Ethereum rockets past resistance: Can ETH sustain its rally?

Yesterday, news of Blackrock's interest in an ETH ETF sent ETH smashing through a significant resistance level at $1,933. But as the excitement builds, there's a storm brewing beneath the surface—a surge in market mechanics that could signal turbulence ahead. How will ETH fair today?

TLDR

- ETH breaks key resistance at $1,933 following Blackrock's ETH ETF news.

- ETH targets $2,120, with strong local support at $2,000 to $2,030.

- Market mechanics show unhealthy levels with a surge in open interest.

- Longs are piling in, but a potential flush out of late Longs looms, causing caution in fresh positions.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

The macro context follows through to all other assets that essentially trade with a high correlation to other risk assets.Technical analysis

After news was released yesterday that Blackrock was looking to file for an ETH ETF, ETH prices surged higher. It smashed through the horizontal resistance of $1,933, which we had previously identified as a major level. Once broken, this opened the door for ETH to move significantly higher, with $2,120 as the next horizontal resistance we had marked. Price hit $2,120 late last night and rejected. However, the price is only 2.5% away from this level, and a retest could be on the cards.Regarding local support for ETH, the current level below price is between $2,000 and $2,030. If ETH does come down, and that level is lost, that’ll open the door for a full retrace back to $1,933. However, we don’t expect this in the very short term.

If BTC holds up, we expect this to enable ETH to continue higher, with a target of $2,340.

ETH 1D

Market mechanics

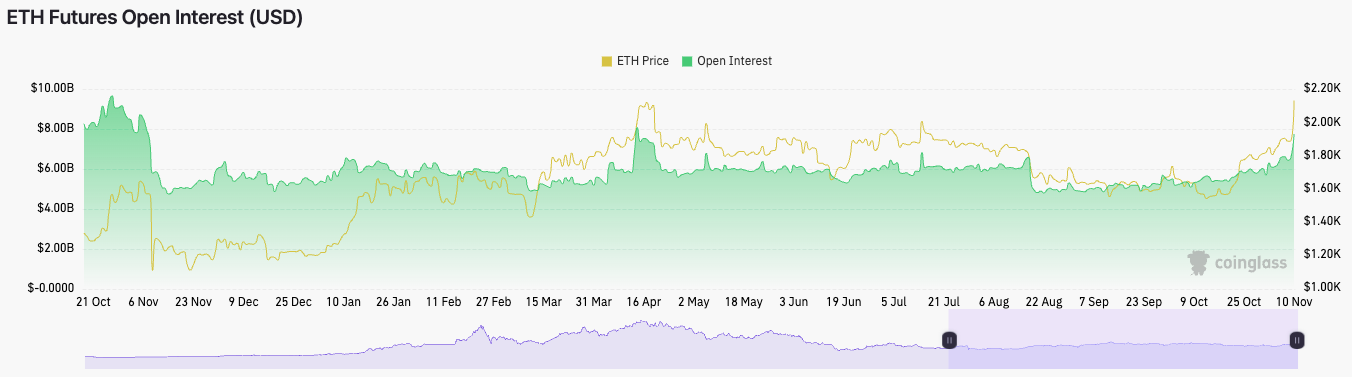

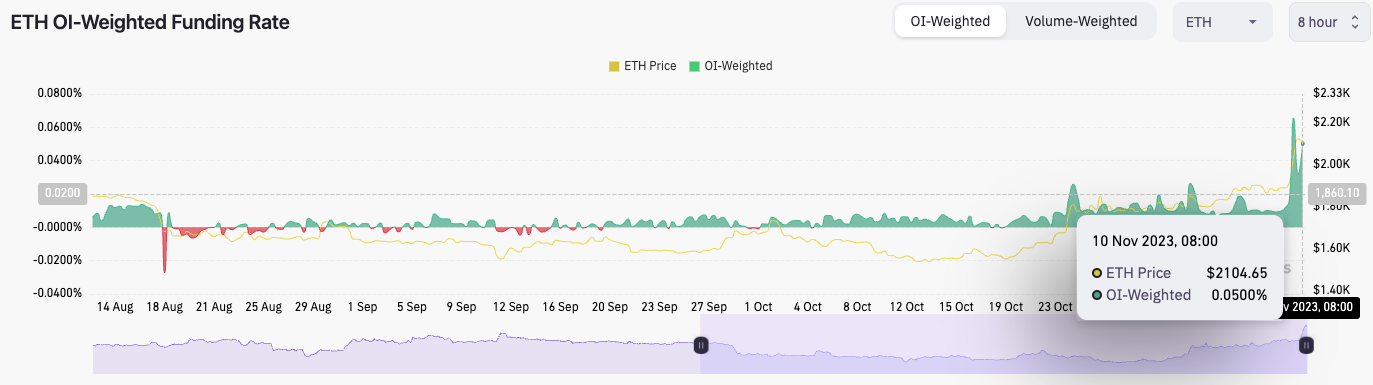

The mechanics look very unhealthy here. The funding rate is positive, and the open interest has spiked massively in the last 24 hours. Perhaps the only positive you can take from this is that the level of open interest isn’t historically high, despite being the highest since April and, before that, November 2022.This suggests that longs have piled in over the last 24 hours, willing to pay a huge premium to shorts to be long. Of course, ETH may go higher in terms of price. However, the mechanics are currently at an unhealthy level, suggesting a flush out of longs is likely in the near term.

Cryptonary’s take

Over the past week or so, we have liked ETH as it’s one of the majors with great fundamentals that has had a big price move up like some other majors. The break above $1,933 is big for ETH and can potentially set it up for a move into $2,340.However, the mechanics behind the move are at very unhealthy levels currently. There’s a lot of open interest (leverage) with it all being positioned long. Usually, this kind of setup punishes late longs, and this would usually result in a flushing out, where the price comes down substantially - a good 5% or so.

We may go higher first, but with the state of the mechanics, this doesn’t look too likely unless more positive ETF news comes out. Secondly, we wouldn’t be looking to open fresh longs/buys at this price simply because of how the mechanics are set up currently.

We love ETH overall, but we wouldn’t take fresh positions without a pullback and a flushing out of the excess leverage.