Market Direction

BTC price prediction today: Can it hold $58,000 support?

Bitcoin (BTC) is trading between key support at $58,000 and resistance at $63,400. With market uncertainty and funding rates fluctuating, will BTC break higher or remain range-bound? Let's explore today’s price prediction and potential moves.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

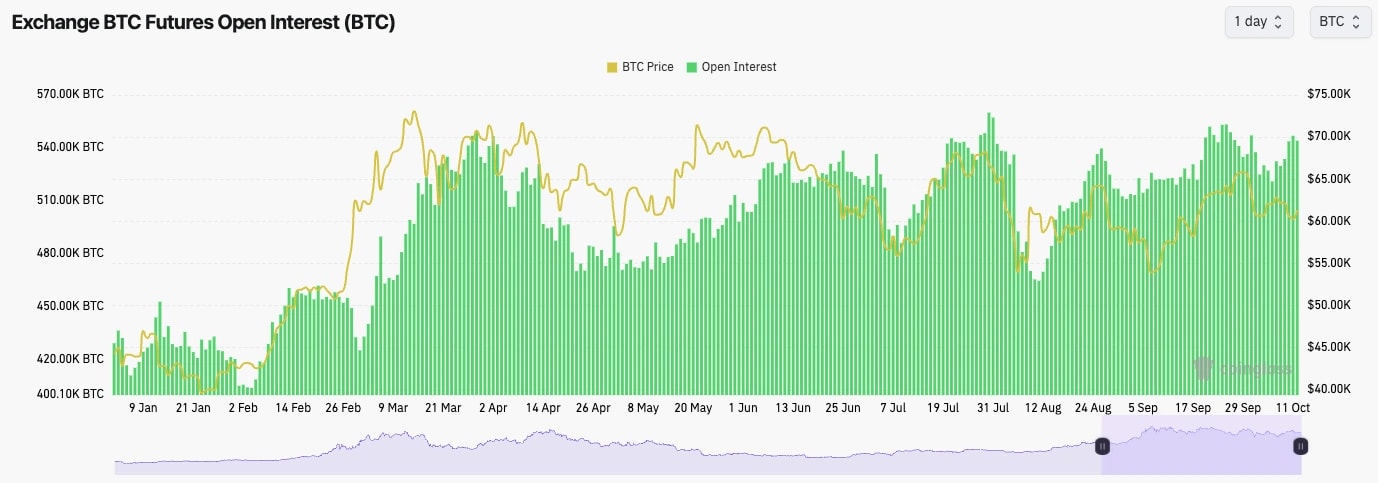

- BTC's Funding Rate has flip-flopped between slightly negative and slightly positive over the past few days, as traders have been shaken out of positions and are unsure of price direction in the near term.

- Overall, Open Interest remains high, indicating that there is still a lot of leverage.

Technical analysis

- Following the bounce from the $60k area, BTC rejected into the horizontal resistance of $63,400.

- BTC then bounced off the top of the Yellow support box between $58,000 and $58,900. We expect this area to continue to hold as the main support.

- BTC is also in a descending wedge on the local timeframe, which is a bullish pattern.

- The RSI has reset and is in the middle territory, with no divergences in play at the current time.

- To the upside, the $63,400 remains the main horizontal resistance over the shorter timeframes.

- To the downside, we'd expect the $58,000 to $58,900 area (Yellow Box) to hold as support if the price were to retest this area again.

- Next Support: $58,000

- Next Resistance: $63,400

- Direction: Neutral

- Upside Target: $63,400

- Downside Target: $58,000

Cryptonary's take

With not much data out over the coming weeks, and with the US election just 4 weeks away, risk appetite in markets may be more subdued. For this reason, we expect there won't be any major breakouts until after the election.In the short term, we expect Bitcoin to trade between $58,000 and $63,400, and our expectation is for the price to break to the upside when a breakout does eventually occur. Over the coming days and fortnight, we expect the price to follow a path similar to the Yellow arrows. Range-bound action for now, but it is possible we will see a light upside over this weekend.