Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

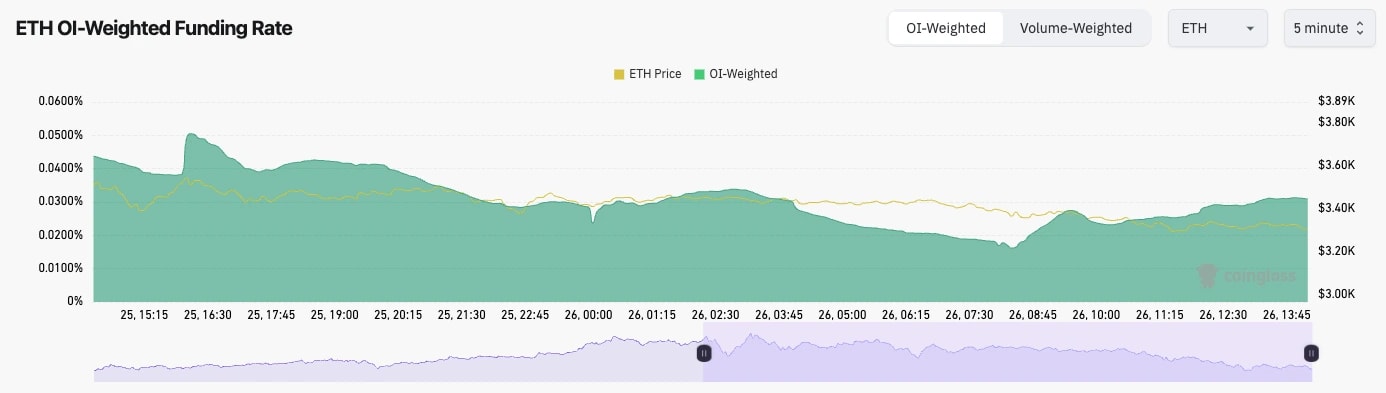

- Like BTC, ETH's Open Interest remain very high. An element of this may be institutional players taking advantage of the carry trade, longing the ETF, shortening the futures, and profiting from the funding rate.

- ETH's Funding Rate also remains high at the 0.03% level, although it has been higher, and this isn't very extreme here, all things considered.

- ETH looks less vulnerable to a flush-out in comparison to BTC, even though it is still somewhat overheated here.

Technical analysis

- Much more positive price action from ETH here, with it being able to hold above the $3,280 horizontal support.

- For now, in the short term, the $3,480 horizontal level remains the major resistance.

- A break above $3,480 and ETH likely moves on to $4,000.

- If $3,280 is lost to the downside, then it's possible that ETH pulls back as much as $3,000, although there is a fair amount of support between $3,000 and $3,280.

- The RSI was overbought but has recently approached back into overbought territory, with it now resetting to 61. This is positive to see it's not overbought.

- Next Support: $3,280

- Next Resistance: $3,480

- Direction: Neutral/Bullish

- Upside Target: $4,000

- Downside Target: $3,050

Cryptonary's take

This is the first time ETH has performed relatively well, even with the rest of the market seeing a more significant pullback. Institutions may be looking at ETH here and saying, "It's 25% off its all-time highs, whilst BTC is 50% above its old all-time highs; there is some divergence here".This may then attract institutional money into ETH here as it's beginning to look more attractive in relation to BTC, despite ETH still somewhat lacking the narrative.

We'd like to see ETH continue to find support above $3,280. If it does this, we'll grow in confidence that a $3,480 break out is on the cards.

We're holding Spot ETH and are not looking to sell it here. Overall, we think ETH looks relatively positive here, especially if BTC can avoid a larger pullback to the $87k area, let's say.