February recap: how we navigated the downturn & what's next

Hey Cryptonary fam, another month in the books, and we took it head-on! With the market keeping us on our toes, we made bold moves, took profits where it mattered, and stayed sharp through the volatility. In this recap, we'll break down the highlights, key lessons, and plays that shaped the month. Let's jump in!

Disclaimer: The content above is not financial or investment advice. Always do your own research and invest responsibly.

1. Spot-on calls & proactive risk management

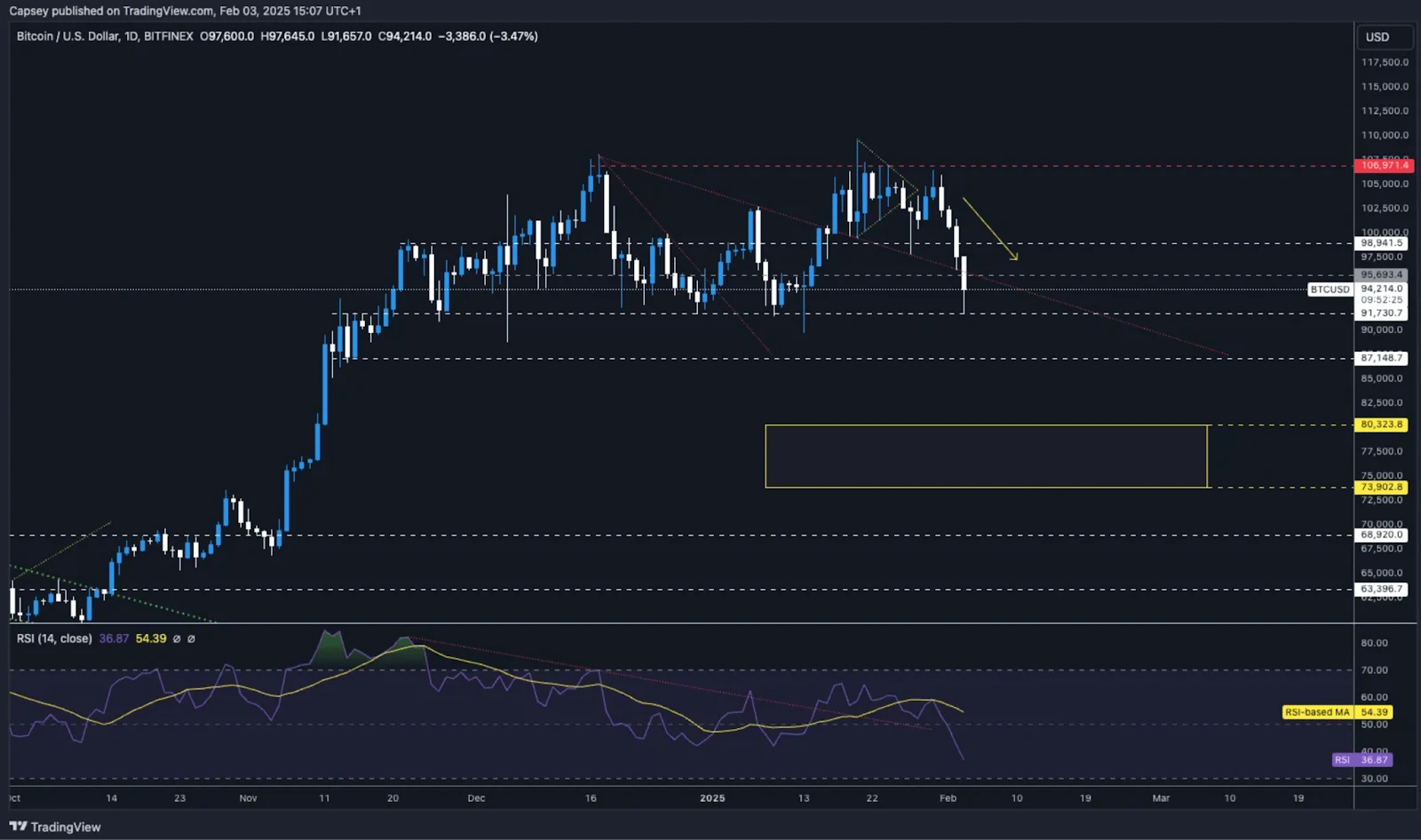

Over the course of February even extending back into January and December, we consistently issued a series of high-conviction calls about market direction, particularly warning of memecoin vulnerabilities and a broader market pullback.Sure enough, Bitcoin dipped into our designated "yellow box" target area ($73,900-$80,300) and ultimately wicked down to around $79,000, validating our scenario for a deeper correction.

While many traders were caught off guard, our stance to lock in profits on overheated memes and shift the majority of capital into stables or yield-generating strategies helped mitigate the downside. We nailed this move down!

2. Research-driven updates & market direction

Additionally, throughout February, we posted regular market updates covering everything from inflation prints and Fed rate expectations to emerging political policy shifts under President Trump. Our data-driven approach highlighted:- Macro headwinds: Sticky inflation in the high 2% range, a sudden reduction in expected Fed rate cuts (from four down to one for 2025), and renewed strength in the U.S. Dollar signalling less liquidity for risk assets in the near term.

- Trump administration policy: Potential pro-crypto executive orders and tariff discussions. While these could be bullish long term, the near-term environment looked tricky given that meaningful policy changes often take quarters to implement.

Key takeaways from our updates

- Fewer Fed rate cuts - The market swiftly repriced from four potential 2025 cuts to possibly one, reinforcing our cautious stance. However, despite this, we still expect 2 or 3 rates in 2025 driven by growth slow in US

- Stronger Dollar & yields - With higher yields and a firmer dollar, risk assets (including crypto) faced increased headwinds and likely remain choppy in the coming weeks/months.

- Possible tariffs & geopolitics - Trump's graduated tariffs could stoke inflation, complicating the market's broader trajectory.

3. "Memecoins on Fire": Insider games & meltdowns

We also released an in-depth analysis on the memecoin market, shining a light on recent pump-and-dump scenarios involving high-profile figures-most notably Trump, Melania, and Argentina's President Milei. These political endorsements and insider snipes led to massive spikes followed by brutal collapses-leaving everyday investors holding heavy losses and tarnishing the memecoin sector's reputation.

Turmoil & leadership shake-ups

- Meteora founder steps down: In the midst of ongoing controversy, @weremeow (the founder of Jupiter) indicated that Ben Chow from Meteora would be stepping down. Community pressure and insider allegations are cited as the primary factors behind this decision. Meanwhile, video evidence obtained by SolanaFloor, featuring Ben Chow and DeFiTuna Founder @cavemandhirk, has added further scrutiny to the scandal by revealing statements that appear to contradict earlier project communications.

- Insider-fueled schemes: Many newly minted tokens-often launched or endorsed by celebrities and political figures-lacked any true grassroots backing. Instead, they functioned primarily as quick-profit vehicles for insiders who cashed out at the market's peak. Retail investors were left nursing significant losses.

- The crippling reputational damage: The onslaught of large-scale liquidity pulls, abrupt "rug pulls," and high-profile leadership shake-ups has severely tarnished the memecoin sector's image.

Lessons learned

- True memes are community-driven meme coins (e.g., DOGE, SHIB, PEPE) that thrive on robust cultures, multiple cycle survivals, and grassroots growth. By contrast, "insider" tokens rarely stand the test of time-especially amid liquidity constraints.

- Flight to Quality: Our earlier recommendation to de-risk from meme coins paid off, as many tokens plummeted over 70%-90%. This meltdown further validated our stance on capital preservation and keeping dry powder on hand. For example, in early February, we urged caution on SPX (the meme coin, not the S&P 500), pointing out extended price action, on-chain signs of whale selling, and the risk of liquidity fragmentation in the memecoin space. Shortly thereafter, SPX lost critical support and retraced heavily -validating our call to scale out.

- Future Potential: Despite the carnage, memecoins as a concept aren't fading away. Upcoming DOGE ETF filings and institutional interest could reignite the narrative-especially for projects offering genuine community engagement and fair distribution.

4. Yield strategies to keep capital working

Even amid turbulence, we emphasised to the Fed that portfolios needn't remain idle. Our February article on Smart Yield Strategies showed how to deploy stablecoins and major assets in DeFi protocols for consistent returns:- Hyperliquid HLP Vault - Earning USDC-denominated yield from market-making fees and liquidations.

- Kamino on Solana - Leveraging a multiplier (looping) strategy to boost yields on both stables and SOL.

- Beefy, Marinade & more - Automated yield optimisers offering anything from mid-single-digit APYs (on ETH) to double digits on Solana-based assets.

Why it mattered

While meme volatility made headlines and majors slowly bled, these yield strategies provided a more stable income stream-helping mitigate potential drawdowns and keep capital productive.5. Our current outlook & next steps

Short-term caution, Long-term opportunity

With sticky inflation, a strong dollar, and uncertain policy timelines, we remain cautious in the near term. We see room for major assets (like BTC and SOL) to potentially revisit lower support zones.We are currently mostly allocated to stablecoins and have yield-generating stablecoin positions. This strategy ensures that our capital is well-preserved and ready to deploy when deeper market discounts appear and risk-on environment returns.

Memecoin market reset

Recent rugs and insider-led projects have damaged the memecoin sector's reputation. We anticipate a "flight to quality" toward established, community-driven meme assets that can weather multi-cycle volatility.If new cult memes emerge, they'll need organic growth, fair distribution, and strong meme culture rather than high-profile endorsements or insider advantage. We believe memecoins are here to stay, and there will be opportunities that the market will present.

Awaiting clear catalysts

Any major positive inflection point as a positive tariffs-related policy from the Trump administration or an unexpected Fed pivot-could flip the market to full-on risk-on mode. However, our base case is that this may take time.We'd rather buy strength backed by tangible catalysts (even at slightly higher prices) than force trades in a murky environment.

6. Final words: How we "Killed It" in February

- Directional accuracy - We flagged meme overextension early, sidestepping heavy losses when the sector capitulated. Same thing with majors, our "yellow boxes" were all hit.

- Proactive profit-taking - Trimming high-risk names allowed us to lock in gains before sharp corrections.

- Focus on research & dispersion - By combining fundamentals (macro research, on-chain data), we capitalised on the market's uneven, choppy movements.

- Yield & capital preservation - Rather than chasing the next hype coin, we highlighted yield-farming strategies that outpaced traditional returns-essentially earning while waiting for better crypto entries.

Other newsworthy events in the month Of February

Bybit exchange hack (What really happened?)

We now know how Bybit was hacked for $1.4 billion in Ethereum

Recent forensics from cybersecurity experts Verichains and Sygnia Labs have identified North Korean attackers (Lazarus Group) as the culprits behind what is now confirmed to be the largest crypto hack in history. Early estimates of a $300 million breach at Bybit have been shattered by new findings, putting total losses at a staggering $1.4 billion.How it happened

- Safe wallet exploit: Contrary to initial assumptions that Bybit's own infrastructure was at fault, audit reports show attackers inserted malicious JavaScript code into Safe's online infrastructure wallet provider long hailed for its impenetrable security.

- Targeted attack: The code is specifically activated only when interacting with Bybit's contract address. Once Bybit used Safe's services, roughly two days after the malicious code was planted, the hack executed.

- Swift cover-up: Minutes after siphoning off $1.4 billion in Ethereum and related tokens, the attackers removed the malicious lines of code from Safe's infrastructure, vanishing without a trace.

Bybit's response

- Not compromised internally: Bybit states its own systems were never directly breached by the North Korean hackers.

- Funds moved: The exchange swiftly relocated most remaining assets from Safe-administered wallets within hours of the attack.

- Bounties & leads: Bybit has since offered up to $140 million in bounties to anyone who can track or freeze the stolen funds. A dedicated bounty dashboard was also launched to coordinate community efforts.

Why it matters

This hack amplifies concerns about third-party wallet providers, even those with top-tier security reputations. For users, it's a stark reminder that sophisticated attackers will exploit any weak link in the chain. "Not your keys, not your coins" rings truer than ever, as even advanced multi-signature setups and top-rated wallet providers can be vulnerable if their infrastructure is compromised.FTX payouts (updates, winners, and losers)

The payout scheme

FTX continues its prolonged bankruptcy proceedings, with fresh rulings indicating how creditors will be compensated. Notably, payouts will be pegged to asset valuations from 2022-the year the exchange collapsed rather than current market prices.Impact on creditors

- Retail investors: Those who held BTC, ETH, or other tokens in FTX wallets could lose out significantly, as crypto prices have rebounded since FTX's collapse.

- Hedge funds & vultures: Firms that purchased FTX claims at steep discounts stand to gain substantially from the final payout, turning risky bets into potentially huge profits.

Key takeaway

For those locked out of their funds, any reimbursement is welcome, but the gap between 2022 valuations and current prices remains a tough pill to swallow. This situation again highlights the importance of self-custody and conducting thorough due diligence on centralised entities.SEC U-turn (Gemini, Coinbase, and OpenSea get a break)

Changing regulatory winds

In a surprising turn, the Securities and Exchange Commission (SEC) has decided to drop or reassess several high-profile cases. Among the fortunate parties:- Gemini: No longer under severe legal scrutiny over Gemini Earn.

- Coinbase: Concerns about unregistered securities are on pause.

- OpenSea: The insider trading case against a former employee was dismissed, indicating a more lenient approach to NFT marketplaces.

Why the sudden change?

Political pressure and a growing pro-crypto stance in the U.S. administration may be driving the SEC to soften its approach. Additionally, the commission appears to recognise the complexity of applying traditional securities law to rapidly evolving crypto technologies.Looking ahead

While this is good news for these platforms, it doesn't mean the SEC is turning a blind eye to future infractions. Think of it as a grace period that could pave the way for more balanced crypto regulations down the line.Franklin Templeton's Solana ETF (A bullish catalyst?)

The ETF filing

In a move that signals heightened institutional interest beyond Bitcoin and Ethereum, Franklin Templeton has officially filed for a Solana ETF. If approved, this could become the first SOL-focused exchange-traded fund in the U.S.Key points

- Why Solana? Despite ongoing controversies in the memecoin space, Solana's speed, scalability, and robust developer ecosystem make it an appealing prospect for institutional investors.

- Potential impact: Should the ETF get the green light, Solana could see a surge of institutional capital, potentially driving up prices and conferring broader market confidence.

- Approval odds: Polymarket estimates an 85% likelihood that we'll see a formal go-ahead by late 2025. If it happens sooner, the market could see a significant uptick in SOL's valuation.

Cryptonary's take

February underscored the importance of balanced positioning: locking in memecoin profits early, staying alert to macro headwinds, and tapping into yield strategies, all while continuing thorough research. Hacks, political entanglements, and regulatory shifts certainly rattled the space, but we remain optimistic about crypto's long-term particularly once liquidity conditions improve.On the macro front, expect heightened volatility over the next two quarters as investors weigh Trump's new tariffs, potential rate hikes, and persistent inflation concerns. These factors could dampen near-term risk-on sentiment, especially if liquidity remains tight.

However, if these uncertainties clear in the latter half of the year-especially if interest rates stabilise or geopolitical tensions ease-we could see a more bullish environment for crypto. Watch for signs of returning liquidity, improving consumer confidence, and any easing of regulatory obstacles as catalysts for a broader market upswing.

Stay informed, stay cautious, and keep your eyes on the bigger picture. As always, Cryptonary will be here to guide you through every twist and turn.

Cryptonary, OUT!