ETH looks primed for takeoff if Bitcoin falters

While Bitcoin struggles at a formidable resistance, Ethereum flexes its muscles for a bullish breakout. With fewer warning signs flashing red and derivatives markets not yet at extreme levels, ETH may soon surge higher and leave Bitcoin in the dust – sounds strange, but it’s valid.

But don’t bet on ETH just yet - there’s a strategic way to optimise your upside here. Let’s jump in.

TLDR

- Ethereum is holding up better than Bitcoin, with fewer overbought signals on key timeframes.

- Crucial resistance was broken at $1,933, paving the way for a rally to $2,500 as the next target.

- We also spotted healthier derivatives market mechanics for ETH than BTC.

- If BTC falters at resistance, ETH is ramping up for an explosive upside, but you need to enter the trade strategically.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

The macro context follows through to all other assets that essentially trade with a high correlation to other risk assets.Technical analysis

Over the past few weeks, we mentioned that if ETH can break out of the main horizontal resistance at $1,933, then it would have a potential upside of the prior high of $2,120. This is exactly where we got to in terms of ETH’s breakout higher.As ETH has pulled back, it has found some local support at around $2,020, with the more major support at $1,933.

On the RSI, ETH is not as overbought. The daily and the 3D are overbought, but the weekly isn’t. There aren’t any bearish divergences to be aware of on any of these major timeframes. This is more positive for ETH, especially when we compare it to BTC.

If ETH can revisit the low/mid $ 1,900, this would likely represent a good buying opportunity.

ETH 1D

Market mechanics

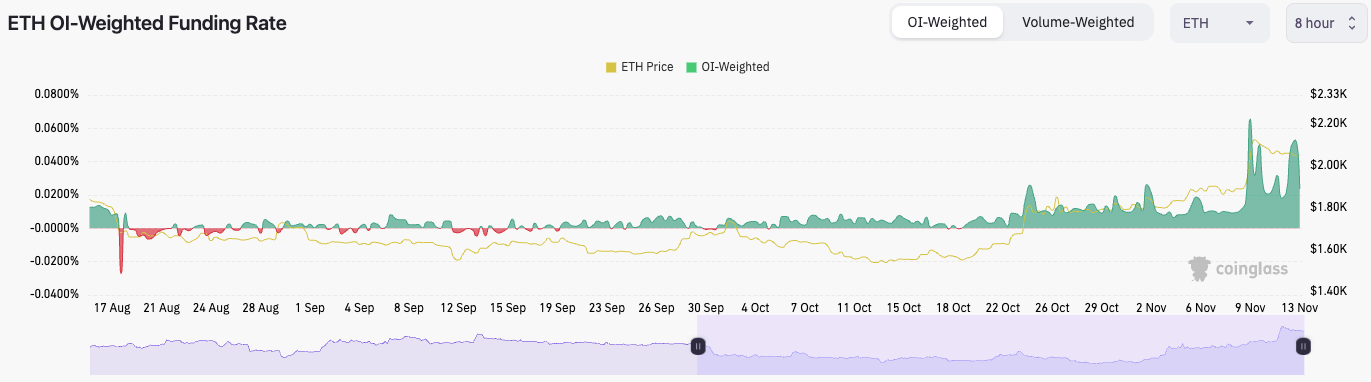

The mechanics looked very unhealthy, but they have calmed down slightly here. The funding rate was very positive but has now returned to a healthier level, still positive, just not so high that it suggests an unhealthy market from the perspective of longs.

In terms of the open interest, this remains very high, so this suggests shorts have built up slightly more to compete with longs - this is a market with a more even balance. And the open interest has spiked up massively in the last 24 hours (since yesterday’s potential ETF news). Perhaps the only positive you can take from this is that the level of open interest isn’t historically high, despite being the highest since April and before that, November 2022.

This suggests that longs have piled in over the last 24 hours, willing to pay a huge premium to shorts to take long positions. Of course, ETH may go higher in terms of price. However, the mechanics are currently at an unhealthy level, suggesting a flush out of longs is likely in the near term.

Cryptonary’s take

ETH is certainly healthier than Bitcoin here. We’ve had a small pullback, and the mechanics aren’t too bad.Ideally, you’d like to see the open interest be slightly lower, but there is an even mix between longs and shorts – so this isn’t all that bad. A healthier market (which this is, again, ideally, with a slightly lesser open interest) usually sees a shake-out of either the longs or shorts; however, ETH isn’t in that spot.

If there is more news on a possible ETF or the BTC ETF is approved, the market will likely continue higher. However, if this news doesn’t come this week, the market may see a further pullback, undoing some of the last 6 weeks’ worth of upside.

If price can fall into the low/mid $1,900 area, we would be strong buyers of ETH.

We love ETH overall but wouldn’t take fresh positions without a pullback.