Ethereum recovers bull flag, but upside still in question

The macro-environment and risk asset correlation are still in play for Ethereum. Technicals show mixed signals, but the upside remains if Ethereum can break through the critical $2,120 resistance. Leverage remains high, so volatility is anticipated in the near term, but the long-term outlook appears constructive, so we continue to favour buying the major dips.

TLDR

- Ethereum recovered its bull flag after dipping below, keeping the uptrend intact.

- Breaking above $2,120 is key for continued upside towards $2,340.

- Leverage is still elevated, so volatility is expected in the days ahead.

- Long-term buys are favoured at $1,933, with aggressive buys under that level.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

The macro context follows through to all other assets that essentially trade with a high correlation to other risk assets.Technical analysis

Considering Blackrock has now filed for an ETH ETF, you’d have expected ETH to see a better performance, but this hasn’t really come.However, despite ETH breaking below its bull flag and bouncing off the main support at $1,933, it has recovered the bull flag, and there is the possibility that it will break to the upside.

The important level to clear above is $2,120. If ETH can do that, then this opens the door for a move to $2,340.

Something else we’re tracking is the uptrend line; if this is lost, ETH may see a more meaningful breakdown where $1,933 is likely the minimum target.

The RSIs are much better. We’ve got a pullback on the daily to where ETH is no longer in the overbought territory while also not coming off the back of any bearish divergences. The 3D is in overbought territory now, but the weekly timeframe isn’t, so there is a slightly mixed picture here, but certainly not as exhausted to the upside as some other coins.

ETH 1D

Market mechanics

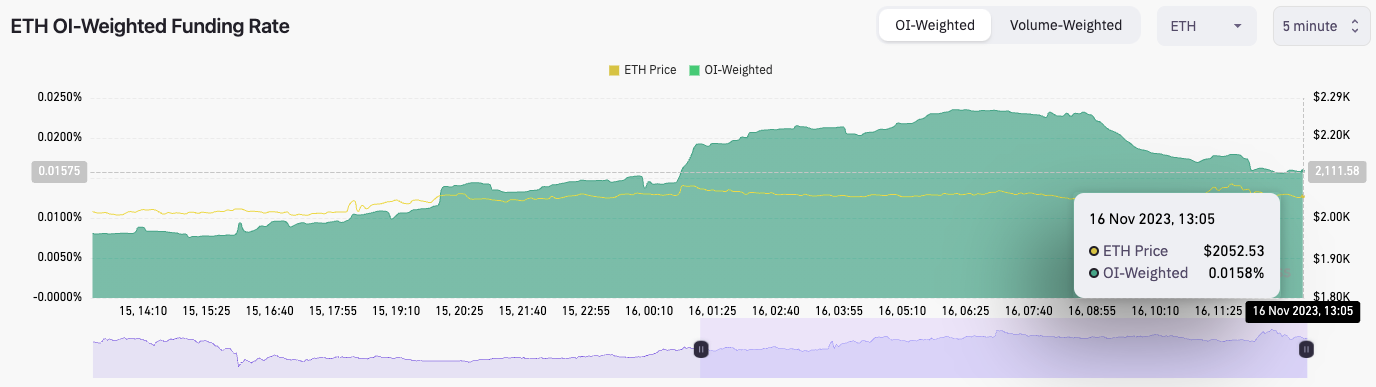

It is still somewhat overheated but it is probably a healthier setup than BTC. The funding rate is at 0.0158%, so a bias to be long, but not massively so that longs look to be the crowded trade is ok from this perspective.

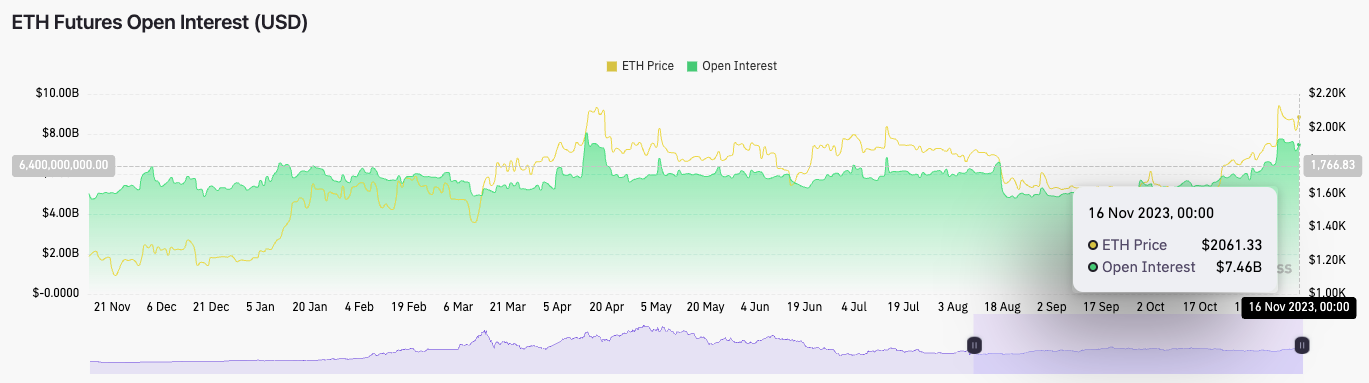

The same goes for the open interest. It’s somewhat overheated, but it is still down 4% or so from where it was a few days ago. However, this isn’t a massive move down in open interest. You couldn’t class a 4% move down in open Interest as a flush-out.

Cryptonary’s take

We will likely see some volatile moves in the coming days, potentially driven by BTC. We would be cautious on ETH here, but we would be long-term buyers of ETH at $1,933 and aggressive long-term buyers sub $1,933.