Major Cryptos consolidate at key levels

We expect to see the price continue to be range-bound for possibly another week. We would see this as positive as it would continue to reset some of the indicators that were significantly overbought. It's important in larger uptrends to have periods of consolidation. This is what we believe we're getting now before the next leg higher.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

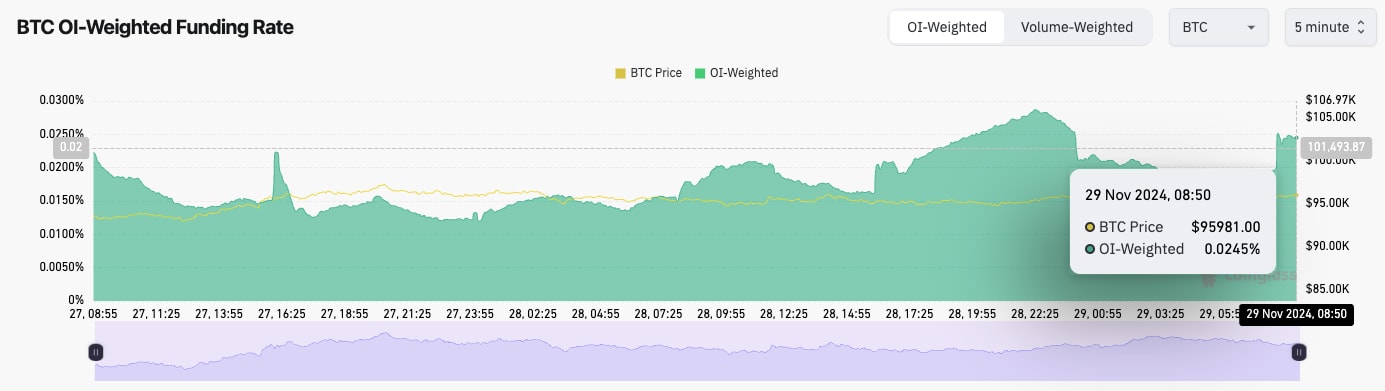

- BTC's Open Interest remains very high, although denominated in coins, and BTC's OI has pulled back approximately 5% since OI peaked, just following the price's all-time high.

- Bitcoin's Funding Rate remains elevated. However, it is not at excessive levels that might suggest that a flush-out is imminent.

Technical analysis

- For the last few days, BTC has been range-bound between its all-time high of $99,500 and the prior resistance, now flipped new support at $91,500.

- This range-bound price action has helped the RSI pull back slightly from overbought territory. However, it's still close to overbought territory. Further consolidation would likely see the RSI continue to pull back.

- On the downside, the support for BTC is $91,500 and then $87,000. Whilst we don't rule out a break below $91,500 (but we think less likely), we expect $87,000 to be major support.

- On the upside, the all-time of $99,500 and the psychological level of $100k will act as the major resistance zone.

- Next Support: $91,500

- Next Resistance: $99,500

- Direction: Neutral

- Upside Target: $99,500

- Downside Target: $91,500

Cryptonary's take

As we expected, Bitcoin holds between $91,000 and $99,500 in this range. It is really positive to see that prices are consolidating at these higher levels following such a huge move after the US Election.ETH:

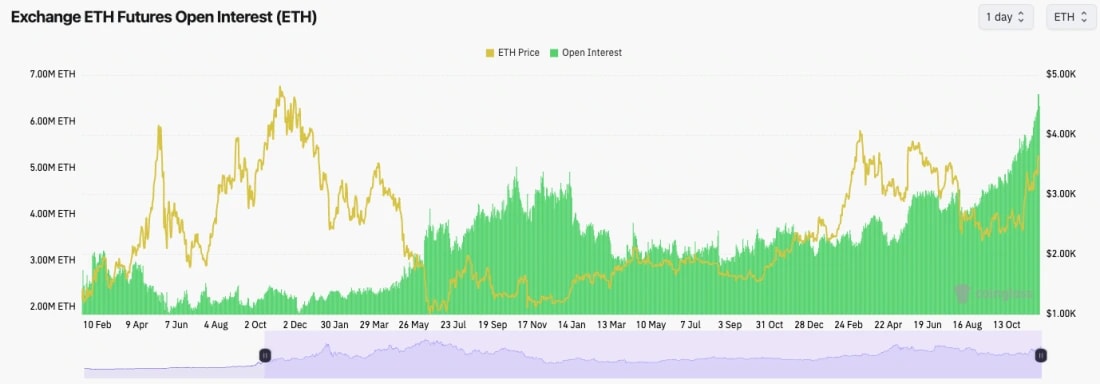

- ETH's Open Interest remains at record highs, while the Funding Rate is also elevated, but it is not excessively high.

- The reason why ETH's Open Interest is likely so high is likely due to large players taking advantage of the 'cash-and-carry' trade. Buy the ETF and Short ETH Spot, and profit from being paid the Funding Rate.

Technical analysis

- Really nice move that, overall, we've called relatively perfectly.

- ETH managed to consolidate between $3,280 and $3,480 before now breaking above $3,480 and pushing into $3,600. $4,000 likely soon.

- In terms of support, we expect $3,480 to be local support, with $3,280 as a stronger support.

- On the upside, we think the main resistance is at $4,000. It's a psychological level as well as a prior resistance level.

- One thing to note here is that ETH has put in a bearish divergence (a higher high in price and a lower high on the oscillator). However, it's not in overbought territory, so that's not as bad.

- Next Support: $3,480

- Next Resistance: $4,000

- Direction: Bullish

- Upside Target: $4,000

- Downside Target: $3,280

Cryptonary's take

ETH's narrative has improved substantially, and price action has been positive for once.Therefore, we do expect ETH to just grind up to $4,000 in the coming week.

If we get this, we'd expect $3,480 to then become a more major support. Overall, we're positive on ETH here, as we pretty much have been since its lows in the low $ 2,000s.

SOL:

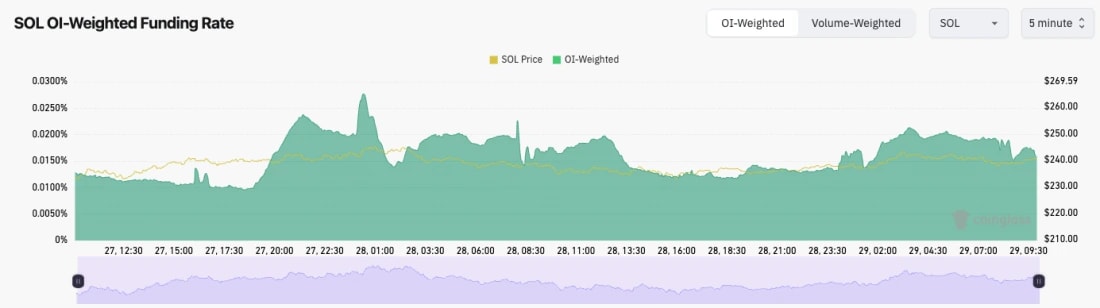

- SOL's Open Interest is down slightly from the highs, indicating that some leverage was flushed out on the pullback to $220.

- SOL's Funding Rate is positive, but it isn't elevated at just 0.0158%. This indicates that positioning is tilted Long, but it's close in balance between Longs and Shorts.

Technical analysis

- We're looking at this chart from a zoomed-out perspective, but we remain on the daily timeframes.

- SOL moved into its all-time highs at $260, rejected, and pulled back to the prior horizontal resistance, now turning new support at $220.

- SOL was able to bounce well at $220, with this pullback to $220 really resetting the RSI, now being significantly below overbought territory.

- We expect the $210 to $220 area to act as strong support for SOL in the short term.

- To the upside, the main horizontal resistance is the prior all-time high, $260.

- Next Support: $220

- Next Resistance: $260

- Direction: Neutral/Bullish

- Upside Target: $260

- Downside Target: $220

Cryptonary's take

SOL still looks really strong here. We're expecting a period of consolidation, similar to BTC, and we believe we're currently in that. We expect that the price will just be range-bound between $220 and $260 for the next week before eventually breaking out to the upside again.WIF:

- WIF has seemed to find its support in the grey box between $2.84 and 2.97.

- The key level for WIF to reclaim back above is the $3.40 level.

- If WIF were to fall below $2.90, there would be a lot of support stacked down to $2.60, so we'd expect a lot of buying pressure to come into WIF sub $3.00. However, we're not expecting WIF to drop much below $3.00.

- This pullback in price has seen the RSI substantially reset, and it is now back in the middle territory at 53.

- If WIF can break out of its downtrend line, that might help fuel a move up to $3.40 and then potentially reclaim that level.

- Next Support: $3.00

- Next Resistance: $3.40

- Direction: Neutral

- Upside Target: $3.40 (then $4.00)

- Downside Target: $2.85

Cryptonary's take

We expect WIF to be range bound between $3.00 and $3.40 for some more days. It's possible that WIF is forming a bottoming pattern here, similar to what DOGE did at the $0.10 area.This might mean that more time is needed at these price levels, but if/when a breakout happens, it might be strong to the upside.

POPCAT:

- We're currently at a key juncture for POPCAT here.

- It's possible that this might be a bottoming zone for POPCAT, with the price just sitting above the support box of $1.13 to $1.20.

- POPCAT still has a hidden bullish divergence (a lower low on the oscillator and a higher low in price). This might help fuel a move back beyond $1.40.

- $1.40 is the local horizontal resistance that POP will need to reclaim. This would also give it a chance to reclaim its uptrend.

- Beyond $1.40, the key horizontal resistance is in the low $1.60's.

- To the downside, we expect the grey box to hold as support.

- The RSI has been reset with it at 44.

- Next Support: $1.20

- Next Resistance: $1.40

- Direction: Neutral

- Upside Target: $1.40

- Downside Target: $1.13

Cryptonary's take

We expect this (the grey box) to be the line in the sand for POPCAT. Ideally, from here, we see it recover $1.40 and push back into the range between $1.40 and $1.60. We're going to need to see strong price action in the short term for POPCAT to potentially reclaim it's uptrend.POPCAT has always been unreliable in its price action, and there have been many times when it's looked weak, and we've seen a monster rally follow. POP has always been a great buy-and-hold rather than a trading asset. We expect that to continue to be the case.

SPX:

- A great bounce from the lows and exactly what we were looking for and called for.

- Price found support between $0.45 and $0.50 as we had predicted, and once $0.50 was reclaimed, price broke out to the upside.

- The price then moved into the $ 0.70s, but it has since pulled back. This is to be expected after a 50% move to the upside.

- To the upside, $0.75 is the key horizontal level to reclaim.

- We're now looking to see SPX hold above $0.60 (a prior horizontal resistance), hopefully now flipped into new support.

- Next Support: $0.60

- Next Resistance: $0.75

- Direction: Bullish

- Upside Target: $0.75

- Downside Target: $0.60

Cryptonary's take

It was a really positive move by SPX, and now, 2 months on from the major run-up, we've probably seen large holders taking some profits, and that is now potentially behind us.We're now looking for SPX to consolidate this move high, preferably above the $0.60 area, and we think we can see that. If SPX can do that, then we can potentially see the start of a new and sustained uptrend.