Market Direction

Ethereum (ETH) price prediction today: Can Ethereum hold $2,420 and push $2,557?

ETH's price remains below $2,557, and it struggles to show strength against other assets. With support at $2,420, Ethereum looks to reclaim higher levels. Can positive market data help ETH break out and target $2,700 soon?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- Like BTC, ETH's Funding Rate has been positive but fluctuated.

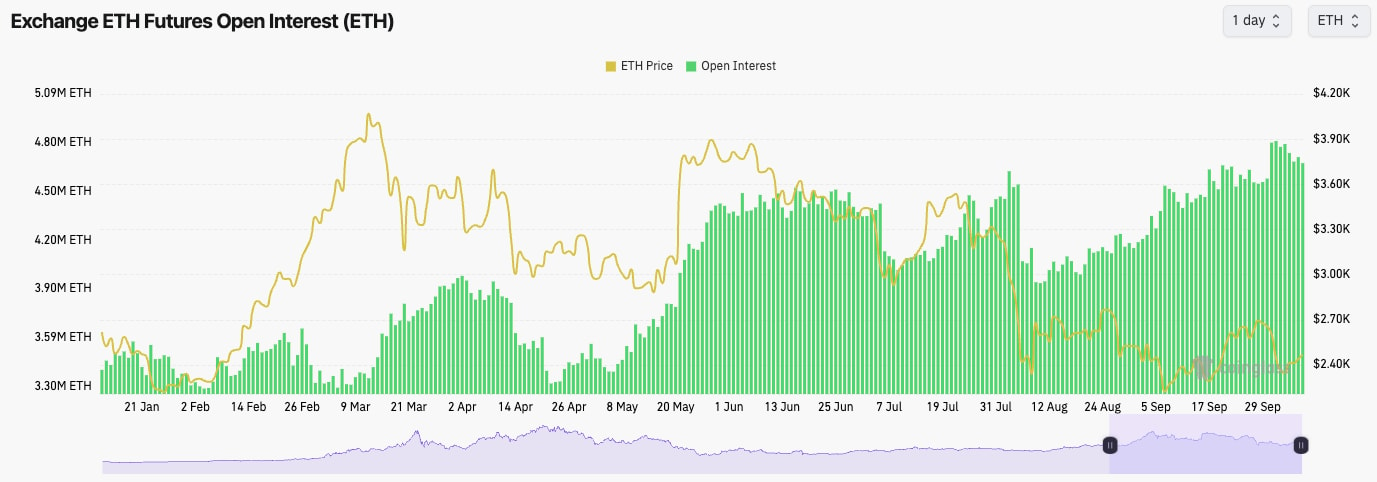

- Open Interest kicked up a week ago, but it has downtrended slightly since ETH dropped from $2,700.

Technical analysis

- Price-wise, ETH continues to struggle and is not showing strength against other assets.

- Having lost the horizontal level of $2,557, ETH broke below its local uptrend and is now battling to reclaim it.

- To the downside, there is local support at $2,420 that we expect to hold. The major support is at $2,150; we don't expect that to be retested.

- To the upside, the clear level to reclaim back above is $2,557, with the major resistance beyond that at $2,875.

- The RSI is back to middle territory but beneath the Moving Average.

- Next few days prediction: Neutral ($2,300 to $2,557 range)

- Next 7 days prediction: Neutral-to-bullish

- Next 7 days price target: $2,557 to $2,700 range reclaim

Cryptonary's take

ETH just continues to underperform, and with other Majors (BTC and SOL) having reclaimed some supports and now in better areas of their price ranges, ETH still struggles beneath $2,557, with its better/upper range being between $2,557 and $2,875.Until ETH can break out of $2,557 and also break out of the main downtrend line (red line), the case for continuing to hold ETH against other assets is becoming a harder argument. We expect ETH to chop between $2,300 and $2,557 over the next few days. If we see positive inflation data on Thursday, this may help ETH break out above $2,557.