The Middle East ceasefire is holding despite morning flare-ups, risk assets have surged into critical resistance zones, and the Fed's dovish pivot is gaining momentum. With majors now testing key levels and altcoins consolidating above support, the next move depends on whether these technical barriers break or hold. Are we seeing the setup for Q4's anticipated rally, or will resistance prove too strong?

- Middle East tension eases: Ceasefire holds despite brief flare-ups; oil drops as markets move on.

- Fed turns dovish: September or October rate cuts likely; Friday's PCE data in focus.

- Crypto hits resistance: BTC, ETH, SOL, and HYPE rally into key levels; consolidation expected.

- ETF inflows steady: Bitcoin ETFs remain positive; watching for momentum as tensions ease.

- Israel-Iran Ceasefire?

- Dovish FED Speak

- Majors Move into Resistances

- Monitoring ETF Flows

- Cryptonary's Take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Israel-Iran ceasefire?

Yesterday, we saw Iran retaliate against the US by bombing a US airbase in Qatar. This followed the US having bombed Iranian nuclear sites in Iran at Natanz and Fordow, setting back the Iranians' nuclear progress by several years. However, the Iranians gave the US considerable notice that they were going to strike the US airbase in Qatar, with their intention then being to pull back from further conflict, essentially welcoming a new round of diplomacy. The damage to the US airbase was limited, whilst personnel and equipment were able to be moved ahead of the strike. This opened the door to Trump and the US pushing for a ceasefire, which was agreed by both sides.But this morning, the Iranians launched missiles into Israel, killing 4 people, to which the Israelis responded. Trump has since lashed out at both and called for both to honour the ceasefire.

Whilst tensions remain high, it's likely we've seen the peak in tensions and we're now on a path to de-escalation in the region. We believe the markets will now begin looking beyond this conflict, expecting a resolution to it in the short term. This outcome is also currently being reflected in Oil. Upon the ceasefire news yesterday (Monday), the price of Oil plummeted, suggesting that the markets had already begun to move on from this conflict.

Oil 1D timeframe:

If the price of Oil had substantially broken out to the upside, that would have caused huge inflationary pressures, and that would be a serious escalation, which would likely see the US step into the conflict in a more meaningful way. But as we suggested, this wouldn't happen, as the Iranians wouldn't look to close the Strait of Hormuz as it negatively impacts their allies e.g., China, whilst it also hugely damages their own economy as they heavily rely on their Oil exports. And, closing the Strait wouldn't impact Israel, so it didn't make sense to do so. This is why we faded this idea.

Dovish FED speak

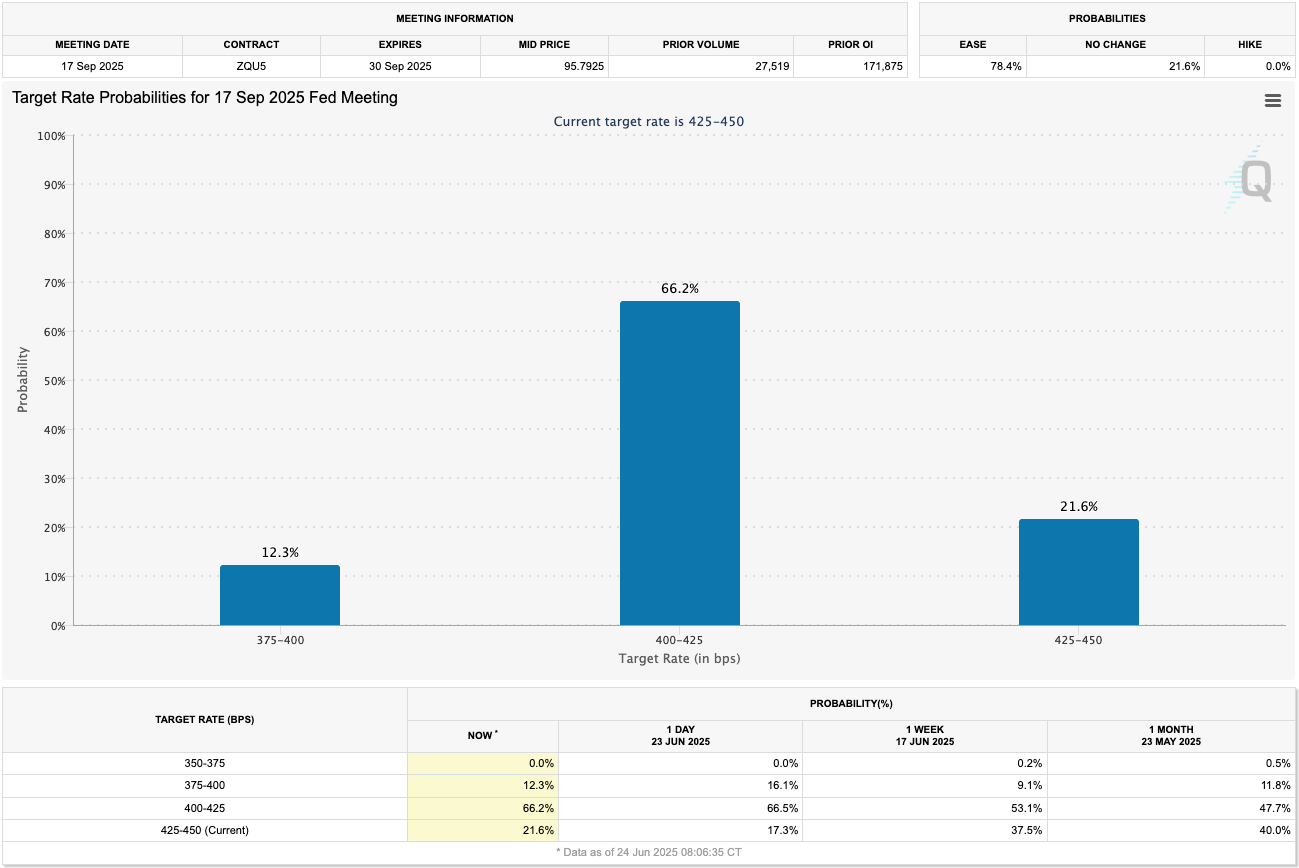

In recent days, we've had two FED members speak (Bowman and Waller), with both suggesting that they could advocate for lowering Interest Rates as early as the next Meeting (July 29th). The reason is that both members are looking to get ahead of the labour market data, which is showing some early signs of softening. However, both did mention that they'd be looking for the next month's data to corroborate, meaning the markets will be closely watching this Friday's PCE (inflation) data. It is worth noting that both Waller and Bowman are Trump picks, and they're perhaps striking a more dovish tone ahead of a new FED Chair being appointed early next year. By striking a more dovish tone, they potentially stand out to President Trump as dovish and therefore "good" candidates in his view. Bond Yields did come down slightly off the back of this dovish FED speak; however, the lower Yields might also have been due to some market participants going risk-off during Iranian retaliatory strikes.Despite the positive FED speak, the market is currently pricing a 16.5% chance that the FED cuts Interest Rates at the end of the July FED Meeting. Although this meeting is 5 weeks away, and therefore, there is more data to come, meaning this percentage can change.

30th July FED Meeting - Odds of Rate Cut:

The market does, however, see a 67.6%% chance that the FED delivers a cut at the mid-September Meeting, with just a 19.8% chance that the FED doesn't cut at that Meeting.

17th September FED Meeting - Odds of Rate Cut:

Our view at Cryptonary is that we'll see an Interest Rate cut in either the September or October FED Meetings. The reason why September might not happen, and a cut may be pushed into October, might be due to higher inflationary pressures from tariffs coming through in the next 1-2 months. In recent months, inflation data has come in softer than expected, but we're continuing to monitor this going forward.

Majors move into resistance

Following the announcement of yesterday's ceasefire in the Middle Eastern conflict, risk assets spiked higher on the news. This saw many of the Crypto Majors (BTC, ETH, SOL and HYPE) put in substantial bounces, with many of them now moving into the underside of their major horizontal resistance levels.BTC - the $105,500 Horizontal Resistance:

SOL - the $144 Horizontal Resistance:

HYPE - just short of the $39.40 Horizontal Resistance:

We will now be closely watching how price develops from here, with our hope being that price can consolidate and then reclaim these key resistance levels.

Alongside the above, we're also closely monitoring TOTAL3 still. On the Iran escalations, TOTAL3 broke down, however, it has since recovered the key horizontal levels (supports) at $784b and $807b. TOTAL3 remains in a downtrend channel, which is a bullish formation upon a price breakout of the downtrend line. Our expectation is that price can consolidate above $784b, and squeeze into the downtrend line before breaking out in the coming weeks. This is medium-term bullish for Alts/Meme's.

TOTAL3 1D timeframe:

Monitoring ETF flows

Monitoring ETF flows

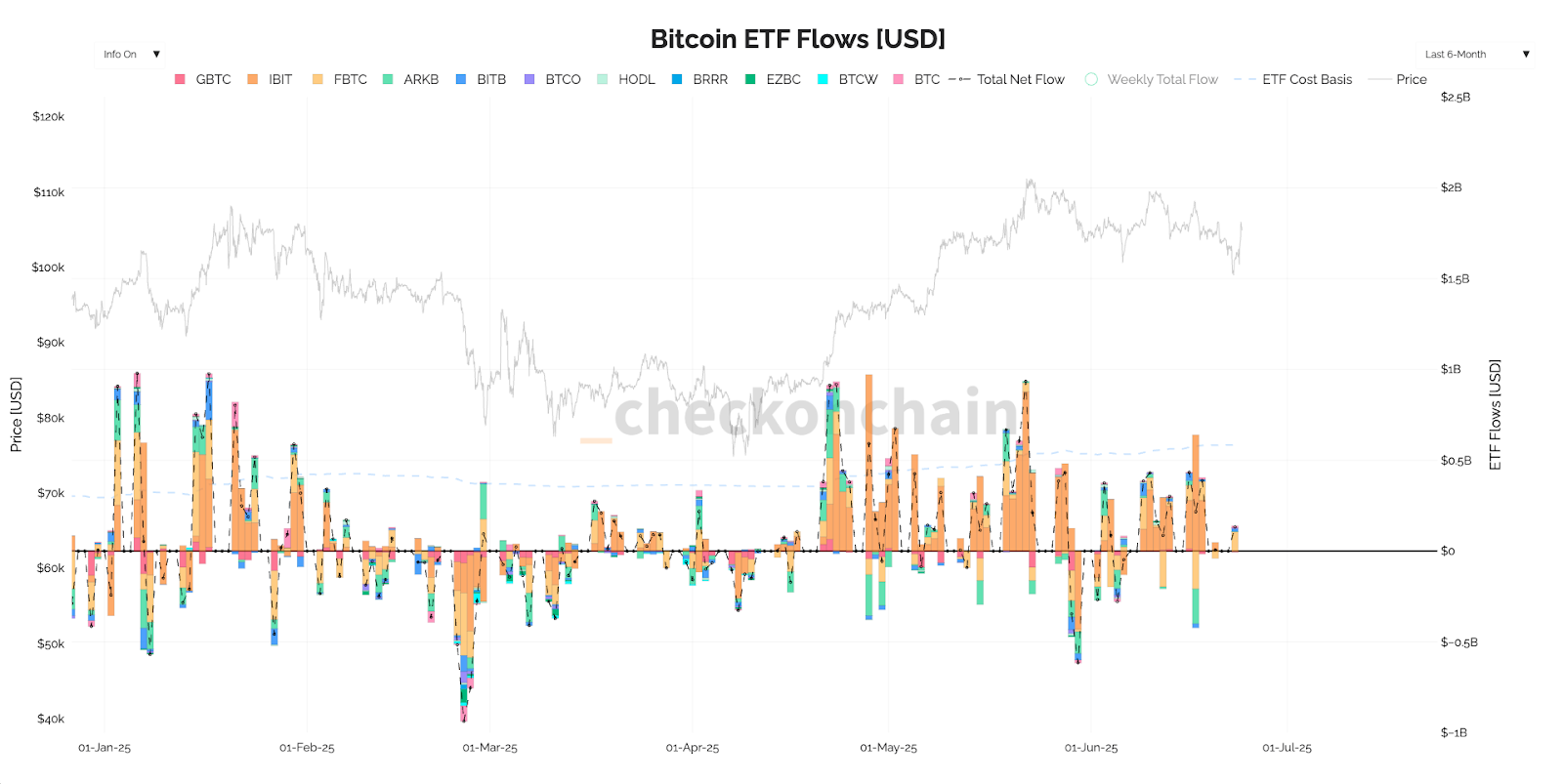

Despite Bitcoin being mostly range-bound over the last two months, we've continued to see positive ETF inflows. We did see that slow on Monday, likely due to the conflict in the Middle East. But now that it seems a ceasefire is going to be implemented, we'd like to see a continuation of positive ETF inflows over the coming weeks. This is another key metric we're watching.

BTC ETF inflows:

Cryptonary's take

In the last week, the market has been swamped by a potential escalation in the Middle East, which then materialised. This produced a tonne of volatility in markets, which we looked to take advantage of. We were able to add to core holdings such as SOL and ETH at $125-$130 (for SOL) and $2,160 (for ETH). Our expectation is that a ceasefire in the Middle East is going to be respected, even if there are a few small bouts of escalation in the coming days, as we saw in the early hours of this morning. This allows the market to likely move on from this event.The Majors (BTC, ETH, SOL and HYPE) are now at their main horizontal resistances, so we're closely watching how price action develops this week.

Our plan remains the same. We’re expecting Interest Rate cuts to come in Q4 of this year (or maybe September if the data corroborates). Therefore, we're looking to build positions over the summer by adding on meaningful price pullbacks, so that we're well-positioned for Q4 2025, going into 2026. We'll continue to put out buy calls (as we did this Sunday) as the coming weeks develop.