BTC, S&P hit highs as China stimulus falls short

As the US election clears market uncertainty, BTC and ETH reach record highs, while the Fed’s next rate cut and China’s stimulus add fuel to crypto and stock rallies.

Let's round off perhaps the busiest week of our entire year.

In this article:

- US Elections.

- FED Meeting. Add in odds for Dec rate cut.

- China Stimulus, underwhelmed expectations.

- BTC.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

US elections

The market movements over the last few days have confirmed to us that we have absolutely got the best outcome from this election - from a Crypto perspective. We can see this in $BTC breaking out to new all-time highs, and doing so with a really meaningful Spot bid. Just check out the Bitcoin ETF flows over the last few days.BTC ETF flows:

Alongside this, the S&P has hit new all-time highs, and Small Caps (the Russel 2000) is up substantially and now very close to new all-time highs. "Trump Trade" assets are playing out as we expected.

Small caps currently trade at 10 times median forward earnings. Since 1987, small caps have traded at a premium to the S&P, which is currently trading at 17 times its median forward earnings. This suggests that there's much more upside for Small Caps (the Russel) to be had here.

Russel 2000:

Ultimately, the fact we have a clear winner from this election means it's not going to be contested, and the uncertainty is now behind us, which is great for markets.

Also, it's a clean sweep for Republicans. For markets in general, this adds some uncertainty as it means Trump has the mandate to implement his policies. These are potentially inflationary, regardless as to whether Trump is a 'markets person' or not.

However, for Crypto, it's likely extremely positive. We now have a president, a house, and a Senate that is more pro-Crypto than against crypto.

House of representatives + Senate members for crypto:

![]()

This setup will most likely see the regulatory environment around crypto change and change for the better. This is a huge shift, especially considering how restrictive the previous administration's enforcement of regulation was.

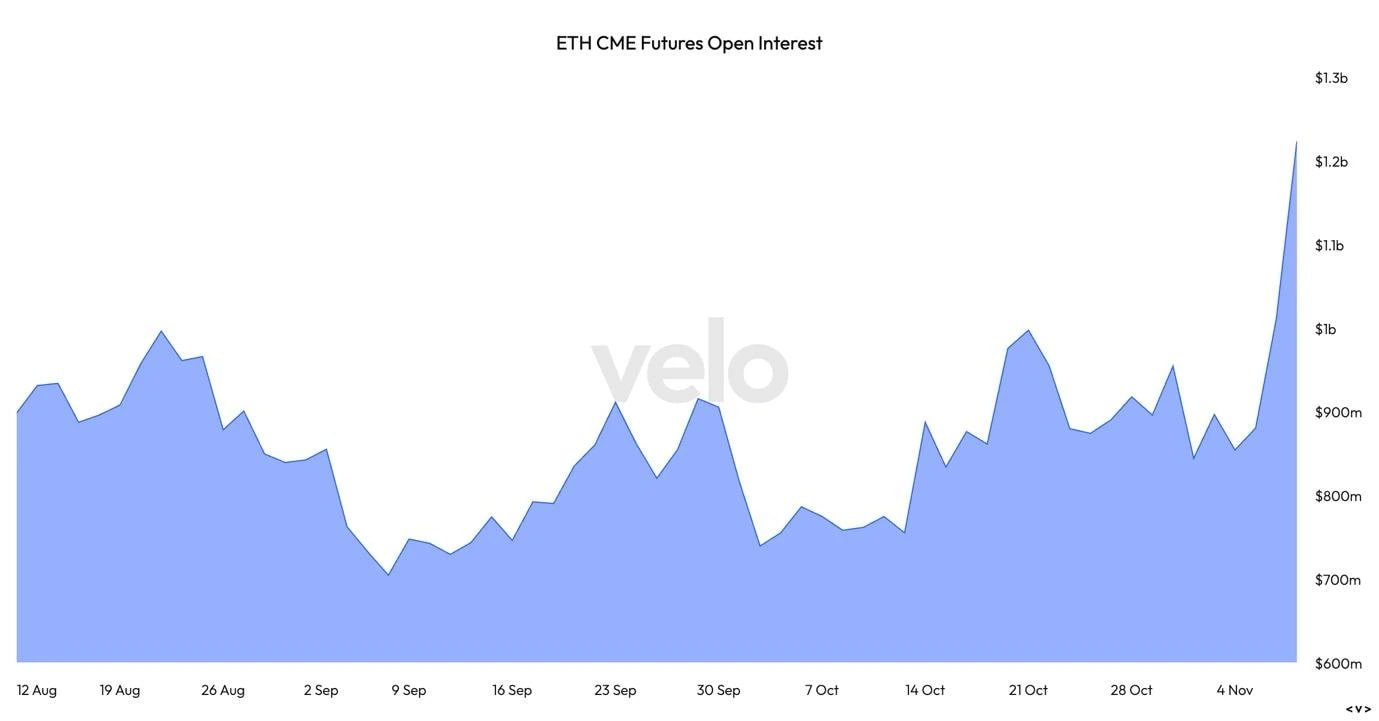

The market has now begun pricing in a potentially more favourable regulatory environment. We can see this with a huge increase in ETH CME Futures Open Interest. This is likely because TradFi participants are getting the green light to take more in Crypto.

It will be interesting to watch whether ETH ETF flows substantially increase as well over the coming weeks/months.

ETH CME futures open interest:

Fed meeting

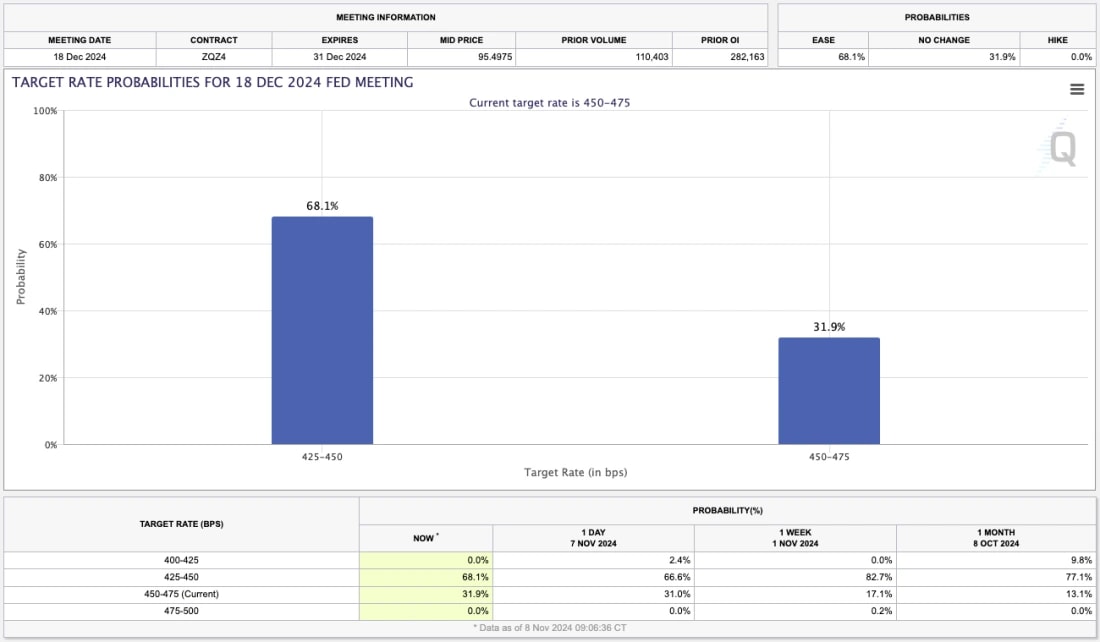

We'll keep this section relatively short.The FED cut Interest Rates by 25bps yesterday, as we and the markets fully expected. However, with Trump being elected, Powell seemed to be slightly more worried about policy going forward, as a Trump win made the outlook slightly more tricky for him and the FED to navigate.

Whilst another 25bps cut is still likely at the December Meeting, Powell did slightly open the door to give himself and the FED some room to potentially skip the December Meeting and push the next Interest Rate cut into the January Meeting.

The market is currently pricing a 68.1% chance that the FED cuts by another 25bps in December.

If the FED does cut in December, Powell may forward a guide for the January Meeting, stating that the FED might skip cutting at that meeting. However, that'll likely be due to strong growth and a labour market that is still more than hanging in there - all positive.

Target rate probabilities for 18th Dec Fed meeting:

One thing we were surprised about in the FED Press Conference, is that none of the journalists asked about QT, and what the FED's plans for it are ie, are they going to end it anytime soon? An end to QT would be net positive for liquidity. It's possible we get more insight on this at the December Meeting.

China stimulus announcement

Today (Friday 8th), the Chinese government announced a $1.4trillion stimulus package in a plan to rejuvenate the economy. China is an export led country driven by their local governments who fund large infrastructure projects.However, as US demand for Chinese goods has slowed over the last few years, along with property prices coming down approximately 10% per year for the last 3 years. This severely impacts the people's net worths and therefore consumers as a result, pull back on spending.

Now whilst a $1.4trillion stimulus package might sound like a lot, the IMF estimates that the Chinese local governments' hidden debts are just north of $8.0trillion. Therefore, a $1.4trillion stimulus package is likely to help the Chinese meet it's growth target this year. But it's unlikely to be enough that the housing market rebounds.

If the Chinese really want to pull their economy out of it's current rut, we'll likely need more stimulus in the months and quarters ahead.

Overall, the stimulus is good, but it's not that "bazooka" that risk assets markets were looking and hoping for.

BTC:

We currently have BTC at all-time highs and although some profit-taking has been realised, it's relatively light considering price is breaking through and hitting new all-time highs.On-Chain models are suggesting that Bitcoin's next local stopping zone is somewhere in the mid $80k's. The Vaulted Price is currently at $83,600 while the MVRV +1 standard deviation is currently at $93,400. I (Tom) personally expect $80k to be hit in just a matter of days, maybe a week.

But in the short-term (maybe that's 1-2 weeks), we expect price to settle between the Vaulted Price and the MVRV +1 standard deviation price. This should put BTC in the mid $80k's in the coming fortnight.

BTC:

Cryptonary's take

Ideally, we would have got a larger stimulus number out of China today, but really that's just us being greedy. This week has gone as well as it could have gone to be honest.The election being over removes that uncertainty for markets, and a Red Sweep likely means we see a more supportive regulatory environment for Crypto. This is massive and likely allows for more investment into Crypto.

Alongside this, we have a very supportive macro backdrop where the economy is strong, and the labour market is hanging in there well. To add to that, the FED are on a rate-cutting path where we probably have at the bare minimum, another 3 x 25bps cuts to come, which takes us into the end of Q1 2025.

We will keep taking it week by week, but in summing all of this up, this is a phenomenal setup over the short, medium and long-term. I'm (Tom) a macro guy (although I started in Crypto) so we're always looking out for what could go wrong. But ultimately here, the setup going forward is fantastic.

If I'm going to put price targets out there, I think we see $80k in the next days/week, and I'd be surprised if we weren't at at least $90k by Christmas. I personally think we'll be at low 6 figures by end of the year.

SEND EM!!!