Eyes on the Dollar Index, SPX, and BTC Dominance

The $SPX stumbles in its ascent as the dollar finds renewed strength. Meanwhile, a Goldilocks moment unfolds in the job market, as JOLT's data paints a picture neither too hot nor too cold. But, amidst these economic intricacies, Bitcoin's dominance in the crypto market continues to rise.

Key topics

- The Dollar Index continues its relief rally.

- JOLT’s data comes in at 8.733m, below the 9.3m consensus - Goldilocks number?

- BTC dominance is growing.

The Dollar Index

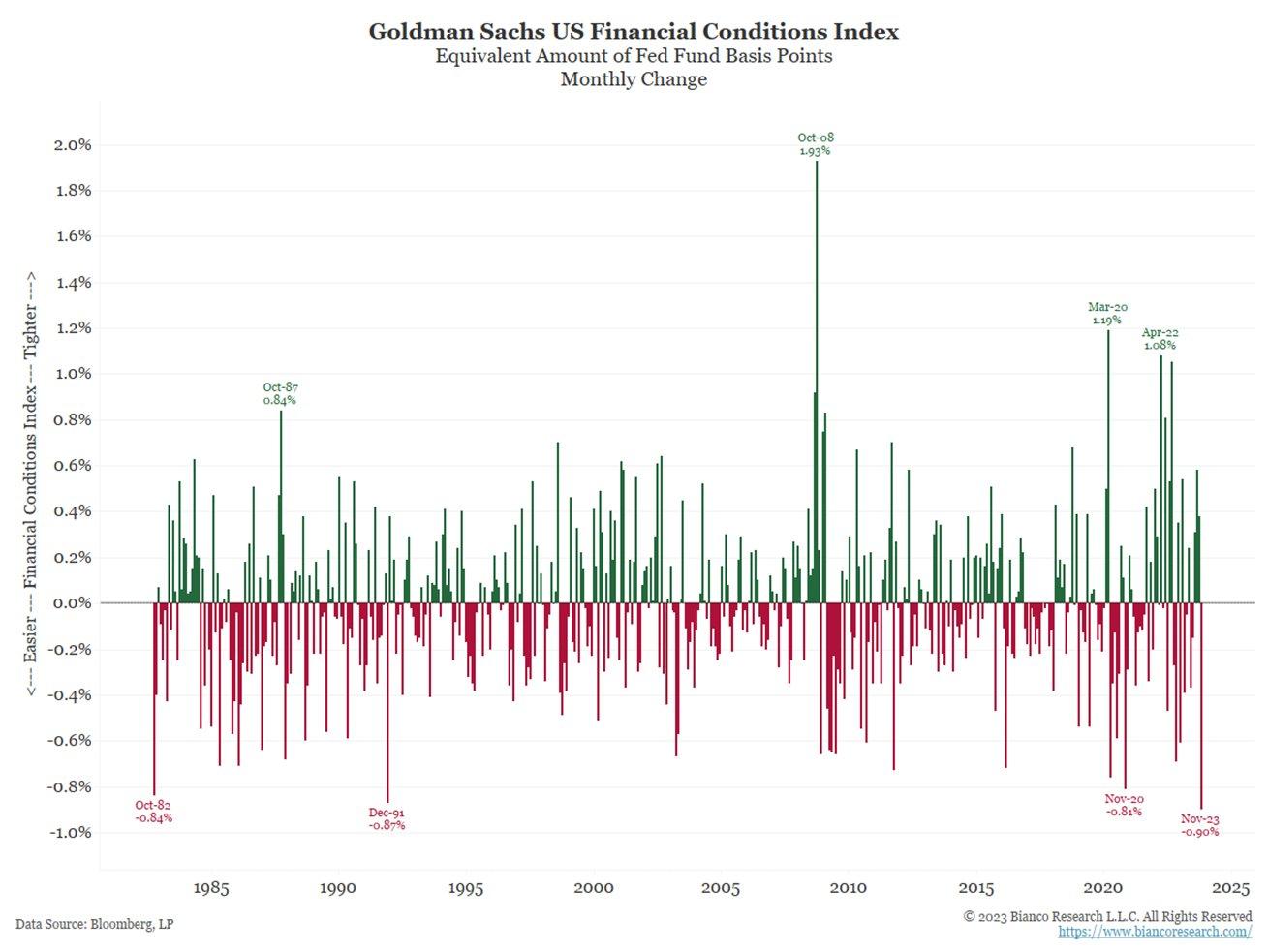

As we called for last week, the DXY (Dollar Index) has continued its relief bounce and is now north of $104. Despite liquidity conditions being good and financial conditions easing significantly in November - so much easing that it was the equivalent of 90 bps of rate cuts - the $SPX has struggled to continue pushing higher, likely due to a rising Dollar.$DXY 1D

Goldman Sachs US Financial Conditions Index

$SPX 1D

JOLT’s Job Openings

The JOLT’s Job Openings data came in a few hours ago at 8.733m, well below the 9.3m consensus. This print was actually taken as somewhat of a Goldilocks number by the markets. Goldilocks is neither too strong nor too weak.This meant that at 8.733m, there was a significant decrease in the data point, which the FED wants to see as it wants to bring the labour market “back into balance” where demand doesn’t so dramatically exceed supply.

But, the number didn’t drop so much that it frightened the markets that there could be something breaking in the labour market soon.

Overall, the markets took this number positively.

BTC Dominance

As is the case for many past cycles, Bitcoin is usually the first mover, where we have Bitcoin recovering the fastest first, and then Alts follow once BTC consolidates.We’re now seeing this play out in this new cycle, with BTC.D now approaching the 55% mark. There is resistance at 57% and 60%. Up until the ETF applications are most likely approved in early January, we may continue to see BTC.D increase.

Following what we think will be the likely approval of Spot BTC ETFs in early January, we’d then expect BTC to slow down and BTC.D to begin a new downtrend.

BTC.D Weekly