Bullish on crypto's future, but short-term concerns linger

We are very bullish in the mid-and long-term; however, in the short term, we are still wary until liquidity begins to pick up again in Q3 or if there are big inflows into the ETH ETFs when they start trading in the coming weeks.

Therefore, our preferred strategy is to keep holding the winners (or the ones we think are the winners of this cycle—this is the barbell strategy of majors and blue chip memes) and add to them on more meaningful price dips.

We are hoping for bullish price action in the very near term, although we are just wary due to the lack of liquidity air pocket we're in until Q3.

In the mid and long-term, we are super bullish.

Let's go!!!

TLDR

- Overall, the crypto outlook is bullish mid/long-term, but the short-term outlook is sluggish until Q3 liquidity improves or ETH ETFs launch.

- ETH broke out on ETF hopes but may range from $3,485-$3,967 for weeks, awaiting ETF launch or Q3 liquidity boost

- SOL cleared the $152 resistance positively, but you can expect similar rangebound action in the higher $152-$190 zone.

- LINK is bullish above $17.75, but bearish divergence hints at a pullback to $15.33 before the eventual breakout

- RUNE coiled between $6.08 support and $7.28 resistance, potentially retesting $5.50 before volatility picks up.

- Liquidity concerns may keep POPCAT, WIF, and other memecoins rangebound despite bullish technicals, with the risk of retesting lows.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

ETH

- The Funding Rate has reset slightly and is now back to 0.01%, meaning there is a relatively even balance between Longs and Shorts.

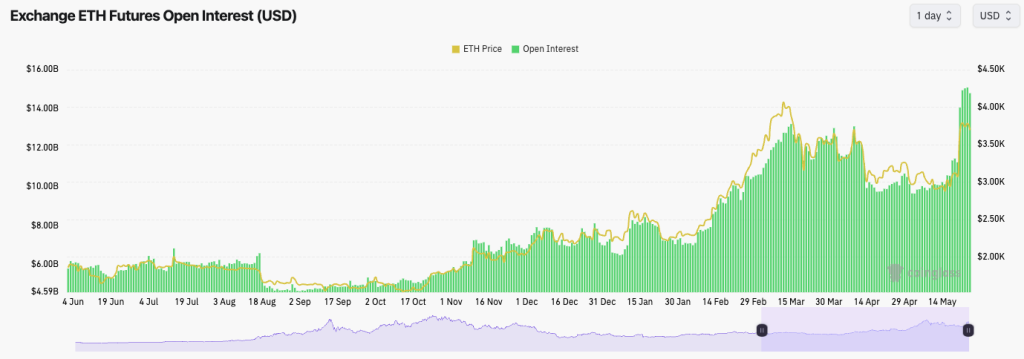

- However, Open Interest (the amount of leverage) remains very high. With more price volatility, you would expect some of this leverage to be unwound, which could cause the price to move more drastically in that specific direction.

- What we do know here is that there are a lot of Shorts open as well (because of the 0.01% Funding Rate—not being weighted to Shorts or Longs), meaning a leverage flush-out doesn't have to be price going lower; it could be in the form of a Short Squeeze.

Technical analysis

- From a technical analysis structure, ETH was prime for a breakout, but then, the unexpected news that the ETH ETF might be approved caused it to break out of its downtrend line and shoot higher on Monday.

- A local level of resistance was at $3,485; however, price smashed through that level with little to no problems.

- ETH will now look to use the $3,485 horizontal level as new support. Price has already retested $3,500 and bounced perfectly from there.

- To the upside, ETH ran into the horizontal resistance at $3,967 and was initially rejected from that level.

- The RSI has pulled back very slightly from overbought territory and narrowly missed putting in a bearish divergence.

Cryptonary's take

ETH has broken out to the upside in a big way, which you'd, of course, expect with the market positively pricing in the ETF news.However, as it'll likely take several weeks before the ETH ETFs can begin trading, prices will likely stay more rangebound for the time being. Therefore, we'd expect prices to range between the two key horizontal levels of $3,485 and $3,967.

A breakout of $3,967 would bring the full bullish reversal, although this may take some more time to happen, potentially when liquidity improves again going into Q3 or whenever the ETH ETFs begin trading; as said, this could take more weeks.

SOL

- SOL's Funding Rate is also at 0.01%, meaning there is an even balance between Longs and Shorts and, therefore, less indication of a leverage flush-out in one specific direction.

- SOL's Open Interest did increase along with the rest of the market on the ETH ETF news on Monday (that it might be approved on Thursday, which it was). However, the amount of Open Interest (leverage) added isn't too extreme, and therefore, SOL is one of the coins less susceptible to a leverage flush out.

Technical analysis

- The first level we were eyeing for SOL to break out of was the horizontal level of $152, which SOL did relatively easily, so that's positive.

- SOL then moved up to $190 and rejected there, although it's finding support in the $160's.

- Essentially, the $152 to $170 area should be a zone of support where traders are attracted to bid SOL, so you'd expect this zone and the final level of $152 to hold. A SOL price break below would be a concern.

- We would like to see price hold above the local uptrend and bounce if the $160 level is tested.

- A full bullish reversal comes when price clears above $205, although this may take more time.

- The RSI is relatively clean in the mid-50s and nowhere near overbought territory.

Cryptonary's take

In the short term, we probably expect the same from SOL as ETH: more rangebound price action. But, what's very positive is that price is now in this higher zone between $152 and $190, rather than being in the lower zone between $131 and $152.If price can establish itself in the higher zone, a breakout of $205 in the mid-term will be more easily achieved. But for the upcoming weeks, we probably expect more choppiness. If price gets there, we would be bidding SOL (particularly if under-exposed) in the low $150s.

LINK

- LINK has bounced nicely from the Yellow Buy Box and is now testing the underside of the horizontal resistance at $17.75.

- Yesterday, LINK pulled back to the horizontal level of $15.33 and bounced from that support, which overall is a strong move.

- On the RSI LINK, a bearish divergence just shy of overbought territory on the Daily chart has formed. This is usually a bearish pattern.

- The 3D and Weekly RSIs are in the middle territory and are, therefore, much cleaner.

Cryptonary's take

The bullish reversal for LINK would come with a price break above the horizontal resistance of $17.75. However, with price putting in a bearish divergence, it's possible we will see a pullback in the short term, which could retest $15.33.LINK acts somewhat as a beta play to ETH, which is likely why we've seen the more positive price action over the past ten days. For now, we think there can be a small rejection in the very short term, which sees $15.33 retested, but for a breakout of $17.75 to come in the mid-term.

RUNE:

- Price has trended upwards since it broke out of the red downtrend line.

- What's also very positive is that price has got back above the horizontal level of $6.08, and price has then pulled back and retested that level of support, having initially rejected from the local resistance of $7.28.

- The RSI is clean on the Daily timeframe so this shouldn't provide any headwinds for price action.

- Currently, RUNE is range-bound between the support of $6.08 and the resistance of $7.28. A breakout (either to the upside or the downside) will likely see a more volatile move in that specific direction.

Cryptonary's take

We wouldn't overcomplicate this until there is a break of this local range.It's possible that price will remain rangeboundd for some time. We don't expect a serious upside for prices until liquidity improves, the ETH ETFs go live, and there are big inflows.

But, in the meantime, remain patient and relaxed, and don't let the chopping prices chop up your portfolio. If I (Tom) had to make a prediction for RUNE, I wouldn't be surprised if it retested $5.50 before moving higher in a month or two. However, note that I do not have much conviction in this take, and RUNE is prone to move in a very volatile manner.

WIF

- Price is really beginning to squeeze into the pinpoint where the downtrend line and the uptrend line meet each other. It's possible that once price breaks out or down from this bigger pennant-like pattern, it'll move in a volatile fashion.

- $2.75 is a local horizontal support, with $2.33 as a larger support beneath it.

- To the upside, the local resistance is at $3.15 and then the major resistance is at $3.41.

- A bullish reversal would come on a clean break above $3.41.

- The RSI is also in a middle ground and becoming more compressed.

Cryptonary's take

When WIF moves and actually makes its next move, it'll likely be volatile. I don't like to say this, but I do see it as possible that the low $2.00s are retested again. I'd add to my position if the price were to get there.Whilst we're a huge believer in WIF in this cycle and see it well above $10, in the short term, whilst overall market liquidity has flat-lined, WIF may struggle to break out of $3.40 and see more substantial upside. However, rather than price breaking down, it is also possible that price remains rangeboundd for the time being. Let's see what we get.

POPCAT

- The first thing to note in this analysis for POPCAT is that we've zoomed in slightly and are looking at this chart in the 4-hour timeframe.

- From a TA point of view, POPCAT looks super clean to go higher having bounced from the support zone between $0.32 and $0.34 whilst also squeezing into the pinpoint where the support zone meets the red downtrend line.

- However, liquidity is a concern similar to the WIF analysis above, so we'll readdress this in the Cryptonary's Take.

- To the upside, $0.40, $0.47, and $0.53 are the key levels for price to rise above.

- The horizontal support remains to be the zone between $0.32 and $0.34.

Cryptonary's take

As many of you know, I (Tom) have a huge bag of POPCAT, so I do want it to go higher.However, I am wary in the short-term despite the actual TA setup looking super bullish if price can break out of the downtrend line and reclaim $0.40 and then $0.47. Since liquidity flat-lined, some memes have struggled, and it's mostly the blue-chip memes and the PolitiFi memes that have still performed relatively well.

I hope that POPCAT does break higher and out of the downtrend line. As I've said, the TA setup is super bullish; I am just wary of that liquidity aspect. If I had to guess (gun to my head), I'd say price can break higher and retest $0.47 but may then reject there.

However, I am also concerned that it may retest $0.32 to $0.34 in the short term. This is very difficult to call here (despite the super bullish TA structure). In the long term, we see POPCAT as a big winner in the Meme space in terms of performance.