Market Updates

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Yesterday, President Trump hosted the White House Crypto Summit, signaling a positive shift in U.S. crypto policy. The buildup was exciting-everyone was expecting this big, historic moment where Trump would sit down with crypto industry leaders and drop some game-changing policy that'd send Bitcoin to the moon. But, as we said in our Market update going into the summit, it turned out to be more of a photo-op than a policy pivot. Here's what went down.

- Strategic Bitcoin Reserve Confirmed - The U.S. will hold approximately 200,000 BTC seized from legal cases, branding it as a "Digital Fort Knox." On paper, that sounds like a big deal, right? But when you dig into the details, it's pretty thin. There's no plan to buy more Bitcoin, no taxpayer funds committed-just a vague directive to "study" budget-neutral ways to grow the stockpile. A "study"? That's the kind of language that tells us there won't be an outright buying as many expected, at least not in the foreseeable future. The market felt the same way-Bitcoin dropped around 3.5% to the $85k region right after the announcement. The % decrease might seem small, but what is important here is that BTC failed to reclaim a key region of $91k, which opens the door for further downside.

We got this move right by the way. We said there was an 80% chance the U.S. would convert its seized Bitcoin into a reserve, but only a 10-15% chance they'd commit to actually buying more. We figured they'd play it coy to avoid front-running, and that's exactly what happened.

We got this move right by the way. We said there was an 80% chance the U.S. would convert its seized Bitcoin into a reserve, but only a 10-15% chance they'd commit to actually buying more. We figured they'd play it coy to avoid front-running, and that's exactly what happened.

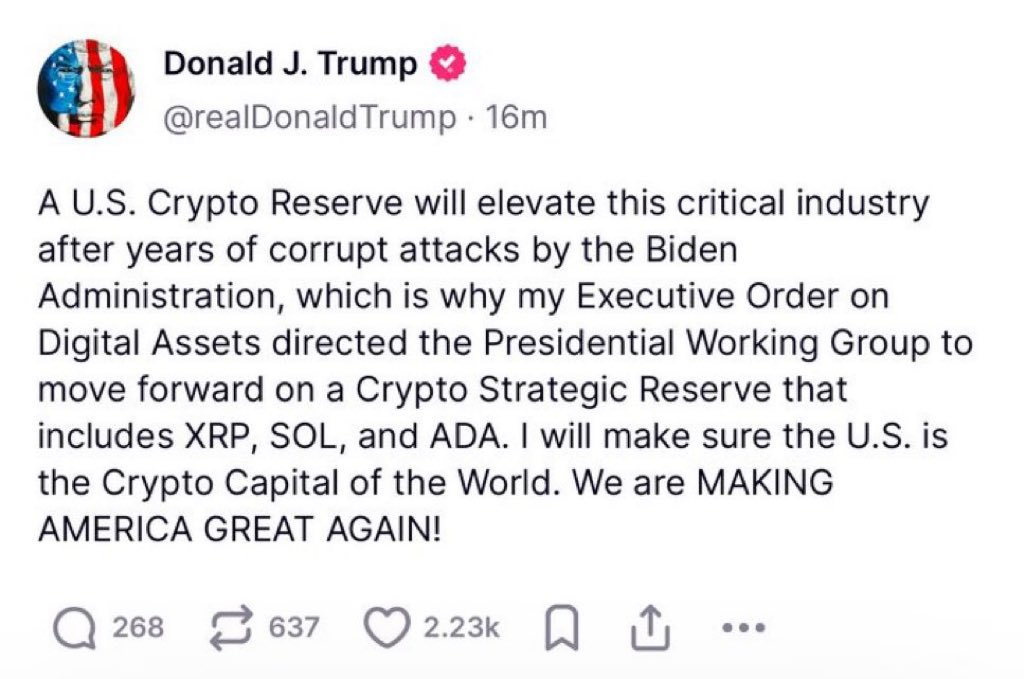

- Regulatory Shift - The administration signaled friendlier crypto regulations but stopped short of detailed commitments. Remember that Truth Social post from Trump, where he name-dropped XRP, Solana, Cardano, Bitcoin, and Ether as part of the reserve? That sent altcoins into a short-lived frenzy-XRP, Solana, and Cardano spiked 20-50% before the summit, as speculators piled in.

But here's the rub: turns out, those mentions were "just examples," not a firm commitment, according to a White House official. The final executive order made it clear-the Strategic Bitcoin Reserve is Bitcoin-only, with non-Bitcoin assets shunted off to a separate "Digital Asset Stockpile" managed by the Treasury, and-yep, you guessed it-no buying plan.

But here's the rub: turns out, those mentions were "just examples," not a firm commitment, according to a White House official. The final executive order made it clear-the Strategic Bitcoin Reserve is Bitcoin-only, with non-Bitcoin assets shunted off to a separate "Digital Asset Stockpile" managed by the Treasury, and-yep, you guessed it-no buying plan.  We warned that the market's expectations were sky-high, and without a firm buying commitment, we'd see a "sell the news" event. We estimated a mere 10% chance of outright altcoin buying. We flagged a potential sell-off in XRP, Solana, and Cardano and the broader market if the summit failed to deliver, and suggested shorting them into range highs.

We warned that the market's expectations were sky-high, and without a firm buying commitment, we'd see a "sell the news" event. We estimated a mere 10% chance of outright altcoin buying. We flagged a potential sell-off in XRP, Solana, and Cardano and the broader market if the summit failed to deliver, and suggested shorting them into range highs.

- Stablecoin Focus - Lastly, Treasury Secretary Scott Bessent emphasized stablecoins' role in keeping the U.S. dollar dominant. Now, banks can hold stablecoins and custody crypto for the customers. This is probably the only thing that is somewhat positive. But we have already been big fans of stablecoins for a while… Hey, stablenary!

- Advisors are setting the course of crypto policies. Trump was one of the prominent sceptics of crypto. A few years ago, he called Bitcoin a "scam," and now he's styling himself as the "crypto president." What changed? It's clear he's leaning hard on his advisors-guys like David Sacks, the White House "crypto czar," and Treasury Secretary Scott Bessent-who are the ones actually steering the ship. Moving forward, it is important to watch and read these people carefully, as they will likely determine where crypto goes next.

What are we watching next? Alright, so the summit's behind us-now what?

- Federal agencies will explore budget-neutral BTC acquisitions, meaning buying could come quietly rather than in public markets. We think the choice of words was very cautionary because if they really want to buy BTC, they don't want to be front-runned. We will be watching the price action/rumours/on-chain wallets in case the US governments will be trying to quietly accumulate BTC while telling everyone that they are not buying.

- It is important to watch the ETF inflows to track where the institutional money is flowing.

- We are watching legislation updates for the next major catalysts as well. Crypto is driven by narratives, and positive legislation such as memecoins and NFTs being classified as collectibles can be the base for the next runs. At the moment, we are watching legislation on stablecoins, RWAs and Layer-1s.