This is the time to start building a much bigger position for the cycle, especially if you are underexposed and haven't scored any big wins in this cycle.

We think the bull market still has another 6 to 12 months to run from here, and given the general state of the market, this is the time to 'be greedy when others are fearful'.

Let's Go!!!

Key questions

- What crucial macro data this week could signal the Fed's next move, and how might it impact the crypto market?

- Is the current Bitcoin supply overhang a cause for concern or a hidden opportunity?

- What do oversold conditions and technical indicators suggest about Bitcoin's next potential move?

- Which undervalued coin has caught our eyes, and why are we building a much larger position now?

- How long might this bull market continue to run, and what strategies should you consider to maximise your gains?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

This week's macro data

Firstly, this week, we have a plethora of Fed-speak. We'll watch for any indications that the Fed speakers are considering an interest rate cut in September. They won't outright say it, but their comments in response to the recent data and how they describe their overall feelings on that data should help indicate whether they're thinking September or November for the first interest rate cut.In recent weeks, the Bond market has priced for the Fed to begin cutting interest rates in September. The key days for macro data this week are Thursday and Friday. On Thursday, we have GDP data, which is expected to come in at 1.3% growth for the quarter. This is a slowdown from the last quarter, which came in at a red-hot 4.3%, but 1.3% is still positive growth despite the growth rate slowing.

Hence, there's a need to moderate the interest rate to accommodate this slowdown before it becomes an outright recession. On Friday, we have the Core PCE data (the Fed's preferred inflation data point to track). It is expected to come in at 0.1% MoM, which is lower than the prior 0.2% reading.

A 0.1% would be a welcome sight for the Fed. It'd continue the lower inflation data we've seen over the last few months, which, along with the economic slowdown, would bring the Fed to the interest rate-cutting table in the September Fed Meeting.

Bitcoin supply overhang

Currently, there is an overhang in the supply of BTC coming to the market. We're seeing some of the basis trade unwind as the Funding Rate has stayed contained for a while, bringing some of the ETF Bitcoin back to the order books.Alongside this, we have Bitcoin miners selling a more considerable amount of Bitcoin. This isn't a concern and is typical of the months after a new Bitcoin Halving. Bitcoin is the same price as it was a month before the Halving, but now miners are being paid half of the reward (in BTC) since the Halving, so their revenues are less now until Bitcoin re-rates to a higher price point.

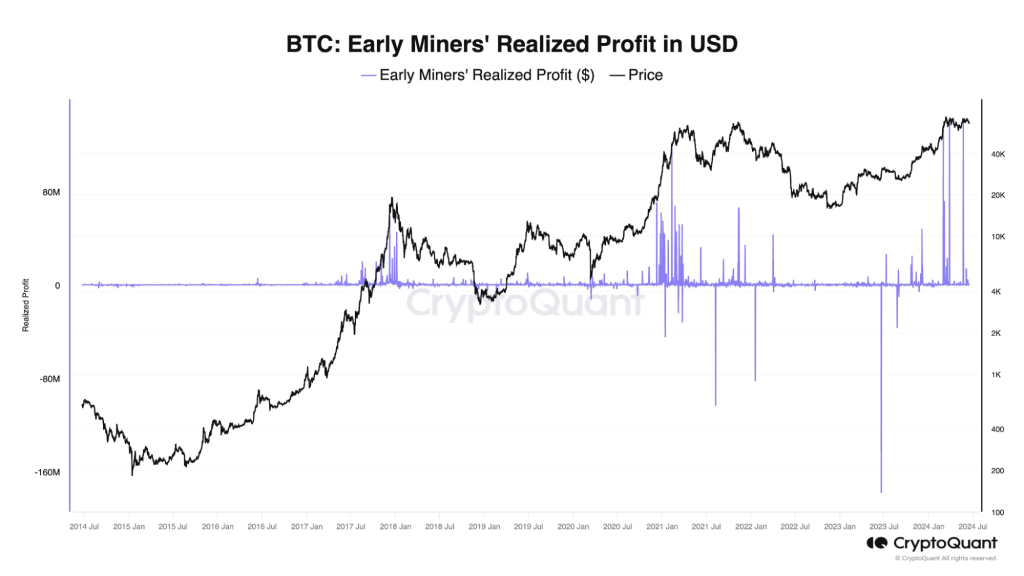

In the chart below, we can see that early miners have been realising some profits. This is likely to cover their costs in the period following the Halving when margins are tighter—half the BTC reward is now being paid.

Bitcoin oversold conditions

In the chart below, we have highlighted all the points in time when Bitcoin has been in oversold territory since the bear market bottom—blue circles on price and the RSI. Each time, Bitcoin has quickly or eventually moved drastically higher. At $61,300, Bitcoin is printing another oversold marker on the RSI.Alongside this, on the 3D timeframe, price has made a higher low, while the oscillator has made a lower low. This is known as a hidden bullish divergence. Bitcoin remains above its 200D MA at $57,600 but is now below the Short-Term Holder Cost Basis of $63,400.

And only 24% of Short-Term Holder Coins are in profit. This is a nice resetting of this metric. Despite price now being below the Short-Term Holder Cost Basis (which is acceptable in a bull market), other technicals suggest this would be the time to get risk-on (be buying) with Bitcoin here. It certainly doesn't suggest being a Bitcoin seller here.

Cryptonary's take

Across the board, we've seen a major resetting over the last few weeks, which is again typical in the immediate months following a Bitcoin Halving event.Bitcoin has been down 15% in the last three weeks. In the first week of this pullback, memes and altcoins (the coins at the very far end of the risk curve) pulled back much more significantly than BTC.

And now that BTC seems to be having its final puke out of the move—maybe there's more to go—there are also many signs pointing to a potential bottom or at least a local bottom here.

Memes and alts haven't continued to bleed with BTC in this most recent move lower. This is a potential signal to us that this may be the end of the move lower for now. Ultimately, knowing if this is the local bottom here is difficult. However, there are positive signs on Bitcoin that this could be a local bottom.

Alongside this, bluechip memecoins have pulled back 60-70% and really look to be in "value territory." Over the past two days, I (Tom) have begun to build a much larger position in $WIF, which looks undervalued at $1.60.

In my opinion, this is one of those periods where you should look to be greedy when other market participants are fearful.

Yes, it may take more months for the highs to be seen again, but we feel confident that today's buys will look great in hindsight at some point in late Q3 or Q4.

Cryptonary Out!