Market Direction

Ethereum ETF: Key resistance levels and market dynamics

Ethereum faces its own challenges as it battles key resistance levels amid the launch of spot ETFs.

Market mechanics

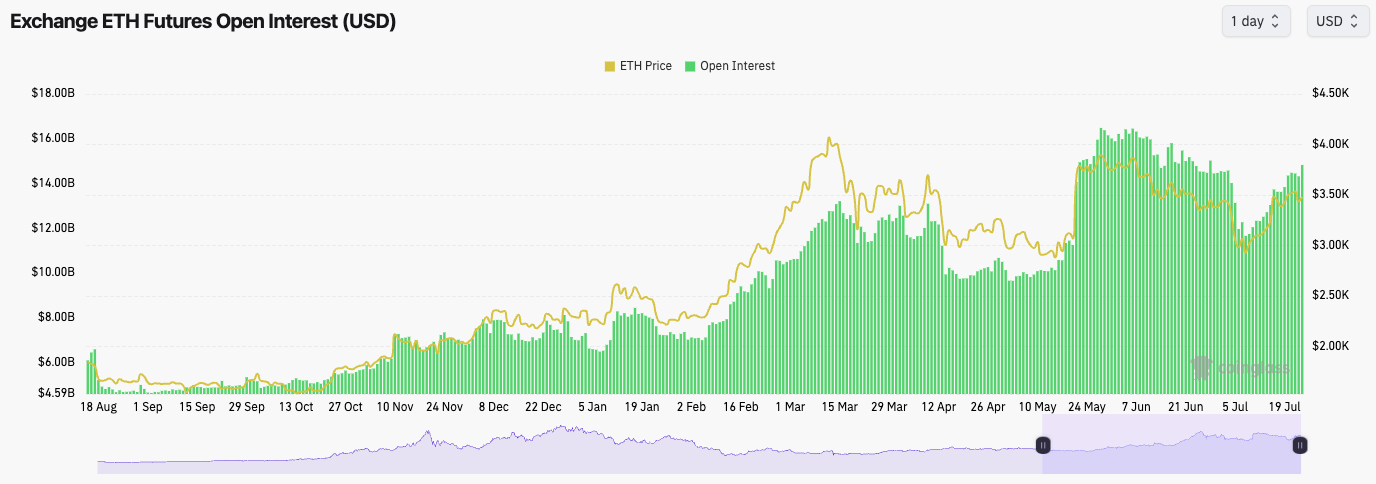

Like Bitcoin's Open Interest (amount of leverage), ETH's Open Interest has also risen since the price lows in early July.Unlike Bitcoin's, ETH's funding rate is quite positive, meaning that most of the Open Interest that has gone on is Longs. This potentially opens the door for a flush out in price = price lower.

ETH Open Interest:

Technical analysis

- ETH is still battling to break out from the downtrend line; however, it is also battling at the horizontal resistance of $3,485. These two levels together provide a sticking point for ETH here.

- To the upside, the $3,720 is the main resistance to clear in the short term.

- To the downside, the level to hold for price is the horizontal support at $3,280. We're expecting a move down to retest this level.

- The RSI is still in clean territory at 54, neither overbought nor oversold. From this perspective, there are no worries.

Cryptonary's take

With the ETH ETF going live and with Open Interest ramping up going into it, especially with the majority of this being Longs, ETH could be vulnerable to a pullback here unless the ETF inflows are super strong.The overall setup here isn't as positive today as it was a week ago, given we've had a potential breakout of the downtrend line, which is struggling to see momentum, and now we have a large buildup of Open Interest.

The most likely outcome in the short term is a retest of $3,280, but we think price could bounce from that level.