BTC pulls back from $38K resistance - What's next?

After rocketing up over the past week to test the major resistance zone around $38,000, Bitcoin has stalled and pulled back slightly, trading between support at $35,600 and resistance at $38,000. Today's inflation data poses a risk for BTC if it comes in hotter than the consensus forecast of 3.3% year-over-year. But when will Bitcoin garner enough momentum for a breakout above $38,000?

TLDR

- Bitcoin pulled back after testing the $38K resistance level.

- Inflation data today poses a risk if it comes in hotter than the 3.3% forecast.

- BTC is now trading rangebound between $35.6K support and $38K resistance.

- The rangebound action will likely continue until we get the ETF approval.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

The focus of today is the inflation data. There is a strong consensus among traders that Inflation is expected to come in at 3.3% YoY. The market has priced it in and fully expects a soft inflation print. Therefore, the risk here is if the data comes in hotter, this would be a downside risk to risk assets that could result in a more meaningful pullback.However, the consensus is that we do get a soft print.

Let’s now dive into the technicals for BTC.

Technical analysis

The strong resistance of $38,000 we outlined has acted as a rejection level for BTC price. We’ve now seen a slight pullback, which, to be honest, we’ve needed, considering how strong the overall move-up has been.In the short term, we feel price will play in the tight range price between the horizontal resistance of $38,000 and the local support of $35,600.

Looking at the RSI, this small move lower for price has brought the RSI down slightly, which again is likely needed considering the move higher. However, we remain in overbought territory on all major timeframes. Therefore, it’s possible we could see more downside in the short term as some of these key indicators need to reset.

BTC 1D

Market mechanics

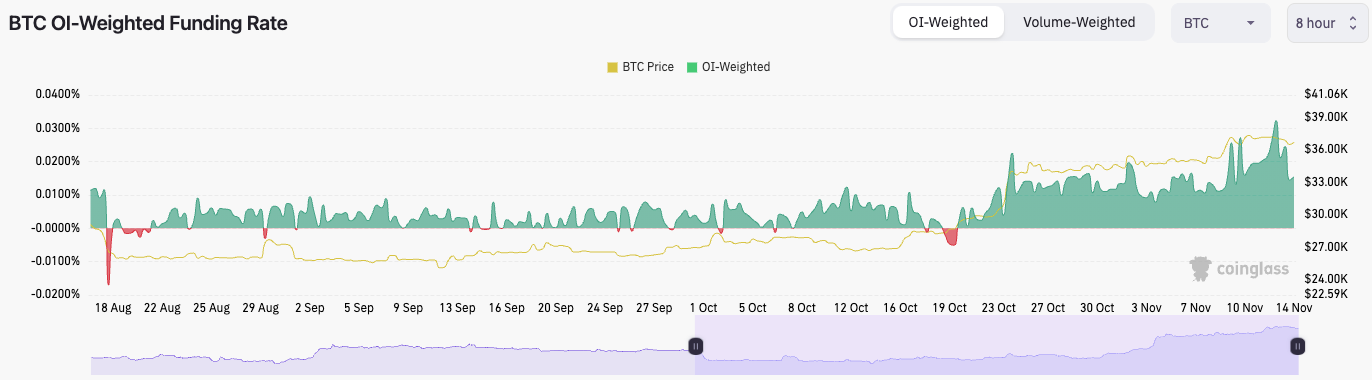

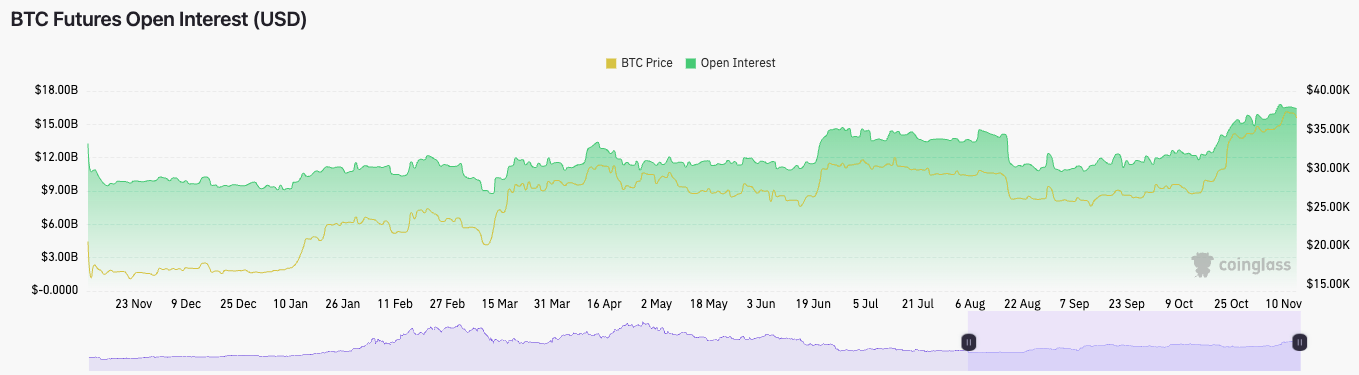

For the mechanics, we’re seeing some slight improvements. Despite the high OI-Weighted funding rate (at 0.0155%), it has come down from 0.0323% over the last 24 hours, so there isn’t this excess of longs like there was a day ago.If we then turn to the open interest, that has also decreased slightly. It remains very high but has come down over the past 24 hours.

What this picture suggests as a whole is that there’s still a lot of leverage, but there isn’t this huge bias to be long. In the last 24 hours, we’ve seen that shorts have built up, and this morning’s slight move higher potentially shook out some late shorts. Still, essentially, the derivatives market is in a healthier spot here despite the fact we feel the level of open interest needs to come down slightly more to flush out some of that remaining excess (in terms of leveraged positions).

Cryptonary’s take

The risk for risk assets today is that inflation comes in slightly hotter, and risk assets (which Bitcoin is) turn lower on this. However, expectations are for a headline print of 3.3%.The derivatives market has cooled off slightly but remains relatively overheated despite longs and shorts coming more into balance.

From assessing all the above, price may continue lower and test the $35,600 level. To get a break above $38,000, we’ll likely need the SEC to approve the ETF applications, but we believe this doesn’t come this week. Bitcoin will likely remain in this tight range between $35,600 and $38,000. Let’s reassess once Bitcoin comes into one of these levels.

We will remain strong DCA buyers of BTC sub $34,000, and we will be aggressive buyers of BTC sub $32,000