Market Direction

BTC, ETH, SOL, HYPE boom or bust after tension

Weekend tensions between Iran and Israel triggered healthy market resets across major cryptocurrencies, with Bitcoin testing key support levels while altcoins consolidate in defined ranges, setting up potential breakout scenarios.

TLDR:

- BTC: Bounced from $102.5K support; watching for breakout above $107K toward $110.5K.

- ETH: Range-bound between $2,420–$2,720; lacks clear direction for now.

- SOL: Holding $144 support; likely to trade between $144–$164 short-term.

- HYPE: In strong uptrend; short-term caution due to bearish divergences.

BTC:

- This weekend's escalation between Iran and Israel saw markets pull back, with BTC's Open Interest pulling back. A healthy development.

- Alongside this, Funding Rates are just about positive, meaning there is no froth from Longs here.

- Overall, this weekend's events have seen a flush in Open Interest, which now provides BTC with a healthier setup to now push higher.

Technical analysis

- Price dropped over the weekend into our main support area between $102.500 and $105,500. Price bounced at $102,600.

- Price has since recovered, and it is now battling at the main horizontal level of $107,000. Price will need to see a few Daily candle closures above this level for confirmation of continued upside.

- Beyond $107,000, the main horizontal resistance is at $110,500 and then the all-time high.

- To the downside, the main support range is between $102,500 and $105,500. We expect to see this area continue to hold as strong support.

- The RSI has pulled back to middle territory, with it now breaching above its moving average.

- Next Support: $102,500

- Next Resistance: $110,500

- Direction: Neutral/Bullish

- Upside Target: $112,000

- Downside Target: $102,500

Cryptonary's take

BTC has recovered well following the escalation this weekend between Iran and Israel, bouncing off the $102,500 horizontal support that we outlined in our last update. We're now looking for BTC to continue showing strength and to close convincingly above $107,000. This would then set up a move back to the highs at $110,500 over the coming days.A close above $107k would strengthen the case for BTC to retest its highs, though macro catalysts like Wednesday's FED decision and ETF flow trends will likely shape near-term direction.

What's next

ETH, SOL, and HYPE are sending mixed signals. Price is calm, but Open Interest and funding say something’s coming. Get ready for whiplash—one breakout could shake everything loose.ETH:

- ETH's Open Interest remains very elevated despite seeing a small flush out over the weekend on escalating tensions in the Middle East.

- ETH's Funding Rate remains positive and stable at 0.01%, indicating there is a healthy bias to be Long amongst traders.

Technical analysis

- War escalations in the Middle East resulted in ETH falling below its key horizontal level of $2,720, and the price returned to its old range of $2,420 to $2,720.

- Price has found support at $2,420, and it's now bounced back to the middle of the range.

- $2,420 is the main horizontal support, with $2,160 the major level below that. To the upside, the key horizontal level is $2,720.

- The RSI has meaningfully reset, and it has retested its downtrend line breakout as new support. However, it is below its moving average for now.

- Next Support: $2,420

- Next Resistance: $2,720

- Direction: Neutral

- Upside Target: $2,720

- Downside Target: $2,420

Cryptonary's take

ETH is essentially back into its range between $2,420 and $2,720, and to be honest, it's neither too bullish nor bearish here. A move higher (and a breakout) is likely now going to be led by other Majors (BTC or SOL), rather than being ETH-led like it was last week. For now, our expectation is that ETH will remain range-bound over the coming days/week, but the price may push into the resistance at $2,720. From there, we'll have to watch to see if price action is strong enough to break out.SOL:

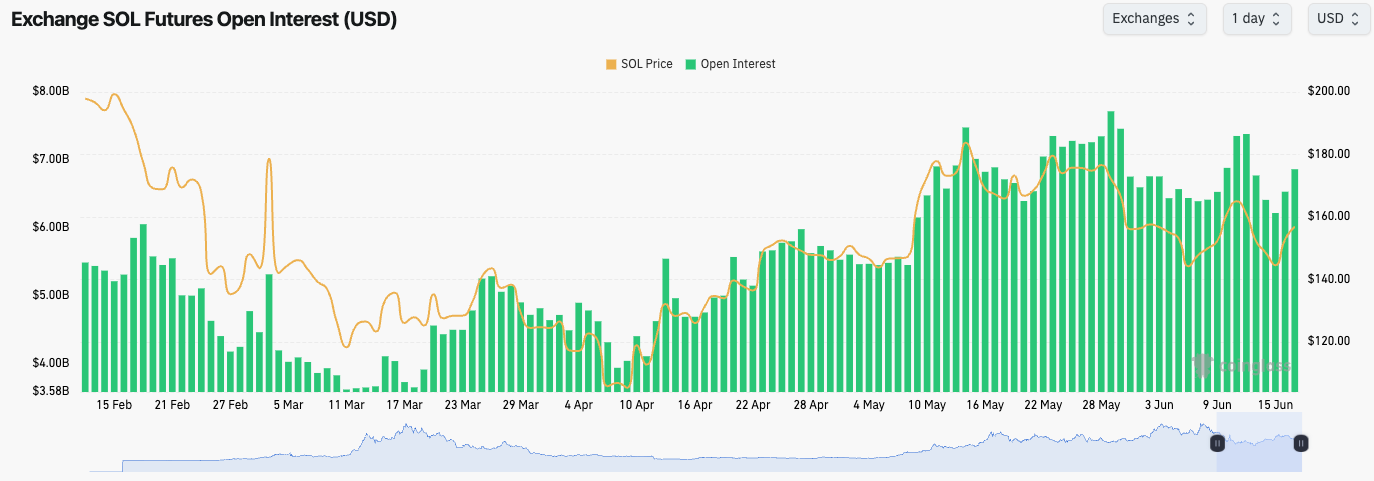

- SOL's Open Interest has increased on today's price bounce, but previously it has decreased as the price has moved lower. This suggests there's a consistent bias amongst traders to Long SOL, hence the unwinding of OI when the price moves down.

- SOL's Funding Rate is positive, but not in frothy territory.

Technical analysis

- We previously identified the Yellow Box as a key area for SOL and its price. Above the Yellow Box, and price action should remain bullish; below it, and we can see further downside.

- SOL has pulled back to a key horizontal support at $144 where price has then bounced from.

- Price is now retesting the underside of the Yellow box, which is a local resistance at $157.

- SOL could now potentially be range-bound, like ETH, between the $144 support and the $164 horizontal resistance.

- If the price breaks down from the $144 horizontal support, then $135 is the next local support. If the price breaks out of $164, the next upside target is $184.

- The RSI is in a healthy position. It's in middle territory, but above its moving average.

- Next Support: $144

- Next Resistance: $164

- Direction: Neutral

- Upside Target: $184

- Downside Target: $144

Cryptonary's take

Like ETH, SOL may stay range-bound between $144 and $157 for now, with upside bias above $157. We're watching for signs of a convincing breakout in either direction, although we'd expect the breakout to be to the upside rather than the downside. The key upside levels for price to clear above are $157 and then $164.If price were to fall below $144, we'd look to add SOL to our long-term bags, between $120 and $144. However, our expectation is that the price remains range-bound between $144 and $157 in the short term.

HYPE:

- HYPE has broken out of its bull pennant, and it continues to put in new highs, whilst price remains supported by a strong uptrend that remains intact.

- Notably, price has put in multiple bearish divergences in overbought territory (higher high in price, lower high on the oscillator). This is potentially the one short-term negative note.

- There is a new local support for price at $39.40, whilst there is a strong support range for price between $32 and $33.

- To the upside, and in terms of resistance, there aren't any key levels as price has gone into price discovery. Key levels now become psychological levels, such as $50.

- Next Support: $39.40

- Next Resistance: $50.00

- Direction: Neutral

- Upside Target: $50.00

- Downside Target: $33.00

Cryptonary's take

HYPE has been one of the strongest performers over the last few months, and it continues to go from strength to strength. But, whilst price has gone into price discovery, we don't plan on buying HYPE up at these levels. However, if there is a significant pullback, then we'd look to accumulate HYPE, but we'd be eyeing the $28 to $33 levels to add to our long-term Spot bags.For those that do own HYPE, we'd continue to keep riding it higher.