Giga ($GIGA) is a memecoin that has captured the attention of the crypto world by leveraging the popular "Gigachad" meme. This meme, which represents extreme masculinity, fitness, and strength, has created a cult-like following. The $GIGA token has established itself on the Solana blockchain, growing organically through community support rather than heavy reliance on external influences or venture capital.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Origins and culture

- Meme foundation: Rooted in the "Gigachad" meme, $GIGA has leveraged the cultural appeal of this internet symbol to foster a dedicated community, amplifying its narrative of strength and loyalty.

- Community-driven: Unlike other memecoins that rely heavily on external backing, $GIGA's success has been driven by grassroots efforts, growing organically without institutional funding.

- Endorsement: A significant milestone for $GIGA was the endorsement from Ernest Khalimov, the model behind the "Gigachad" meme. His Instagram post boosted community enthusiasm and solidified $GIGA's place in the meme coin ecosystem. Khalimov humorously acknowledged the attention, thanking fans and playfully crediting his physical appearance for the overwhelming response.

- Price performance: $GIGA has delivered consistent performance, with several months of positive price action, cementing its reputation alongside other top meme coins like $POPCAT and $WIF.

- Market capitalization: The token hit a peak market cap of $300 million in mid-2024 before stabilizing around $150 million, showcasing both its growth potential and natural market corrections.

Token holding patterns and average holding duration

Top holders overview

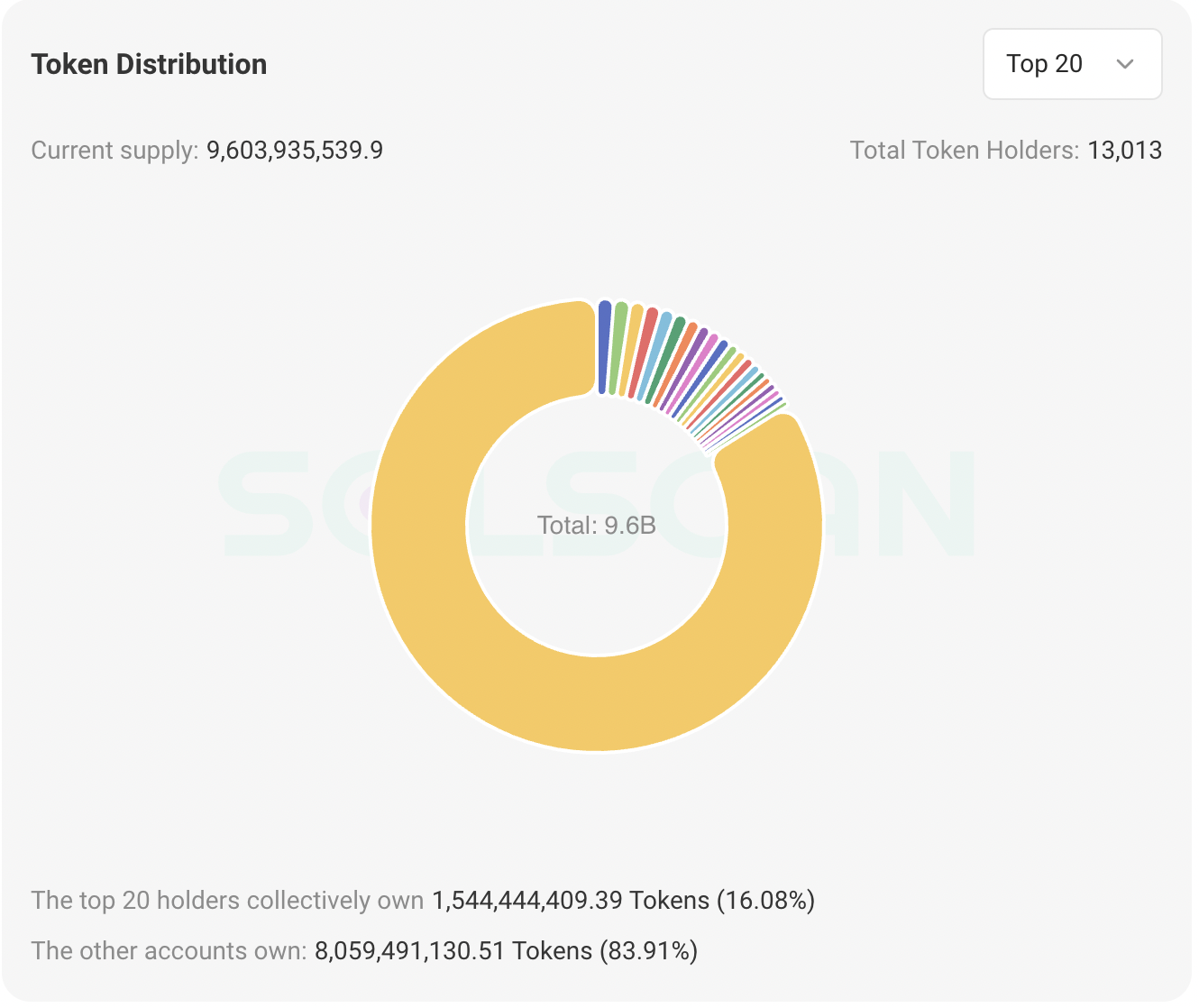

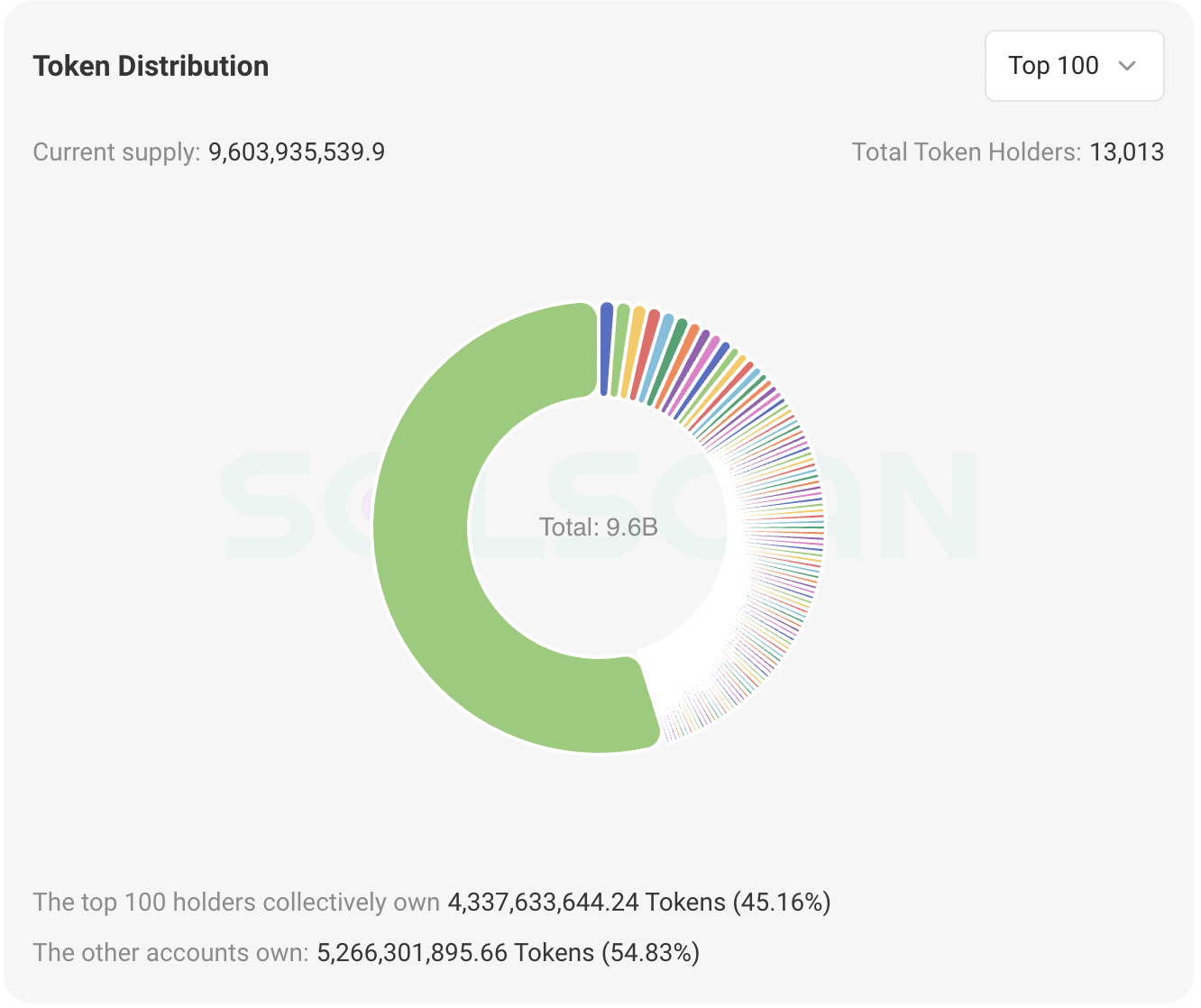

The $GIGA token has shown a relatively decentralized distribution, with no individual wallet holding an overwhelmingly large percentage of the total supply. This spread highlights the broad participation of investors and limits the control that any single wallet can have over the token's price action. Analysing the top 10, 20, and 100 holders allows us to understand the structure of $GIGA's ecosystem and how token ownership is distributed across the community.Top 10 holders:

The top 10 holders account for a diverse distribution of the total token supply, with each wallet holding approximately 1% of the total supply. This spread reduces the risk of large-scale dumping by any single holder. Moreover, the holding duration reflects a blend of both long-term holders and relatively newer positions, indicating a mix of conviction and short-term trading activity within the largest wallets.

Key insights

- Top 10 wallets collectively hold 10.28% of the total supply, showing a wide distribution without a dominant holder.

- Average holding per wallet: The top 10 wallets holds an average of 101.7 million tokens, representing 1.06% per wallet on average.

- Average holding duration: The top 10 wallets have an average holding duration of 149.68 days, suggesting a combination of early believers and relatively recent entrants.

- Most held token duration: The longest-held wallet has been holding for 229.33 days, showing early commitment to the token's long-term potential.

Top 20 and top 100 holders

The top 20 wallets hold a relatively small percentage of the total supply, confirming that $GIGA is widely distributed and not controlled by a few large wallets. This dispersion creates a more decentralized network, where no one group of holders can significantly sway the market. Similarly, the top 100 wallets show a steady distribution, with an increasing number of wallets holding smaller portions of the total supply. Key insights:- Top 20 wallets collectively hold 1.54 billion tokens, or 16.08% of the total supply, averaging 77.2 million tokens per wallet.

- Average holding duration (Top 20): These wallets show an average holding duration of 128.01 days, reflecting a combination of long-term holders and recent accumulators.

- Top 100 wallets collectively hold 45.16% of the total supply, representing a broader distribution of tokens across a wider range of investors.

- Average holding duration (Top 100): The top 100 holders have an average holding duration of 84.42 days, reflecting broader market participation. This decentralized token holding structure, combined with a healthy average holding duration, signals strong confidence in $GIGA while minimizing the risk of large-scale liquidation by whales. These patterns reflect a strong foundation for long-term growth, as the distribution and average holding durations suggest that $GIGA has a balanced and engaged community behind it.

Holder count vs. market cap analysis

Over the past month, we have observed notable changes in the correlation between $GIGA's market capitalisation and its holder count. By analysing these shifts, we can infer critical insights into the sentiment and trends surrounding the token. The overall increase in holder count is substantial, growing by 1,632 holders (approx. 14.4%) during the observed period. However, this period also witnessed a decline in market capitalization by $33.69M, dropping approximately 18% from $187.93M to $154.24M.Key insights:

- Inverse relationship: Despite a notable increase in the holder count, the market cap saw a decline. This suggests that new investors have been entering the market, yet either larger holders are selling or prices have been correcting, leading to a lower overall valuation.

- Increasing community engagement: The steady growth in holders highlights that the $GIGA community is expanding, with more wallets accumulating tokens despite broader market corrections. Potential accumulation: A growing number of holders during a downtrend in market cap often points to accumulation phases. It can indicate that investors are strategically accumulating during dips, especially given the sharp holder growth despite market cap declines.

- Market sentiment: The fact that the market cap dropped while the holder count rose could indicate market uncertainty or broader market influences beyond the control of $GIGA, such as macroeconomic trends or corrections in the broader crypto market.

Meme sentiment analysis for $GIGA

Meme sentiment analysis for $GIGA

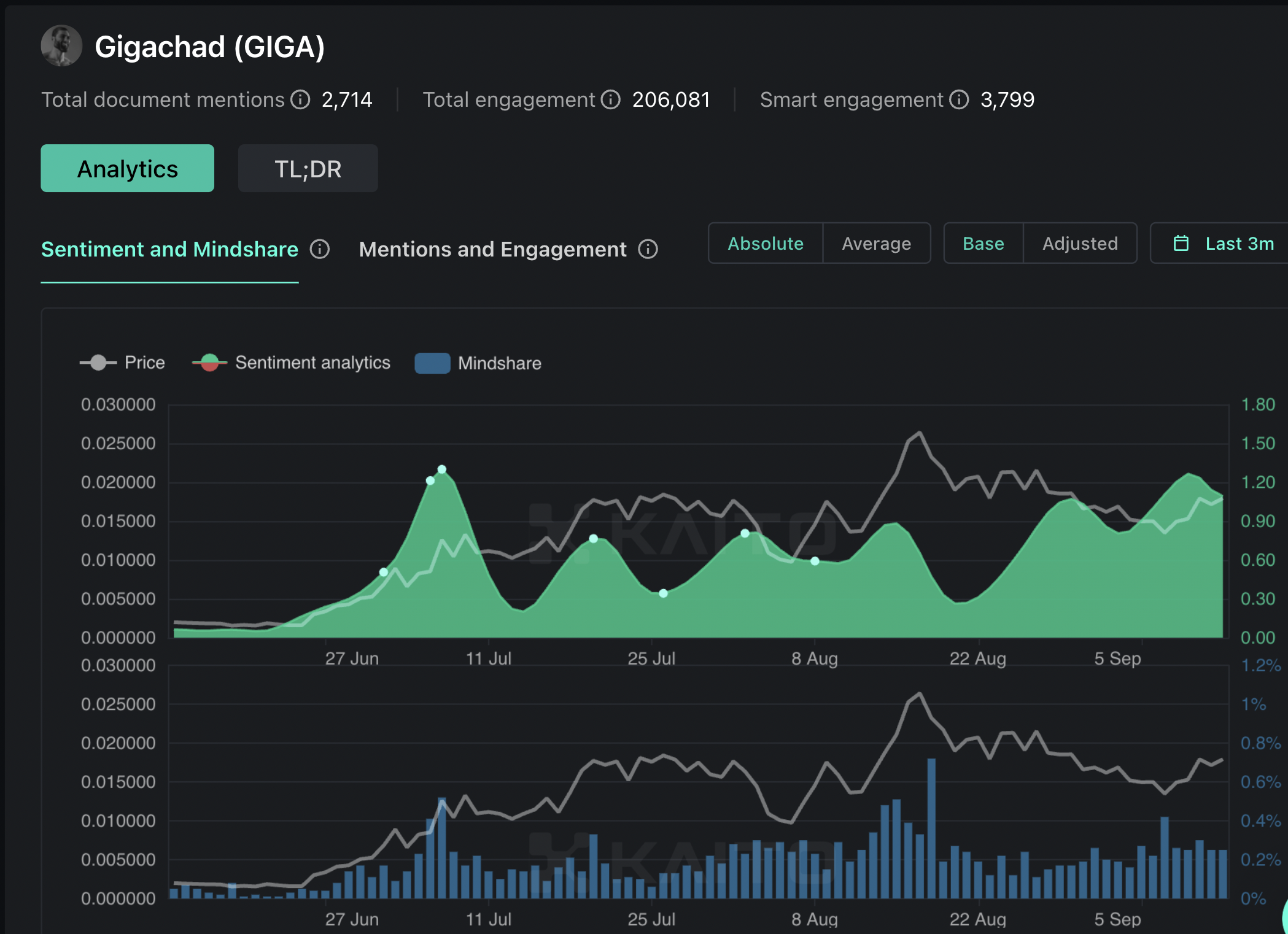

In the context of meme coins, sentiment and community engagement often serve as vital indicators of market potential. For $GIGA, these two metrics, Sentiment analytics and Token mindshare, offer a clear picture of how the community feels and how much attention the token is garnering across the wider crypto landscape. As we delve into these metrics, we will see how $GIGA's performance in terms of sentiment and attention has evolved since mid-2024, particularly around key moments like price surges, community endorsements, and significant market events. .

Sentiment analytics

The Sentiment analytics metric tracks the overall bullish or bearish sentiment of the $GIGA community. Over the past three months, $GIGA's sentiment has experienced notable fluctuations, often aligning with major events, price movements, or market updates.- Day 1 (14 June 2024):Sentiment started at 0.06, with $GIGA trading at $0.001984. This reflected a cautious but optimistic outlook from early adopters as the token began gaining traction in the market. Sentiment data peak (7 July 2024): Sentiment analytics peaked at 1.09, with the price soaring to $0.017926. This surge came during one of $GIGA's strongest rallies, driven by heightened market excitement and community enthusiasm following key endorsements and social media virality.

- Latest data (12 September 2024): Sentiment currently sits at 0.47, with the token priced at $0.023196. Although sentiment has cooled slightly from its peak, it remains highly positive, indicating continued optimism around $GIGA's potential, even after market corrections.

- While $GIGA has shown significant price movements, the sentiment usually lags price action by 2-3 days, as commonly observed in Kaito's analytics. For example, after the price peak at $0.017926 on July 7, 2024, sentiment analytics followed with a 1.09 rating, showing increased positive sentiment post-peak. This is a typical phenomenon where retail traders and investors become more vocal after significant price movements.

- Furthermore, the highest sentiment recorded was 1.30 on July 7, when $GIGA exhibited unstoppable momentum, breaking multiple resistances on its way to a new high. By contrast, the sentiment score dipped to 0.47 on August 18, reflecting a pullback in market enthusiasm as price retraced and consolidated.

Token mindshare

Token mindshare measures the share of voice for $GIGA within the broader cryptocurrency ecosystem, indicating how much of the market's attention is focused on the project.- Day 1 (14 June 2024): $GIGA had a mindshare of 0.05%, indicating limited but growing attention from the broader community as the token started to gain visibility.

- Mindshare data peak (18 August 2024): Mindshare surged to 0.52%, coinciding with a market price of $0.012583. This peak in attention likely reflects an increase in mentions and discussions on platforms like social media, driven by significant developments in the project, including the endorsement from Ernest Khalimov.

- Latest data (12 September 2024): Mindshare has now risen to 0.72%, with the token priced at $0.023196. This shows that $GIGA is commanding more attention in the market, signaling strong community engagement and a growing presence within the memecoin space.

Token mindshare heatmap analysis

The token mindshare heatmap provides insight into the relative prominence of various meme coins in the Solana ecosystem over the past three months. This metric measures the "share of voice" a particular token holds within the overall cryptocurrency market, highlighting how often the token is being mentioned and engaged with in comparison to its peers.From the heatmap, we see that $GIGA holds a 4.49% mindshare, placing it at the fifth position among the top Solana-based meme coins. While this is impressive, it trails behind some of the larger tokens like $WIF (11.17%), $POPCAT (9.03%), and $BONK (7.07%). These figures indicate that, while $GIGA has carved out a niche, there is room for further growth in terms of market visibility.

Interestingly, some of the tokens with higher mindshare percentages like $WIF and $BONK have been experiencing declining sentiment, as shown by their price performance on the heatmap. Conversely, $GIGA stands out with a more stable or growing price, suggesting a stronger community and narrative despite the lower overall mindshare.

Historical price action of $GIGA

Giga's journey, which began on January 4, 2024, has been nothing short of extraordinary, particularly when viewed on a logarithmic chart that showcases its rapid and significant price fluctuations. This analysis of Giga's price action helps us understand how the meme coin ascended from virtually nothing to one of the more well-known names in the space. Here's a more detailed breakdown:- Launch and initial ATH: $GIGA started from a microcap base of just over $5,000 on launch day. By the end of January 4, 2024, the token achieved an ATH of $442,000, marking an incredible 8,360% surge. This monumental rise indicated the massive interest from early meme coin investors, who tend to jump on emerging tokens in the hopes of hitting a jackpot.

- Significant retracement: After hitting its ATH, $GIGA experienced a drastic 96% retracement, a common phenomenon in meme coins that face initial sell-offs after major rallies. The price fell to $17,000 market cap, a steep drop that would cause concern for most projects, but $GIGA demonstrated resilience.

- Rebound and bullish structure: Despite the major retracement, $GIGA didn't falter. It rebounded and hit a new ATH of $1.5 million market cap. Since then, the coin has moved consistently within a Higher High (HH) and Higher Low (HL) bullish structure, as indicated by yellow dots on the chart. This structure has persisted throughout its existence, showing a strong trend in favour of the bulls.

- Strength in the community: The bullish structure not only reflects $GIGA's price action but also highlights the loyalty and strength of its community. Each new high reflects renewed interest and trust in the token. The most recent high was at $300 million market cap, and while the token has retraced to around $160 million, it appears poised for another swing upward, continuing its historical trend of breaking previous highs.

Current market outlook

On the 12-hour chart of $GIGA, we observe that the token has maintained a strong bullish structure, which is evident from the higher highs (HH) and higher lows (HL) marked by yellow dots. This formation has remained consistent despite the retracements, indicating solid buying support and accumulation throughout.$GIGA is currently showing signs of bullish momentum as it attempts to break above the key resistance level at $175 million. This price level has been a significant barrier in the recent price action, but $GIGA is pushing upward, signaling potential for further growth. The overall market structure remains bullish, with the coin continuing to trade in a well-defined higher high and higher low structure.

Key Observations:

- Resistance push: The price is actively testing the $175 million resistance, a crucial level for $GIGA. A successful break and close above this level would likely result in further bullish continuation, with the next target at $221 million, followed by the previous all-time high of $300 million.

- Break of downtrend: The orange dotted downtrend line, which has been acting as a resistance for several weeks, has been broken. This trendline represented a bearish structure since $GIGA's previous high at $300 million. Breaking above this line signals a potential reversal of the downtrend, adding to the bullish outlook for $GIGA in the short to medium term.

- Support levels: On the downside, $131 million remains a strong support zone. The demand zone between $123 million and $150 million, marked by a grey box on the chart, has proven to be an effective area for accumulation. If the price pulls back, this zone is expected to act as a critical support, offering a buying opportunity for long-term investors.

Potential outcomes

Upside: If the $175 million resistance is taken out, we could see a rapid move to $221 million, which is the next key resistance, followed by a possible retest of the $300 million ATH. Beyond this, $GIGA would enter price discovery mode, leading to new highs.Downside: If $175 million is not broken and the market softens, $GIGA could return to the $123 million - $150 million demand zone, offering another opportunity for accumulation.

Potential risks and challenges for $GIGA

While $GIGA has demonstrated impressive growth and has a strong community backing it, several risks need to be considered that could impact its future performance.1. Market volatility and Memecoin nature

Memecoins are known for their extreme volatility. While $GIGA has attracted a loyal following, its price action is still subject to sudden spikes and dips. The high volatility can lead to drastic market corrections, as seen in previous memecoins, where hype cycles fade quickly.

2. Whale dominance and market manipulation

Even though $GIGA's token distribution is relatively decentralized compared to other memecoins, the top 100 wallets still control around 45% of the total supply. This concentration presents a risk of market manipulation. If a few large holders decide to sell off their holdings, it could trigger a sharp drop in price, causing panic among smaller investors.

3. Breaking below key support

GIGA is currently trading between key support and resistance levels. Should the price break below the $65 million support zone, this could trigger a shift in the market structure to the downside. A breakdown below this level could lead to increased selling pressure and a bearish reversal in the medium term, which would disrupt the bullish outlook.

Cryptonarys take

$GIGA has proven itself as a formidable player in the meme coin space, fueled by its strong community, smart use of the "Gigachad" meme, and consistent price action. From its modest beginnings with a market cap of just over $5K, it has climbed steadily, attracting the attention of early investors and showing resilience through multiple cycles of accumulation and retracement.The historical price action, marked by a steady higher-high, higher-low structure, demonstrates the strong demand and investor confidence in the project, further solidifying its place in the meme coin landscape. The current market outlook reflects a phase of consolidation within the range of $131 million to $175 million, with the price now flirting with a crucial resistance at $175 million. A breakout from this level could lead to an exciting move toward the $221 million range, potentially paving the way for $GIGA to retest its ATH of $300 million.

The demand zone between $123 million and $150 million serves as a solid buffer for downside protection, presenting an ideal accumulation zone for both new and seasoned investors. The coin's ability to reclaim these levels, even amidst market corrections, speaks volumes about its bullish nature and future potential. Overall, $GIGA remains one of the more promising meme coins in the market.

The firm bullish structure, combined with its community-driven momentum and notable social engagement metrics, ensures that $GIGA is well-positioned for future growth. While meme coins are inherently volatile, $GIGA's consistent price action and robust support levels make it a strong contender for those looking for exposure in this space.