Market Direction

- On most Exchanges, ETH's Funding Rate is more positive than BTC's, indicating a stronger bias amongst traders to be Long rather than Short. This is healthy after a leverage resetting, which is what we saw last week.

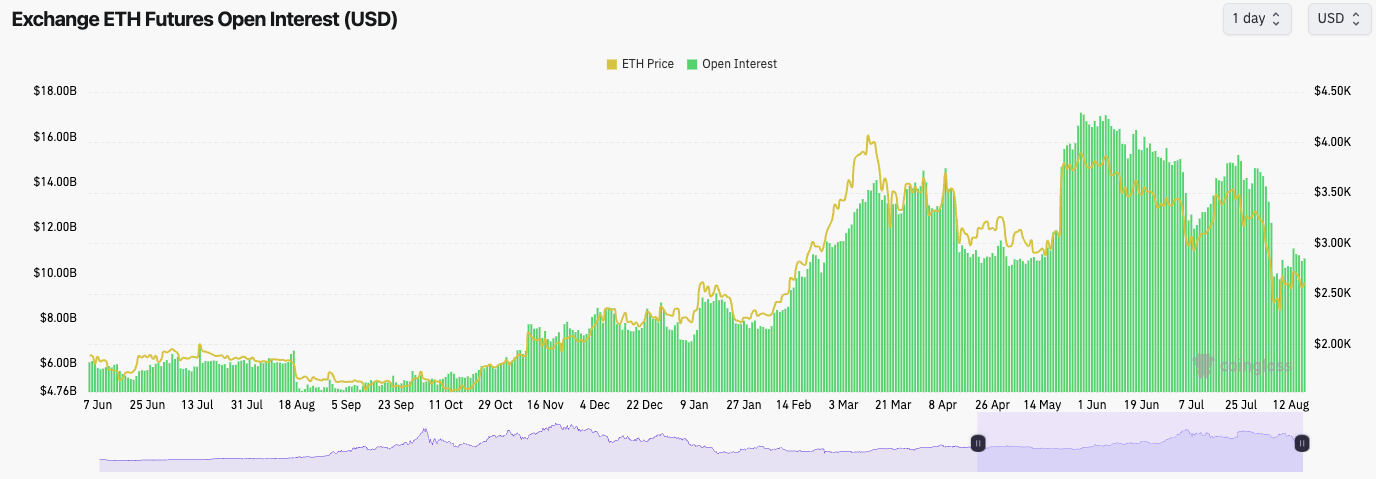

- - Following ETH's Open Interest flush out, we haven't seen leverage pile back on which is a positive sign.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Technical analysis

- - ETH bounced well from the major support of $2,150 but now remains in this lower price range between $2,300 and $2,700, with price still not convincingly being able to progress up to the major horizontal level of $2,875.

- - ETH didn't quite pull back to the red arrows level we had previously identified

- - In terms of price formations, ETH currently looks like it's in a ascending wedge on the local timeframe. These have a bias to break down.

- - If the ascending wedge were to break down, the target area would be $2,330 to $2,400. However, this would be an area would strongly consider bidding ETH.

Cryptonary's take

We're expecting ETH to remain range-bound between $2,330 and $2,700 over the weekend and the first few days of next week.Whilst it's also possible ETH see's some downside in the coming weeks, we do believe any retest of the $2,150 to $2,400 area we would be strong buyers of ETH if we're given the opportunity at those price points. The target would be to sell at some point in 2025 at considerably higher prices.

What is Ethereum: Ethereum (ETH) is a groundbreaking decentralized platform that facilitates the creation and execution of smart contracts and decentralized applications (dApps) without the need for intermediaries. Launched by Vitalik Buterin in 2015, Ethereum's innovative blockchain technology enables a wide range of applications and has become a cornerstone of the decentralized finance (DeFi) space. Ethereum's ATH is $4,868.

How to buy ETH:

- Via Centralized Exchange (CEX):

- Select a CEX like Binance, Coinbase, or Kraken.

- Sign up and complete any verification processes.

- Deposit funds into your account.

- Go to the ETH trading section and purchase ETH.