Explore the Latest WIF Crypto Analysis and Predictions

- Dogwifhat (WIF) Price Prediction today: Is $2.20 breakout next? (August 9, 2024)

- Dogwifhat (WIF) price prediction: What's next after $1.60 break? (August 7, 2024)

- WIF crypto price prediction for today: Can it reclaim $2.20 today? (August 1, 2024)

- Price prediction today: WIF, POPCAT, TREMP (August 1, 2024)

- Dogwifhat (WIF) price prediction: Why $2.20 is a critical buy zone (July 24, 2024)

- Price prediction on Bitcoin, Ethereum, Solana & memecoins (July 24, 2024)

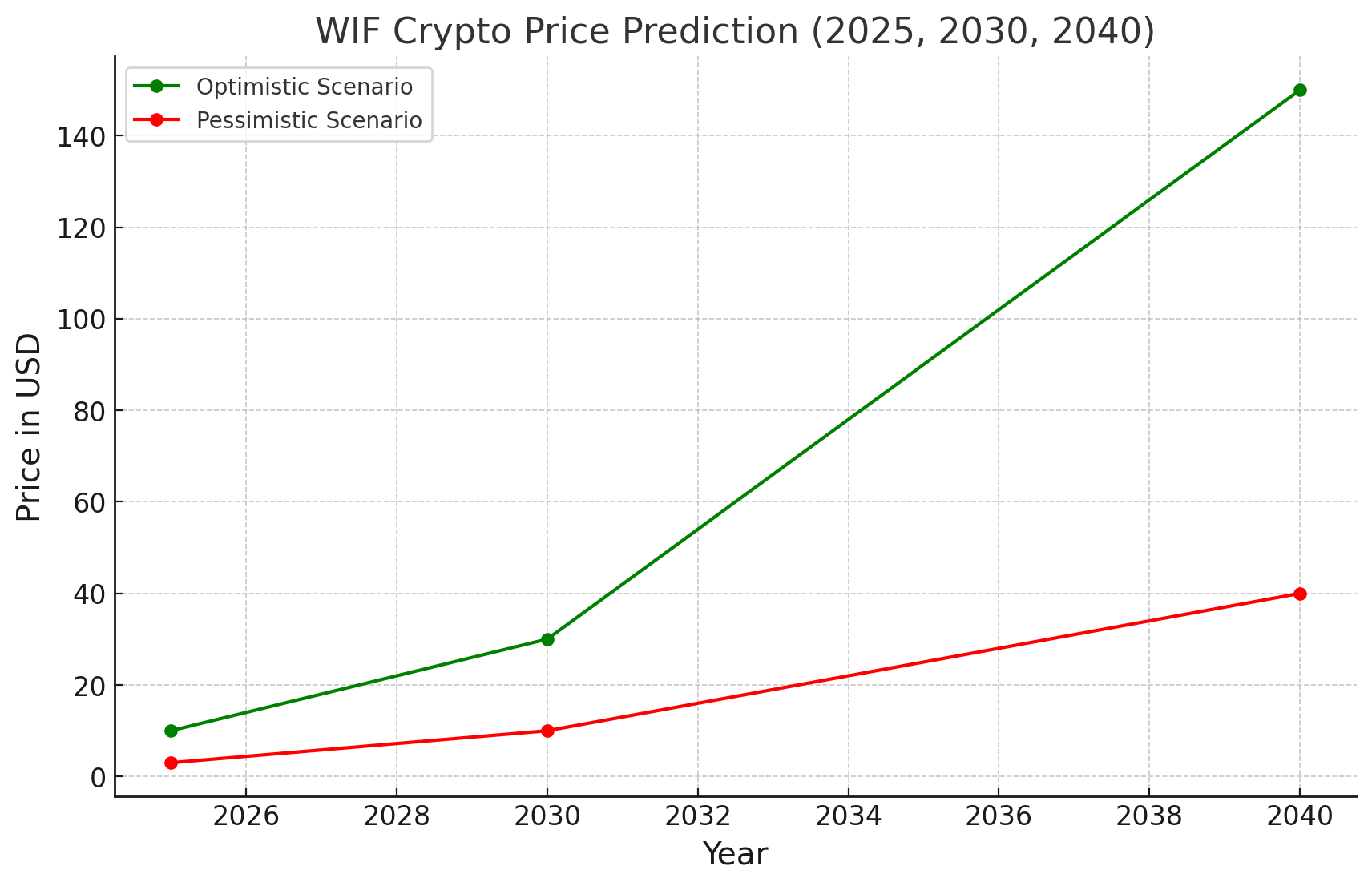

WIF Price Predictions

2025 Price Prediction

- Optimistic Scenario ($5-$10):

- Why?: If WIF continues to innovate, possibly with new technological upgrades or broader adoption, the price could rise significantly. Market sentiment could remain bullish, and overall economic conditions might favor cryptocurrencies.

- Key Drivers: Adoption in new markets, technological advancements, partnerships, and a strong crypto market overall.

- Pessimistic Scenario ($1-$3):

- Why?: If WIF faces regulatory challenges, technological issues, or a lack of adoption, the price might stagnate or decline.

- Key Drivers: Regulatory crackdowns, technological challenges, or a general bear market in crypto.

2030 Price Prediction

- Optimistic Scenario ($20-$30):

- Why?: By 2030, WIF could potentially become a major player in its niche, leading to a substantial increase in price. Continued innovation and a strong community would be key.

- Key Drivers: Widespread adoption, continuous technological improvements, and a stable or growing crypto market.

- Pessimistic Scenario ($5-$10):

- Why?: If WIF fails to differentiate itself or if the market becomes oversaturated, the price might struggle to grow significantly.

- Key Drivers: Market competition, technological stagnation, or a prolonged bear market.

2040 Price Prediction

- Optimistic Scenario ($100-$150):

- Why?: If WIF survives the long term and becomes integral to the digital economy, its price could see massive growth. Long-term success stories often see exponential growth.

- Key Drivers: Integration into the broader digital economy, sustained technological leadership, and widespread adoption.

- Pessimistic scenario ($20-$40):

- Why?: By 2040, if newer, better technologies replace WIF, its price might fall or stabilize at lower levels.

- Key Drivers: Technological obsolescence, market irrelevance, or systemic issues within the cryptocurrency space.

Factors affecting WIF price

Let's break down the WIF crypto price prediction process into detailed steps, covering every aspect to help you understand how such predictions can be made and the potential factors that could influence the price in 2025, 2030, and 2040.1. Historical data analysis

- Objective: To understand the past behavior of WIF's price, including trends, cycles, and patterns.

- Steps:

- Collect Data: Gather historical price data from the inception of WIF to the present. This includes daily, weekly, and monthly prices.

- Identify Trends: Look for long-term trends, such as consistent growth, decline, or periods of stability. Pay attention to significant price movements and correlate them with events (e.g., major news, technological updates).

- Pattern Recognition: Identify recurring patterns like bull and bear cycles, which can help predict future movements. For example, if WIF has shown a pattern of doubling in price after certain technological upgrades, this could be factored into the predictions.

2. Market sentiment analysis

- Objective: To gauge how the market feels about WIF, which can influence its price.

- Steps:

- Social Media Monitoring: Track discussions about WIF on platforms like Twitter, Reddit, and specialized crypto forums. Positive or negative sentiment can often lead to price spikes or drops.

- News Analysis: Monitor news sources for articles about WIF. Announcements about partnerships, technological breakthroughs, or regulatory challenges can significantly impact sentiment.

- Community Engagement: Assess the level of community engagement and developer activity. A vibrant and active community usually correlates with a stronger price outlook.

3. Technical analysis

- Objective: To use historical price data to predict future price movements based on patterns and technical indicators.

- Steps:

- Chart Analysis: Plot the price on different time frames (daily, weekly, monthly) and use chart patterns like head and shoulders, flags, or triangles to predict future movements.

- Indicators: Apply technical indicators such as Moving Averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). For instance, a bullish crossover in MACD might suggest an upward price movement.

- Support and Resistance Levels: Identify key price levels where WIF has historically found support (low points) and resistance (high points). These levels can help predict where the price might head in the future.

4. Fundamental analysis

- Objective: To assess the intrinsic value of WIF based on its utility, adoption, and broader market conditions.

- Steps:

- Use Case Evaluation: Analyze what WIF is used for. A strong, unique use case (e.g., being integral to a successful DeFi platform) can increase demand and price.

- Adoption Rate: Look at how widely WIF is being adopted. Are more people and businesses using it? Increasing adoption typically leads to price appreciation.

- Partnerships and Integrations: Investigate any partnerships or integrations with other platforms. Strategic partnerships can significantly boost WIF’s value by increasing its utility.

- Regulatory Environment: Consider the impact of government regulations. Favorable regulations can enhance WIF's value, while restrictive laws can suppress it.

5. Economic factors

- Objective: To understand how broader economic conditions might influence WIF’s price.

- Steps:

- Global Economic Conditions: Consider the impact of global economic trends, such as inflation, interest rates, and economic growth. For instance, in times of high inflation, cryptocurrencies are sometimes seen as a hedge, potentially increasing demand for WIF.

- Monetary Policy: Central bank policies, especially in major economies, can affect cryptocurrency prices. For example, quantitative easing can lead to increased liquidity in the market, some of which may flow into cryptocurrencies.

- Market Correlation: Assess how WIF correlates with other assets, like Bitcoin or the stock market. If WIF tends to follow Bitcoin’s price movements, Bitcoin’s price trends will be a significant factor in WIF’s future price.

6. AI-based forecasting models

- Objective: To leverage machine learning models that can analyze large datasets and predict future prices based on identified patterns and correlations.

- Steps:

- Data Feeding: Feed historical price data, along with economic indicators and market sentiment data, into the AI model.

- Model Training: Train the model to recognize patterns that have historically led to price increases or decreases.

- Prediction Output: Use the trained model to predict future prices. The model might produce a range of possible prices with different probabilities.

FAQs

1. What is dogwifhat (WIF) and how does it work?

Dogwifhat (WIF) is a cryptocurrency, often categorized as a meme coin, that gained popularity through internet memes and social media trends. It operates on the Ethereum blockchain, leveraging smart contract technology. Like other cryptocurrencies, WIF has a finite supply, determined by its whitepaper. Its value is derived from market demand, speculation, and community engagement. The underlying technology of WIF is primarily based on the Ethereum platform, inheriting its security and functionality.

2. What factors influence the price of dogwifhat (WIF)?

Several factors can impact the price of dogwifhat (WIF):

- Market Sentiment: The overall sentiment towards WIF among the crypto community can significantly influence its price. Positive news, social media trends, and celebrity endorsements can drive up demand and price.

- Supply and Demand: The balance between the available supply of WIF and the demand for it in the market determines its price. Increased demand with a limited supply can lead to price appreciation.

- Cryptocurrency Market Trends: The broader cryptocurrency market often influences the price of individual coins, including WIF. A bullish or bearish market can impact WIF's value.

- Speculation and FOMO (Fear of Missing Out): Speculative trading and the psychological factor of FOMO can cause rapid price fluctuations in meme coins like WIF.

- Regulatory Environment: Changes in cryptocurrency regulations can affect the overall market sentiment and, consequently, the price of WIF.

3. Where can I buy dogwifhat (WIF)?

WIF is typically listed on popular cryptocurrency exchanges. To buy WIF, you would generally need to:

- Create an account on a supported exchange.

- Verify your identity according to the exchange's requirements.

- Deposit funds into your exchange wallet (usually in a more established cryptocurrency like Bitcoin or Ethereum).

- Use the exchange's trading platform to purchase WIF.

Please note: The availability of WIF on exchanges can change, so it's essential to check the latest information before making a purchase.

4. Is dogwifhat (WIF) a good investment?

Investing in cryptocurrencies, including WIF, carries significant risks. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Meme coins like WIF are particularly susceptible to price swings based on market sentiment and speculation.

Before investing in WIF or any cryptocurrency, it's crucial to conduct thorough research, understand the risks involved, and consider consulting with a financial advisor.