Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

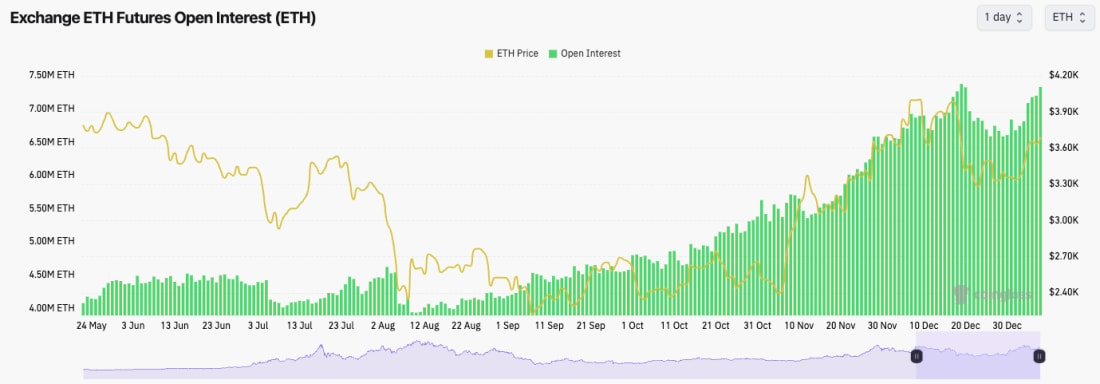

- It's really interesting to see that ETH's OI (by number of coins) is back to its highs. This shows that a lot of leverage has been put into ETH recently.

- ETH's Funding Rate is flat at 0.01%, meaning that the increased Open Interest is a relatively even mix of Longs and Shorts.

- This leverage setup is likely TradFi players taking advantage of the basis trade - Long the ETH ETF, Short the Futures, and take the Funding Rate as the arbitrage risk-free.

Technical analysis

- Exactly what we were expecting and looking for: a clean break above the range resistance at $3,480.

- $3,700 is a local resistance, but it might just be a short-term stopping point before ETH ends up heading higher to $4,000 again.

- If there is a more meaningful pullback (we're not expecting one), then $3,480 is likely to be old resistance now flipped into new support.

- The RSI has broken above its moving average, and at 58, it's still a long way from even being close to overbought. More upside likely.

- Next Support: $3,480

- Next Resistance: $3,970

- Direction: Bullish

- Upside Target: $3,970

- Downside Target: $3,480