BTC, ETH, SOL, HYPE – all at critical levels – what happens next?

We’re tracking the tightest ranges and most critical zones in the market right now. From BTC’s $106.9K support to ETH’s $2,420 line, SOL’s uptrend squeeze to HYPE’s overheated RSI, everything is about to change. You can’t afford to miss this.

TLDR:

- BTC: Consolidating near highs. Target: $120K. Support: $106.9K. Neutral/Bullish.

- ETH: Holding $2,420. Target: $3,050. Bullish.

- SOL: Ranging $162–$184. Target: $203. Neutral.

- HYPE: Overbought. Likely pullback or pause. Neutral/Bearish.

BTC:

- BTC's Open Interest has increased to new highs, whilst the Funding Rate is positive but still contained. This suggests that a lot of leverage has been applied recently, but that it's evenly balanced between Longs and Shorts.

Technical analysis

- Bitcoin remains in its main uptrend after having broken out to new all-time highs.

- To the downside, the key zone of support is between $105,000 and $106,900. Price has remained above this zone, and used it as support several times already. This is the key level for price to hold.

- Below $105,000, the major horizontal support level is at $98,900.

- To the upside, the all-time high of $111,900 is the horizontal resistance. Beyond that, $120,000 is the next horizontal resistance.

- Over the last few days, BTC has been range-bound between $107,000 and $110,000. A period of consolidation is healthy during larger uptrend patterns.

- The RSI has pulled back from overbought territory, and a period of resetting this metric is positive. However, the RSI is now below its moving average, which is also overbought.

- Next Support: $106,900

- Next Resistance: $111,900

- Direction: Neutral/Bullish

- Upside Target: $120,000

- Downside Target: $98,900

Cryptonary's take

After breaking out to new all-time highs, BTC has remained range-bound at the highs, whilst the overall amount of leverage has increased, it is not yet in frothy territory.As all-time high breakouts go, this is a healthy breakout. This suggests that there could be more upside to be had in the near term following a small period of consolidation in the very short term. BTC's move continues to be supported by strong ETF flows and a weakening Dollar backdrop.

Our near-term price target for BTC is $120,000. This kind of BTC breakout will likely bring many more opportunities across the rest of the space, which we'll be on the lookout for and keen to take advantage of.

ETH:

- ETH's Open Interest has increased to new highs whilst the Funding Rate is meaningfully positive. This suggests that most of the build-up in new OI is Longs.

Technical analysis

- Following its breakout, ETH has remained range-bound between $2,420 (the horizontal support) and $2,720 (the local resistance).

- ETH's RSI has reset during this period of consolidation above a key horizontal support ($2,420), and it now looks ready to breach back above $2,720 and target $3,050.

- If ETH can break out of $2,720, then $3,050 is the next horizontal resistance.

- To the downside, if ETH were to lose $2,420, then the next major horizontal support is $2,160.

- Next Support: $2,420

- Next Resistance: $2,720

- Direction: Bullish

- Upside Target: $3,050

- Downside Target: $2,160

Cryptonary's take

ETH has held and consolidated above a key technical level - the $2,420 horizontal support. During this period of consolidation, the RSI has also reset slightly, although it does remain below its moving average.Our expectation is that ETH's next major move will be a breakout to the upside, with a breakout of $2,720, seeing ETH potentially push onto $3,050. Our view would be invalidated with a breakdown below $2,420.

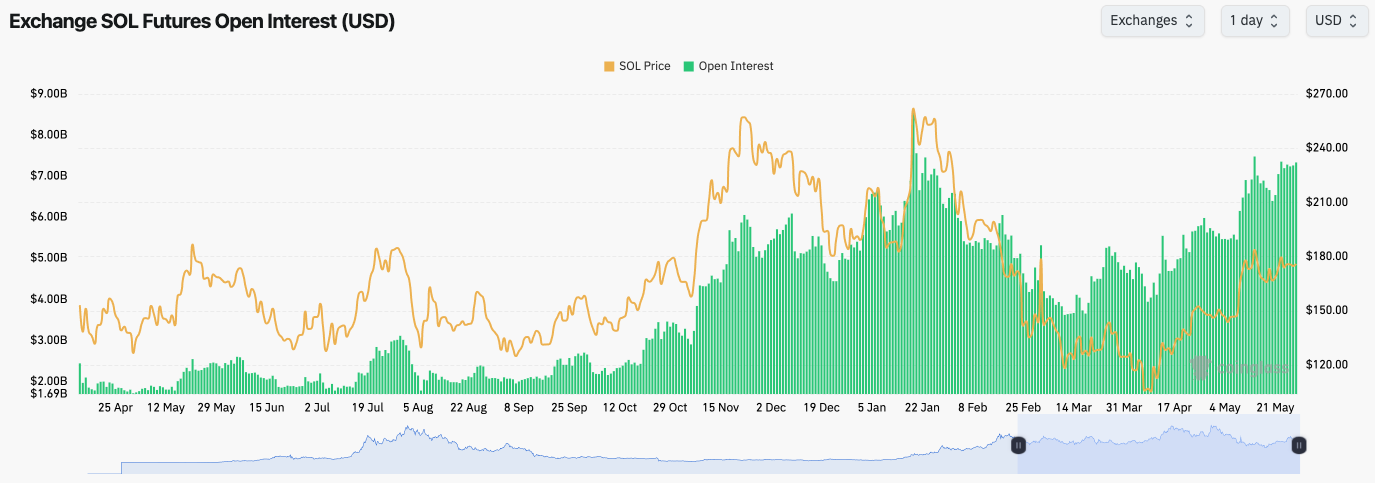

SOL:

- SOL's Open Interest has increased whilst Funding is now positive, suggesting that the increase in OI is Longs.

- We were seeing periods of negative Funding for SOL, suggesting that there was demand to shorten it. A sizeable amount of those Shorts have been squeezed or closed out, though now.

Technical analysis

- SOL has remained above its horizontal support of $162, but it's still finding resistance at the horizontal level of $184.

- Since the early April lows, SOL has respected its uptrend line, although the price is now squeezing against its uptrend line.

- To the upside, the horizontal resistances are at $184 and then $203.

- On the downside, the horizontal supports are at $162 and $147.

- SOL has consolidated above $162 for the last few weeks. This has allowed the RSI to reset from overbought territory. However, the RSI is now below its moving average.

- Next Support: $162

- Next Resistance: $184

- Direction: Neutral

- Upside Target: $203

- Downside Target: $147

Cryptonary's take

SOL is at a crucial point here. It’s contained in its key range between $162 and $184, whilst it's battling against its major uptrend line. If the uptrend line is lost, then a revisit of $162 is likely. However, if SOL can hold above the uptrend line, then a breakout of $184 and a push to $203 is on the cards.We wouldn't be surprised to see a small flush lower to $162 before a move higher, a reclaim of the range, and then a breakout of $184. A retest of $162 would therefore be a constructive setup. This is still a bullish setup, just not as bullish as ETH's current setup.

HYPE:

- HYPE has held towards its highs following the breakout of the $28.00 level.

- The RSI remains very overbought, with the moving average also well into overbought territory. This suggests there could be room for HYPE to pull back or at least consolidate for some time.

- There is local support at $32.00, with the major horizontal support at $28.00.

- The resistance for now remains the all-time high of $40.00.

- Next Support: $28.00

- Next Resistance: $40.00

- Direction: Neutral/Bearish

- Upside Target: $40.00

- Downside Target: $28.00

Cryptonary's take

It's possible we see HYPE go through a period of consolidation in the short term. During this, HYPE might then form a bull flag or a bull pennant. This would then allow the indicators to more meaningfully reset, and also provide a clean trading setup that'll allow us to go Long on HYPE. However, for now, we'll need to give the chart time to form a clearer and obvious technical pattern. We'll reassess for Long entries once the structure forms and the indicators cool further.If HYPE were to revisit the mid-20s, that's when we'd consider accumulating for the long-term, assuming there is no major turn again in the macro environment.