Market Direction

BTC, ETH, SOL, HYPE: Fragile, fueled, or finished?

Major cryptocurrencies face pivotal support and resistance levels as market dynamics shift. Open interest patterns and funding rates reveal critical insights for positioning across Bitcoin, Ethereum, Solana, and Hyperliquid in this volatile environment.

TLDR:

- BTC: Healthy pullback; strong support at $102.5k–$107k. Targeting $112k–$120k.

- ETH: Retesting $2,720 support; holding could lead to $3,050.

- SOL: Pullback to $157 support; long-term bullish, adding on dips to $144.

- HYPE: Overbought with bearish divergence; wait for pullback to $32–$34.

BTC:

- Looking at the Open Interest on a more zoomed-in view, we can see that OI ramped up into the price spike into $110k, and OI has since pulled back.

- Funding Rates also remain subdued, which is positive.

- So far, this is a small but healthy leverage flush out.

Technical analysis

- On the local timeframes, BTC has reached an all-time high.

- Price has now pulled back to a key horizontal level of $107k. This is a major support.

- Below $107k, there is a strong support zone between $102,500 and $105,500, which we expect the price to hold.

- To the upside, the main resistance is between $110,000 and the all-time high of $112,000.

- The RSI has nicely reset on this move, with it now sitting on its moving average. This is positive.

- Next Support: $105,500

- Next Resistance: $112,000

- Direction: Neutral/Bullish

- Upside Target: $112,000 (then $120,000)

- Downside Target: $102,500

Cryptonary's take

Despite the slight pullback, the price action looks positive here, and to us, this just looks like a healthy pullback. If $107k is lost, then we expect the price to be heavily supported between $102,500 and $105,500, and we'd be buyers of this dip should we get it. However, we're not ruling out that $107k just holds here.For now, we're remaining patient, but if we see dips into the $102,500 to $105,500 range, then we'll become dip buyers with a view to a long-term hold (at least 12 months).

ETH:

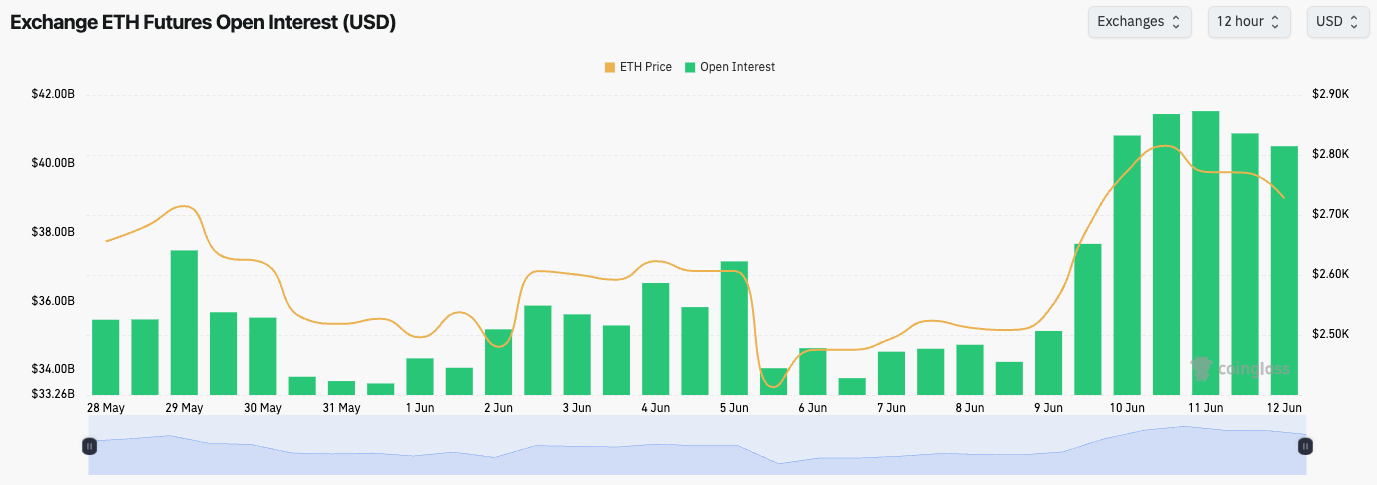

- ETH's Open Interest ramped up as price moved up, although the price move up was backed by solid Spot buying also.

- Price has pulled back slightly, and the Open Interest has remained high.

- There doesn't look to be a leverage flush out on the horizon here, especially as the Funding Rate remains within range at 0.01%.

Technical analysis

- ETH broke out of its local uptrend line and then the main horizontal resistance at $2,720.

- Price is now pulling back to $2,720 to test it as new support.

- We're looking for a price to hold this support and bounce from here.

- Upside target and next major horizontal resistance is $3,050.

- If $2,720 fails, the range reopens between $2,420 and $2,720.

- Below $2,720, local support lies at $2,580, with major support at $2,420.

- The RSI has broken out of its downtrend and now sits on its moving average — not overbought, looks constructive.

- Next Support: $2,720

- Next Resistance: $3,050

- Direction: Neutral/Bullish

- Upside Target: $3,050

- Downside Target: $2,420

Cryptonary's take

The Majors, particularly BTC and ETH, are at crucial levels here, balancing on top of key supports. Although if these supports are lost, there are several supports below the current level. If the geopolitical environment can stabilise (Iran/Israel), then we'd expect the price to bounce at or around these levels ($2,720), and move higher from here.SOL:

- SOL's Open Interest is also at highs, and it hasn't yet come off, which is relevant considering price has had a 5% pullback.

- SOL's Funding Rate remains subdued, which suggests that there is a relatively even balance between Longs and Shorts. This is a healthy setup.

Technical analysis

- SOL has broken out from its downtrend line, and the price is now pulling back slightly.

- New support zone identified between $157 and $164, replacing the previous clean line at $162.

- Price initially rejected the top of the local range at $162, but found support at $157.

- RSI has broken out and now reset in middle territory — a constructive signal.

- If price breaks down, next move could reach $144.

- Base case: price holds $157 and climbs toward $180.

- Next Support: $157 (then $144)

- Next Resistance: $164

- Direction: Neutral/Bullish

- Upside Target: $180

- Downside Target: $144

Cryptonary's take

SOL has broken out and is now pulling back and retesting a local support at $157. In 12 months' time, we expect SOL to be substantially higher, likely well above new all-time highs. Therefore, we'll begin dipping our toes in, adding to our long-term SOL bags between $144 and $157, and we're inclined to add a small amount at the current price to immediately increase our exposure. We're not looking to rush here, and we're looking to progressively add to this position over the coming months.HYPE:

- HYPE held its uptrend line, and then the price broke out of the bull pennant.

- Price has made a new high; however, a bearish divergence has now formed in overbought territory (higher high in price, lower high on the oscillator).

- This suggests a pullback is possible here in the short term.

- There is likely strong support for HYPE between $32 and $34.

- A local level (support) for price to pull back to might be $36.80.

- To the upside, there is no major resistance, although you'd take the all-time high as the next local resistance level.

- Next Support: $32

- Next Resistance: $44

- Direction: Neutral/Bearish

- Upside Target: $44

- Downside Target: $28