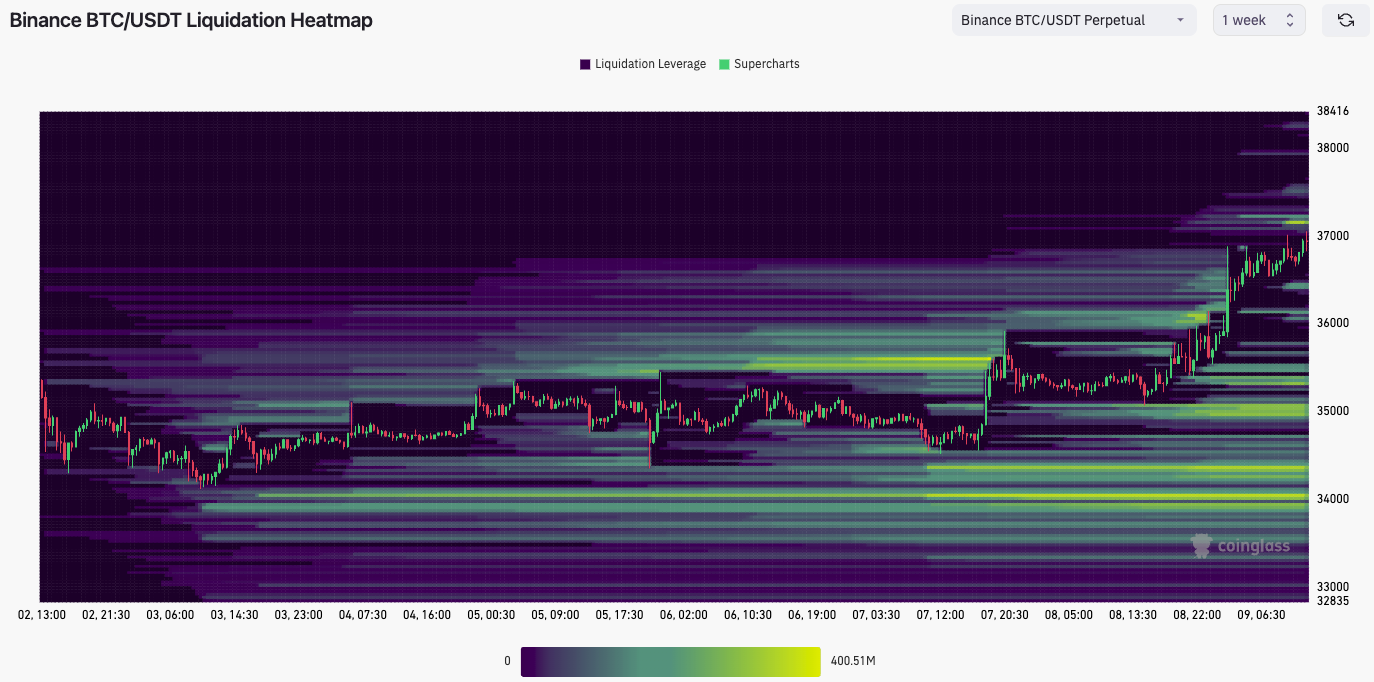

The funding rate remains positive and is relatively high. It is not super high to the point it’s ultra frothy, but it’s beginning to get there. When we look at open interest, that’s also at monthly highs. So, this is becoming frothy here and likely just being driven by the hype around a potential ETF approval.If we look at the liquidation heatmap, we can see the major liquidation level for shorts is at $37,200; we do think this level can be taken.

The major liquidation level is at $34,000. If a Spot BTC ETF isn’t approved in the next week, we may see the market sell-off slightly. Market makers and exchanges will hunt that $34,000 level if there's a selloff.

Cryptonary’s take

Despite prices grinding higher, we feel the accommodative macro conditions and the hype of an imminent Spot BTC ETF approval are the catalysts for the market driving higher.The derivatives market is becoming overheated but not yet at alarming levels, suggesting that there may be a further upside. Still, the risk/reward of buying in or longing at current prices for a short-term trade is relatively poor. That’s despite the fact we think prices can go up a bit more in the short term.

If a Spot BTC ETF isn’t approved in the coming week, the disappointment may drive a small sell-off. Exchanges and MMs will target the $34,000 area. If price does get there, we think this will provide a great opportunity to buy Bitcoin for the long term - assuming you have a 12-18 month viewpoint.