In this week's Market Update, we'll cover the below topics:

- Recent Data and FOMC Minutes.

- Trump Treasury Secretary Boosts Markets.

- On-Chain Data.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Recent data and FOMC minutes

Recent data has continued to support a relatively strong outlook for the US, particularly in comparison to other economies, e.g., European economies. Over the last few weeks, we've seen Initial Jobless Claims continue to come in in the low 200k's. This is low for Jobless Claims and means that the number of people filing for Unemployment Benefits isn't rising.If we then look ahead to next Friday (6th), Non-Farm Payrolls is expected to rebound strongly to 194k. This all suggests to us that the labour market remains strong. Meanwhile, the US continues to grow at 2.8%, as seen in today's GDP figures.

Yesterday, we received the FOMC Minutes. The overwhelming takeaway from the Minutes is that we're beginning to see some dissent among members. Robust growth in the US, and with a labour market that's still more than hanging in there, has some FED members questioning if they need to be as aggressive with cutting Interest Rates.

Members aren't calling for an outright pause but for the potential to not cut rates and just pause at upcoming Meetings. This may also be due to Trump winning the election and some FED members being worried that his policies might be inflationary. Therefore, FED members might be more cautious about cutting aggressively ahead of Trump's implementation of his policies.

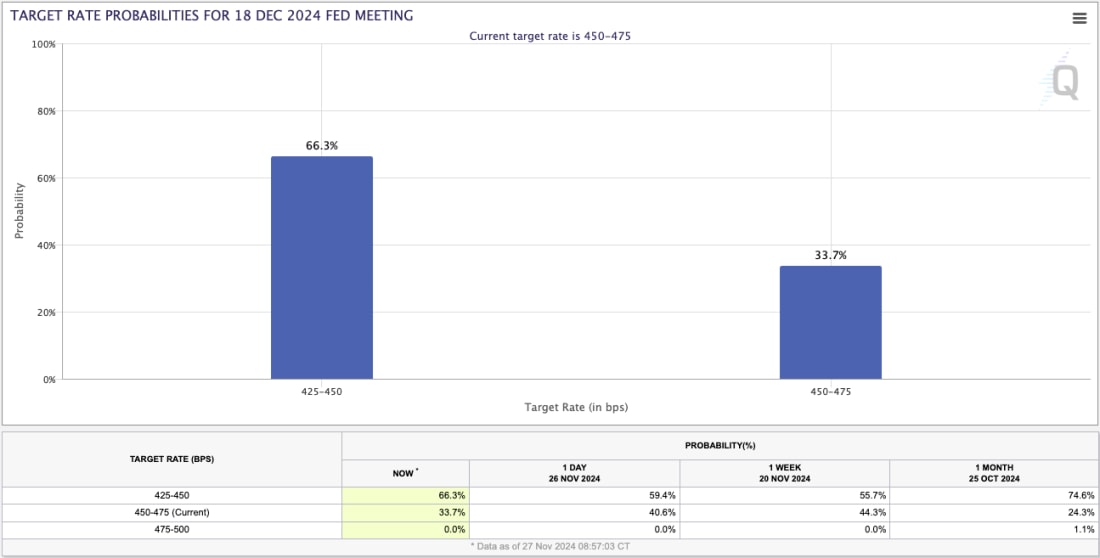

The market is currently pricing a 66.3% chance that the FED still does a 25bps Interest Rate cut at the December Meeting. But, the market is now also pricing for just 3 more Interest Rate cuts between now and the end of 2025, perhaps late Q1 25, and then Q2 2025.

Ultimately, the FED still sees itself as restrictive, and it is likely to continue the easing (cutting interest rates) cycle. And, even though the market is now pricing in fewer Interest Rate cuts, it's coming off the back of strong US growth, which is positive for risk assets (Equities and Crypto).

All good; the markets are likely to keep going on a zoomed-out view.

Target rate probabilities for the 18 Dec FED meeting:

Trump treasury secretary boosts markets

This week, President-elect Trump announced that Scott Bessant would become the next Treasury Secretary. Bessant is a hedge fund manager who has previously worked for Soros and Druckenmiller and made big $ from predicting Central Banking mistakes and next moves.The markets responded positively to the announcement that Bessant was Trump's pick, as many see him as extremely capable. Bessant is seen as someone who might quell some of Trump's more aggressive policies.

On the back of the announcement, the dollar pulled back slightly, and bonds were bid down (Yields down). This is likely due to investors having confidence in Bessant that he can bring the long-end bond yield lower; therefore, investors are buying these bonds to lock in the yield. The US10Y seems to have found a top just shy of 4.50%.

Overall, Scott Bessant is seen as phenomenally capable and, therefore, a great Treasury pick by Trump. This is positive for markets.

On-chain data

We'll now dive into the on-chain data to assess how things look under the hood following BTC's explosive move up to the $99k level. What we're looking for here are signs of exhaustion and whether this is the top or just a local top.Firstly, we've seen a lot of worry in the Discord over the past few days despite BTC being in the mid $ 90k range. This is likely because BTC has had its run, and Alts and memes have lagged, and that's where we're more clearly positioned. So, in terms of BTC drawing down in a bull market, we can see from the below that this current move down is very minimal. So, on that front, we're all fine, and this move is very normal.

Bitcoin bull market correction drawdowns:

Bitcoin is in the process of making its large move higher (say from $60k to $150k), whereas Alts/memes are yet to have their all-time high breakout. We can see this below from Ki Young Ju (CryptoQuant founder).

Bitcoin market cap to altcoin market cap:

This cycle is different in that it's being driven by Institutional adoption, but we still expect it to be a matter of time before we see more significant retail inflows into the space. That's likely when the Alts/memes can really get going again. This is typical of prior cycles; Bitcoin moves first, followed by ETH, then followed by the Alts market.

What we also notice is that Bitcoin is approximately 35% higher than its prior all-time highs (from $73k to now $95k), whilst ETH is approximately 40% below its all-time highs. Institutional players will likely look at this as a divergence. This might be why we're seeing a more substantial bid come into ETH.

Beyond that, SOL is likely only a matter of time, particularly if an SOL ETF is approved in 2025 under a new Trump regime. It's possible here that ETH/BTC has bottomed. Bold call, but we're going for it. If we're right, this would likely also mean that an Alt/Meme season is on the near-term horizon.

ETH/BTC bottomed?

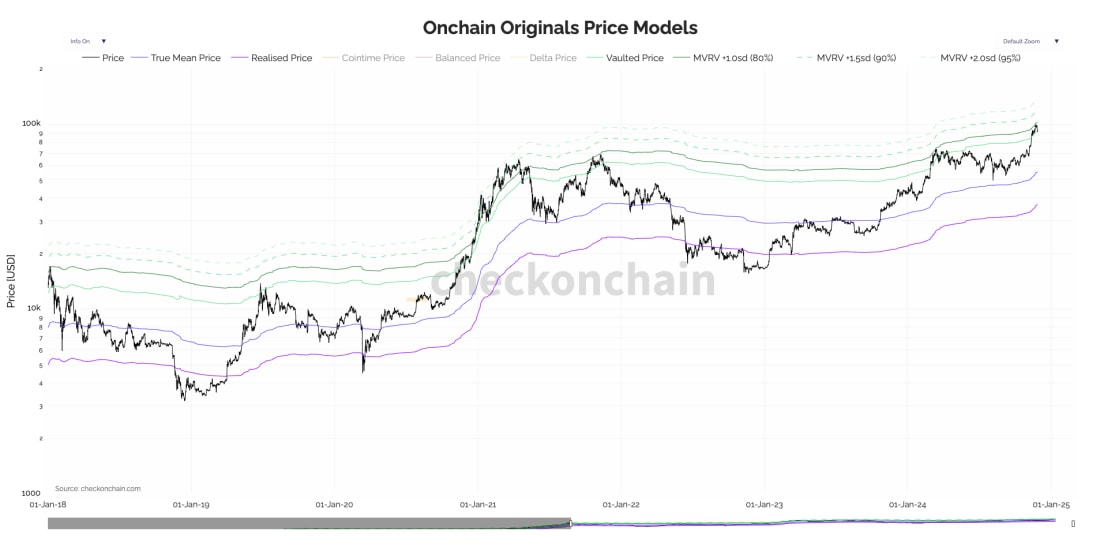

But, back to BTC on-chain data. With this larger move up, on-chain pricing models currently show that Bitcoin is at the top of its range locally speaking. However, at this point in the last cycle, BTC broke through this range and pushed on to +1.5 and +2 standard deviations above its MVRV +1 standard deviation.

So, this may mean we're in for a short-term pullback, which we may have already had over the last few days. But, it can be the case that BTC remains range-bound here between $90k and $100k for a week or so.

At that time, this could give Alts/Memes breath and allow them to make their own moves. Alongside this, the on-chain pricing models are tilted higher, meaning the next retest for BTC would be north of $100k. Lastly, MVRV +2 standard deviations currently sits at a whopping $136k...

Onchain pricing models:

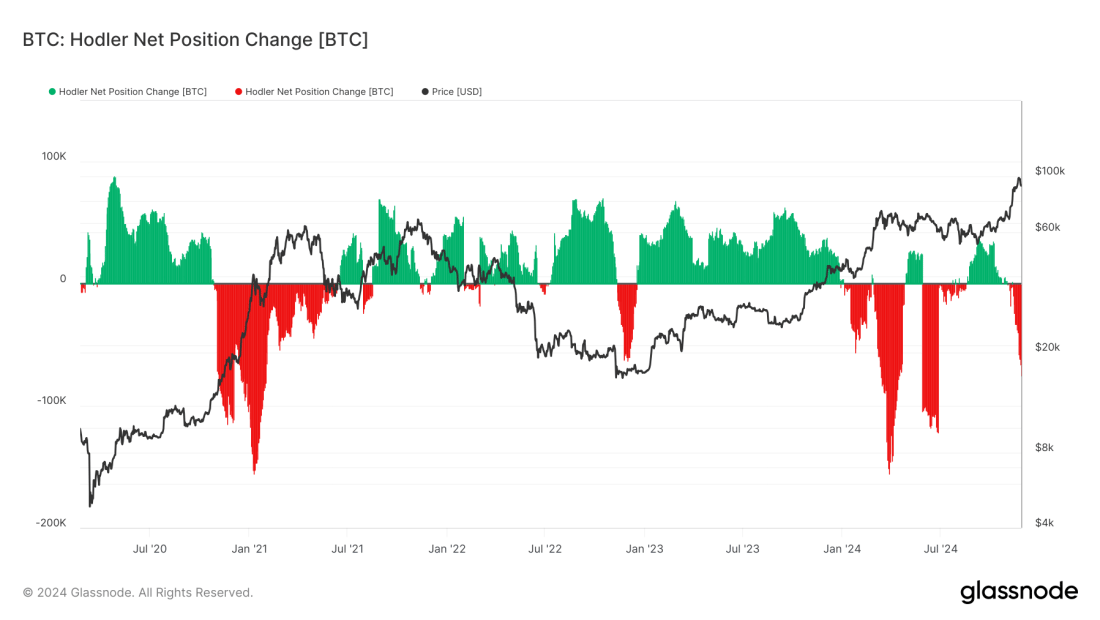

The current pullback was driven by some long-term holders' booking profits, which we can see from a declining net position change in the Hodlers. LTH is currently selling $2.02b worth of BTC a day, although this is mostly from the 6m to 1y old coins cohort. So this is more likely swing traders, whilst it also highlights the significant amount of new demand coming in to buy up these coins.

Hodler net position change:

In the above, we can see prior times when Retail engaged with excessive trading, and this has marked periods close to tops/local tops. We can see that it's currently in 'neutral' territory, indicating that euphoria and animal spirits haven't returned yet.

Cryptonary's take

Macro: The macro still looks good and is therefore supportive for risk assets (Equities and Crypto) going into year-end. This is fuelled by strong growth and a robust US labour market. We're also in a strong seasonal period for corporate buybacks, supporting the bid in Equities.On-Chain: Whilst BTC might need a breather in the short-term, rather than majorly pulling back, it more likely just needs a week or so of consolidating between $90k and $100k. This is due to Long-Term Holders realising some profit-taking into $99k. However, on-chain models are suggesting BTC goes higher in the medium term, whilst we're also in the early inning of retail returning to the space.

Final Thoughts: Even though this "cycle" is different in ways from prior cycles, we still expect the pattern of BTC running first, and then ALTS/Meme's running following the BTC move up. We still believe BTC is in its "run-up", with maybe $120k to $130k being the medium-term target.

But, with BTC moving from $60k to $99k and now consolidating, we expect that now is the start of the Alt/Meme coin season as retail begins coming back into the space, becoming more comfortable and therefore then beginning to bet more and go further out the risk curve (Alts/Meme's) with these bets.

In the short term, we expect that the worst of the Alt/Meme coin pullback is behind us and that we may have bottomed here. A bold call, but again, we're going for it. For the next few months...

Buckle up!!!