Why you should read this report

- Uncover the key support and resistance levels for BTC, ETH, and SOL that smart traders are watching closely.

- Learn why Ethereum's recent selloff may present an attractive opportunity, especially in light of upcoming developments.

- Find out which meme coin is forming a potentially bullish pattern and the critical price levels to monitor.

- Explore how a popular altcoin's technical setup could be misleading - and why the analysis suggests an unexpected outcome.

Bitcoin (BTC)

Bitcoin's Funding Rate has been choppy over the last few days, moving back and forth from slightly positive to slightly negative.These are not meaningful swings, but they do reflect the heightened indecision among traders as they flip-flop between Longing and Shorting.

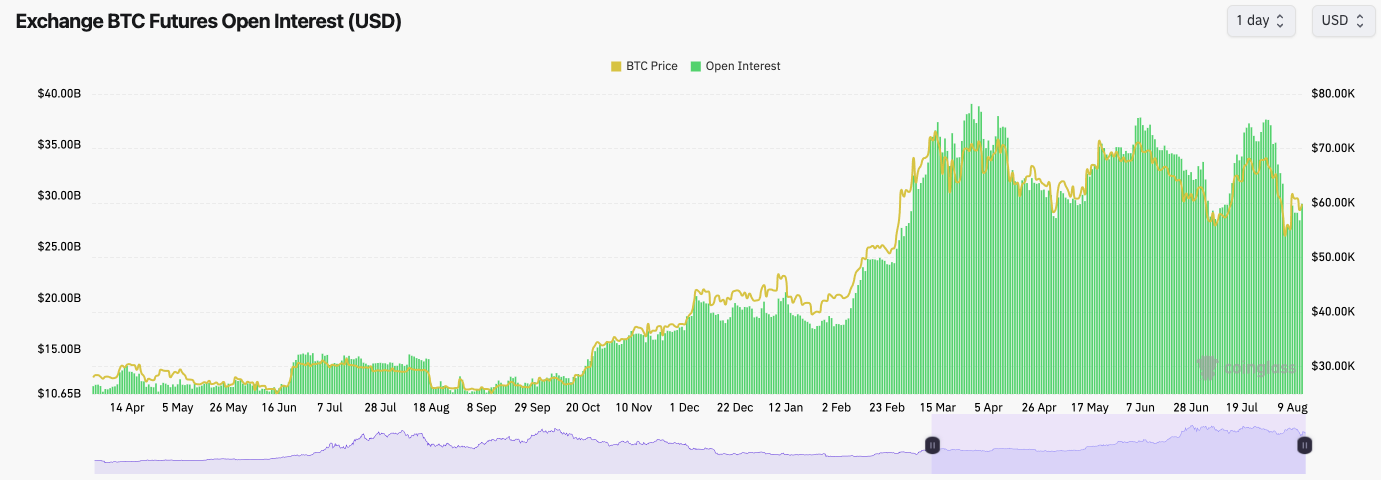

Open Interest is up, just shy of 10% in the last day, but it remains well below the recent highs, indicating that a large amount of the excess leverage has been flushed out.

BTC Open Interest:

Technical analysis

- Following last week's really strong bounce in price, we did conclude that we expected Bitcoin to have a small retracement to follow it.

- We expected the retracement to reach $56k. However, BTC has bounced (for now) from the local low of $57,700, perfectly following the red arrows we drew out on the chart at the back end of last week.

- The RSI remain in middle territory so this shouldn't be a headwind for price moving in either direction.

- To the upside, the $63,400 level remains the horizontal resistance.

- To the downside, there is a local support at $58k which price bounced from this time. Beyond that the main support is at $52,800.

Cryptonary's take

Bitcoin has bounced well from the $52k support, but price is still suppressed beneath $63,400.With August usually a quiet month, we have seen heightened volatility. However, our expectation is that price remains range-bound over the coming days, maybe even over the next week. We expect price to remain between $58k and $62k. However, it's also possible that the price dips into the $56k to $57k area. If so, we would be buyers of specific altcoins or memes if they hit their price targets on another retest lower.

Ultimately, whilst many of the big traders are on their holidays, we don't expect the markets to do much here unless there's a unique event such as the Iran/Israel bombing. So, remain patient and don't let this market cut you up.

ETH

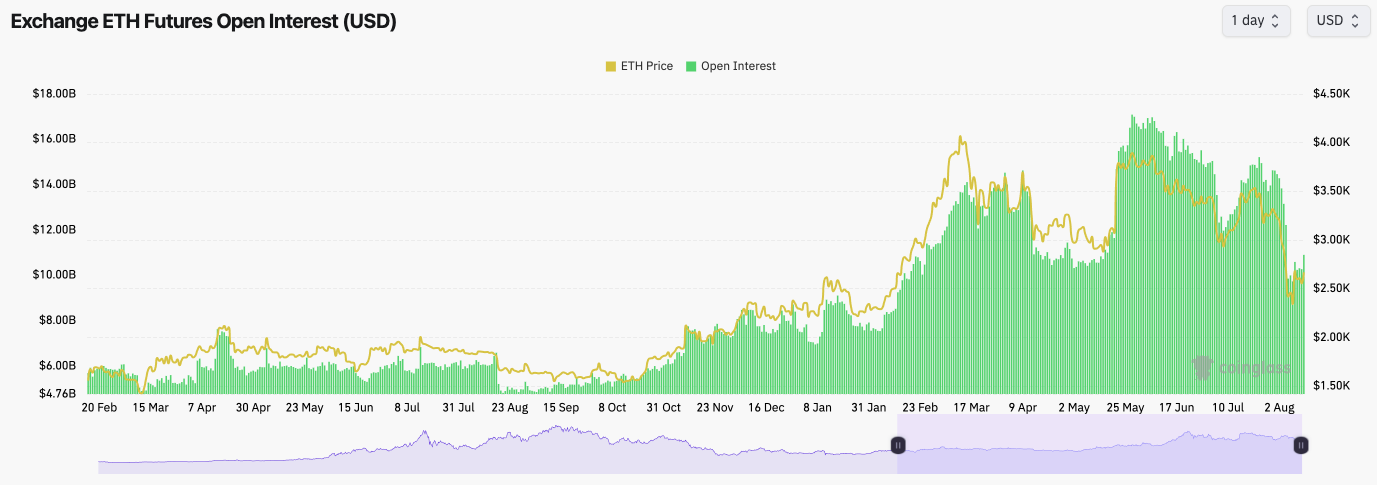

ETH's Funding Rate has essentially performed similarly to BTC, fluctuating between slightly negative to slightly positive over the last few days, indicating indecision amongst traders to go Long or Short.ETH's Open Interest has also kicked up in the last 24 hours, however, it remains well below its highs. The excess leverage that was here has been flushed out and is reluctant to go back on - this is a positive sign.

ETH Open Interest:

Technical analysis

- ETH rejected at the local level of $2,700 but buyers stepped in at $2,500 and price is now squeezing back against $2,700.

- If ETH can break above $2,700, the short-term target is for price to retest the underside of the major horizontal resistance of $2,875. This resistance may prove too strong in the very short term.

- The RSI is at 40, meaning it's still quite low, so there is room for further upside in price.

- If ETH were to dip back to $2,400 we would expect that area to hold as support, and that price is likely to be a good entry for longer-term buys.

Cryptonary's take

The key for ETH here is to show some strength, push on, and retest $2,875, which we believe price can do in the coming days. The real signal will then be if ETH can break above $2,875. In the short term, we don't expect it to.Out of all the majors, ETH has sold off the most. With the introduction of the ETF and the potential for new buyers, ETH is quite attractively priced. Therefore, we would expect ETH to move higher here and retest $2,875 in the coming days.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

SOL

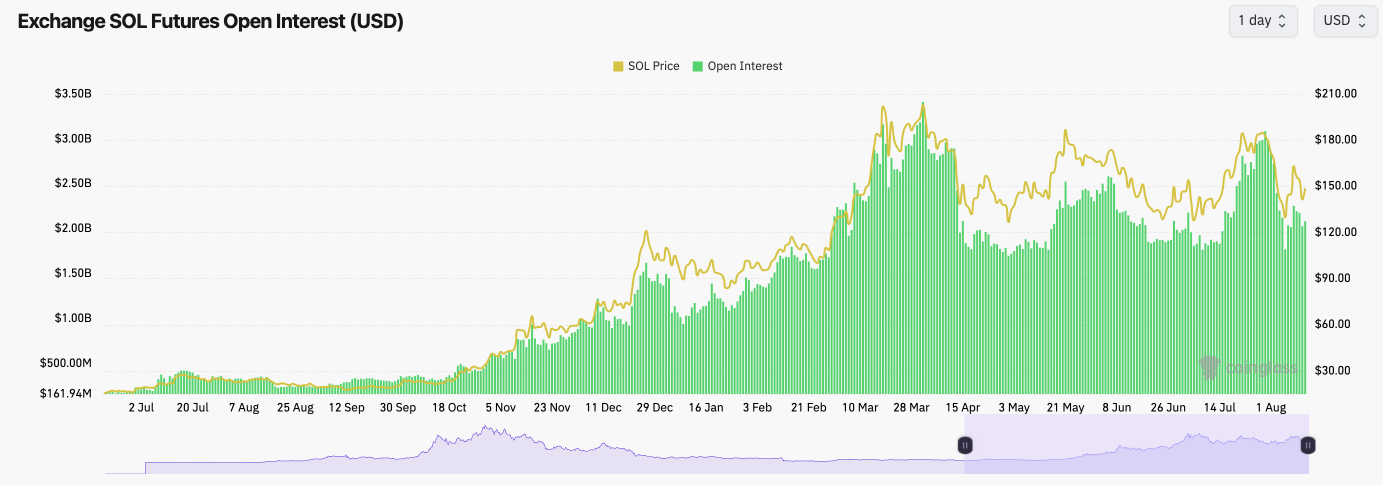

SOL's Funding Rate has also been whip-sawing from slightly positive to slightly negative over the last few days, suggesting indecision from traders.SOL's Open Interest has also reset, but it has reset to the baseline we've seen over the last few months. Every time SOL's Open Interest spikes and then begins to decline, that has represented a local top for price. This will be key to watch and track going forward.

SOL's Open Interest:

Technical analysis

- In our last Market Direction, we expected price to pullback from the $160 level and retest the $135 to $145 level. We hit $140 and bounced... nice, good call.

- Price found support between the $135 and $145 area, a local support zone.

- The RSI is at 46, so relatively middle territory, meaning it's not a headwind for price going in either direction.

- Price is now currently in the middle of the range between the major resistance at $162 and the major support area between $125 and $132.

- It's hard to say what price will do in the very short term; the data doesn't suggest one way or the other.

Cryptonary's take

We expect prices to be range-bound between $125 and $160 over the coming week, so we will look to add risk around $130 and de-risk around $160, just for the time being while we're in August. We will then re-assess as the days progress, but essentially, we're not expecting fireworks here anytime soon.

WIF

- It's pivotal for WIF that it can hold above the $1.50 to $1.60 support range. A breakdown below this range would likely see a retest of the range lows at $1.10.

- WIF is forming a bull flag here above the $1.60 support; a break-out target would be the $2.20 area.

- $2.20 is a horizontal resistance, so it's possible that if price does break higher, $2.20 acts as the next stumbling block for price.

- If price does move higher to $2.20 and rejects, you'd want to see the $1.90 area act as a local support for price.

- There is a local downtrend line (red dotted line) that price would also likely find resistance at if it broke out of its current bull flag.

- The RSI is in middle territory so this shouldn't provide any headwind for price.

Cryptonary's take

Ultimately, price has to hold above $1.50 to $1.60, which we believe price will as long as Bitcoin doesn't have a major breakdown and drag the rest of the market with it. If price did break down to $1.60, we would add more WIF to our spot bags.Assuming BTC doesn't drop in price substantially, which we don't think it will, we'd expect WIF to see more upside over the coming days/week. Price could breakout of the bull flag and test the $2.20 horizontal resistance area. We would expect a first rejection at that level, but we'll reassess based on how price behaves if it can get to $2.20.

POPCAT

- POP rejected from the underside of the local uptrend as we expected it would do.

- Price has then pulled back to our target range of $0.45 to $0.55 with price bouncing from the middle of this range at $0.50.

- Price is also forming a bull flag just above the horizontal support of $0.55, which would have a breakout target of $0.70. A break above $0.70 would be super bullish and likely shove price up towards the all-time highs, however, we're not expecting this to play out in the short-term.

- What we do note is that there is a large Head & Shoulders pattern on POP, with the early July highs as the left shoulder, the all-time highs as the head, and the recent peak at $0.66 as the right shoulder.

- A Head & Shoulder pattern is usually bearish and breaks to the downside. Despite this pattern forming, I am not expecting this pattern to play out.

- If price does pull back substantially, we'd expect the support zone of $0.40 to hold as support.

Cryptonary's take

Overall, we're leaning more bullish on POP here in the short-term, however that would rely on a break out of the bull flag pattern. We're not necessarily expecting a break down for price, but we would target the $0.40 level if price did break down. We're also wary of the Head & Shoulders technical pattern forming, but we don't expect this to play out. If BTC holds up, then POP can get to $0.70 this week if a break out of the bull flag can be achieved - which we think it can.Let's see.